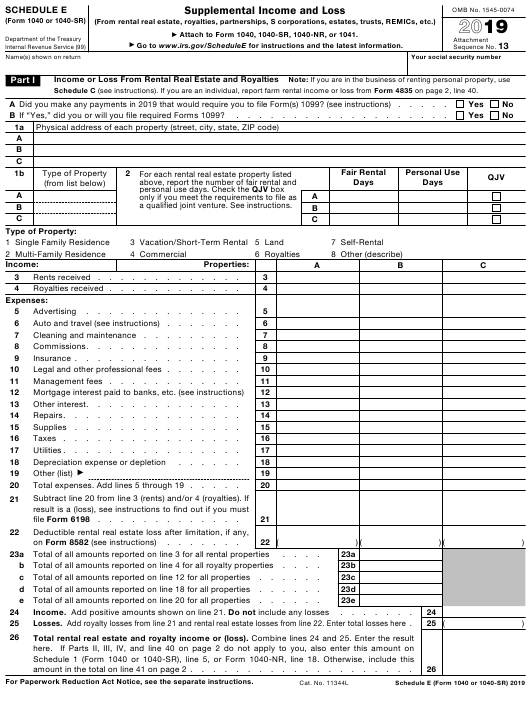

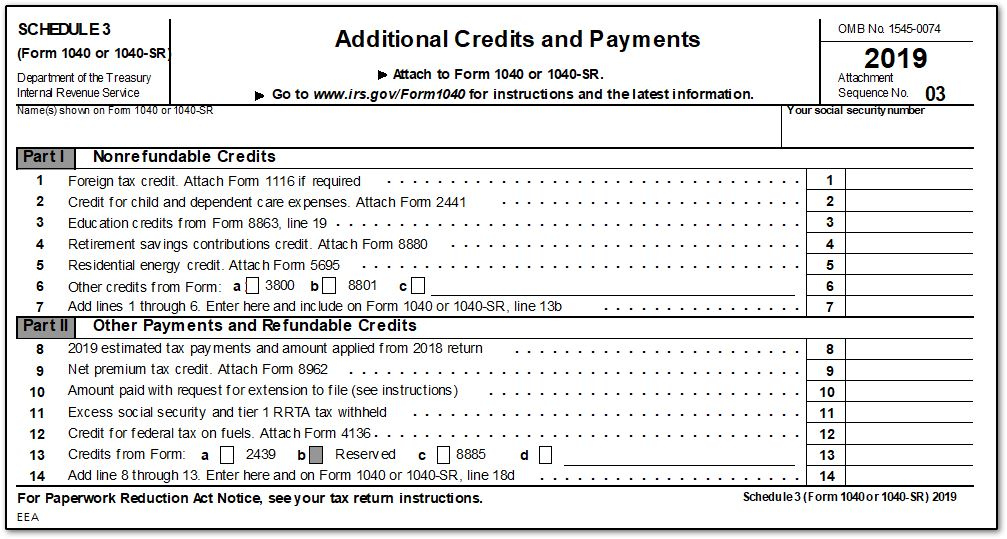

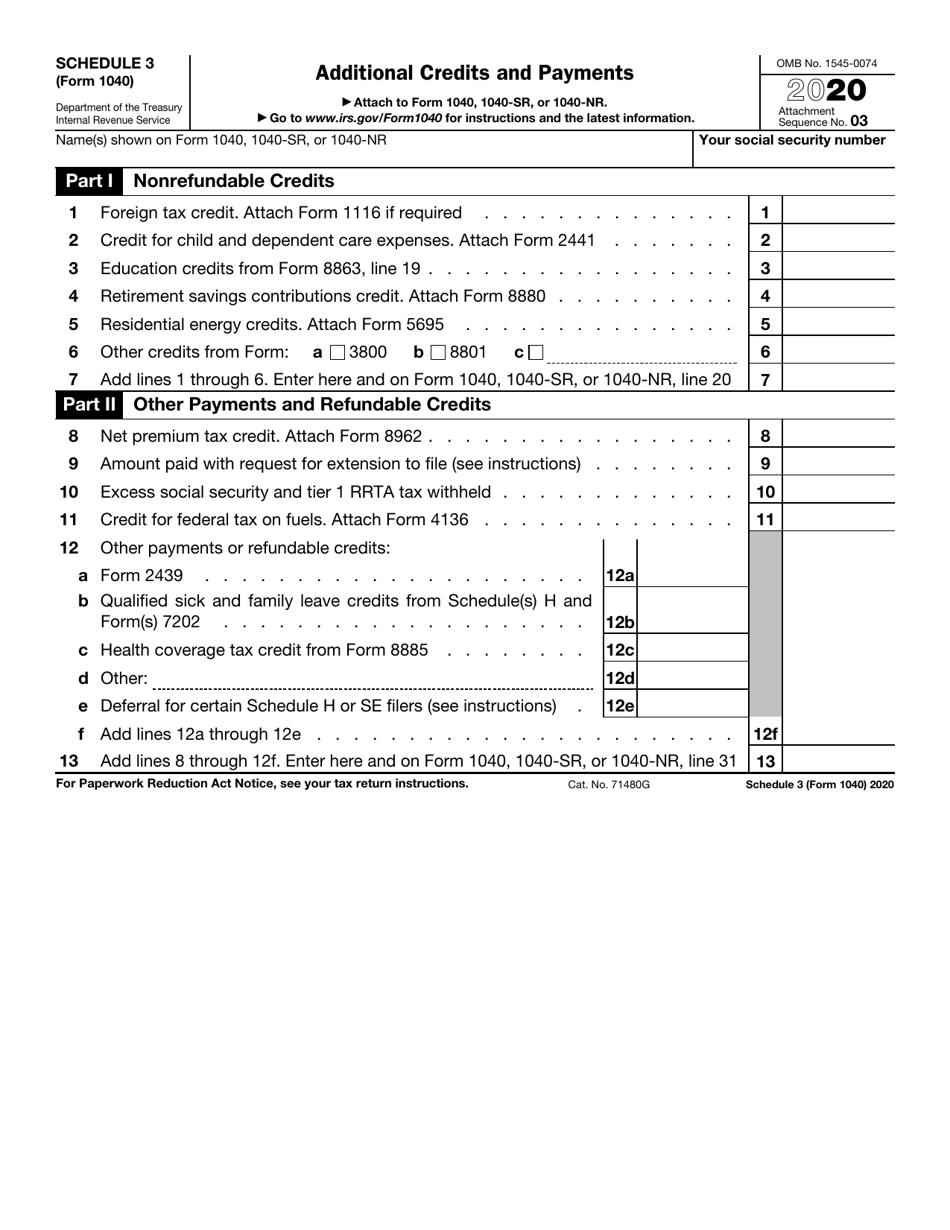

Form 1040 Schedule 3

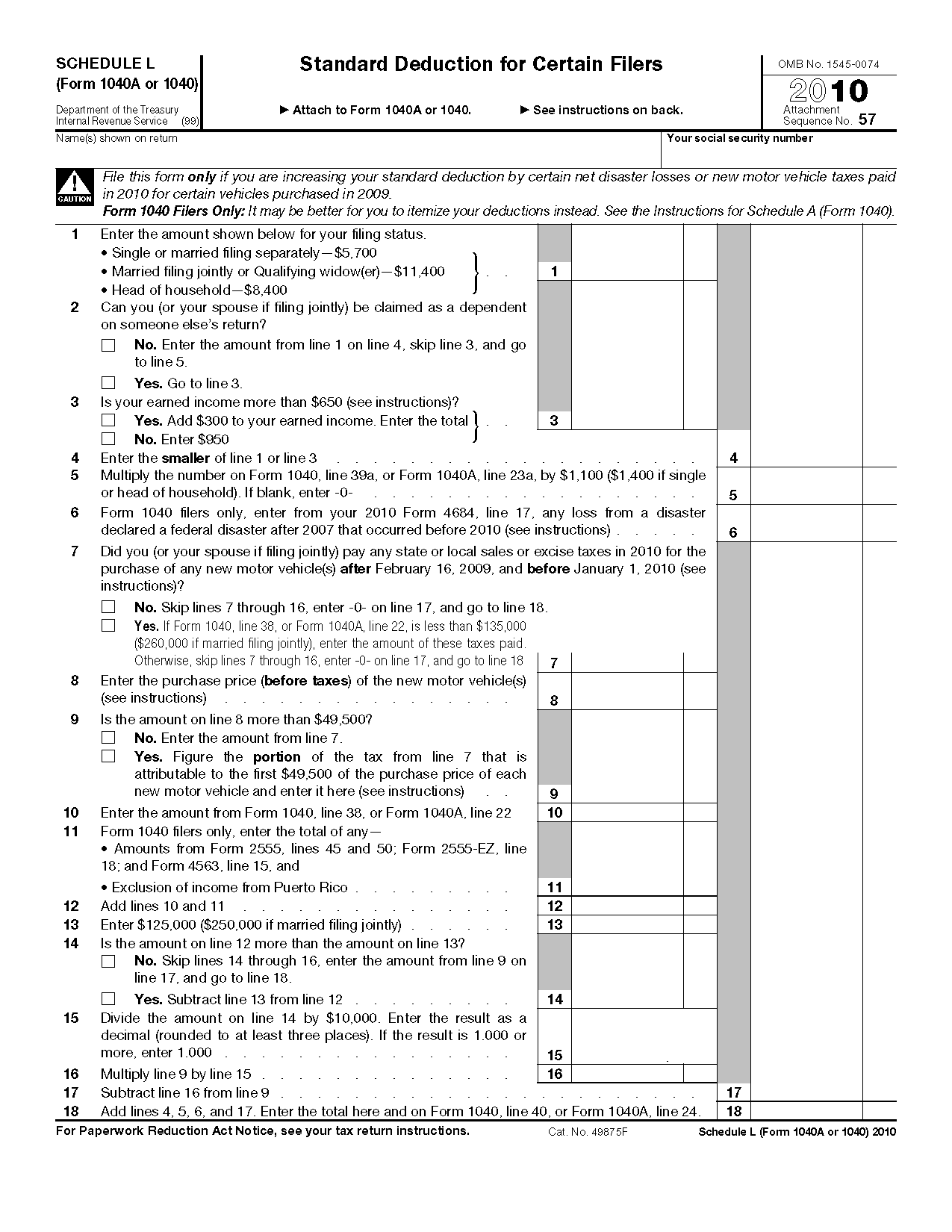

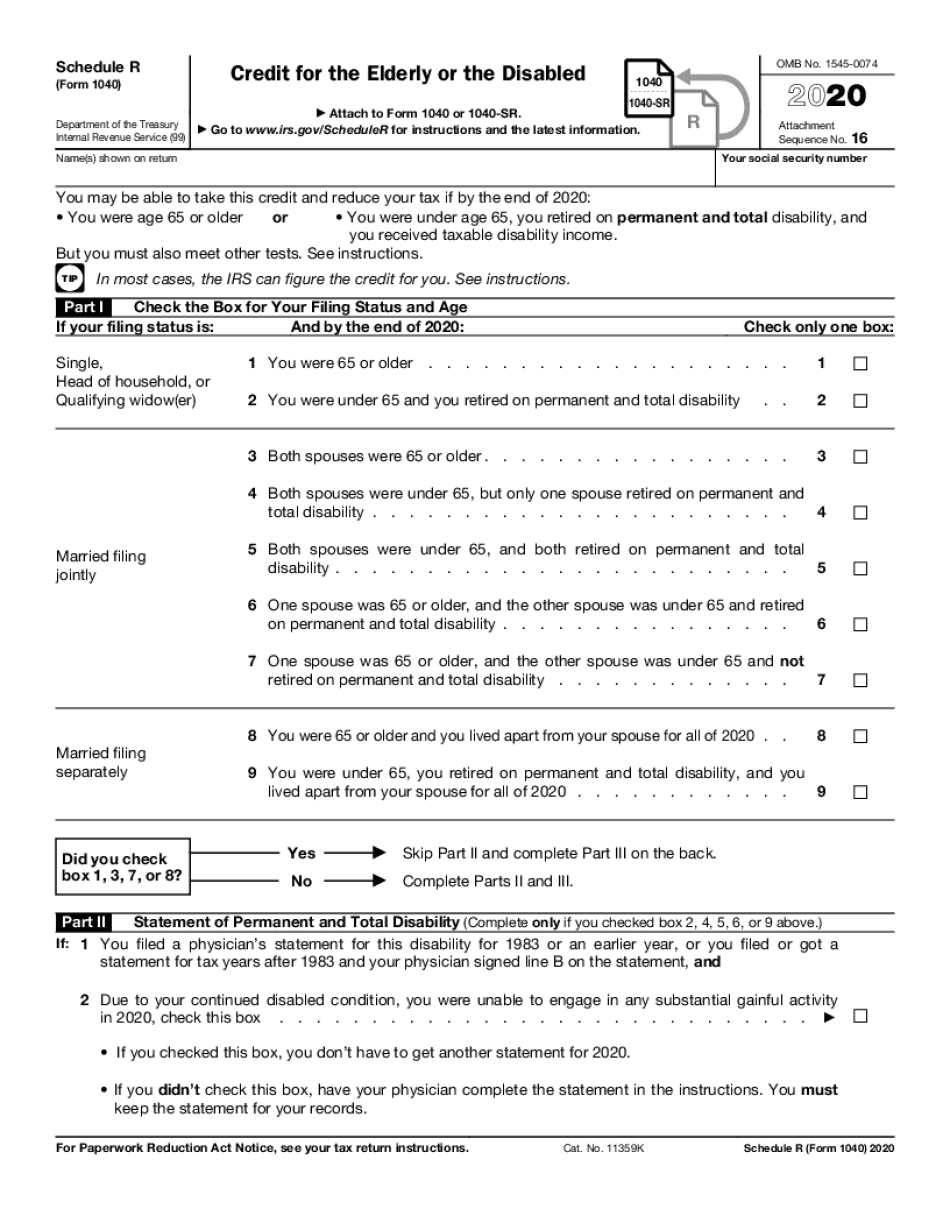

Form 1040 Schedule 3 - Web schedule 3 is a new form that reports nonrefundable credits on your form 1040. Schedule 3 is where you’ll report any credits and payments for things like child tax credit, dependent care expenses, general business credit,. And irs.gov/schedulea for schedule a (form 1040), for example, and similarly for other. Instead of a long form, taxpayers have a much shorter form. Web schedule 3 (form 1040) 2020 additional credits and payments department of the treasury internal revenue service. Web schedule 2, part i schedule 3, part i schedule 2, part ii schedule 3, part ii. Web some of the credits will be entered on the appropriate lines of the return while some payments and credits may be entered on schedule 3, additional credits and payments. Web the irs was able to shrink form 1040 by moving some details out of the form. Additional income and adjustments to income. Web form 1040 schedule 3 holds invaluable information for taxpayers hoping to make the most of their tax credits. Web the irs was able to shrink form 1040 by moving some details out of the form. Instead of a long form, taxpayers have a much shorter form. Web on line 29a through 29e, subtract line 28e from line 27e to get your total income or loss from schedule e. Web this course will help tax professionals navigate common questions. I have attached a screenshot below that shows the items included. Web some of the credits will be entered on the appropriate lines of the return while some payments and credits may be entered on schedule 3, additional credits and payments. Instead of a long form, taxpayers have a much shorter form. Enter this amount on schedule 1, line 5. Web schedule 2, part i schedule 3, part i schedule 2, part ii schedule 3, part ii. Web this course will help tax professionals navigate common questions they may receive about schedule c. Web schedule 3 is a new form that reports nonrefundable credits on your form 1040. Web some of the credits will be entered on the appropriate lines. 71480g 12f 13 schedule 3 (form. Web on line 29a through 29e, subtract line 28e from line 27e to get your total income or loss from schedule e. Web what is schedule 3 (form 1040)? Web schedule 3 (form 1040) 2020 additional credits and payments department of the treasury internal revenue service. Schedule 3 is where you’ll report any credits. I have attached a screenshot below that shows the items included. It reviews elements of proprietor income and examines the. You can take advantage of various nonrefundable and. Web schedule 2, part i schedule 3, part i schedule 2, part ii schedule 3, part ii. New line 13g added for the refundable. Schedule 3 (form 1040), additional credits and payments, is a form issued by the internal revenue service (irs) to report. Schedule 3 is where you’ll report any credits and payments for things like child tax credit, dependent care expenses, general business credit,. New line 13g added for the refundable. Web schedule 3 (form 1040) 2020 additional credits and payments department. New line 13g added for the refundable. Enter this amount on schedule 1, line 5 of your form. Schedule 3 (form 1040), additional credits and payments, is a form issued by the internal revenue service (irs) to report. Web on line 29a through 29e, subtract line 28e from line 27e to get your total income or loss from schedule e.. Calculate over 1,500 tax planning strategies automatically and save tens of thousands Web form 1040 schedule 3 holds invaluable information for taxpayers hoping to make the most of their tax credits. Web what is schedule 3 (form 1040)? Web irs form 1040 schedule 3 (2022) is used for alternative minimum tax and repayment of any excess premium tax credits.the form_type. Web some of the credits will be entered on the appropriate lines of the return while some payments and credits may be entered on schedule 3, additional credits and payments. Calculate over 1,500 tax planning strategies automatically and save tens of thousands Web irs form 1040 schedule 3 (2022) is used for alternative minimum tax and repayment of any excess. Additional income and adjustments to income. Enter this amount on schedule 1, line 5 of your form. Web schedule 3 (form 1040) 2020 additional credits and payments department of the treasury internal revenue service. New line 13g added for the refundable. Web what is schedule 3 (form 1040)? New line 13g added for the refundable. Enter this amount on schedule 1, line 5 of your form. Web schedule 3 (form 1040) 2020 additional credits and payments department of the treasury internal revenue service. Ad tax plan at both the federal and state levels with over 1,500 tax planning strategies. And irs.gov/schedulea for schedule a (form 1040), for example, and similarly for other. Schedule 3 (form 1040), additional credits and payments, is a form issued by the internal revenue service (irs) to report. For 2022, you will use form 1040 or, if you were born before january 2,. Web form 1040 schedule 3 holds invaluable information for taxpayers hoping to make the most of their tax credits. Web what is schedule 3 (form 1040)? Schedule 3 is where you’ll report any credits and payments for things like child tax credit, dependent care expenses, general business credit,. Web irs form 1040 schedule 3 (2022) is used for alternative minimum tax and repayment of any excess premium tax credits.the form_type parameter. Web some of the credits will be entered on the appropriate lines of the return while some payments and credits may be entered on schedule 3, additional credits and payments. Web based on the provided information, the explaination for schedule 1 and schedule 3 of form 1040 are as follows: However, if your return is more complicated (for example, you. Estimate your taxes and refunds easily with this free tax calculator from aarp. Web taxpayers can elect to report foreign tax on form 1040, schedule 3 without filing form 1116 as long as the following conditions are met: 71480g 12f 13 schedule 3 (form. Additional income and adjustments to income. Instead of a long form, taxpayers have a much shorter form. Web the irs was able to shrink form 1040 by moving some details out of the form.2020 Form IRS 1040 Schedule AFill Online, Printable, Fillable, Blank

IRS Form 1040 Schedule 3 Download Fillable PDF or Fill Online

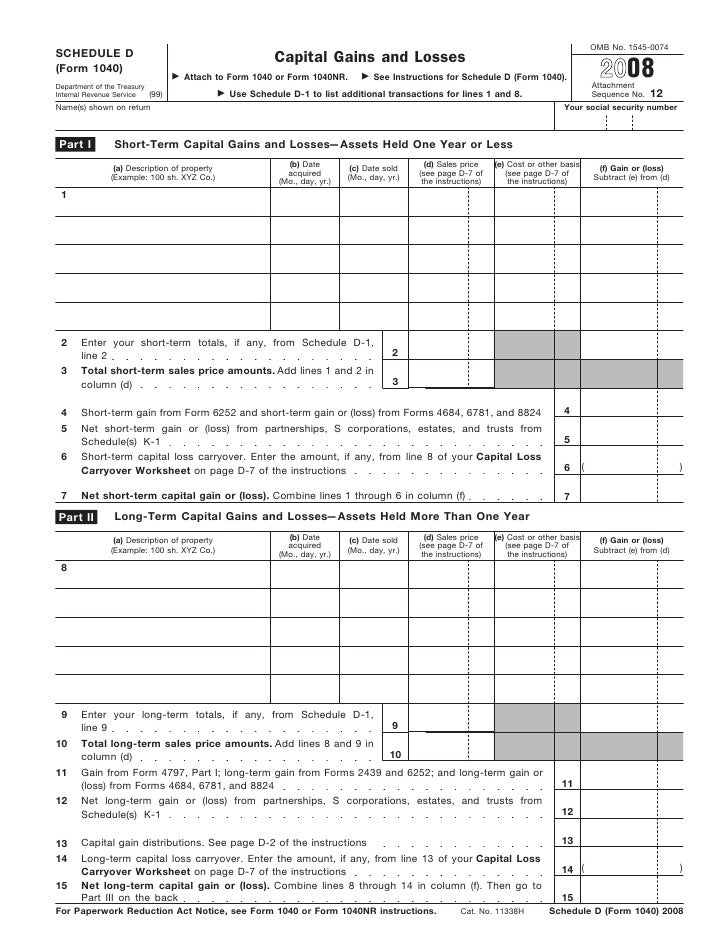

Form 1040, Schedule DCapital Gains and Losses Worksheet Template Tips

Form 1040 U.S. Individual Tax Return Definition

From Schedule A Form 1040 Or 1040 SR 1040 Form Printable

IRS 1120 Schedule M3 2019 Fill out Tax Template Online US Legal Forms

Irs 1040 Form Example IRS Offers New Look At Form 1040SR (U.S. Tax

1040 Schedule 3 Form 2441 1040 Form Printable

Irs 1040 Form 2020 Printable IRS 1040 2018 Fill and Sign Printable

Free Printable 1040a Tax Form Printable Templates

Related Post:

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at9.17.55AM-43bd78fa82bb4fa397892e3e69047cf2.png)