California Corporations Annual Order Form

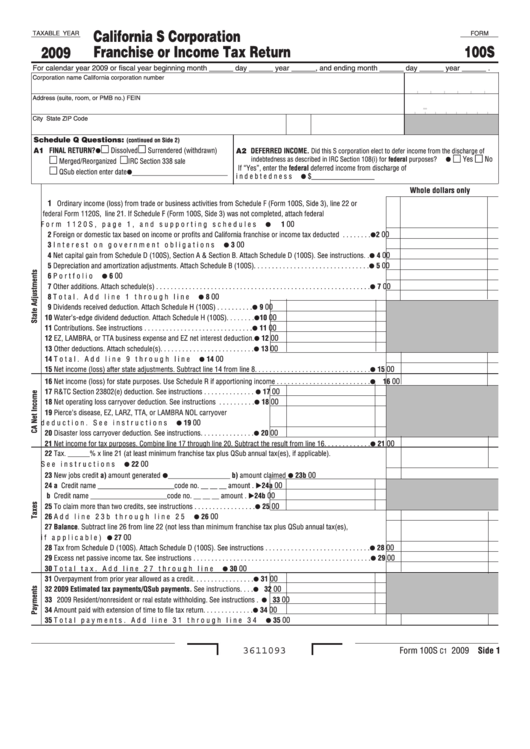

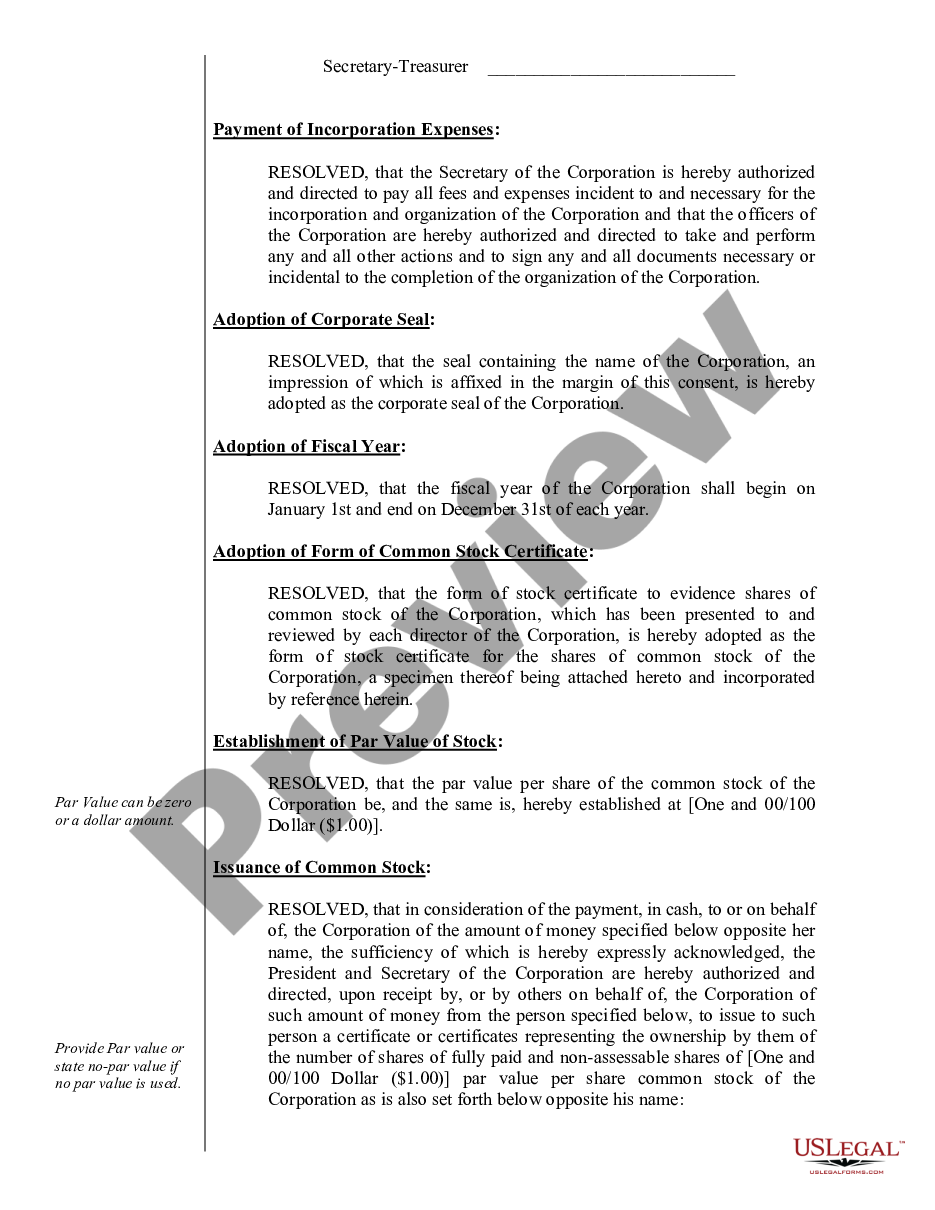

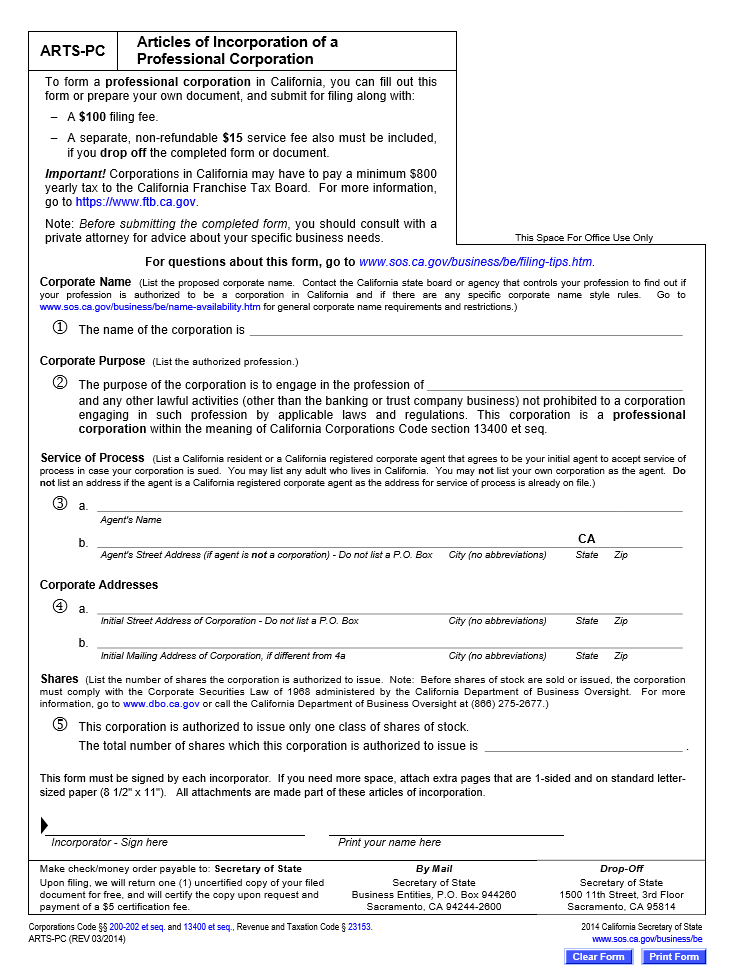

California Corporations Annual Order Form - File online for faster response. For more information, get form ftb 3805z, form ftb 3807, or form ftb 3809. References in these instructions are to the internal revenue code (irc) as of january 1, 2015, and to the california revenue and taxation code (r&tc). Over 140 business filings, name reservations, and orders for certificates of status and certified copies of corporations, limited liability companies and limited partnerships available online. 2021 instructions for form 100 corporation tax booklet revised: For instructions on creating a secure okta account, see section 1. Nol carryover deductions for the ez, tta, or lambra are suspended for the 2020, 2021, and 2022 taxable years, if the corporation's taxable income is $1,000,000 or more. Use the tables to determine your organization's filing requirement for the following forms: Web you must file california s corporation franchise or income tax return (form 100s) if the corporation is: Over 140 business filings, name reservations, and orders for certificates of status and certified copies of corporations, limited liability companies and limited partnerships available online. Web this solicitation, california corporations annual order form and similar solicitations, are not being sent on behalf of the california secretary of state. Web what forms do i need to file for a corporation? California secretary of state 1500 11th street sacramento, california 95814 office: For complete list of tax rates. Significant changes and important reminders include: If the articles do not name the initial directors, the incorporators can do whatever is necessary to finish setting up the corporation in. Web business entities records request. 2022, 2021, and 2020 california personal income tax forms and publications. Nol carryover deductions for the ez, tta, or lambra are suspended for the 2020, 2021, and 2022 taxable years, if the. If the articles do not name the initial directors, the incorporators can do whatever is necessary to finish setting up the corporation in. Web business entities records request. Form 100 is due on the 15th day of the third month after the close of the year. For complete list of tax rates. Web california corporations annual order form. For more information, get form ftb 3805z, form ftb 3807, or form ftb 3809. A corporation is an entity that is owned by its shareholders (owners). Generally taxed on their income and the owners are taxed on these earnings when distributed as payments or when the shareholder sells stock. Web what forms do i need to file for a corporation?. © 2023 ca secretary of state Visit our tax rates table. Web as of april 7, 2022, bizfile online is the california secretary of state’s platform for online business filings and orders. For more information, get form ftb 3805z, form ftb 3807, or form ftb 3809. You will need to create an okta account to file initial filings, amendments, statements. California corporation franchise or income tax return. Web the annual tax for s corporations is the greater of 1.5% of the corporation's net income or $800. Web the california business search provides access to available information for corporations, limited liability companies and limited partnerships of record with the california secretary of state, with free pdf copies of over 17 million. Web what forms do i need to file for a corporation? Web as of april 7, 2022, bizfile online is the california secretary of state’s platform for online business filings and orders. © 2023 ca secretary of state Web free uncertified pdf copies of corporation, limited liability company and limited partnership documents, including statements of information of record for corporations. Web what forms do i need to file for a corporation? All california c corporations and llcs treated as corporations file form 100 (california franchise or income tax return). 2021 instructions for form 100 corporation tax booklet revised: The business entities section of the secretary of state’s office processes filings, maintains records and provides information to the public relating. Your. Corporations can be taxed 2 different ways. Form 100 is due on the 15th day of the third month after the close of the year. Web free uncertified pdf copies of corporation, limited liability company and limited partnership documents, including statements of information of record for corporations and limited liability companies. Web this solicitation, california corporations annual order form and. Web california corporations annual order form. Web this solicitation, california corporations annual order form and similar solicitations, are not being sent on behalf of the california secretary of state. Nol carryover deductions for the ez, tta, or lambra are suspended for the 2020, 2021, and 2022 taxable years, if the corporation's taxable income is $1,000,000 or more. The misleading solicitation. © 2023 ca secretary of state Current year business entity tax forms and publications. When do i file my corporation return? The status of the llc can be checked online on the secretary of state’s. This is a corporate record maintenance package for existing. File by mail or in person. You will need to create an okta account to file initial filings, amendments, statements of information, and to order certificates online. Web the business entity filings can be submitted directly online. Nol carryover deductions for the ez, tta, or lambra are suspended for the 2020, 2021, and 2022 taxable years, if the corporation's taxable income is $1,000,000 or more. For instructions on creating a secure okta account, see section 1. You can order the following forms by phone: California secretary of state 1500 11th street sacramento, california 95814 office: The business entities section of the secretary of state’s office processes filings, maintains records and provides information to the public relating. References in these instructions are to the internal revenue code (irc) as of january 1, 2015, and to the california revenue and taxation code (r&tc). If the articles do not name the initial directors, the incorporators can do whatever is necessary to finish setting up the corporation in. Web california law provides that one or more natural persons, partnerships, associations, or corporations may form a corporation. Web over 140 business filings, name reservations, and orders for certificates of status and certified copies of corporations, limited liability companies and limited partnerships available online. Web california corporations annual order form. © 2023 ca secretary of state Web you must file california s corporation franchise or income tax return (form 100s) if the corporation is:How to Hold and Document a California Corporation's Shareholder Form

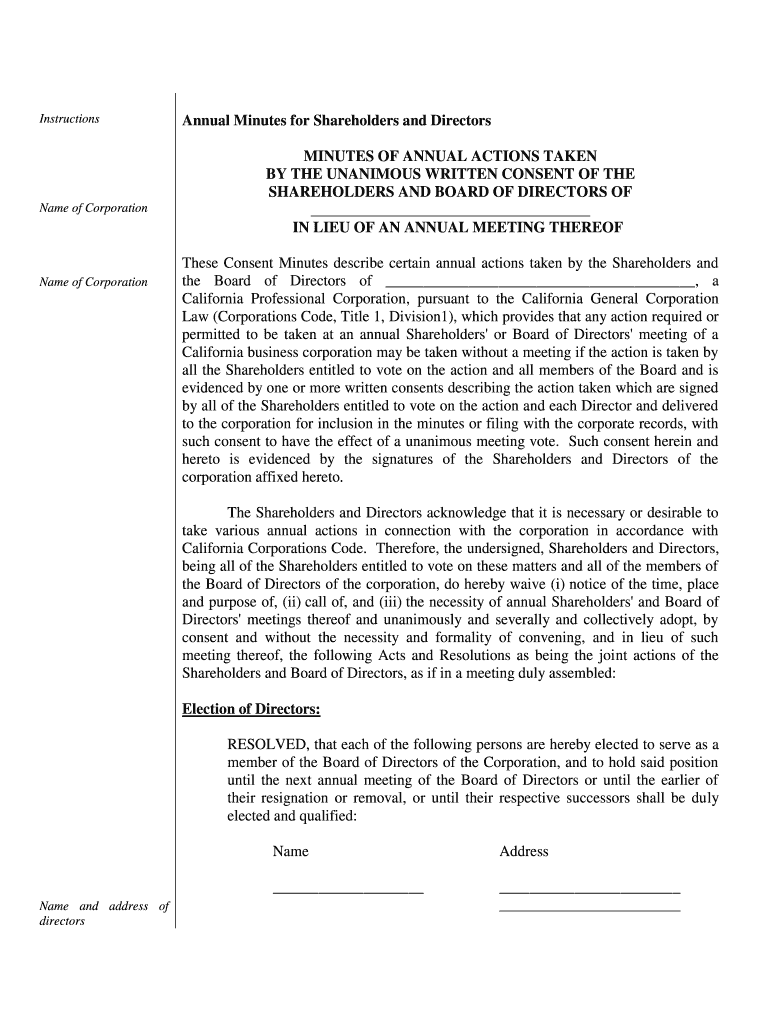

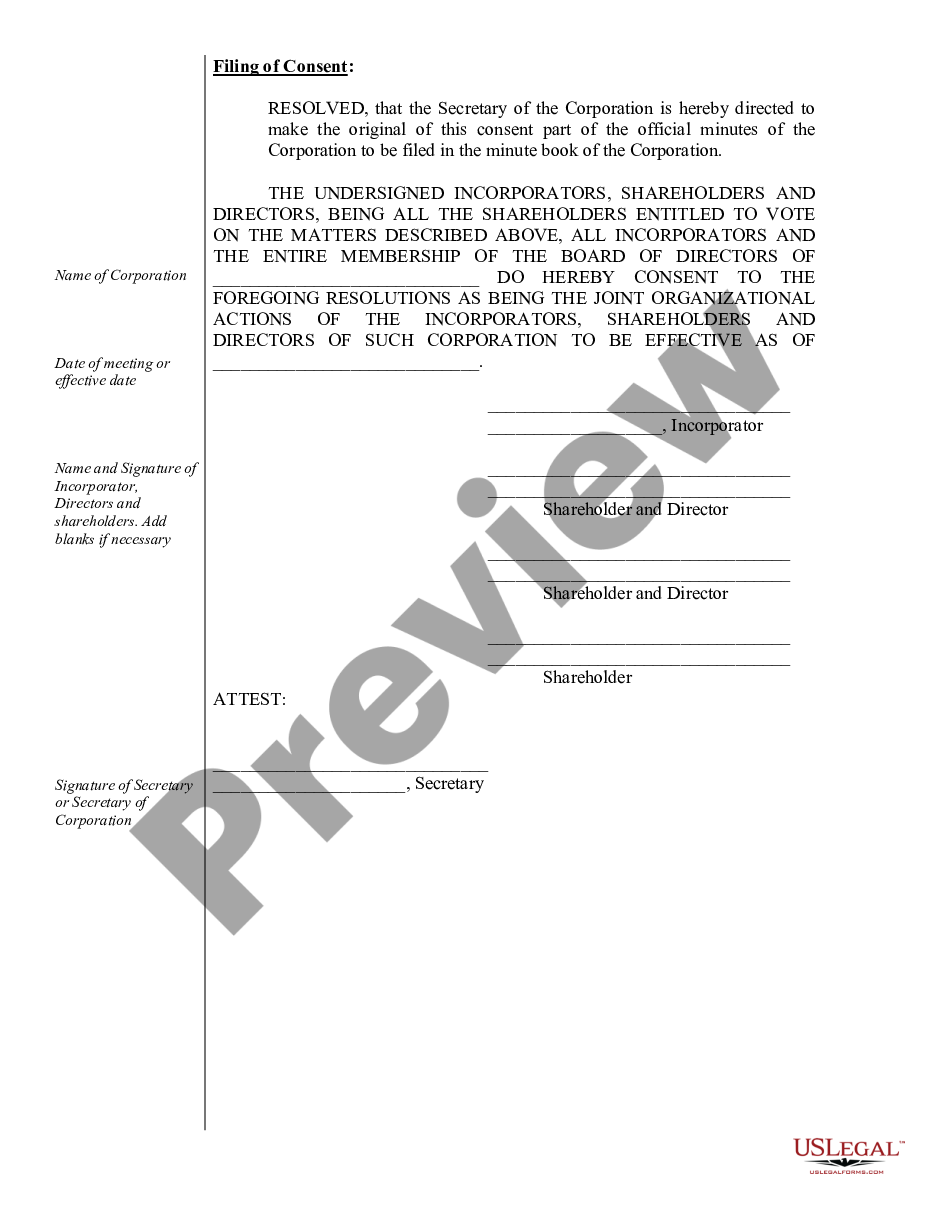

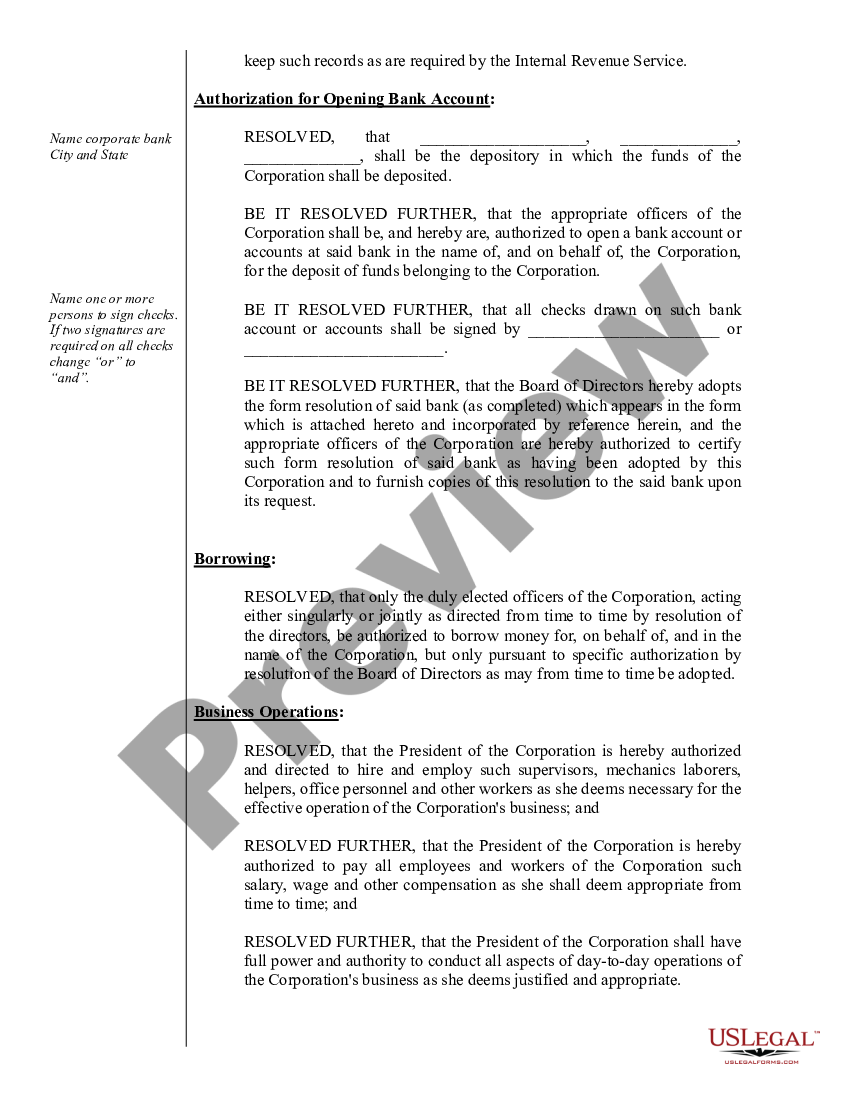

California Corporations Annual Order Form US Legal Forms

California Corporations Annual Order Form US Legal Forms

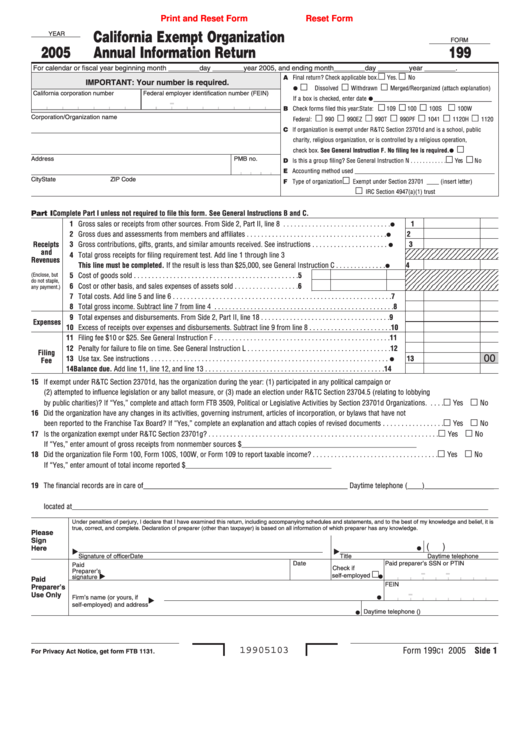

Fillable Form 199 California Exempt Organization Annual Information

Fillable Form 100s California S Corporation Franchise Or Tax

Incorporate in California Do Business The Right Way

Form HCD OL15 Download Printable PDF or Fill Online Notice of Change of

California Corporations Annual Order Form US Legal Forms

California Corporation Form Order Fill Online, Printable, Fillable

Free California Articles Of Incorporation Templates CA Secretary Of State

Related Post: