New Jersey Tax Extension Form

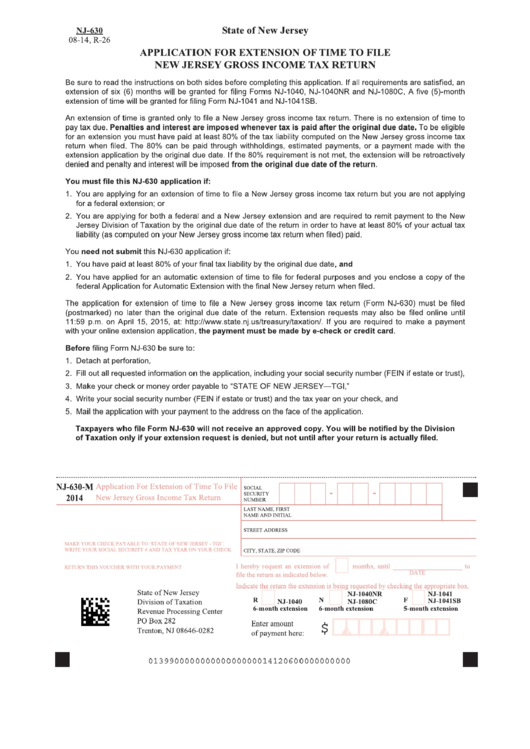

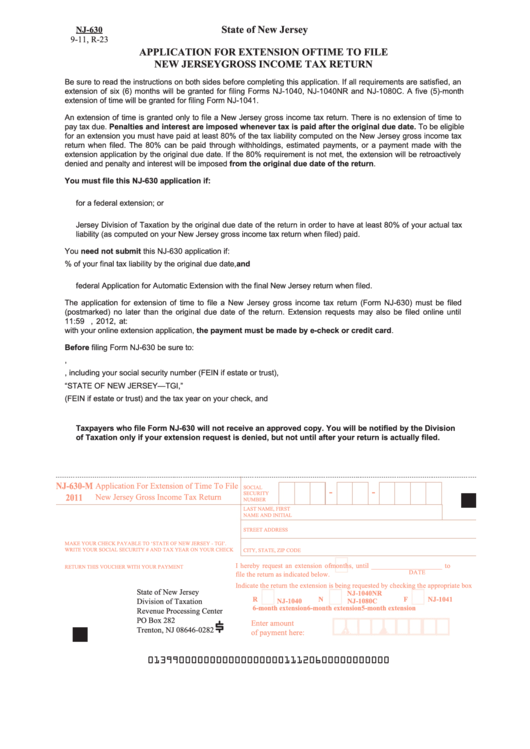

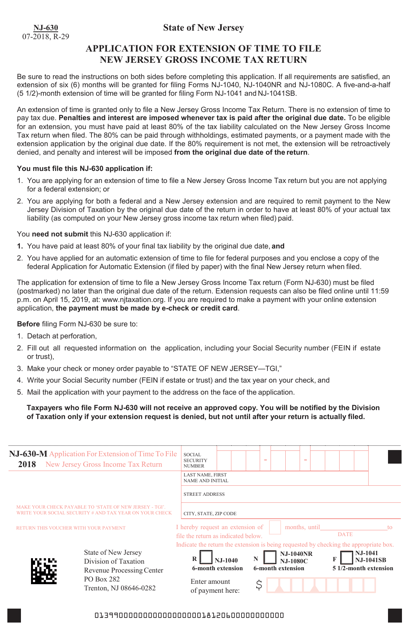

New Jersey Tax Extension Form - Pay income taxes only by credit or debit card (fee applies) or arrange for a payment to be deducted from your bank account. Web what form does the state of new jersey require to apply for an extension? Pay all or some of your new jersey income taxes online via: You may file the form: You must pay at least 80% of any. (property tax reimbursement) alcoholic beverage tax. New jersey division of taxation. Complete, edit or print tax forms instantly. You may file the form: If you owe nj income taxes, you will either have to submit a nj. You may file the form: If you owe nj income taxes, you will either have to submit a nj. Pay income taxes only by credit or debit card (fee applies) or arrange for a payment to be deducted from your bank account. Complete, edit or print tax forms instantly. Web file for an extension of a deadline for income tax. You may file the form: Application for extension of time to. Web file for an extension of a deadline for income tax filings. You must pay at least 80% of any. Get ready for tax season deadlines by completing any required tax forms today. There is no extension of time to pay the tax due. Nj division of taxation subject: Web an extension of time is granted only to file a new jersey income tax return. New jersey division of taxation. Pay income taxes only by credit or debit card (fee applies) or arrange for a payment to be deducted from your bank account. New jersey income tax extension. Web file your personal tax extension now! Web file for an extension of a deadline for income tax filings. An extension of time is granted only to file a new jersey gross income tax return. Web form 4868, application for automatic extension of time to file u.s. Web what form does the state of new jersey require to apply for an extension? New jersey division of taxation. Web form 4868, application for automatic extension of time to file u.s. An extension of time is granted only to file a new jersey gross income tax return. Complete, edit or print tax forms instantly. New jersey personal income tax returns are due by the 15th day of the 4th month after the end of the tax year (april 15 for calendar year. There is no extension of time to pay the tax due. Web an extension of time is granted only to file a new jersey income tax return. To request an extension with. Get ready for tax season deadlines by completing any required tax forms today. To request an extension with new jersey no later than april 18, 2023. Check your irs tax refund status. Web file for an extension of a deadline for income tax filings. You may file the form: Pay income taxes only by credit or debit card (fee applies) or arrange for a payment to be deducted from your bank account. You must pay at least 80% of any. Application for extension of time to. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Sign into your efile.com account and check acceptance by the irs. Check your irs tax refund status. Pay income taxes only by credit or debit card (fee applies) or arrange for a payment to be deducted from your bank account. (property tax reimbursement) alcoholic beverage tax. Application for extension of time to. Web an extension of time is granted only to file a new jersey income tax return. Sign into your efile.com account and check acceptance by the irs. Get ready for tax season deadlines by completing any required tax forms today. Web form 4868, application for automatic extension of time to file u.s. An extension of time is granted only to. You may file the form: Check your irs tax refund status. Nj division of taxation subject: New jersey income tax extension. Web new jersey tax extension form: Web form 4868, application for automatic extension of time to file u.s. Complete, edit or print tax forms instantly. There is no extension of time to pay the tax due. Pay income taxes only by credit or debit card (fee applies) or arrange for a payment to be deducted from your bank account. To request an extension with new jersey no later than april 18, 2023. New jersey division of taxation. Web an extension of time is granted only to file a new jersey income tax return. Pay all or some of your new jersey income taxes online via: Complete, edit or print tax forms instantly. Web what form does the state of new jersey require to apply for an extension? Get ready for tax season deadlines by completing any required tax forms today. New jersey personal income tax returns are due by the 15th day of the 4th month after the end of the tax year (april 15 for calendar year. An extension of time is granted only to file a new jersey gross income tax return. You may file the form: Application for extension of time to.Fillable Form Nj630M Application For Extension Of Time To File New

Fillable Form Nj630 Application For Extension Of Time To File New

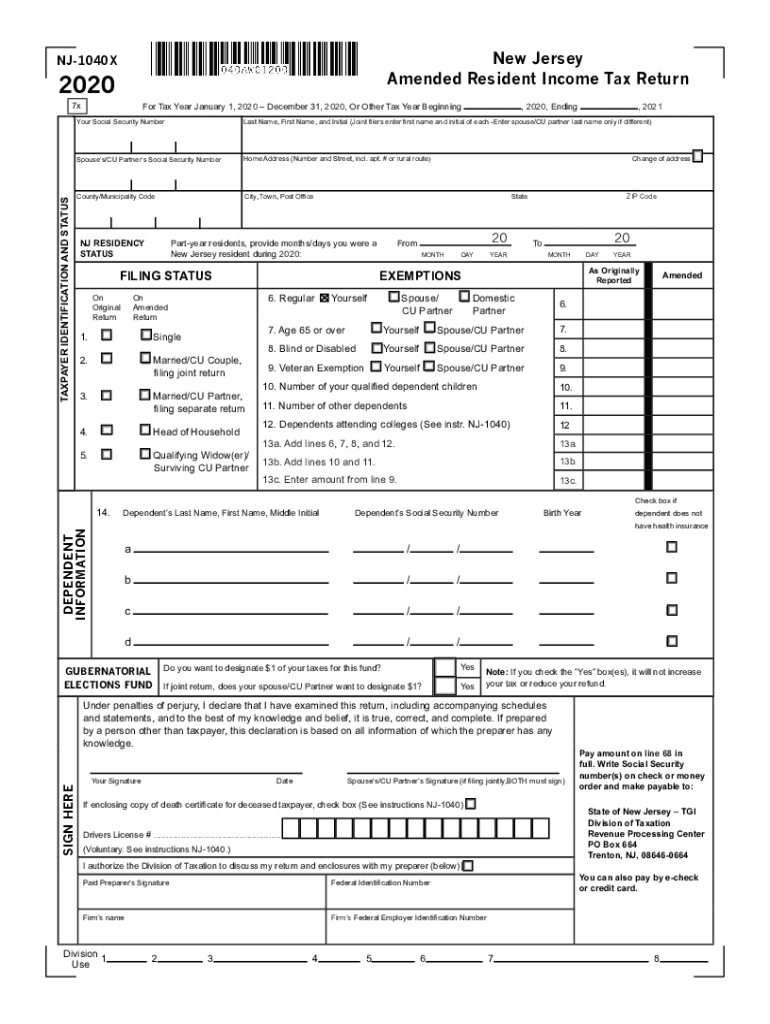

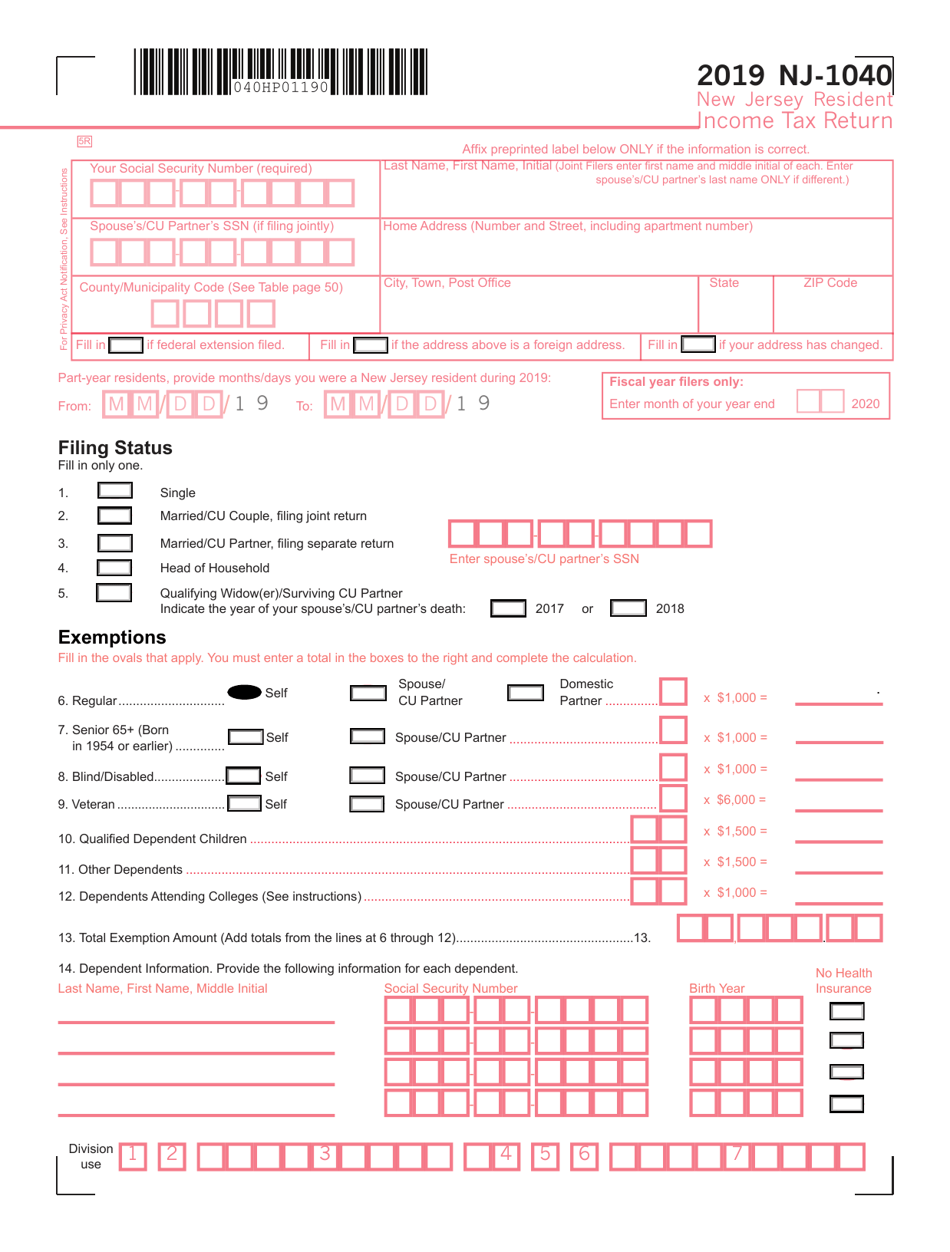

2020 Form NJ DoT NJ1040xFill Online, Printable, Fillable, Blank

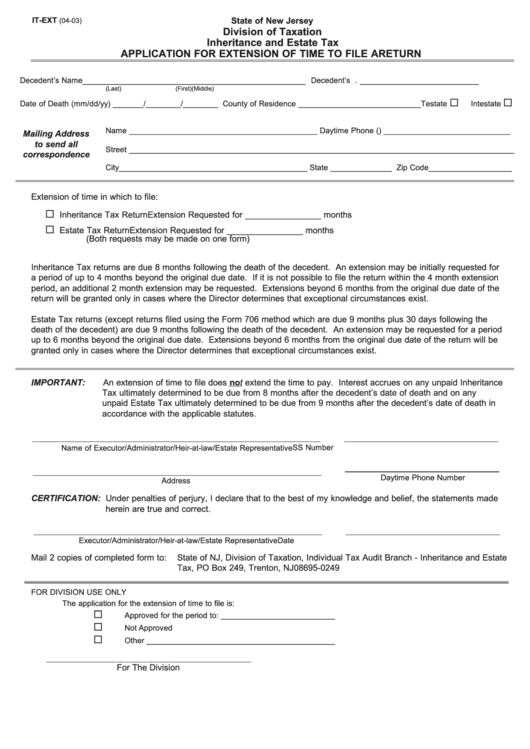

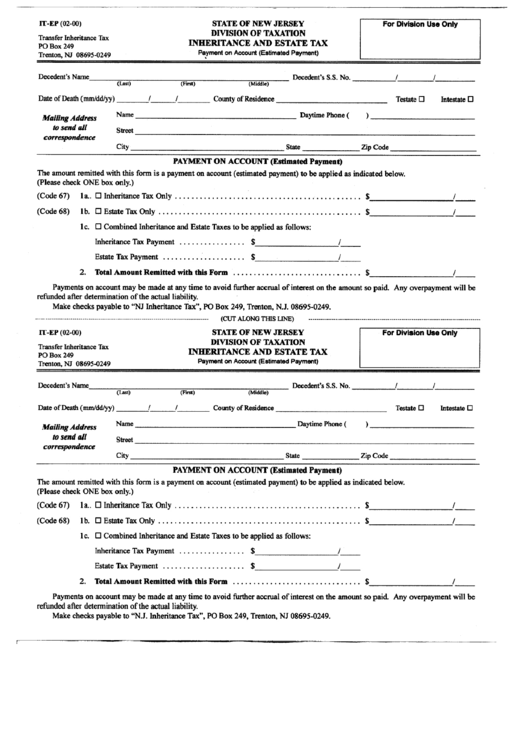

Fillable Form ItExt Inheritance And Estate Tax Application For

Form NJ630 Download Fillable PDF or Fill Online Application for

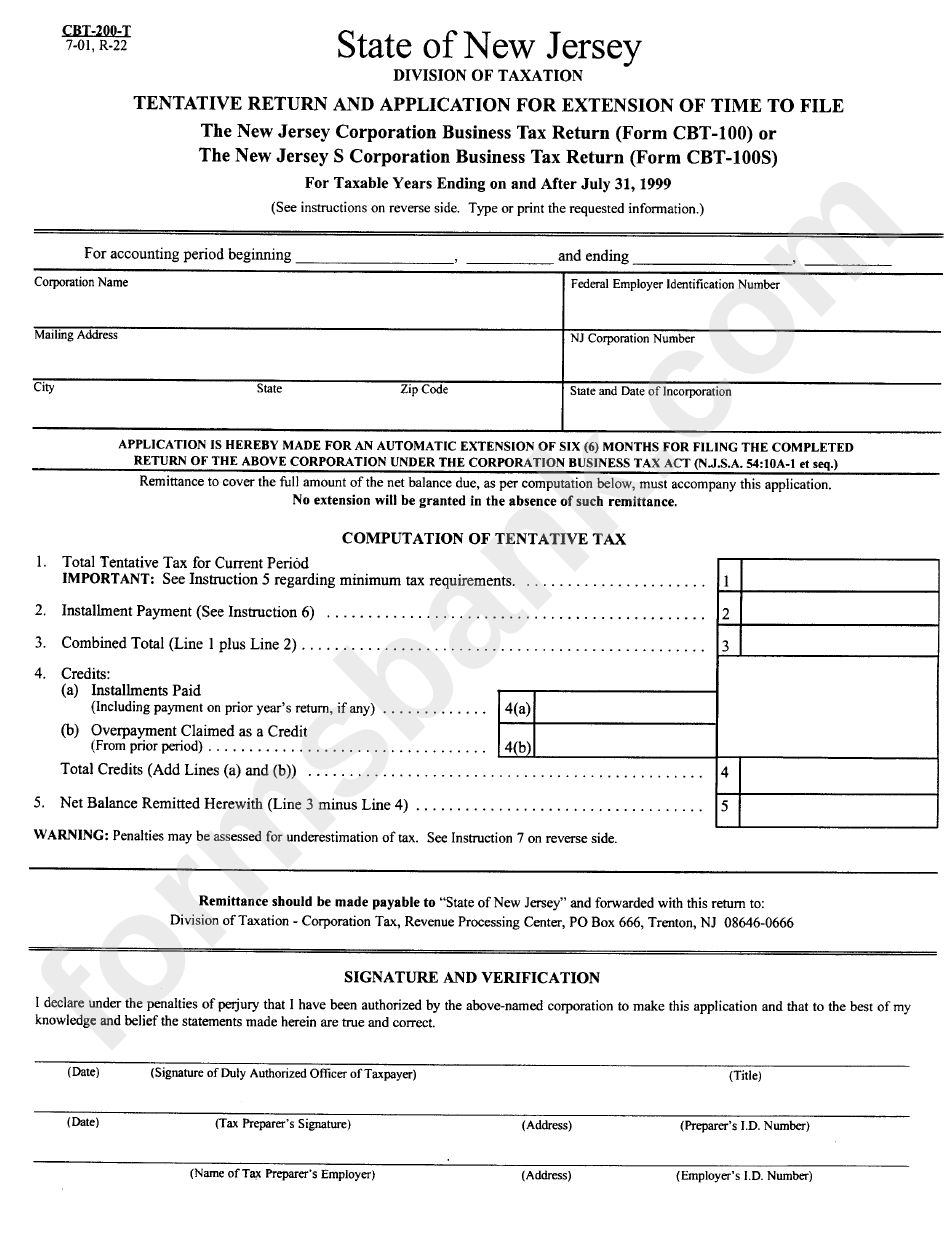

Form Cbt200T Tentative Return And Application For Extension Of Time

NJ Resident Tax Return

Form ItEp State Of New Jersey Division Of Taxation Inheritance And

Form NJ1040 Download Fillable PDF or Fill Online New Jersey Resident

CBT100 New Jersey Corporation Business Tax Return NJ.gov Fill out

Related Post: