Ny Form It 203 Instructions

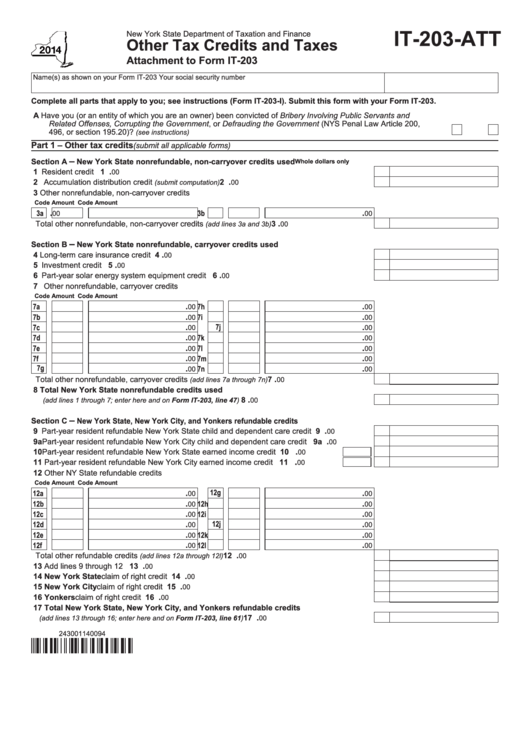

Ny Form It 203 Instructions - Web here's a list of some of the most commonly used new york tax forms: Were not a resident of new york state and received income during the tax. A part‑year resident of new york state who incurs losses in the resident or nonresident period, or both, must make a separate nol computation for each period. • you have income from a new york source (see below and page 6) and your new york agi (federal. Keep a copy for your records. Your federal adjusted gross income (agi) is $41,000 or less regardless of age, or. Payment voucher for income tax returns. (if additional lines are needed, submit a schedule.). However, if you both choose to file a. Web new york state • new york city • yonkers • mctmt. Payment voucher for income tax returns. Your federal adjusted gross income (agi) is $41,000 or less regardless of age, or. Web you may be eligible for free file using one of the software providers below, if: • as a nonresident received certain income related to a profession or occupation. For the year january 1, 2022, through december 31, 2022, or. Were not a resident of new york state and received income during the tax. For the year january 1, 2022, through december 31, 2022, or fiscal year beginning. • as a nonresident received certain income related to a profession or occupation. You can download or print. Your federal adjusted gross income (agi) is $41,000 or less regardless of age, or. Web you may be eligible for free file using one of the software providers below, if: Web new york state • new york city • yonkers • mctmt. Were not a resident of new york state and received income during the tax. Payment voucher for income tax returns. Individual income tax return tax return. • as a nonresident received certain income related to a profession or occupation. Keep a copy for your records. Web you may be eligible for free file using one of the software providers below, if: Web here's a list of some of the most commonly used new york tax forms: Web new york state • new york city • yonkers. For the year january 1, 2022, through december 31, 2022, or fiscal year beginning. Were not a resident of new york state and received income during the tax. Web new york state • new york city • yonkers • mctmt. A part‑year resident of new york state who incurs losses in the resident or nonresident period, or both, must make. Individual income tax return tax return. • you have income from a new york source (see below and page 6) and your new york agi (federal. Web you may be eligible for free file using one of the software providers below, if: You can download or print. Web new york state • new york city • yonkers • mctmt. You can download or print. (if additional lines are needed, submit a schedule.). For the year january 1, 2022, through december 31, 2022, or fiscal year beginning. Web you may be eligible for free file using one of the software providers below, if: • as a nonresident received certain income related to a profession or occupation. Were not a resident of new york state and received income during the tax. For the year january 1, 2022, through december 31, 2022, or fiscal year beginning. A part‑year resident of new york state who incurs losses in the resident or nonresident period, or both, must make a separate nol computation for each period. However, if you both choose. Were not a resident of new york state and received income during the tax. You can download or print. Web here's a list of some of the most commonly used new york tax forms: (if additional lines are needed, submit a schedule.). Individual income tax return tax return. You can download or print. Web you may be eligible for free file using one of the software providers below, if: Keep a copy for your records. For the year january 1, 2022, through december 31, 2022, or fiscal year beginning. Web here's a list of some of the most commonly used new york tax forms: Keep a copy for your records. You can download or print. Were not a resident of new york state and received income during the tax. Web you may be eligible for free file using one of the software providers below, if: For the year january 1, 2022, through december 31, 2022, or fiscal year beginning. Web new york state • new york city • yonkers • mctmt. However, if you both choose to file a. • as a nonresident received certain income related to a profession or occupation. A part‑year resident of new york state who incurs losses in the resident or nonresident period, or both, must make a separate nol computation for each period. Individual income tax return tax return. • you have income from a new york source (see below and page 6) and your new york agi (federal. Web here's a list of some of the most commonly used new york tax forms: (if additional lines are needed, submit a schedule.). Your federal adjusted gross income (agi) is $41,000 or less regardless of age, or. Payment voucher for income tax returns.Fillable Form It203Att New York Other Tax Credits And Taxes 2014

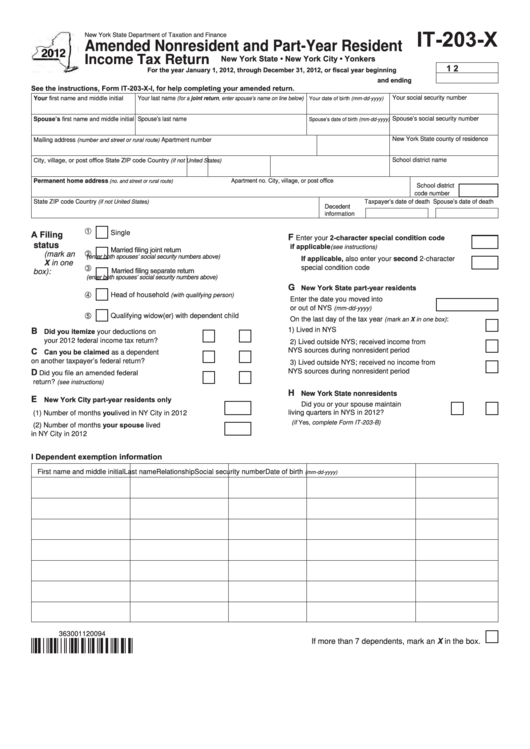

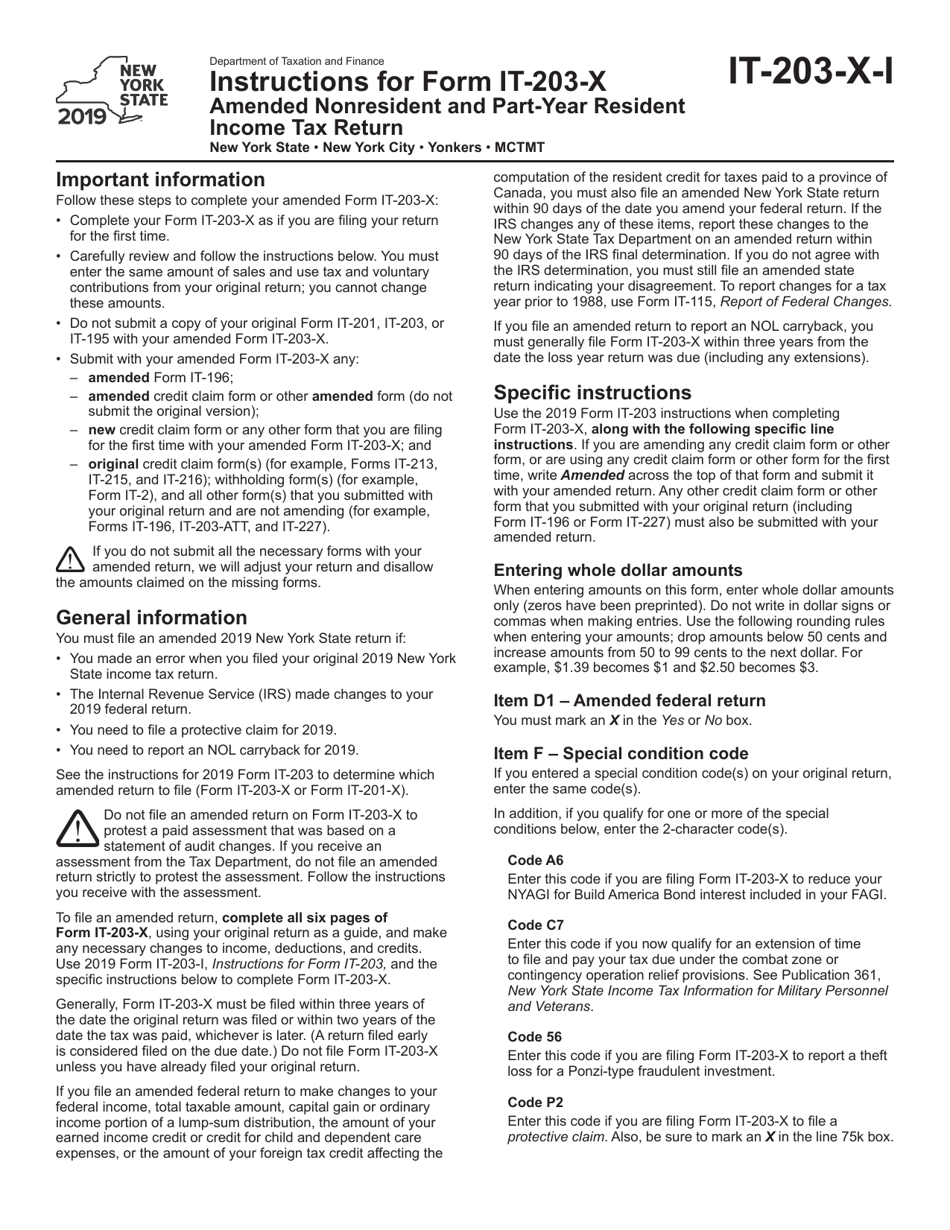

Fillable Form It203X New York Amended Nonresident And PartYear

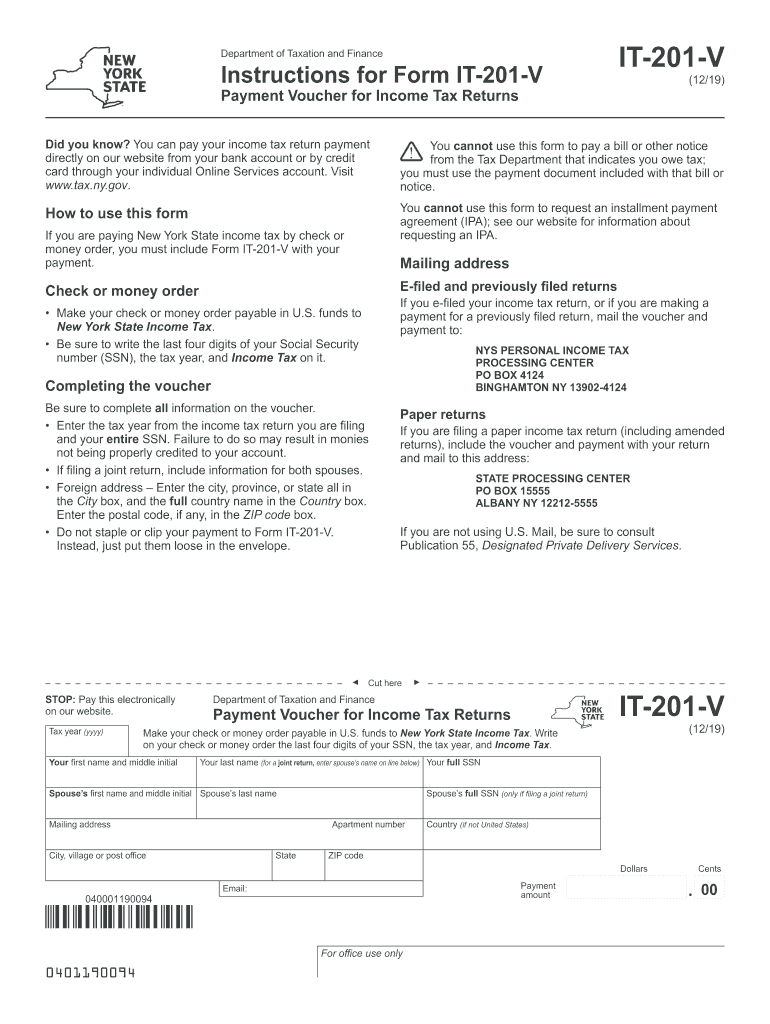

Form it 201 v 2018 Fill out & sign online DocHub

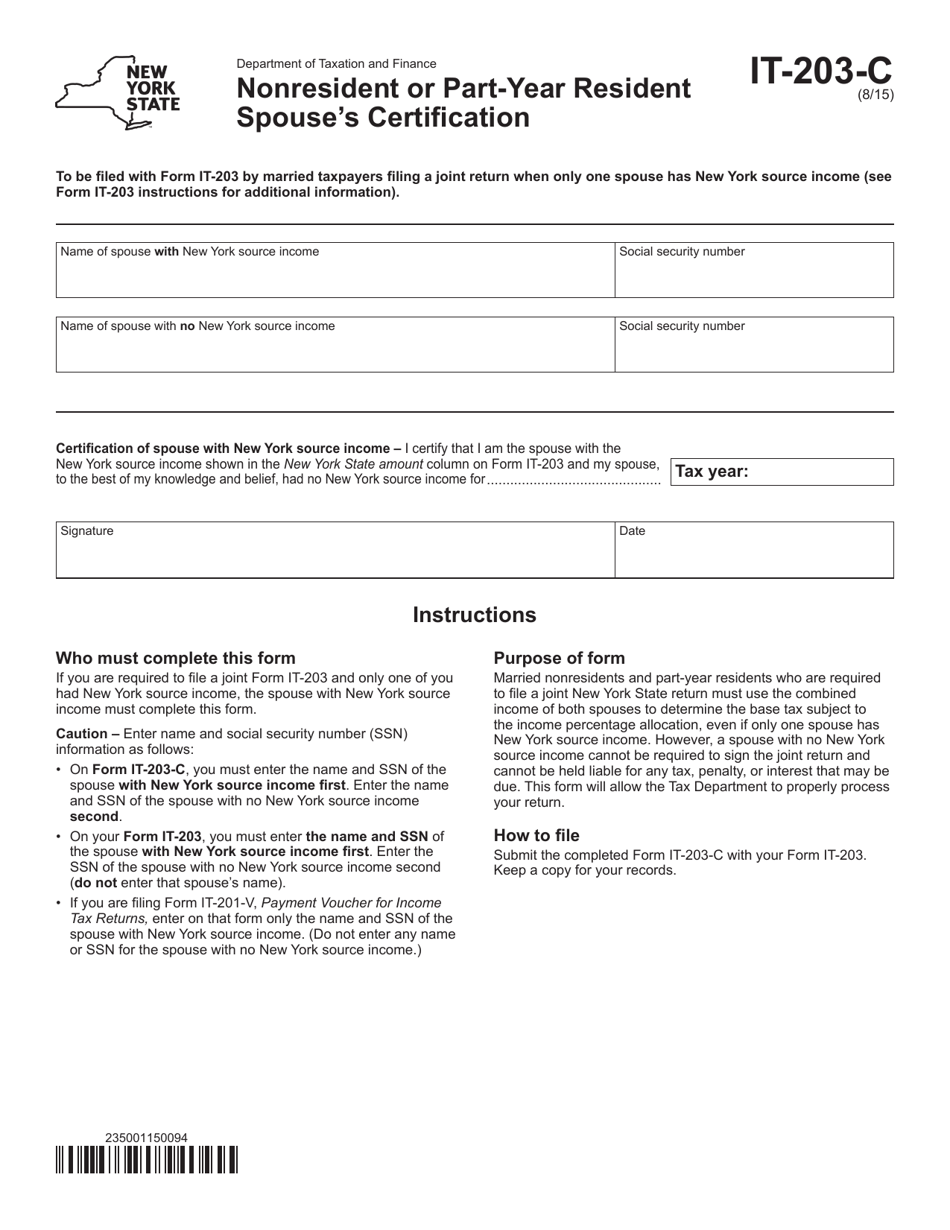

Form IT203C Download Fillable PDF or Fill Online Nonresident or Part

Download Instructions for Form IT203X Amended Nonresident and Part

NY IT203 2011 Fill out Tax Template Online US Legal Forms

2020 Form NY IT203TMATTB Fill Online, Printable, Fillable, Blank

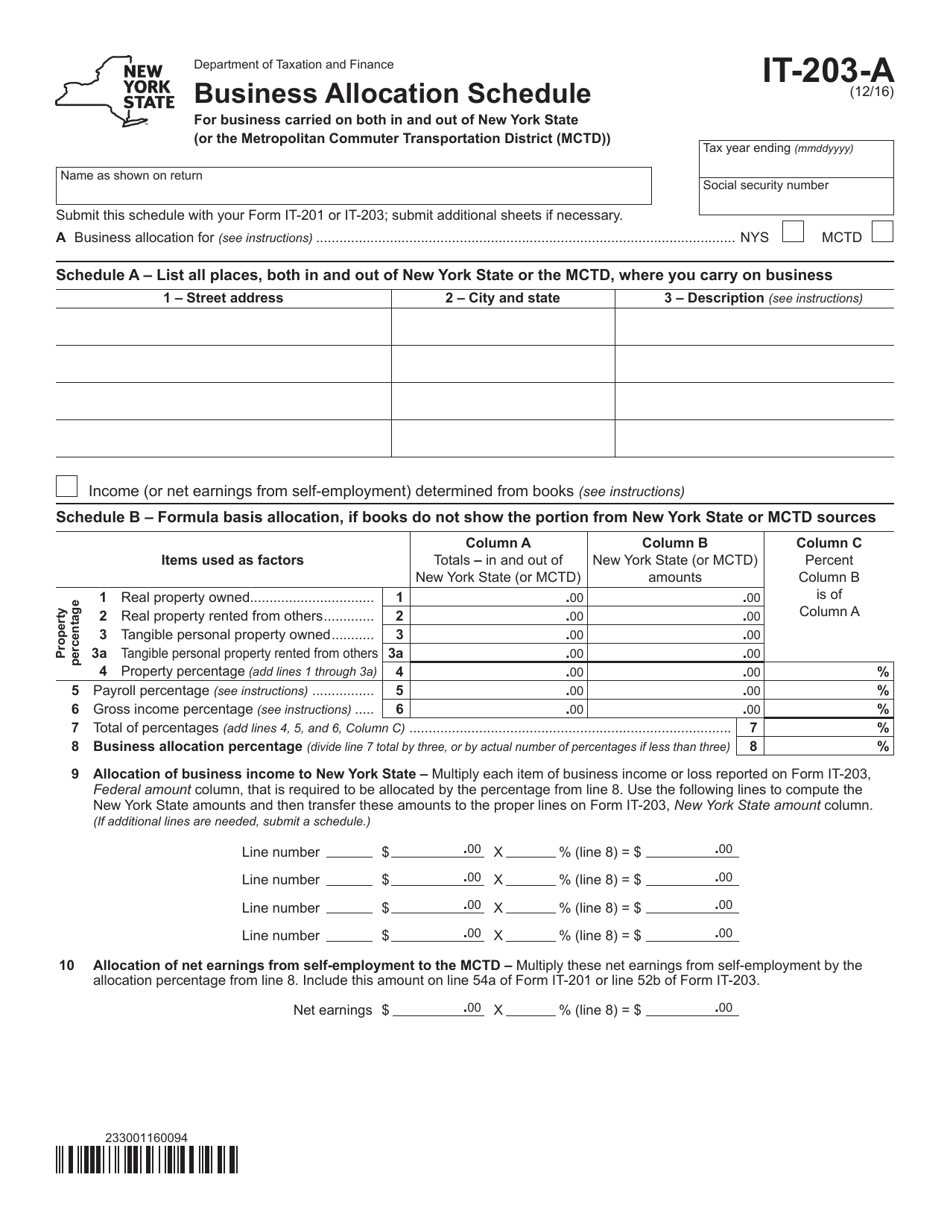

Form IT203A Download Fillable PDF or Fill Online Business Allocation

2020 NY Form IT203XFill Online, Printable, Fillable, Blank pdfFiller

Form IT203TM Download Fillable PDF or Fill Online Group Return for

Related Post: