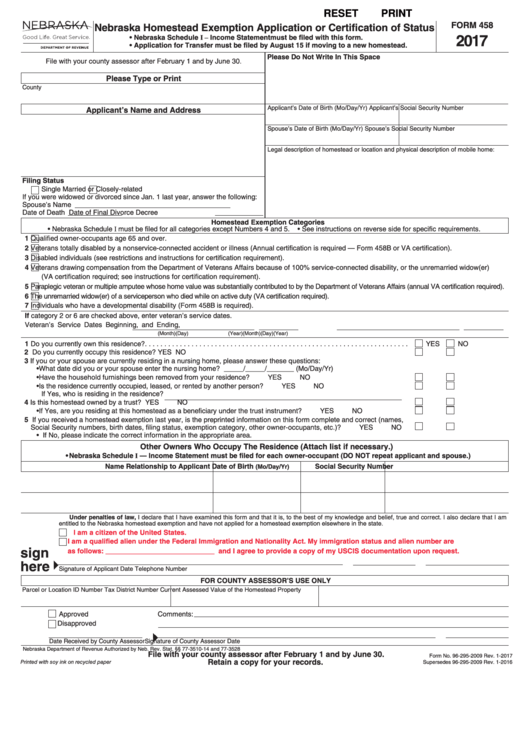

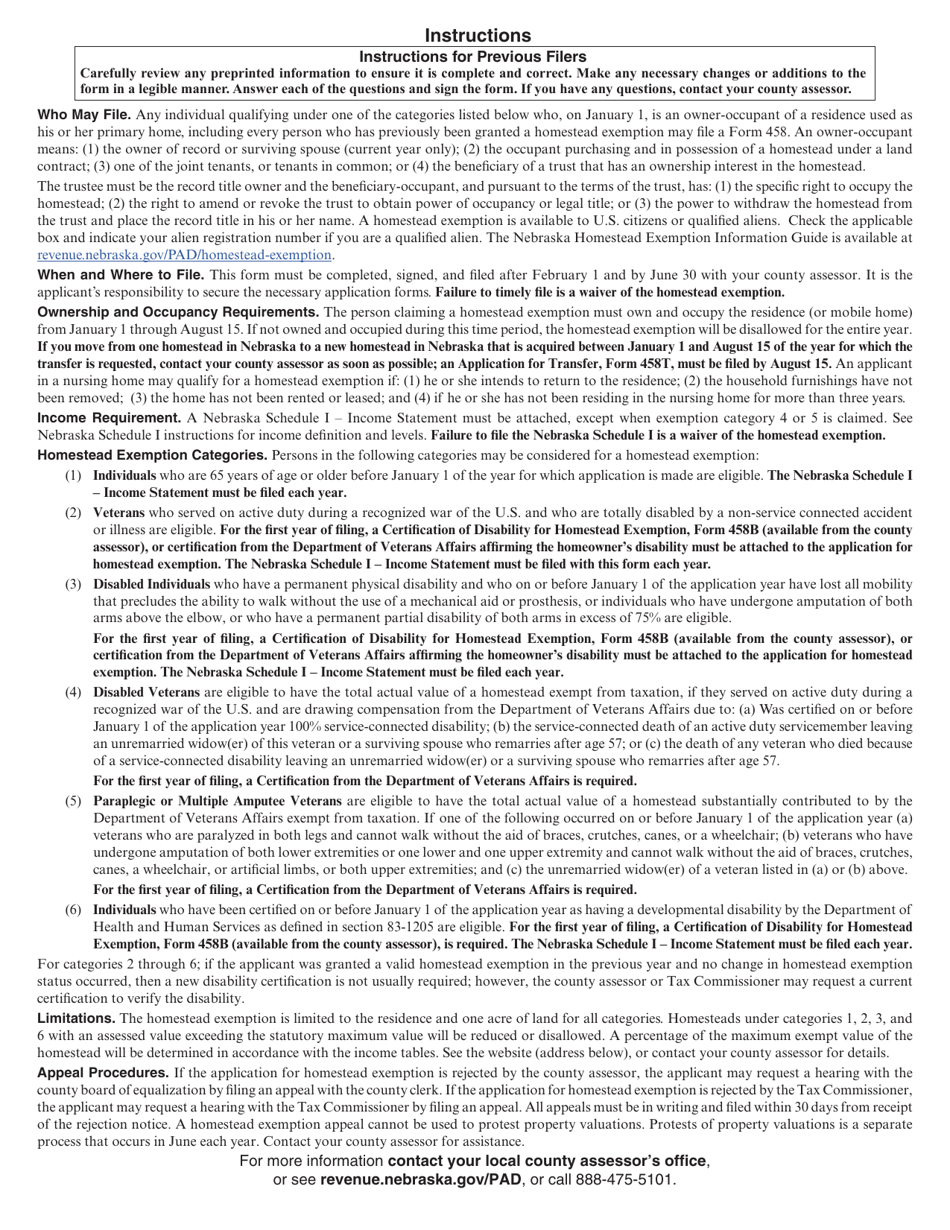

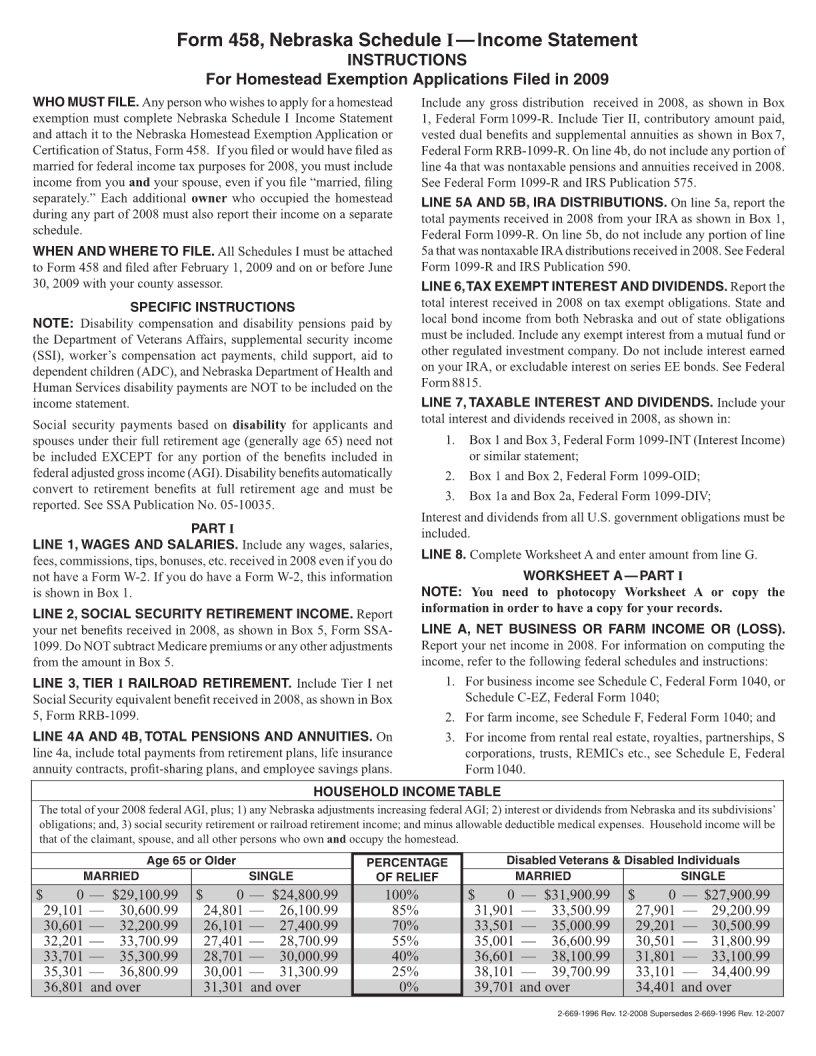

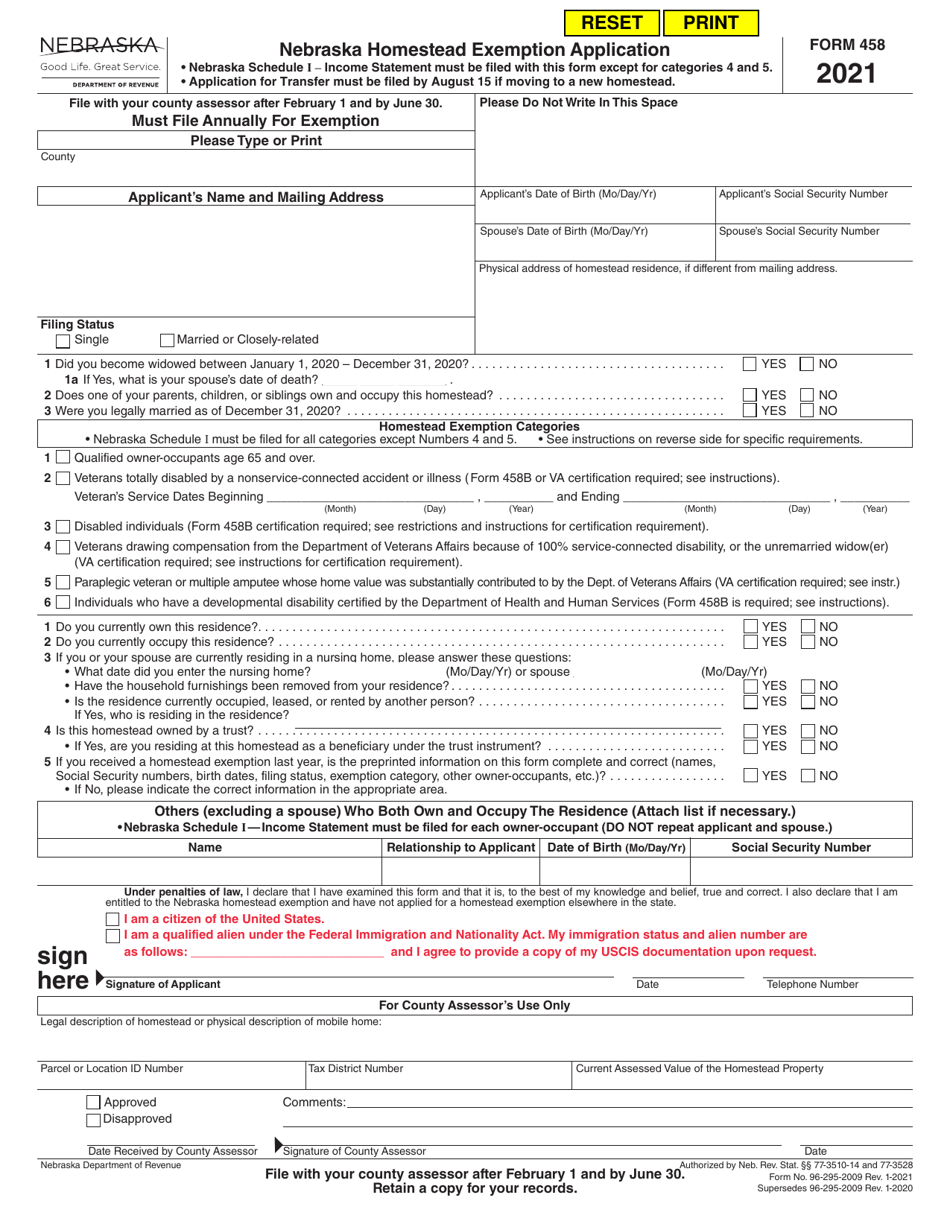

Nebraska Homestead Exemption Application Form 458

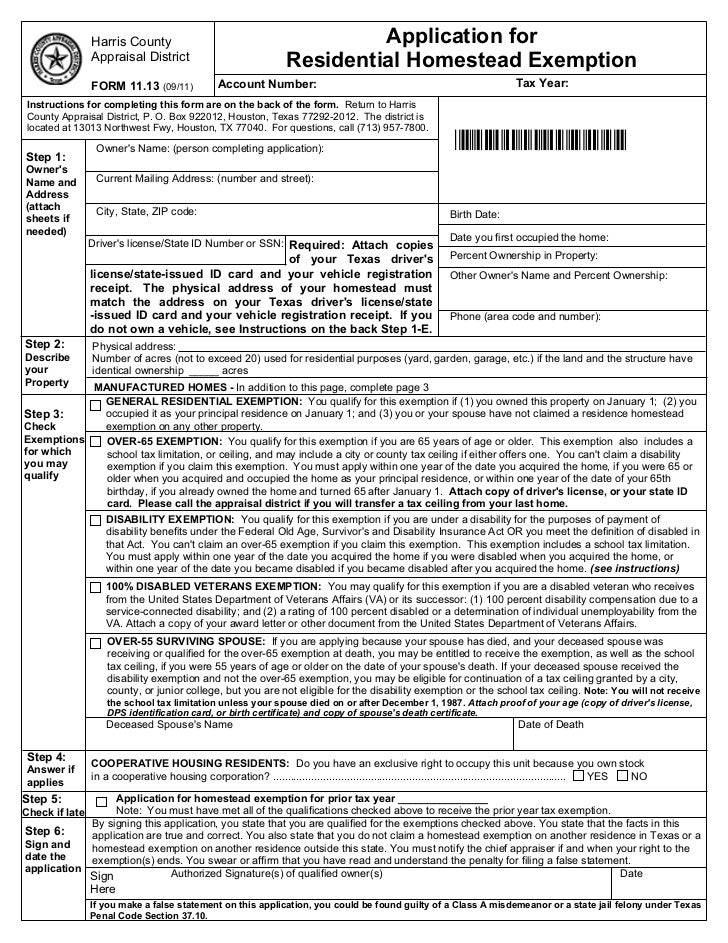

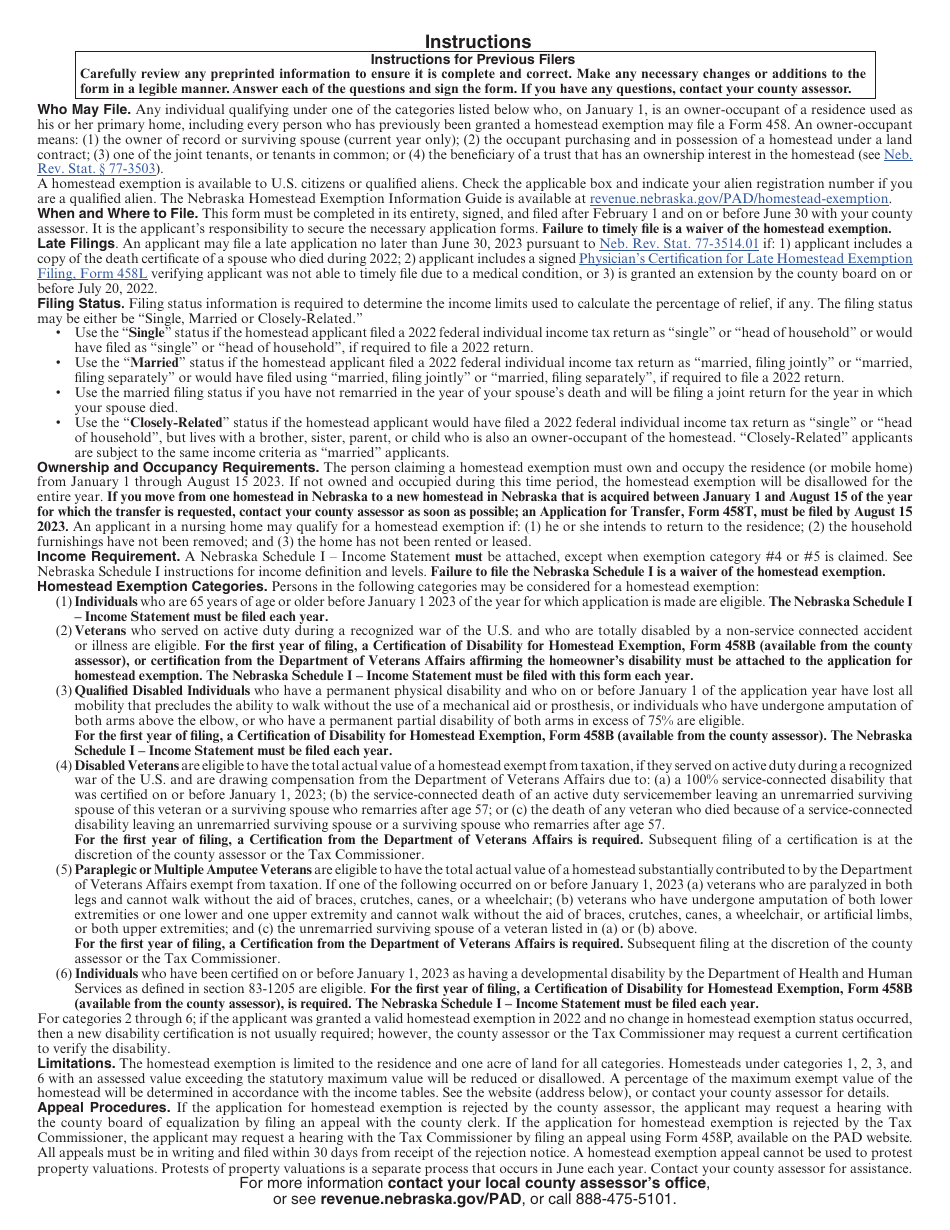

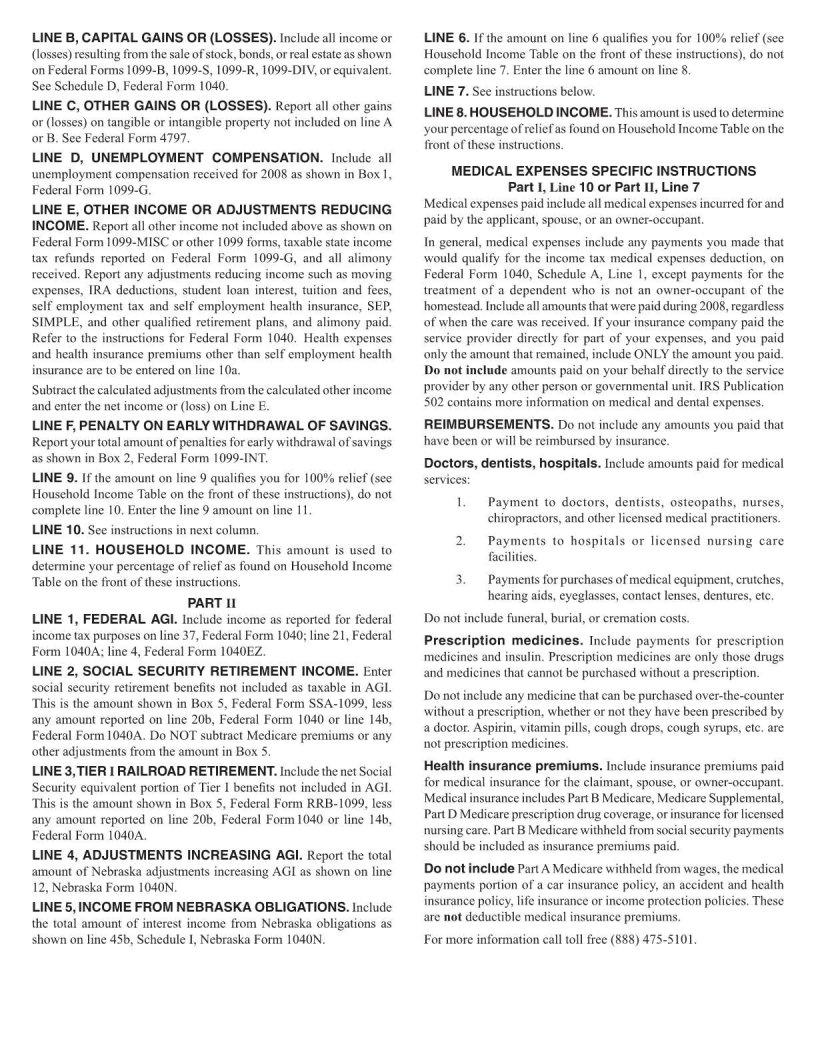

Nebraska Homestead Exemption Application Form 458 - Tax year 2021 homestead exemption. Retain a copy for your records. Web file 2022 form 458 and all schedules with your county assessor after february 1, 2022 and on or before june 30, 2022. The nebraska department of revenue, property assessment division (dor) reminds property owners. Web file 2018 form 458 and all schedules with your county assessor after february 1, 2018 and by july 2, 2018. Web homestead exemption, form 458b (available from the county assessor), is required for the first year of filing. For filing after february 1, 2022, and on or before june 30, 2022. Web file 2023 form 458 and all schedules with your county assessor after february 1, 2023 and on or before june 30, 2023. Web nebraska homestead exemption application, form 458. For filing after february 1, 2023, and on or before june 30, 2023. Web if you need an application, or have questions, you may contact our office at: Web the nebraska homestead exemption application, form 458, must be filed with your county assessor between february 2, 2023 and june 30, 2023. Retain a copy for your records. For categories 3, 4, 5, 6, and 7; Retain a copy for your records. Web application will result in the loss of the homestead exemption for a period of three years. Web where can i find information about the homestead exemption? Web file 2018 form 458 and all schedules with your county assessor after february 1, 2018 and by july 2, 2018. Web file 2022 form 458 and all schedules with your county assessor. Web file form 458 and all schedules with your county assessor after february 1 and by june 30. Web file 2022 form 458 and all schedules with your county assessor after february 1, 2022 and on or before june 30, 2022. Application for transfer must be filed by august 15 if moving to a new. Web failure to properly complete. Web application will result in the loss of the homestead exemption for a period of three years. Application for transfer must be filed by august 15 if moving to a new. Web if you need an application, or have questions, you may contact our office at: If the applicant was granted a valid. The 2024 form will be available february. The 2024 form will be available february 2, 2024. Web nebraska homestead exemption application, form 458. Here is a guide that. Nebraska homestead exemption application • nebraska schedule. Web where can i find information about the homestead exemption? Retain a copy for your records. Retain a copy for your records. Tax year 2021 homestead exemption. For filing after february 1, 2022, and on or before june 30, 2022. • attach this schedule to the. • attach this schedule to the 2016 nebraska. Web file 2022 form 458 and all schedules with your county assessor after february 1, 2022 and on or before june 30, 2022. Web nebraska homestead exemption application good life. For categories 3, 4, 5, 6, and 7; Web file 2018 form 458 and all schedules with your county assessor after february. Application for transfer must be filed by august 15 if moving to a new. Web file 2022 form 458 and all schedules with your county assessor after february 1, 2022 and on or before june 30, 2022. Web where can i find information about the homestead exemption? Web the nebraska homestead exemption application, form 458, must be filed with your. Web the nebraska homestead exemption application, form 458, (opens in a new window) must be filed with your county assessor between february 2, 2022 and. Web nebraska homestead exemption application good life. Web form 458 schedule i (income statement) when you file a homestead exemption application, you will need the following income information (if applicable): Web application will result in. • attach this schedule to the 2016 nebraska. Application for transfer must be filed by august 15 if moving to a new. Web form 458 schedule i (income statement) when you file a homestead exemption application, you will need the following income information (if applicable): Web the nebraska homestead exemption application, form 458, must be filed with your county assessor. Retain a copy for your records. Web application will result in the loss of the homestead exemption for a period of three years. Nebraska homestead exemption application, form 458. • attach this schedule to the. Web form 458 schedule i (income statement) when you file a homestead exemption application, you will need the following income information (if applicable): Web if you need an application, or have questions, you may contact our office at: Web failure to properly complete or timely file this application will result in a denial of the exemption. Web nebraska homestead exemption application, form 458. Application for transfer must be filed by august 15 if moving to a new. Application for transfer must be filed by august 15 if moving to a new. Web file 2018 form 458 and all schedules with your county assessor after february 1, 2018 and by july 2, 2018. For categories 3, 4, 5, 6, and 7; Web nebraska homestead exemption application good life. Tach this schedule to the. Nebraska schedule i — income statement must be filed with this form except for categories 4 and. Where can i find information about the homestead. Web file 2022 form 458 and all schedules with your county assessor after february 1, 2022 and on or before june 30, 2022. The 2024 form will be available february 2, 2024. Nebraska homestead exemption application • nebraska schedule. Retain a copy for your records.Homestead exemption form

Form 458 Download Fillable PDF or Fill Online Nebraska Homestead

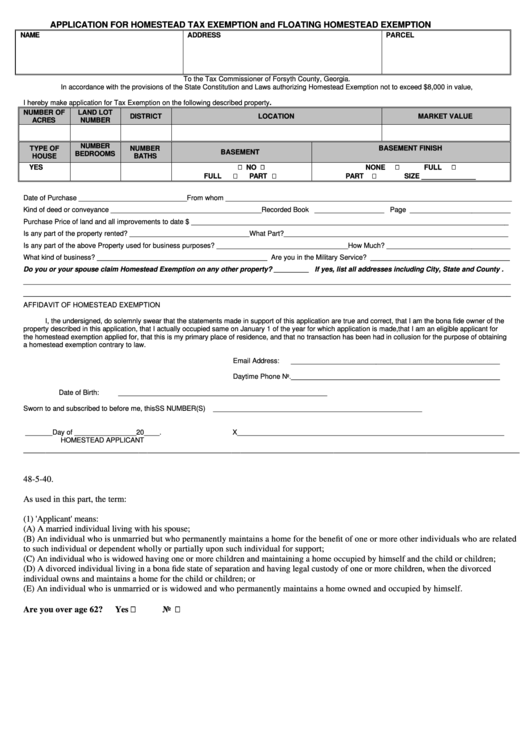

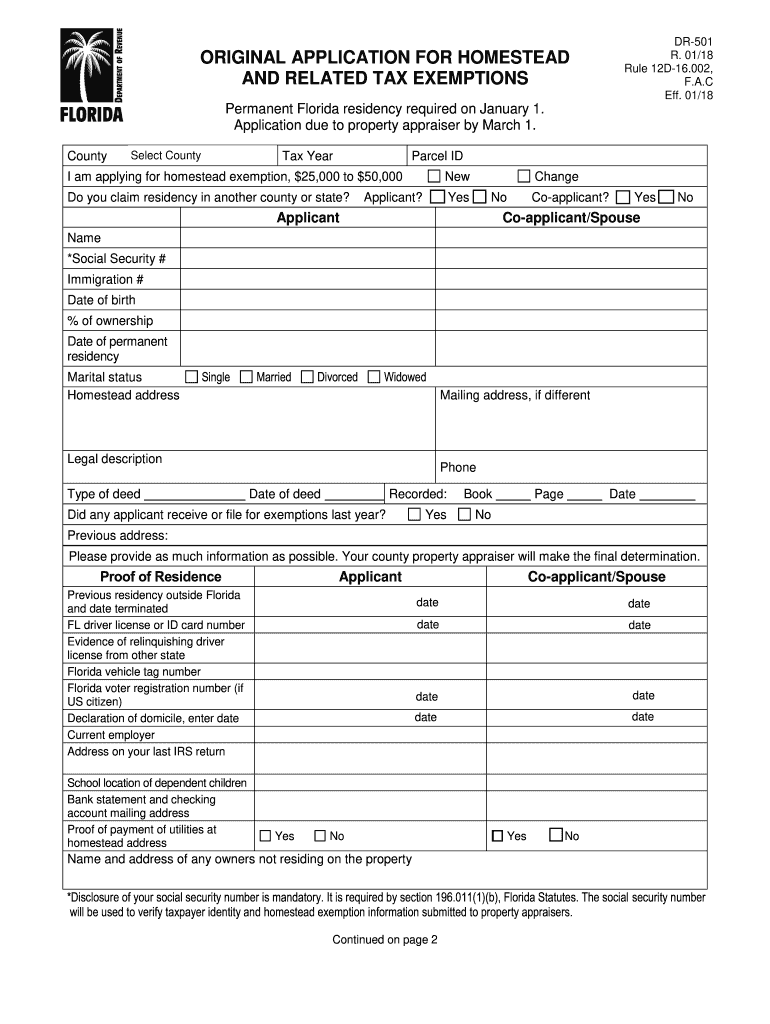

Application For Homestead Tax Exemption And Floating Homestead

Ne Form 458 ≡ Fill Out Printable PDF Forms Online

Fillable Form 458 Nebraska Homestead Exemption Application Or

Form 458 Download Fillable PDF or Fill Online Nebraska Homestead

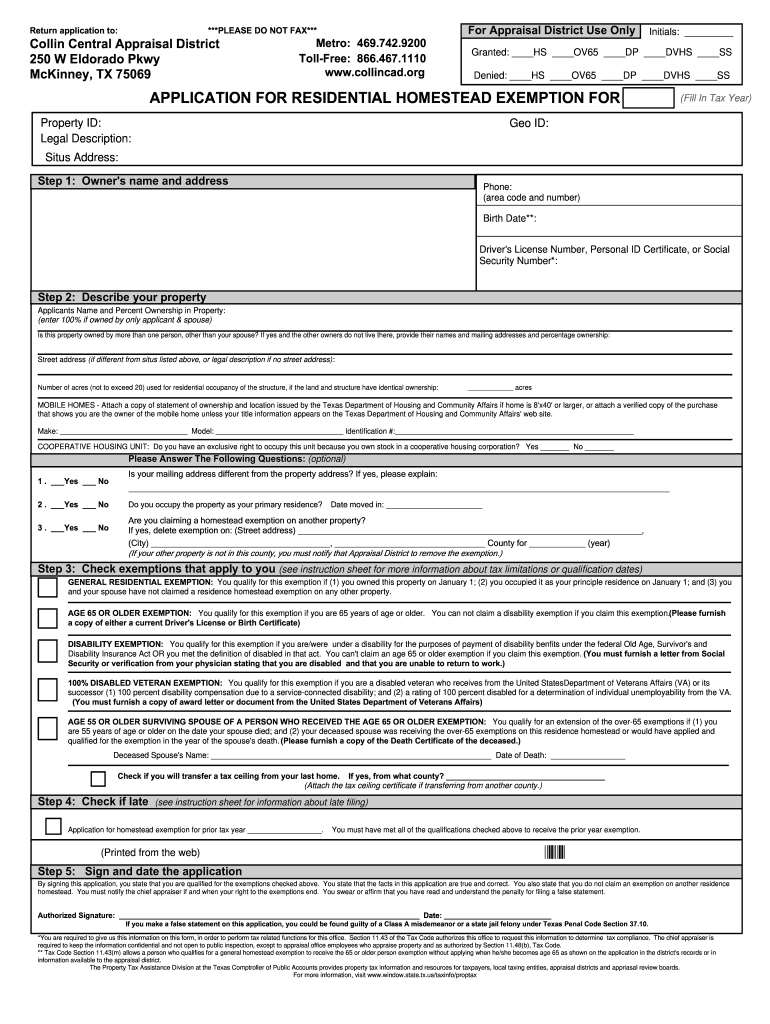

Collin County Homestead Exemption Application Fill Online, Printable

Ne Form 458 ≡ Fill Out Printable PDF Forms Online

Form 458 Download Fillable PDF or Fill Online Nebraska Homestead

Hillsborough County Homestead Fill Out and Sign Printable PDF

Related Post: