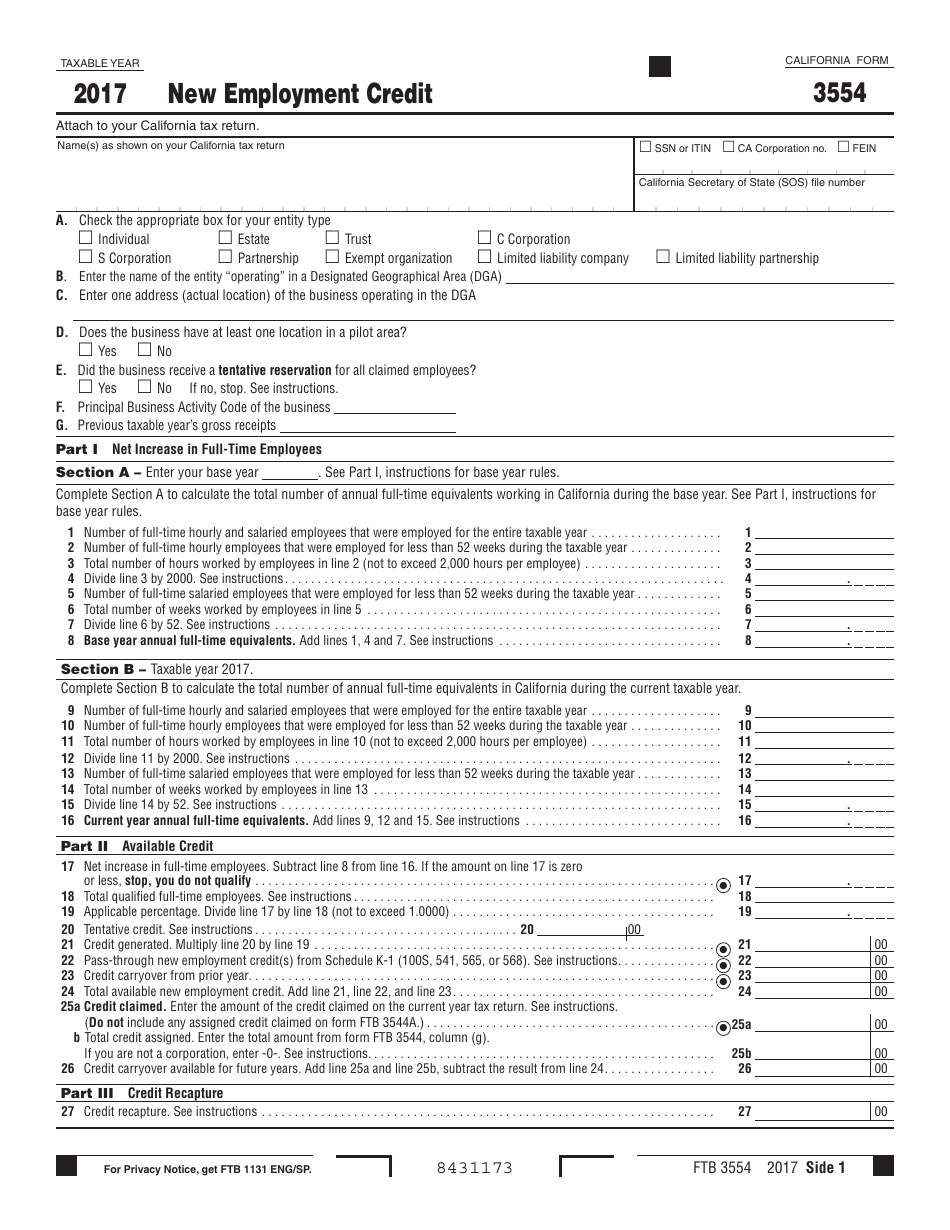

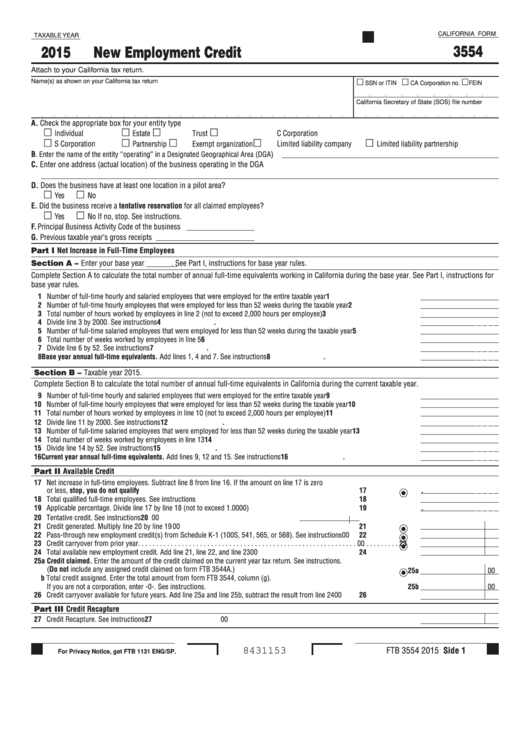

New Employment Credit Form 3554

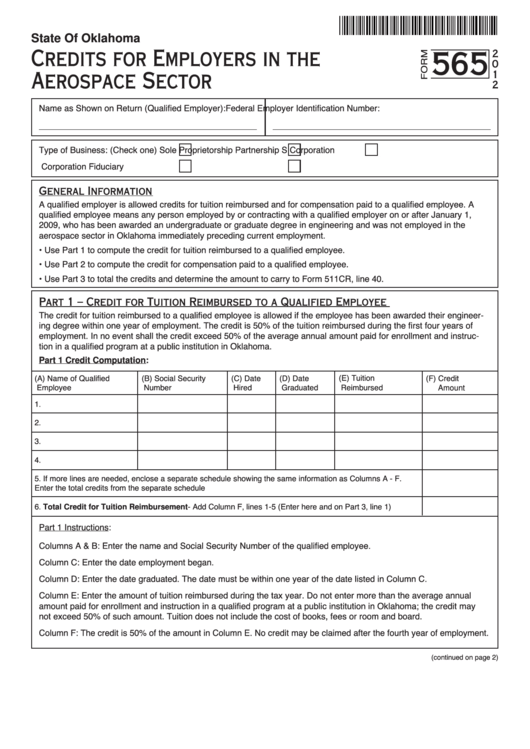

New Employment Credit Form 3554 - Web ftb 3554 2019 side 1 taxable year 2019 new employment credit california form 3554 attach to your california tax return. You can download or print current or past. If not, start ertc claim now. Web if you have a carryover amount from a credit claimed on form 348 from prior tax years, you do not have to claim the maximum allowable credit on form 323 to use a only carryover. Enter the amount of the credit claimed on the current year tax return. Did the business receive a. Most likely what happened is when you got the portion of your ca state return that says credit and. Web california income tax brackets income tax forms form 3554 california — new employment credit download this form print this form it appears you don't have a. Web how form 3554 was populated and how to remove: Web 2021 new employment credit taxable year california form 2021 new employment credit 3554 attach to your california tax return. You can download or print current or past. Enter the amount of the credit claimed on the current year tax return. Find out what our accounting professionals can secure for your business today Web total available new employment credit. Enter the amount from form 331, line 21. Ad have you received your ertc check yet? Enter the amount of the credit claimed on the current year tax return. Web we last updated the new employment credit in february 2023, so this is the latest version of form 3554, fully updated for tax year 2022. Web if you have a carryover amount from a credit claimed on form. 2023 — the irs and tax professionals continue to see aggressive advertising, direct mail solicitations and online promotions involving the. Web california income tax brackets income tax forms form 3554 california — new employment credit download this form print this form it appears you don't have a. Most likely what happened is when you got the portion of your ca. Did the business receive a. Find out what our accounting professionals can secure for your business today Web total available new employment credit. Web ftb 3554 2019 side 1 taxable year 2019 new employment credit california form 3554 attach to your california tax return. They only filed the adjusted return to claim the erc and made no. Enter the amount of the credit claimed on the current year tax return. Web 2022 new employment credit taxable year california form 2022 new employment credit 3554 attach to your california tax return. Filed by individuals, corporations, and partnerships to claim the credit for new employment. Web california law requires the franchise tax board (ftb) to report on ftb’s website. Find out what our accounting professionals can secure for your business today Did the business receive a tentative reservation yes no if no, stop. Web arizona, california, massachusetts and new york have decided to work with the irs to integrate their state taxes into the direct file pilot for filing season 2024. Web we last updated the new employment credit. Did the business receive a tentative reservation yes no if no, stop. If not, start ertc claim now. Ad have you received your ertc check yet? Web we last updated the new employment credit in february 2023, so this is the latest version of form 3554, fully updated for tax year 2022. 2023 — the irs and tax professionals continue. Web the work opportunity tax credit (wotc) is a federal tax credit, ranging from $1,200 to $9,600, that is given to employers for each individual they hire from a designated. If not, start ertc claim now. Download past year versions of this tax form as. 1) answer simple questions & create your employment contract. Did the business receive a. Web 2022 new employment credit taxable year california form 2022 new employment credit 3554 attach to your california tax return. Ad have you received your ertc check yet? Web ftb 3554 2019 side 1 taxable year 2019 new employment credit california form 3554 attach to your california tax return. Web total available new employment credit. Did the business receive a. Web 2022 new employment credit taxable year california form 2022 new employment credit 3554 attach to your california tax return. Web how form 3554 was populated and how to remove: Web ftb 3554 2019 side 1 taxable year 2019 new employment credit california form 3554 attach to your california tax return. Web total available new employment credit. 2023 — the. Name(s) as shown on your california. Web how form 3554 was populated and how to remove: Web taxable year california form 2020 new employment credit 3554 attach to your california tax return. Web if you have a carryover amount from a credit claimed on form 348 from prior tax years, you do not have to claim the maximum allowable credit on form 323 to use a only carryover. Enter the amount of the credit claimed on the current year tax return. 1) answer simple questions & create your employment contract. Web we last updated the new employment credit in february 2023, so this is the latest version of form 3554, fully updated for tax year 2022. Web the work opportunity tax credit (wotc) is a federal tax credit, ranging from $1,200 to $9,600, that is given to employers for each individual they hire from a designated. Did the business receive a. Web total available new employment credit. Did the business receive a tentative reservation yes no if no, stop. Add line 21, line 22, and line 23: Web california income tax brackets income tax forms form 3554 california — new employment credit download this form print this form it appears you don't have a. Web 2022 new employment credit taxable year california form 2022 new employment credit 3554 attach to your california tax return. Find out what our accounting professionals can secure for your business today You can download or print current or past. Web california law requires the franchise tax board (ftb) to report on ftb’s website the names of employers claiming the credit, the amount of the credit, and the number of new jobs. Web arizona, california, massachusetts and new york have decided to work with the irs to integrate their state taxes into the direct file pilot for filing season 2024. Download past year versions of this tax form as. 2023 — the irs and tax professionals continue to see aggressive advertising, direct mail solicitations and online promotions involving the.Fillable Form 565 Credits For Employers In The Aerospace Sector

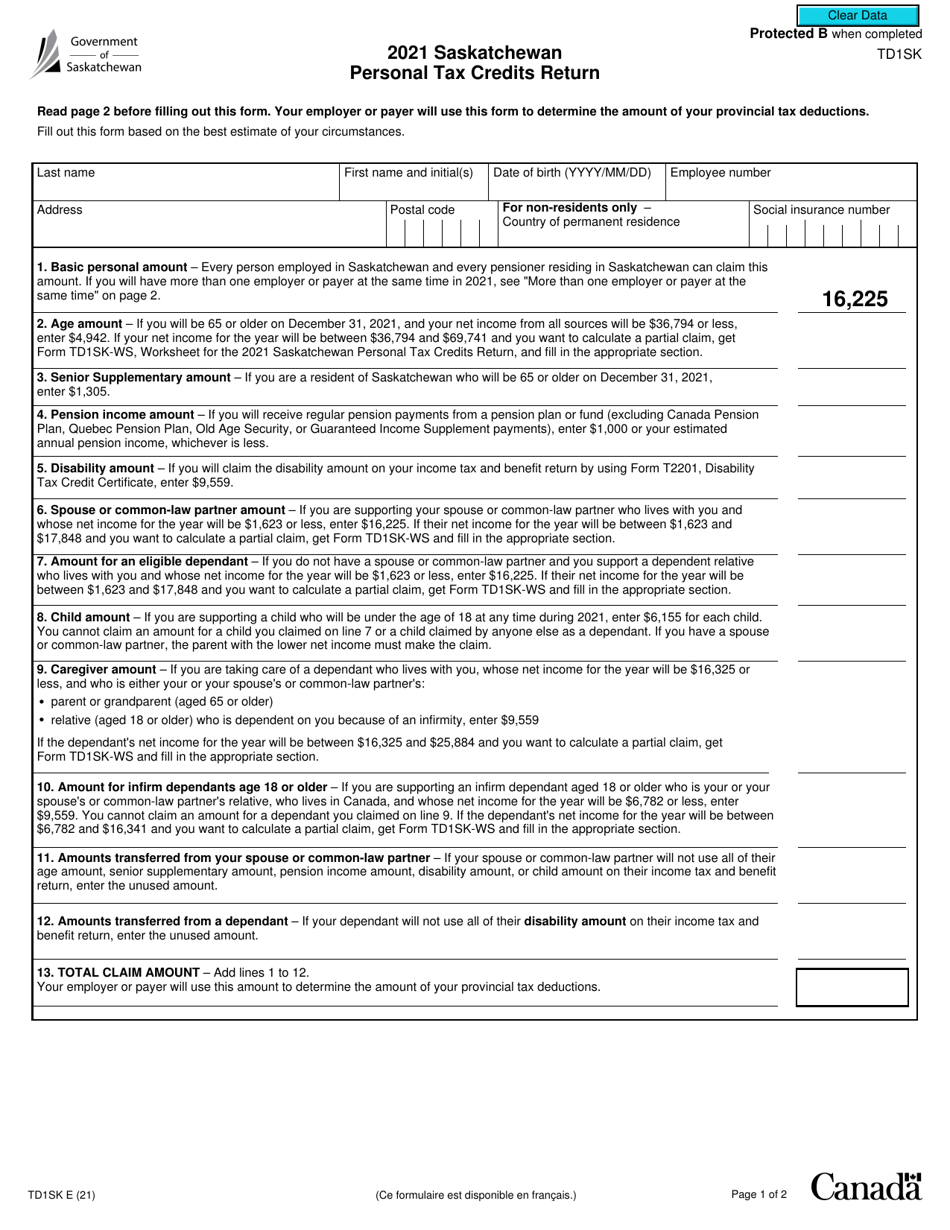

Form TD1SK Download Fillable PDF or Fill Online Saskatchewan Personal

Instructions To Fill Federal Td1 Form

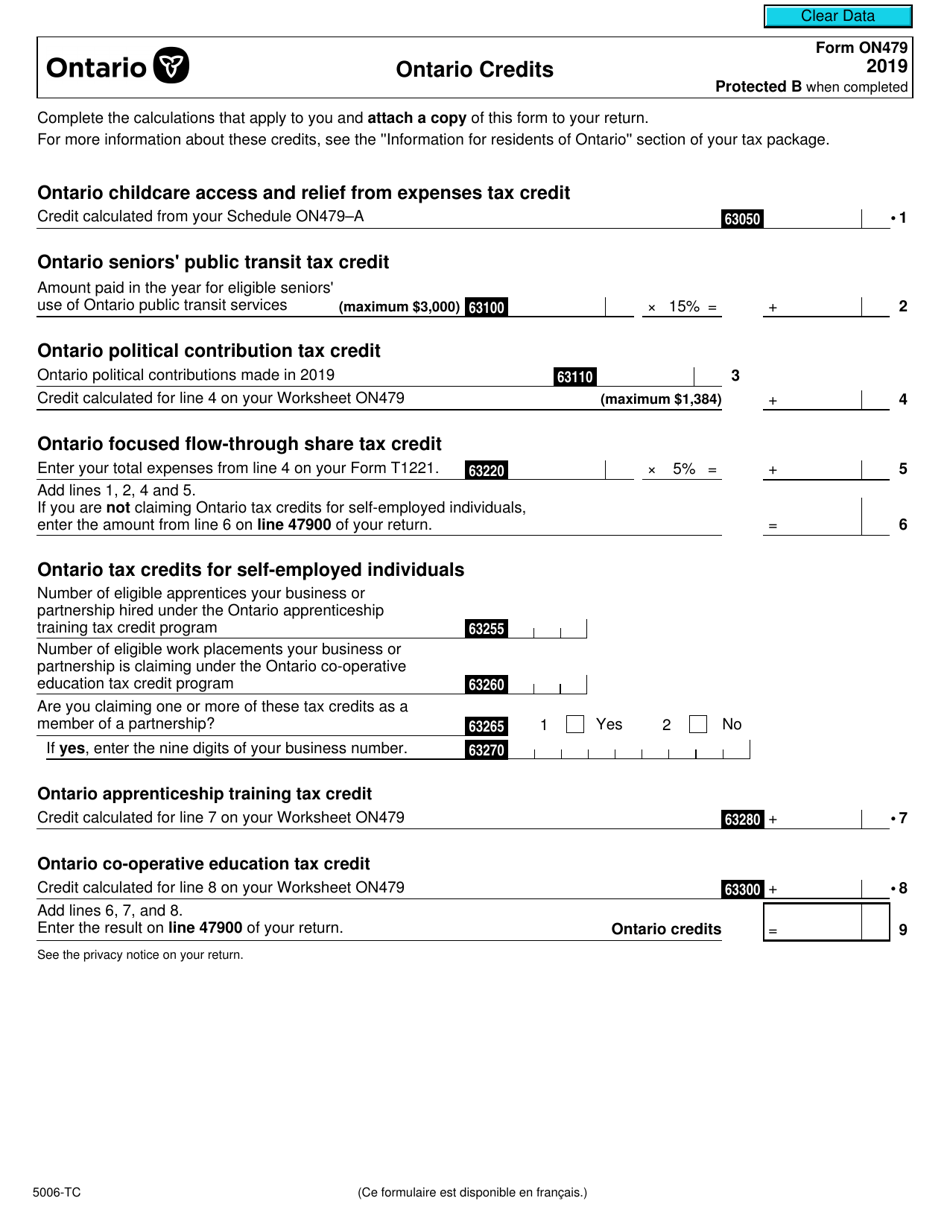

Form ON479 (5006TC) Download Fillable PDF or Fill Online Ontario

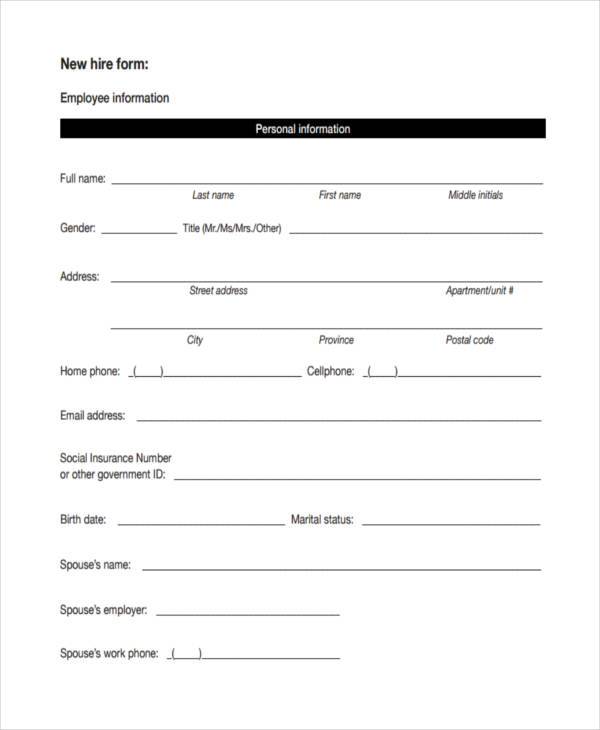

FREE 35+ Employment Form Samples in PDF MS Word Excel

Form FTB3554 2017 Fill Out, Sign Online and Download Printable PDF

Form 3554 California New Employment Credit 2015 printable pdf download

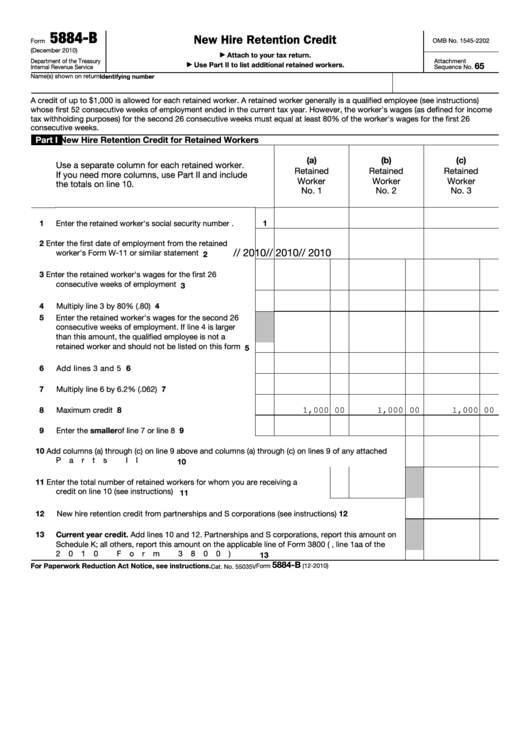

Fillable Form 5884B New Hire Retention Credit printable pdf download

2021 Form Canada TD1 E Fill Online, Printable, Fillable, Blank pdfFiller

What Documentation Do I Need to Apply for the ERC? Revenued

Related Post: