Ohio Extension Form

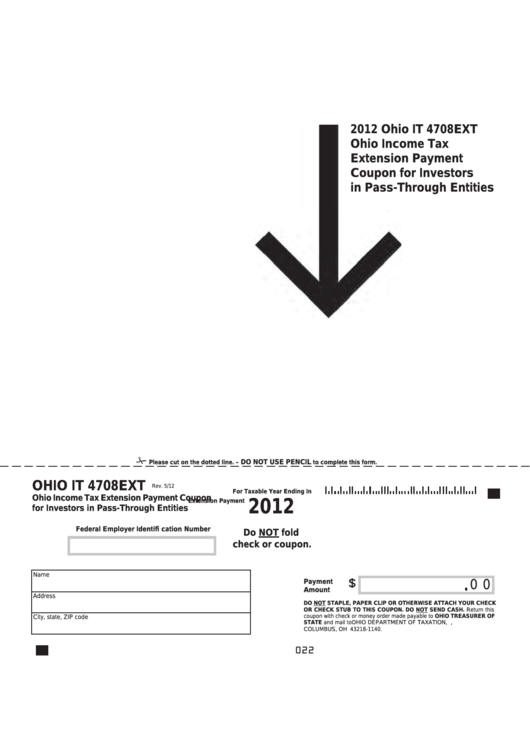

Ohio Extension Form - Estimated income tax and/or extension of time to file. Web anticipated tax balance due on 2022 annual return $ (extension payment) 2023 estimated tax payment (not less than 1/4 of total estimate) $ if you are making an estimated payment enter the amount on line 2. The automatic extension only applies to filing a return; Web the state of ohio doesn’t require any extension form as it automatically grants extensions up to 6 months. More about the ohio form it 40p individual income tax voucher ty 2022. All tax payments are due by the original due date of the return. 3 what is the statute of limitations for the pte and fiduciary income taxes? Get ready for tax season deadlines by completing any required tax forms today. Web rita will prepare your return for you. Ohio does not have an extension request form, but honors the irs extension. The top portion of the form must be filled out by the owner or operator of the vehicle. 1 what is the statute of limitations for the pte and fiduciary income taxes? Within osu extension, the agriculture and natural resources team provides ohioans resources and educational programs focusing on profitable and sustainable agriculture, a clean environment and. Web ohio does. Web in order to get an ohio personal extension, you must first obtain a federal tax extension ( irs form 4868 ). Web file your business federal tax extension. (april 15 for calendar year taxpayers) or interest and penalties will be charged. 3 what is the extended due date for the it 1041 fiduciary income tax return? Web pharmacy technician. More about the ohio form it 40p individual income tax voucher ty 2022. Click here to see what's new for tax year 2022. Ohio does not have an extension request form, but honors the irs extension. 2570 harding highway, lima, oh 45804. No extensions are granted for payment of taxes due. Estimated income tax and/or extension of time to file. This page serves as an online headquarters for taxpayers looking for more information about the ohio individual and school district income tax. Use this form if you are exempt from filing an individual municipal income tax return. To obtain an ohio tax extension, you must first file a federal tax extension. Web in order to get an ohio personal extension, you must first obtain a federal tax extension ( irs form 4868 ). Real estate, family law, estate planning, business forms and power of attorney forms. For cincinnati, indicate whether or not a federal extension form 4868 has been filed on the ojcinext screen. This page serves as an online headquarters. 2570 harding highway, lima, oh 45804. Web the state of ohio doesn’t require any extension form as it automatically grants extensions up to 6 months. This page serves as an online headquarters for taxpayers looking for more information about the ohio individual and school district income tax. Web you can extend the due date for filing your ohio it 1040. Newsletter is produced by the ohio state university extension agronomy team, state specialists at the ohio state university and the ohio agricultural research and development center (oardc). Web for taxpayers not on a federal extension, an extension request must be submitted on or before the date the municipal income tax return is due. Be sure not to include or redact. 3 what is the statute of limitations for the pte and fiduciary income taxes? Web the extension of time to file the ohio tax return is the same number of months as the extension of time to file the federal tax return. Web anticipated tax balance due on 2022 annual return $ (extension payment) 2023 estimated tax payment (not less. The state of ohio recognizes a valid federal extension and will automatically grant you a corresponding state extension — there is no separate ohio application form. Newsletter is produced by the ohio state university extension agronomy team, state specialists at the ohio state university and the ohio agricultural research and development center (oardc). 2 what is the due date for. Get ready for tax season deadlines by completing any required tax forms today. Web ohio does not have a separate extension request form. Try it for free now! All tax payments are due by the original due date of the return. Estimated income tax and/or extension of time to file. Newsletter is produced by the ohio state university extension agronomy team, state specialists at the ohio state university and the ohio agricultural research and development center (oardc). Ohio does not have its own separate state extension form. (april 15 for calendar year taxpayers) or interest and penalties will be charged. Estimated income tax and/or extension of time to file. Web ohio tax extension form: 2 what is the due date for the it 1041 fiduciary income tax return? Web the state of ohio doesn’t require any extension form as it automatically grants extensions up to 6 months. More about the ohio form it 40p individual income tax voucher ty 2022. For cincinnati, indicate whether or not a federal extension form 4868 has been filed on the ojcinext screen. Explore more file form 4868 and extend your 1040 deadline up to 6 months. Web file your business federal tax extension. 2570 harding highway, lima, oh 45804. 3 what is the extended due date for the it 1041 fiduciary income tax return? Within osu extension, the agriculture and natural resources team provides ohioans resources and educational programs focusing on profitable and sustainable agriculture, a clean environment and. Web rita will prepare your return for you. 3 what is the statute of limitations for the pte and fiduciary income taxes? Include this voucher with your payment for your original ohio income tax return. Get ready for tax season deadlines by completing any required tax forms today. Use this form if you are exempt from filing an individual municipal income tax return. To obtain an ohio tax extension, you must first file a federal tax extension (irs form 4868).Fillable Ohio Form It 4708ext Ohio Tax Extension Payment

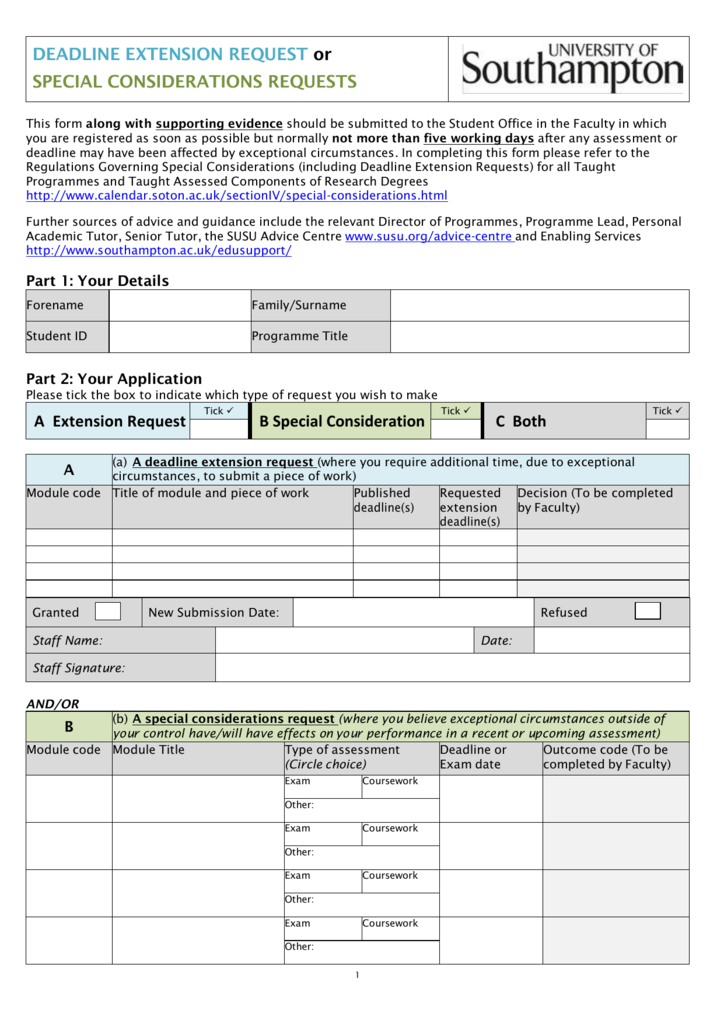

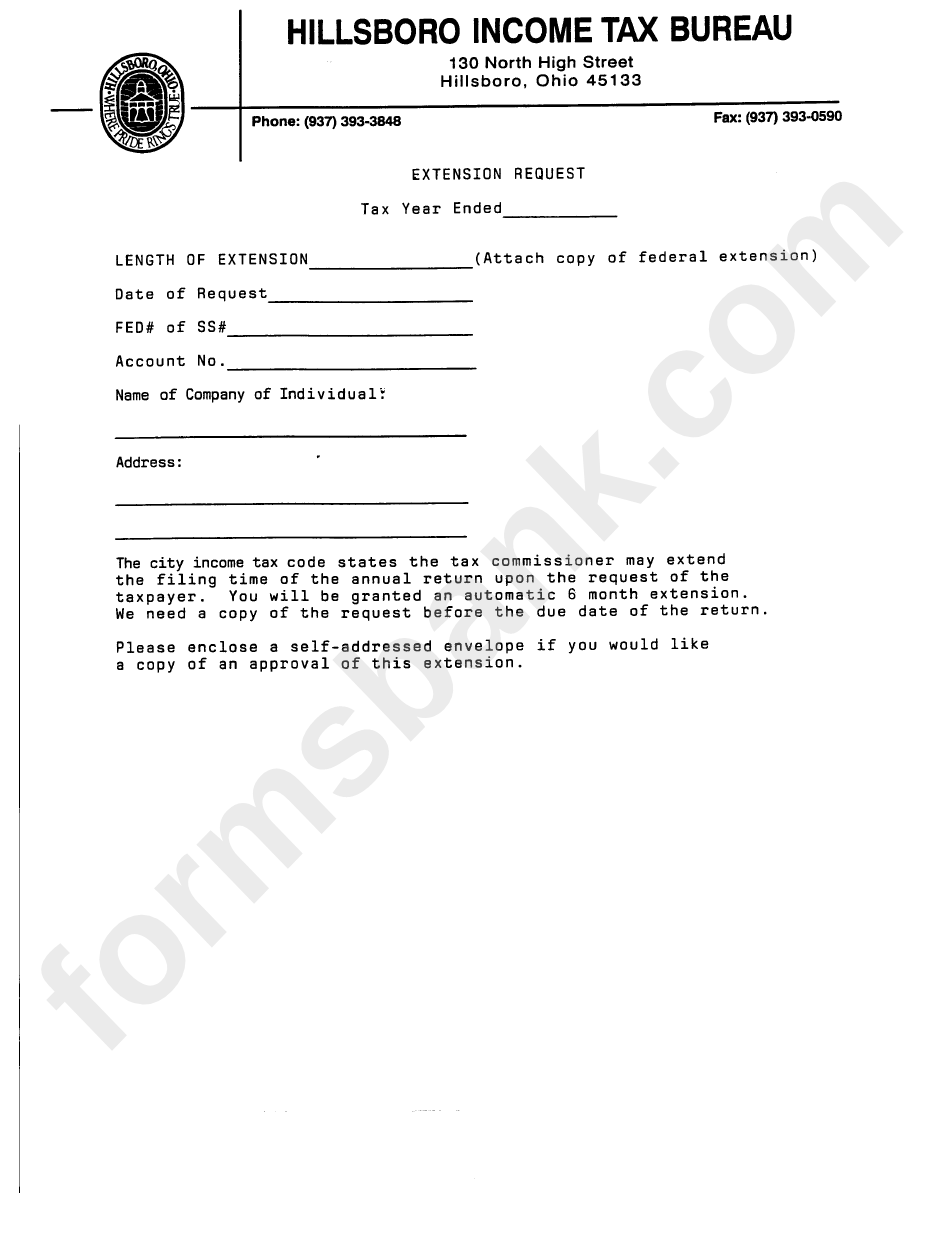

A Extension Request

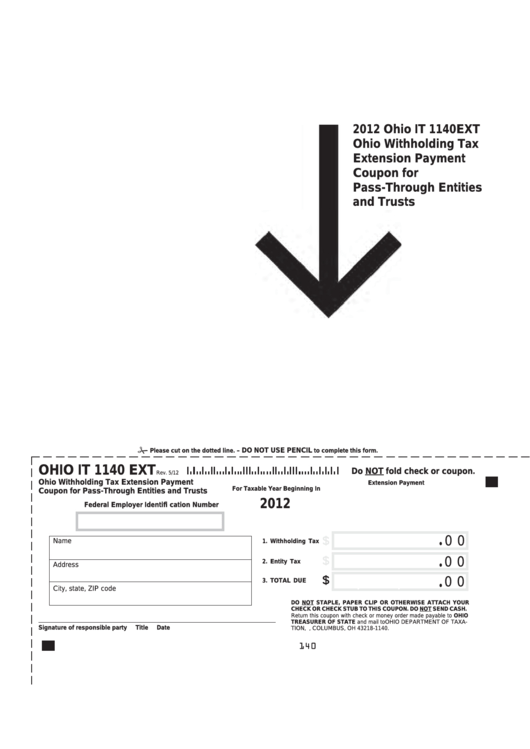

Fillable Ohio Form It 1140 Ext Ohio Withholding Tax Extension Payment

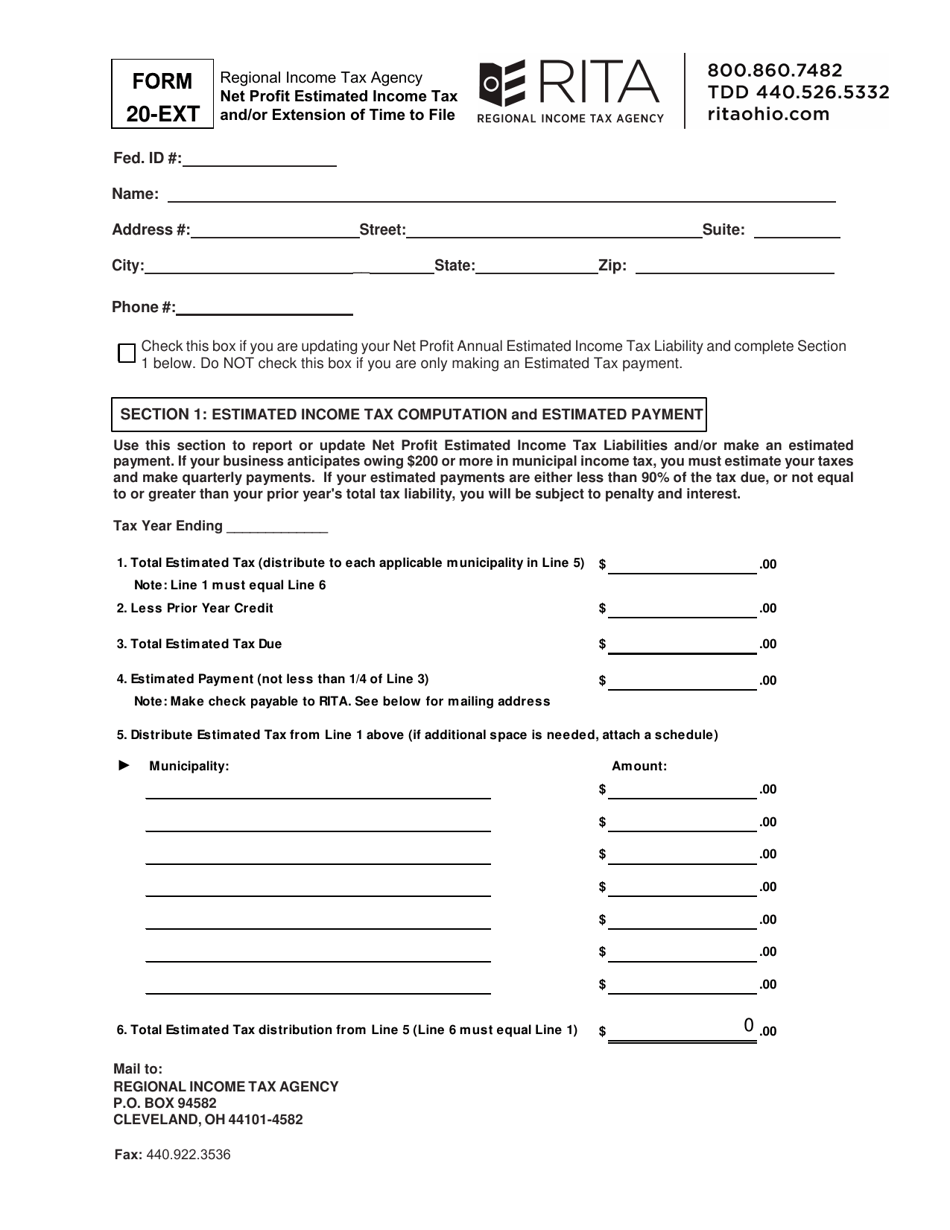

Form 20EXT Fill Out, Sign Online and Download Fillable PDF, Ohio

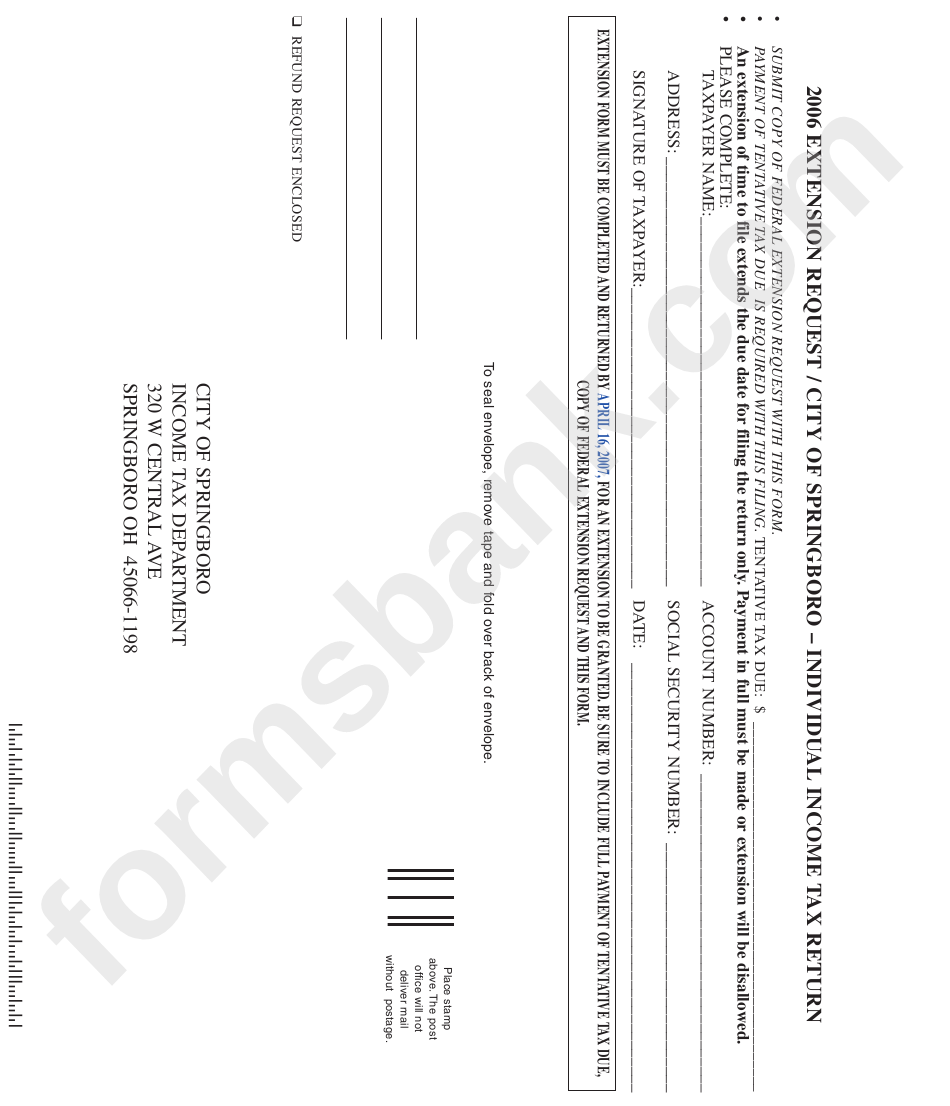

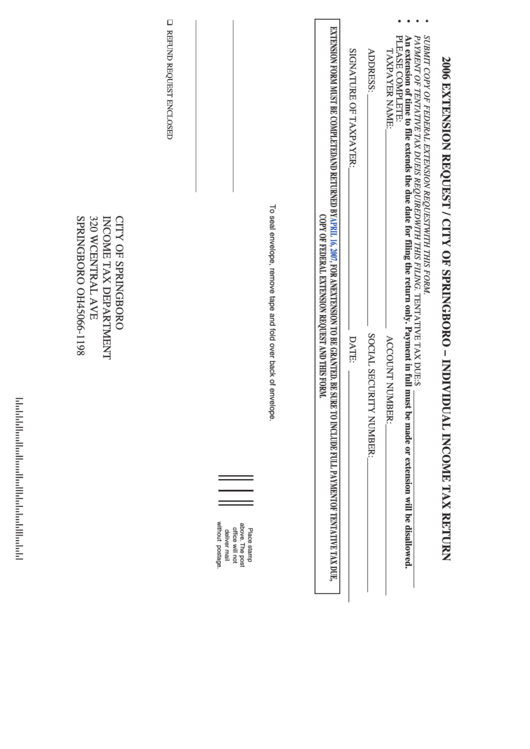

2006 Extension Request / City Of Springboro Individual Tax

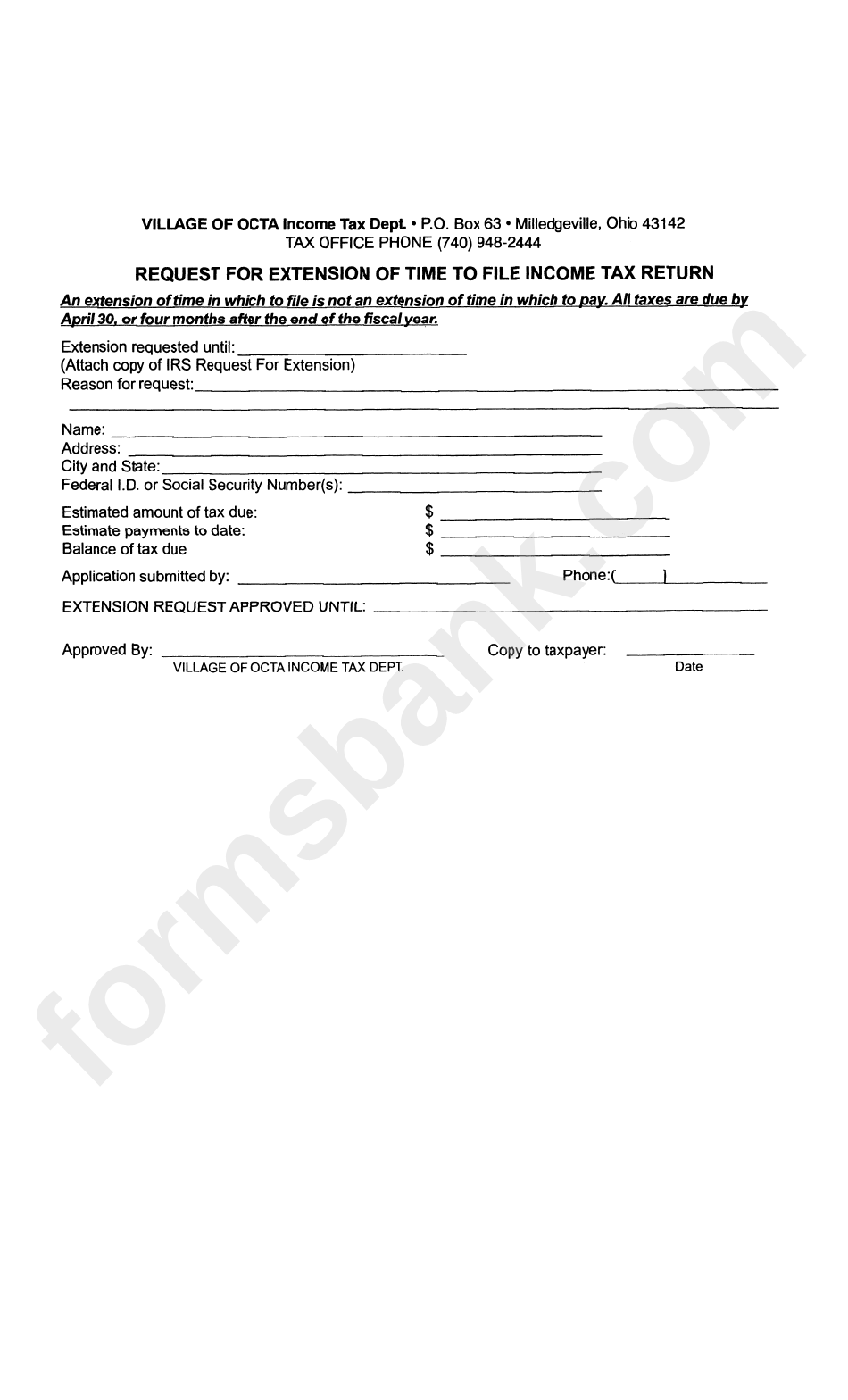

Request For Extension Of Time To File Tax Return Form State Of

2006 Extension Request / City Of Springboro Individual Tax

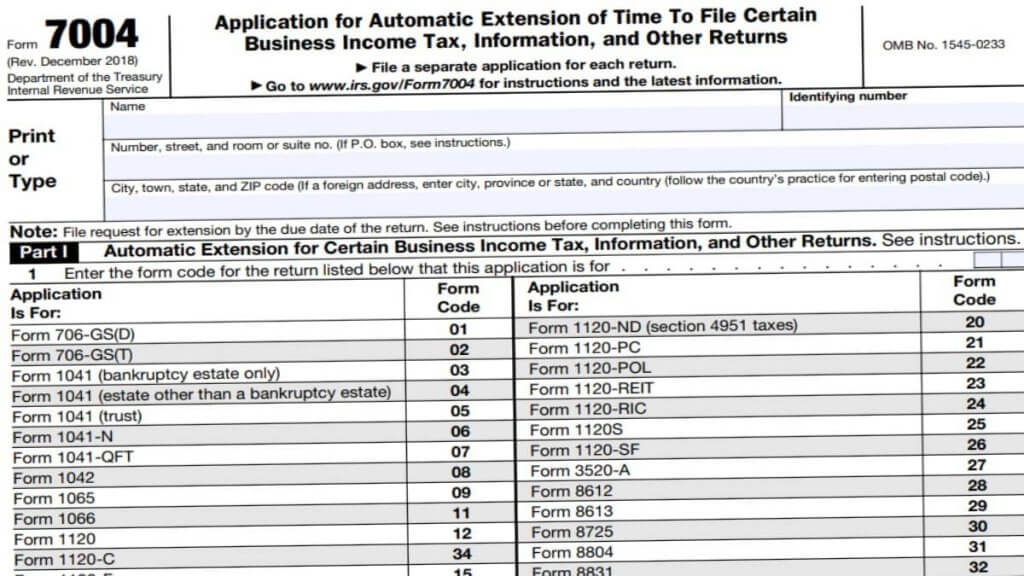

Business Tax Extension 7004 Form 2023

Extension Request Form State Of Ohio printable pdf download

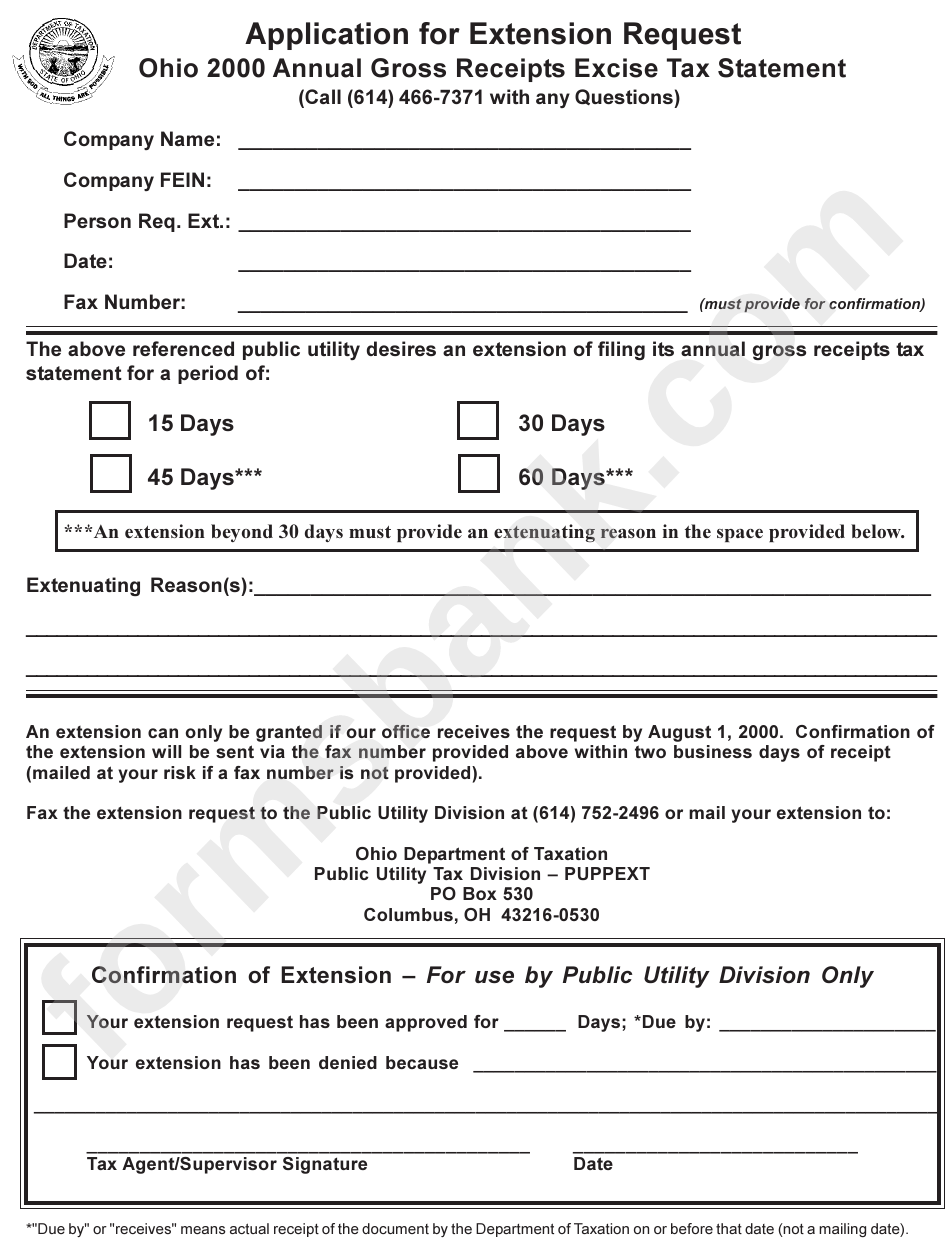

Application For Extension Request Ohio 2000 Annual Gross Receipts

Related Post: