Ny It-203 Form

Ny It-203 Form - Purposes and are required to file federal form 1040nr,u.s. 3 7 1 1 4 0 0 6. Easily sign the form with your finger. In turbotax it will generate automatically if you need to file either. However, if you both choose to file a. For more information about the new york income tax, see the new york income tax page. This form is for income earned in tax year 2022, with tax returns. Web if you are a u.s. 3 7or more is rounded up). 26 new york state amount: Page last reviewed or updated:. However, if you both choose to file a. Nonresident alien for federal income tax. 26 new york state amount: Web not ready to file electronically? Nonresident alien for federal income tax. Web not ready to file electronically? If you do round numbers, you must be 1 1 4 4 8 1. This form is for income earned in tax year 2022, with tax returns. You can download or print. Web the ny it 203 form is a powerful tool for filing taxes in the state of new york. If you do round numbers, you must be 1 1 4 4 8 1. You can download or print. This form is for income earned in tax year 2022, with tax returns. Web gross income and new york additions to income. Easily sign the form with your finger. Web the ny it 203 form is a powerful tool for filing taxes in the state of new york. 27 federal amount income > large partnership passthrough: Nonresident alien for federal income tax. 3 7or more is rounded up). Web the form 1: 3 7 1 1 4 0 0 6. This form is for income earned in tax year 2022, with tax returns. Nonresident alien for federal income tax. 26 new york state amount: Web 2022 new york state tax table. To compute your tax, see tax. For more information about the new york income tax, see the new york income tax page. 3 7 1 1 4 0 0 6. 27 federal amount income > large partnership passthrough: To compute your tax, see tax. Purposes and are required to file federal form 1040nr,u.s. Nonresident alien for federal income tax. 27 federal amount income > large partnership passthrough: 26 new york state amount: 3 7or more is rounded up). A penalty of $500 may be imposed for furnishing false information that. Web department of taxation and finance. Page last reviewed or updated:. 26 new york state amount: Purposes and are required to file federal form 1040nr,u.s. Web if you are a u.s. In turbotax it will generate automatically if you need to file either. You can download or print. 27 federal amount income > large partnership passthrough: Web the ny it 203 form is a powerful tool for filing taxes in the state of new york. Web the form 1: In turbotax it will generate automatically if you need to file either. 27 federal amount income > large partnership passthrough: Purposes and are required to file federal form 1040nr,u.s. If you do round numbers, you must be 1 1 4 4 8 1. Open form follow the instructions. 3 7or more is rounded up). In turbotax it will generate automatically if you need to file either. 26 new york state amount: Submitting the form provides state taxing authority with 1099, w2 and other necessary information. However, if you both choose to file a. A penalty of $500 may be imposed for furnishing false information that. Ad uslegalforms.com has been visited by 100k+ users in the past month To compute your tax, see tax. This form is for income earned in tax year 2022, with tax returns. Purposes and are required to file federal form 1040nr,u.s. Web department of taxation and finance. Nonresident alien for federal income tax. Nonresident alien income tax return, you may be required. Modifications are be made in screen 51.091, new york modifications. You can download or print. 3 7 1 1 4 0 0 6. Easily sign the form with your finger. Web the ny it 203 form is a powerful tool for filing taxes in the state of new york.Form IT203GRATTC Schedule C Download Fillable PDF or Fill Online

New york state it 203 instructions

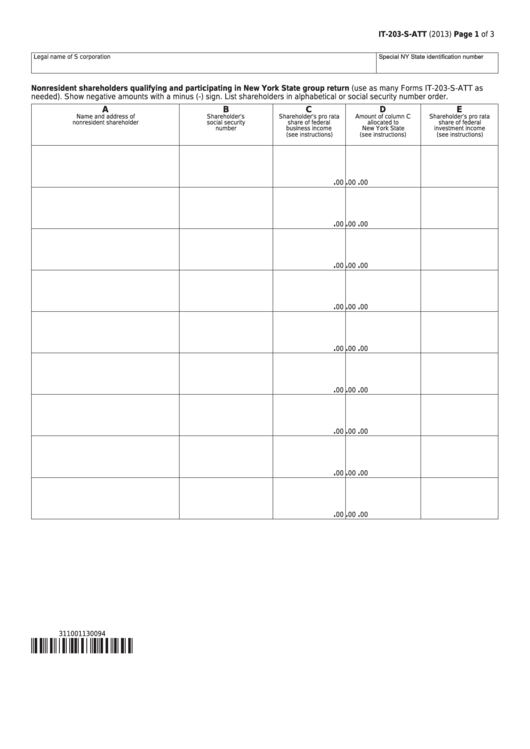

Fillable Form It203SAtt New York State Group Return printable pdf

Fill Free fillable Form 1 IT203 Nonresident and PartYear Resident

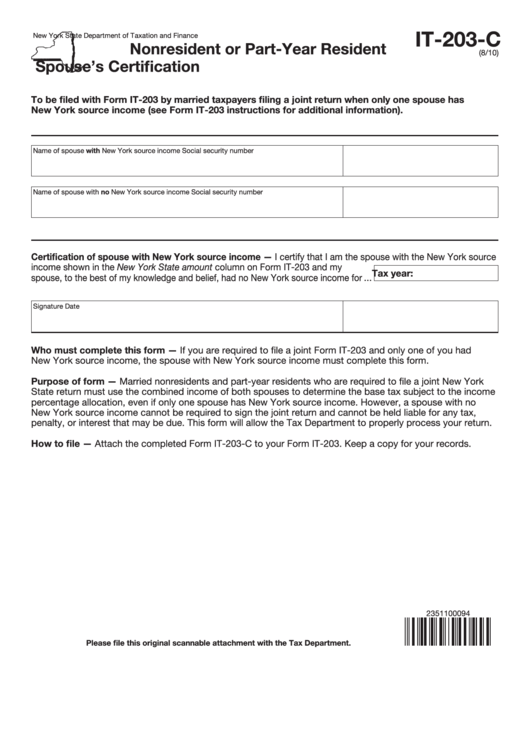

Form IT203C Nonresident or PartYear Resident Spouse's Certification,

It 203 form new york Fill out & sign online DocHub

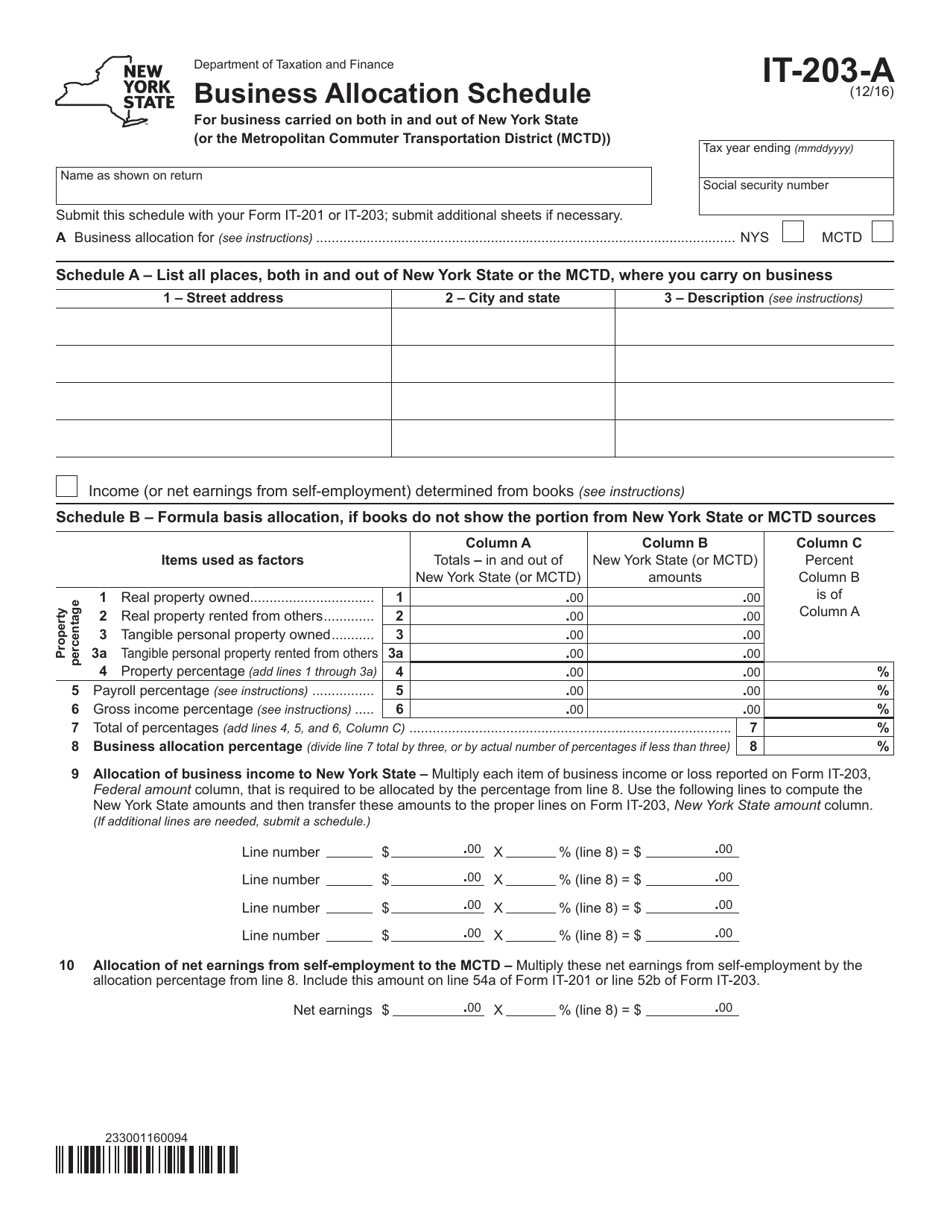

Form IT203A Download Fillable PDF or Fill Online Business Allocation

Form IT203X (2011) (Fillin) Amended Nonresident and PartYear

Fillable Form It203C Nonresident Or PartYear Resident Spouse'S

2019 Form NY IT203 Fill Online, Printable, Fillable, Blank pdfFiller

Related Post: