California Form 592 Instructions

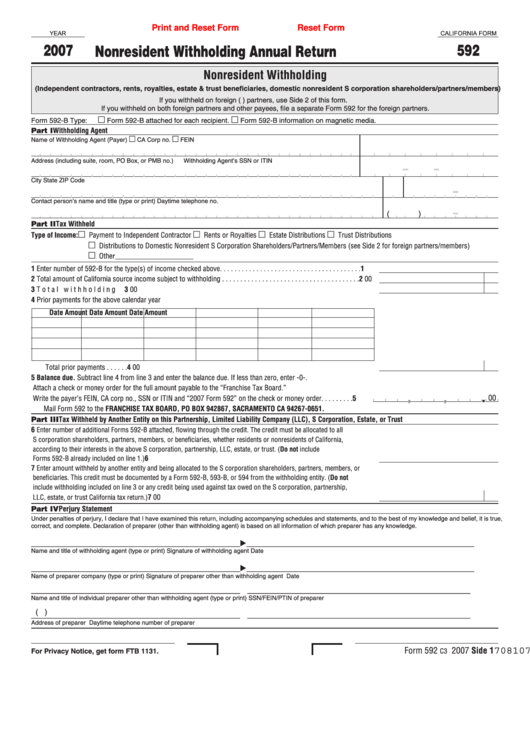

California Form 592 Instructions - Use form 592 to report the total withholding under california revenue and taxation code (r&tc) sections 18662 and 18664. Business name ssn or itin fein ca corp no. Web to do this, use the following steps: Complete, edit or print tax forms instantly. Web taxact ® supports the the preparation of california individual and business tax returns, but does not support the reporting requirement by employers (i.e. Web form 592 is a return that is filed quarterly. • april 18, 2022 june 15, 2022 september 15, 2022 january 17, 2023. Web we last updated the resident and nonresident withholding statement in january 2023, so this is the latest version of form 592, fully updated for tax year 2022. The 592 contains a list of all payees withheld upon during the filing period. Upload, modify or create forms. Tax withheld on california source income is reported to the franchise tax board (ftb) using form 592. Try it for free now! Items of income that are subject to. Web use form 592 to report the total withholding under california revenue and taxation code (r&tc) sections 18662 and 18664. Tax withheld on california source income is reported to the franchise. See the 2022 form instructions. Each quarter the partnership or llc must report the distributions to the partners or members and pay the withholding tax due on those. Form 592 includes a schedule of payees section, on side 2, that requires the withholding agent to identify the payees, the income amounts, and the withholding amounts. Updated 9 months ago by. The 592 contains a list of all payees withheld upon during the filing period. Web taxact ® supports the the preparation of california individual and business tax returns, but does not support the reporting requirement by employers (i.e. Upload, modify or create forms. This schedule will allow the ftb. Web you are reporting withholding on domestic nonresident individuals. Click the links below to see the form instructions. Web to do this, use the following steps: Items of income that are subject to. • april 18, 2022 june 15, 2022 september 15, 2022 january 17, 2023. Upload, modify or create forms. Updated 10 months ago by greg hatfield. Web use form 592 to report the total withholding under california revenue and taxation code (r&tc) sections 18662 and 18664. Ad download or email form 592 & more fillable forms, register and subscribe now! Click the links below to see the form instructions. Use form 592, resident and nonresident withholding statement. Click the links below to see the form instructions. Web we last updated the resident and nonresident withholding statement in january 2023, so this is the latest version of form 592, fully updated for tax year 2022. Use form 592, resident and nonresident withholding statement. This schedule will allow the ftb. Form 592 includes a schedule of payees section, on. Business name ssn or itin fein ca corp no. Web video instructions and help with filling out and completing 592 form 2023 use our simple instructions for the rapid and easy submitting of the 592v 2023. • april 18, 2022 june 15, 2022 september 15, 2022 january 17, 2023. Use form 592, resident and nonresident withholding statement. Web use form. Items of income that are subject to. See the 2022 form instructions. Web we last updated the resident and nonresident withholding statement in january 2023, so this is the latest version of form 592, fully updated for tax year 2022. Ad download or email form 592 & more fillable forms, register and subscribe now! Web go to california > nonresident. Complete, edit or print tax forms instantly. Click the links below to see the form instructions. Use form 592, resident and nonresident withholding statement. This applies to domestic residents and nonresidents, regardless. Web taxact ® supports the the preparation of california individual and business tax returns, but does not support the reporting requirement by employers (i.e. Tax withheld on california source income is reported to the franchise tax board (ftb) using form 592. Each quarter the partnership or llc must report the distributions to the partners or members and pay the withholding tax due on those. Web use form 592 to report the total withholding under california revenue and taxation code (r&tc) sections 18662 and 18664.. Go to the california > other worksheet. Updated 10 months ago by greg hatfield. Try it for free now! Each quarter the partnership or llc must report the distributions to the partners or members and pay the withholding tax due on those. Upload, modify or create forms. Web use form 592 to report the total withholding under california revenue and taxation code (r&tc) sections 18662 and 18664. Form 592 includes a schedule of payees section, on side 2, that requires the withholding agent to identify the payees, the income amounts, and the withholding amounts. Web to do this, use the following steps: See the 2022 form instructions. Use form 592 to report the total withholding under california revenue and taxation code (r&tc) sections 18662 and 18664. • april 18, 2022 june 15, 2022 september 15, 2022 january 17, 2023. Web we last updated the resident and nonresident withholding statement in january 2023, so this is the latest version of form 592, fully updated for tax year 2022. Web go to california > nonresident withholding worksheet. Web video instructions and help with filling out and completing 592 form 2023 use our simple instructions for the rapid and easy submitting of the 592v 2023. Use form 592, resident and nonresident withholding statement. This schedule will allow the ftb. This applies to domestic residents and nonresidents, regardless. The 592 contains a list of all payees withheld upon during the filing period. Web use form 592 to report the total withholding under california revenue and taxation code (r&tc) sections 18662 and 18664. Click the links below to see the form instructions.CA FTB 592F 2020 Fill out Tax Template Online US Legal Forms

California Withholding Tax Form 592

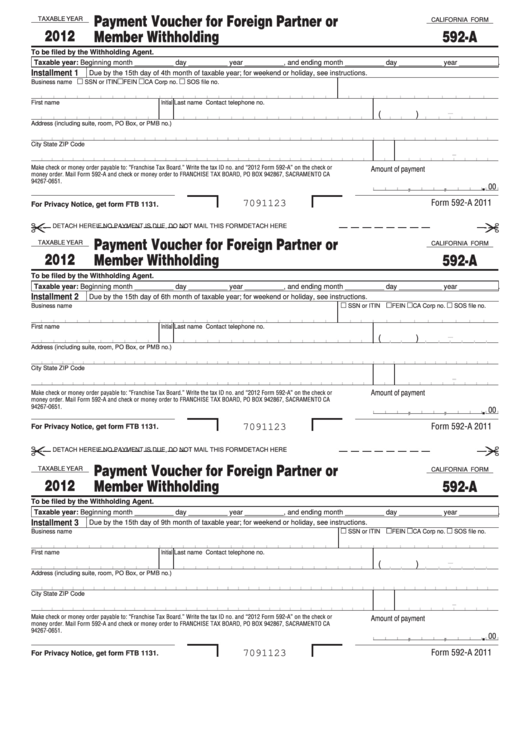

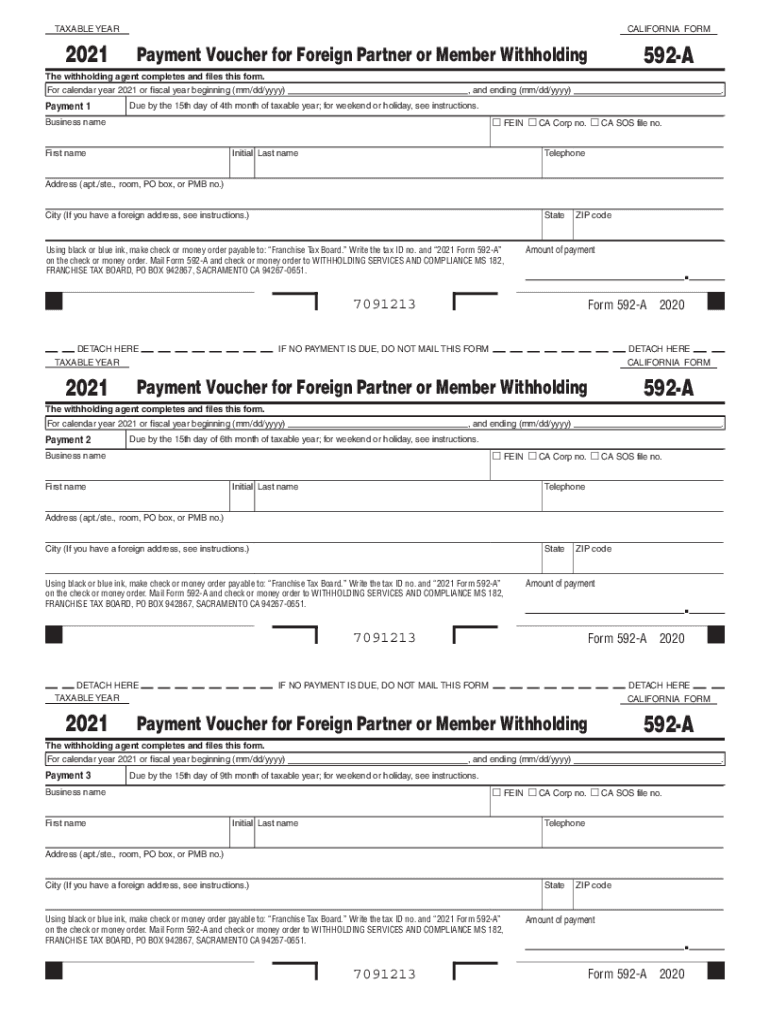

Fillable California Form 592A Payment Voucher For Foreign Partner Or

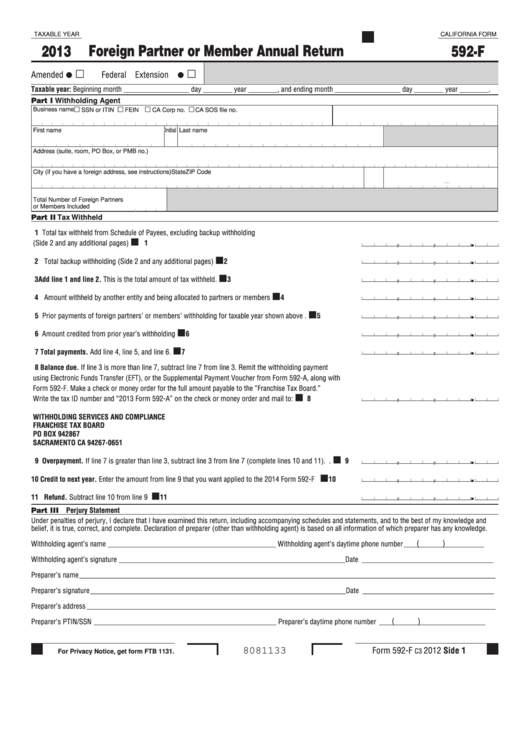

Fillable California Form 592F Foreign Partner Or Member Annual

California 592 A Fill Out and Sign Printable PDF Template signNow

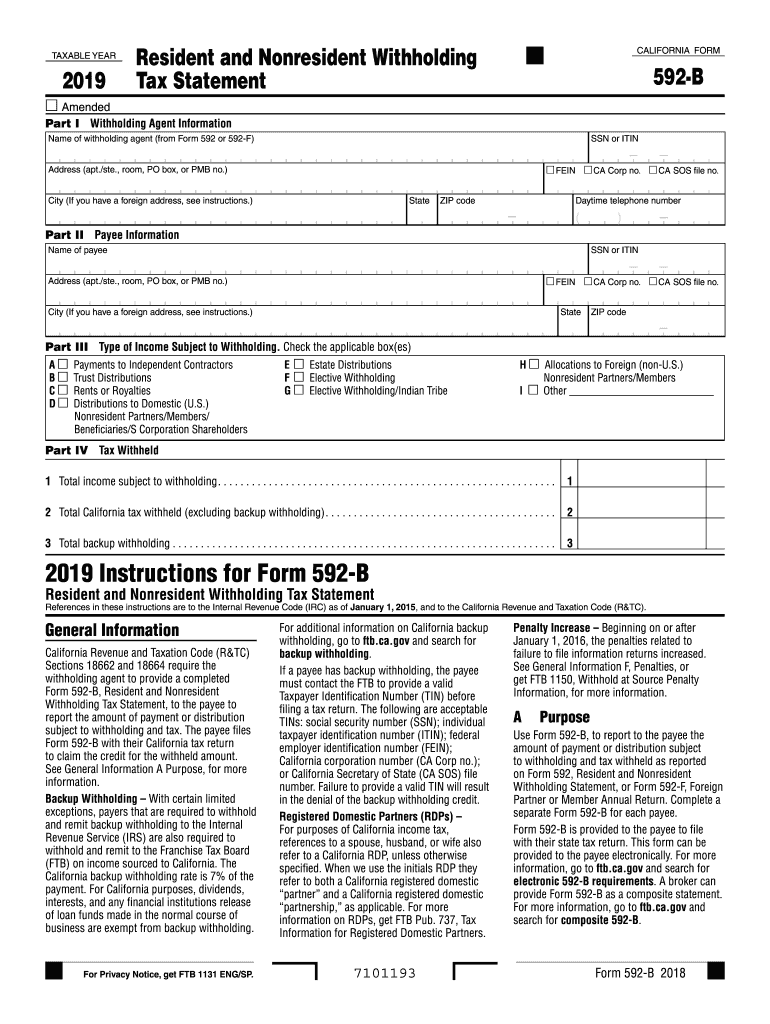

California 592 B 2019 Fill Out and Sign Printable PDF Template signNow

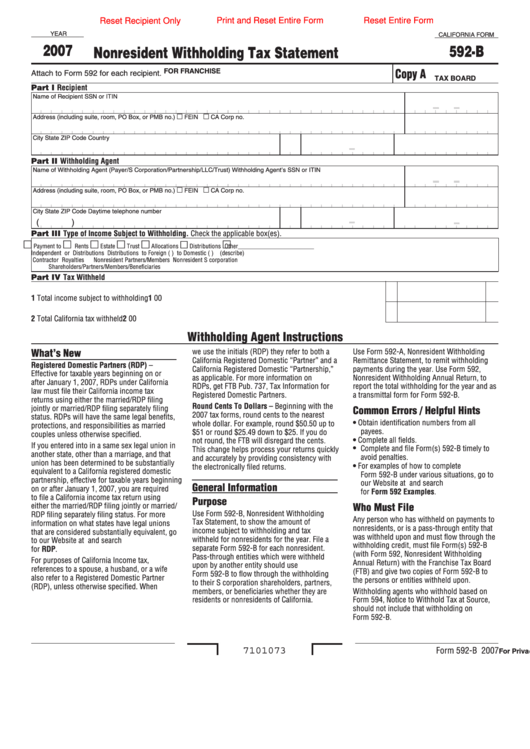

Fillable California Form 592B Nonresident Withholding Tax Statement

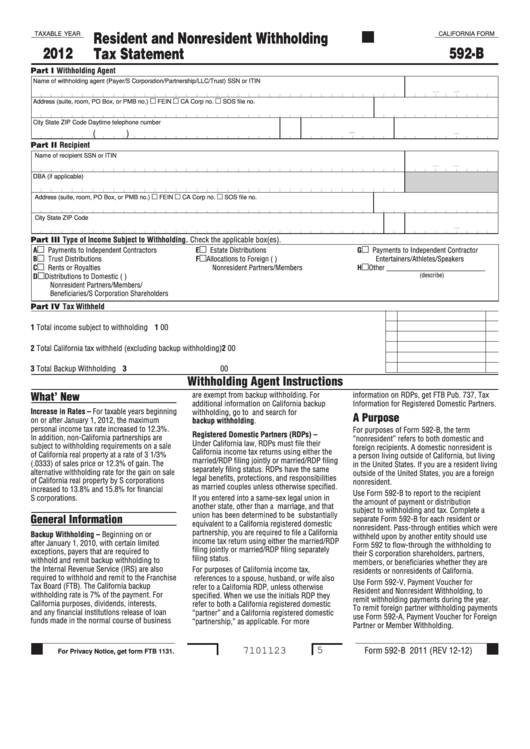

592 B Fill Out and Sign Printable PDF Template signNow

Standard form 592 t Fill out & sign online DocHub

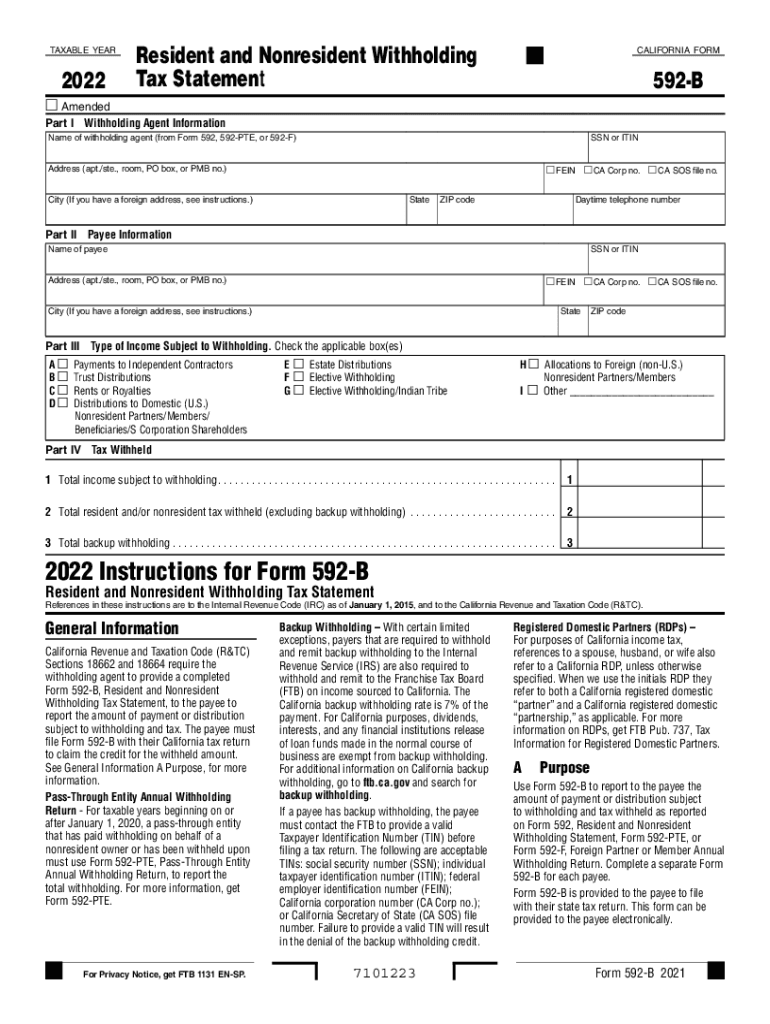

Fillable California Form 592B Resident And Nonresident Withholding

Related Post: