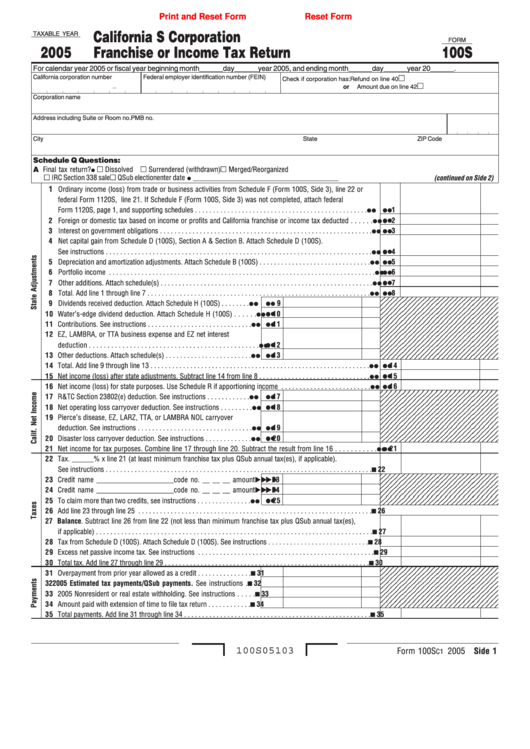

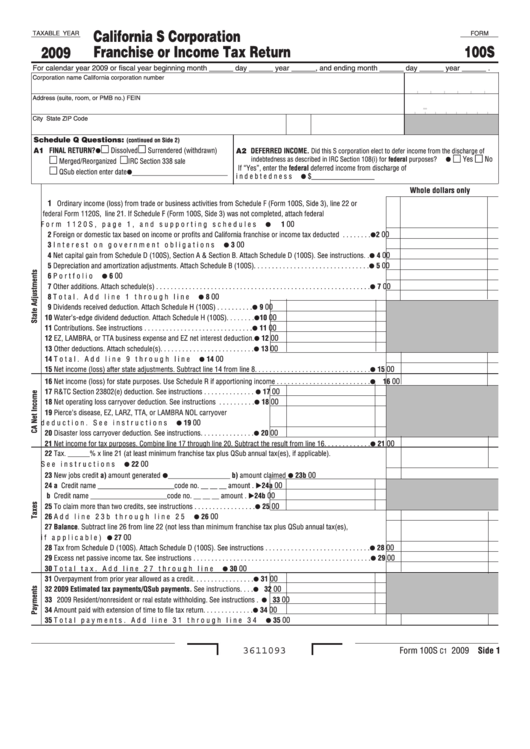

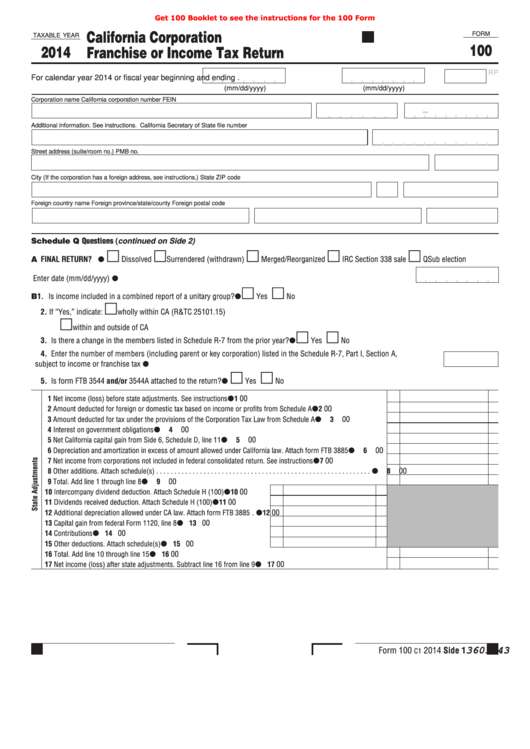

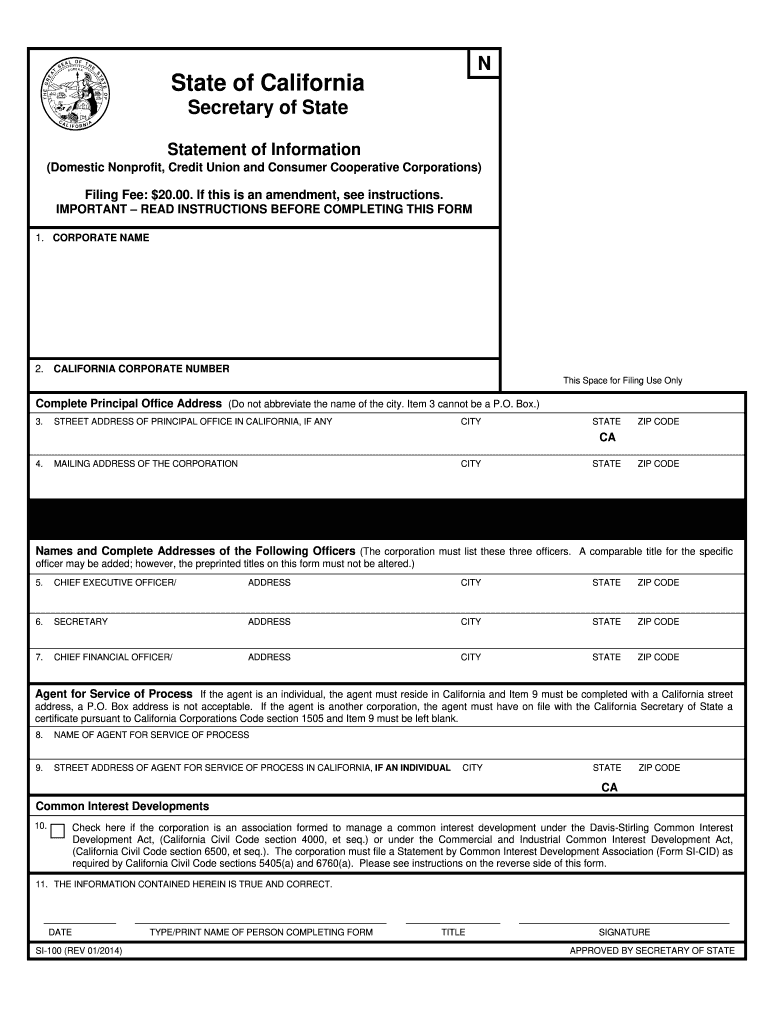

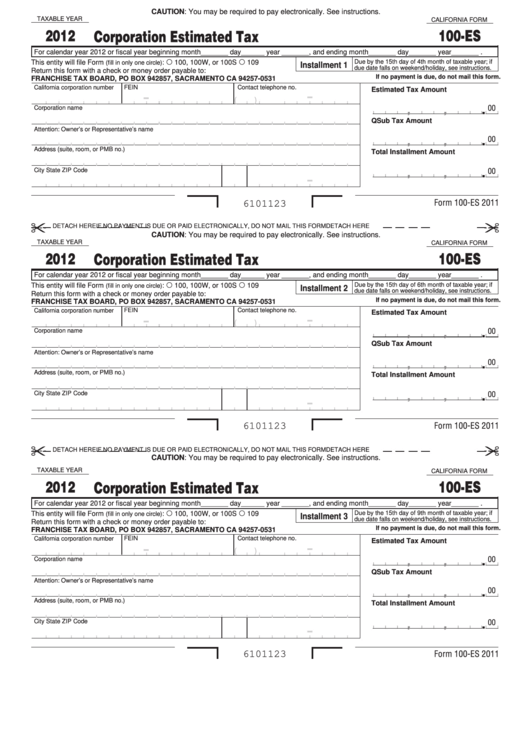

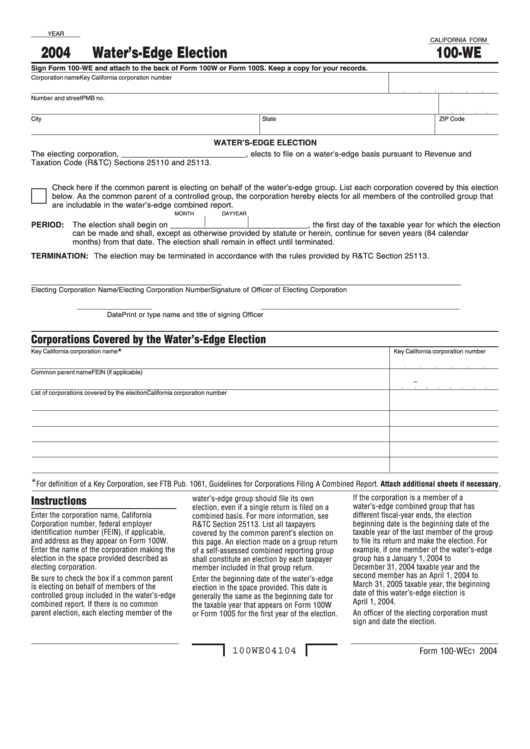

California Form 100

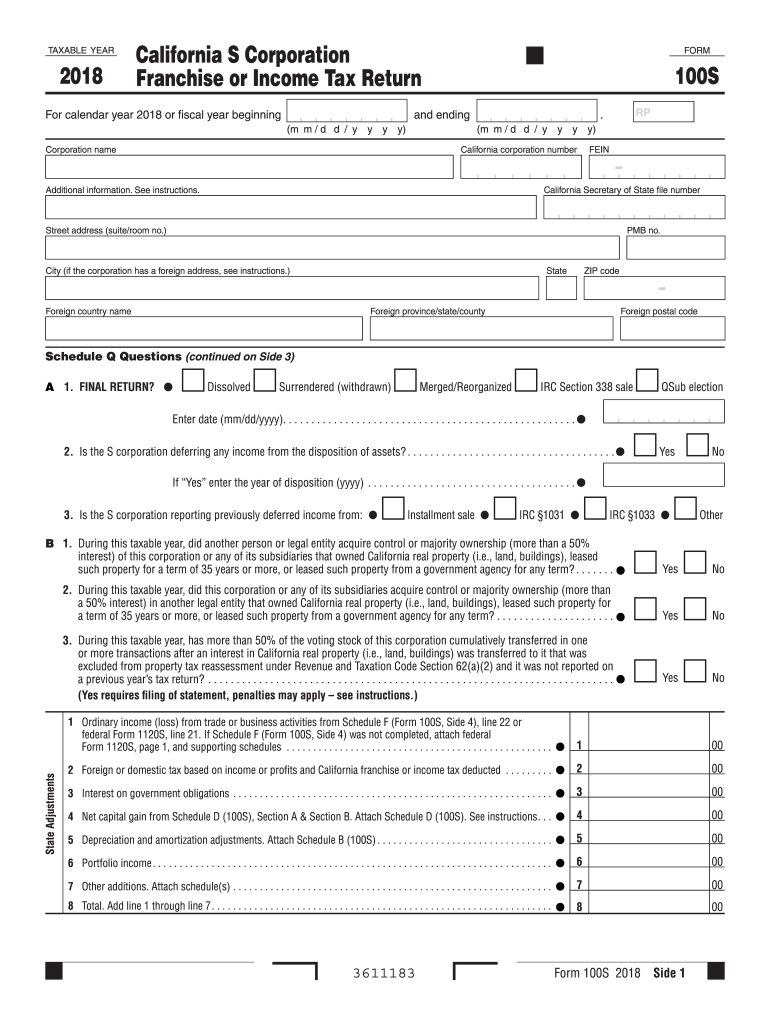

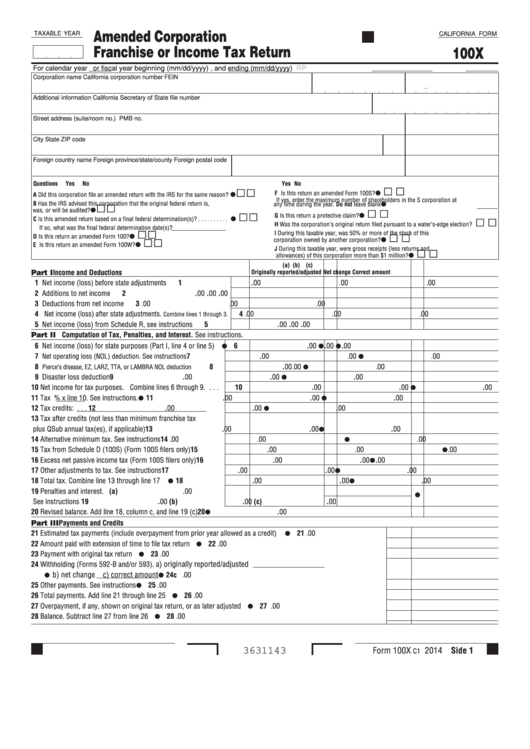

California Form 100 - Ad download or email ca form 100 & more fillable forms, register and subscribe now! Web 3601203 form 100 2020 side 1 taxable year 2020 california corporation franchise or income tax return form 100 schedule q questions (continued on side 2) a final. Web since the s corporation is doing business in both nevada and california, it must file form 100s (california s corporation franchise or income tax return) and use schedule r to. Web 2021 form 100s california s corporation franchise or income tax return. During this taxable year, did another person or legal entity. Web the hamas terrorists who murdered babies in their cribs last week weren’t stamped with pathological hatred at birth. Get ready for tax season deadlines by completing any required tax forms today. Web form 100s is used if a corporation has elected to be a small business corporation (s corporation). California corporation franchise or income tax return (form 100) california s corporation franchise or income tax. When do i file my corporation return? Web since the s corporation is doing business in both nevada and california, it must file form 100s (california s corporation franchise or income tax return) and use schedule r to. Web select this payment type if you are filing an amended tax return (form 100x) with a balance due. Ad download or email ca form 100 & more fillable. Web since the s corporation is doing business in both nevada and california, it must file form 100s (california s corporation franchise or income tax return) and use schedule r to. Web 3601203 form 100 2020 side 1 taxable year 2020 california corporation franchise or income tax return form 100 schedule q questions (continued on side 2) a final. Web. Ad download or email ca form 100 & more fillable forms, register and subscribe now! Lifo recapture due to s corporation. Web you must file california s corporation franchise or income tax return (form 100s) if the corporation is: Web all california c corporations and llcs treated as corporations file form 100 (california franchise or income tax return). Web 2021. Web select this payment type if you are filing an amended tax return (form 100x) with a balance due. Notice of proposed assessment (npa) payment select this payment type if you. Use revenue and taxation code (r&tc) sections 19011, 19021, 19023, 19025 through 19027, and 19142 through 19161 to determine the estimated tax. Web 2021 form 100s california s corporation. Web all california c corporations and llcs treated as corporations file form 100 (california franchise or income tax return). Web • form 100, california corporation franchise or income tax return, including combined reports • form 100s, california s corporation franchise or income tax return • form. Filing form 100w without errors will expedite processing. Microsoft released the following nonsecurity updates. Web all california c corporations and llcs treated as corporations file form 100 (california franchise or income tax return). When do i file my corporation return? Web 2021 form 100s california s corporation franchise or income tax return. Ad download or email ca form 100 & more fillable forms, register and subscribe now! During this taxable year, did another person. It was an acquired habit, the result of a. Web since the s corporation is doing business in both nevada and california, it must file form 100s (california s corporation franchise or income tax return) and use schedule r to. Get ready for tax season deadlines by completing any required tax forms today. Web • form 100, california corporation franchise. Lifo recapture due to s corporation. When do i file my corporation return? Web since the s corporation is doing business in both nevada and california, it must file form 100s (california s corporation franchise or income tax return) and use schedule r to. Using black or blue ink, make the check or money order payable to the franchise tax. Lifo recapture due to s corporation. Web we last updated the california corporation franchise or income tax return in january 2023, so this is the latest version of form 100, fully updated for tax year 2022. Ad download or email ca form 100 & more fillable forms, register and subscribe now! During this taxable year, did another person or legal. Web the hamas terrorists who murdered babies in their cribs last week weren’t stamped with pathological hatred at birth. Web 2021 form 100s california s corporation franchise or income tax return. Get ready for tax season deadlines by completing any required tax forms today. Web since the s corporation is doing business in both nevada and california, it must file. It was an acquired habit, the result of a. Ad download or email ca form 100 & more fillable forms, register and subscribe now! Web 2021 form 100s california s corporation franchise or income tax return. Web 3611203 form 100s 2020 side 1 b 1. Web all california c corporations and llcs treated as corporations file form 100 (california franchise or income tax return). When do i file my corporation return? Web form 100s is used if a corporation has elected to be a small business corporation (s corporation). Web • form 100, california corporation franchise or income tax return, including combined reports • form 100s, california s corporation franchise or income tax return • form. Web since the s corporation is doing business in both nevada and california, it must file form 100s (california s corporation franchise or income tax return) and use schedule r to. Use revenue and taxation code (r&tc) sections 19011, 19021, 19023, 19025 through 19027, and 19142 through 19161 to determine the estimated tax. Filing form 100w without errors will expedite processing. Using black or blue ink, make the check or money order payable to the franchise tax board. write the california corporation number and. All federal s corporations subject to california laws must file form 100s. Statement of information (california nonprofit, credit union and. Web we last updated the california corporation franchise or income tax return in january 2023, so this is the latest version of form 100, fully updated for tax year 2022. Web 64 rows the following table lists the acceptable business forms and. During this taxable year, did another person or legal entity. Web form 100 is california’s tax return for corporations, banks, financial corporations, real estate mortgage investment conduits (remics), regulated investment companies (rics),. Web the hamas terrorists who murdered babies in their cribs last week weren’t stamped with pathological hatred at birth. Web you must file california s corporation franchise or income tax return (form 100s) if the corporation is:Fillable Form 100s California S Corporation Franchise Or Tax

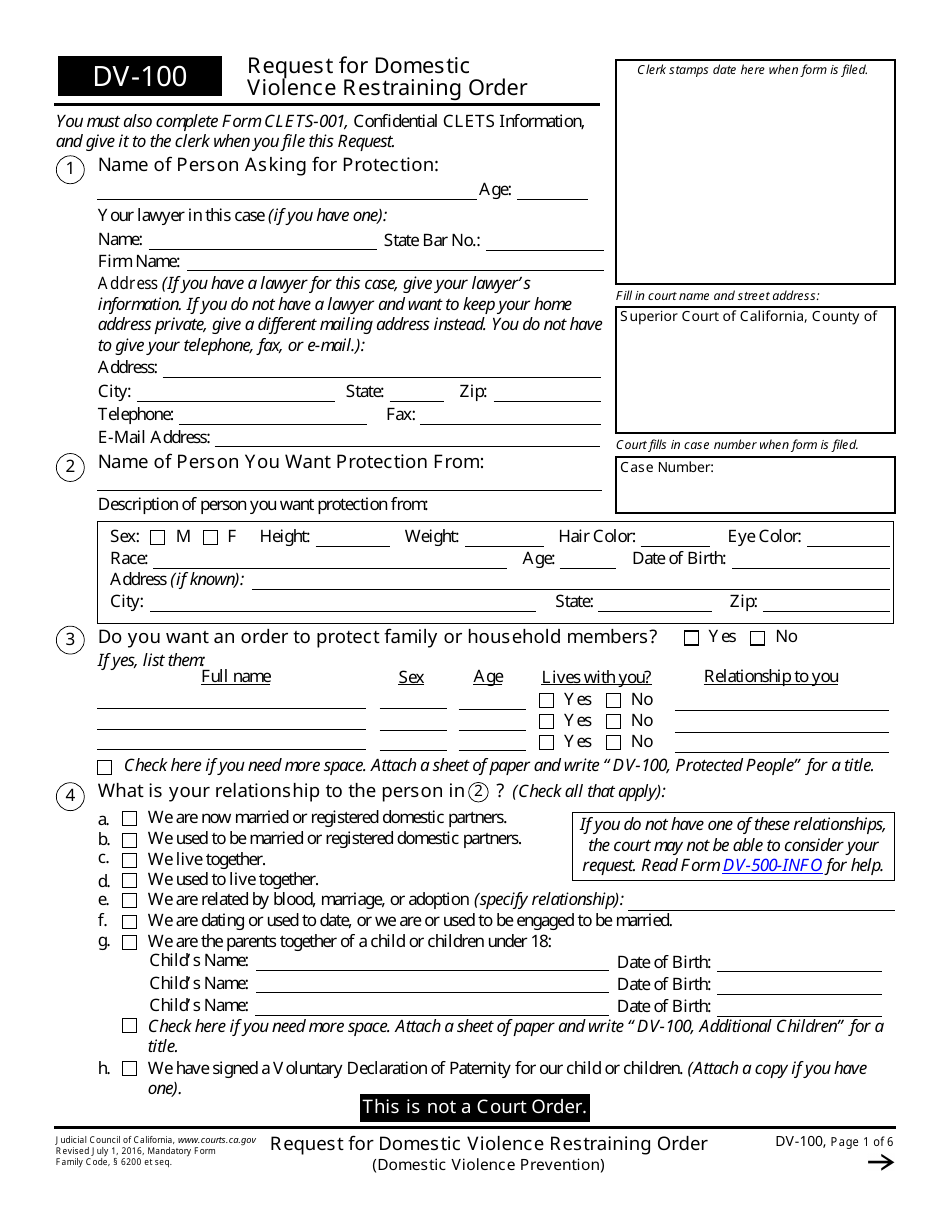

Form DV100 Fill Out, Sign Online and Download Fillable PDF

Fillable Form 100s California S Corporation Franchise Or Tax

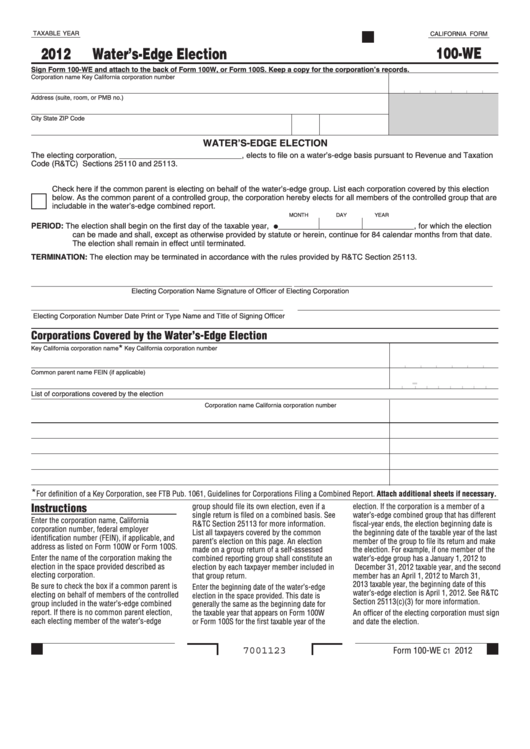

California Form 100We Water'SEdge Election 2012 printable pdf

Fillable Form 100 California Corporation Franchise Or Tax

California Form Si 100 Fill Out and Sign Printable PDF Template signNow

Fillable California Form 100Es Corporation Estimated Tax 2012

California Form 100We Water'SEdge Election 2004 printable pdf

2018 Ca Form 100S Inputable Fill Out and Sign Printable PDF Template

Fillable Form 100x California Amended Corporation Franchise Or

Related Post: