Nebraska Form Ptc

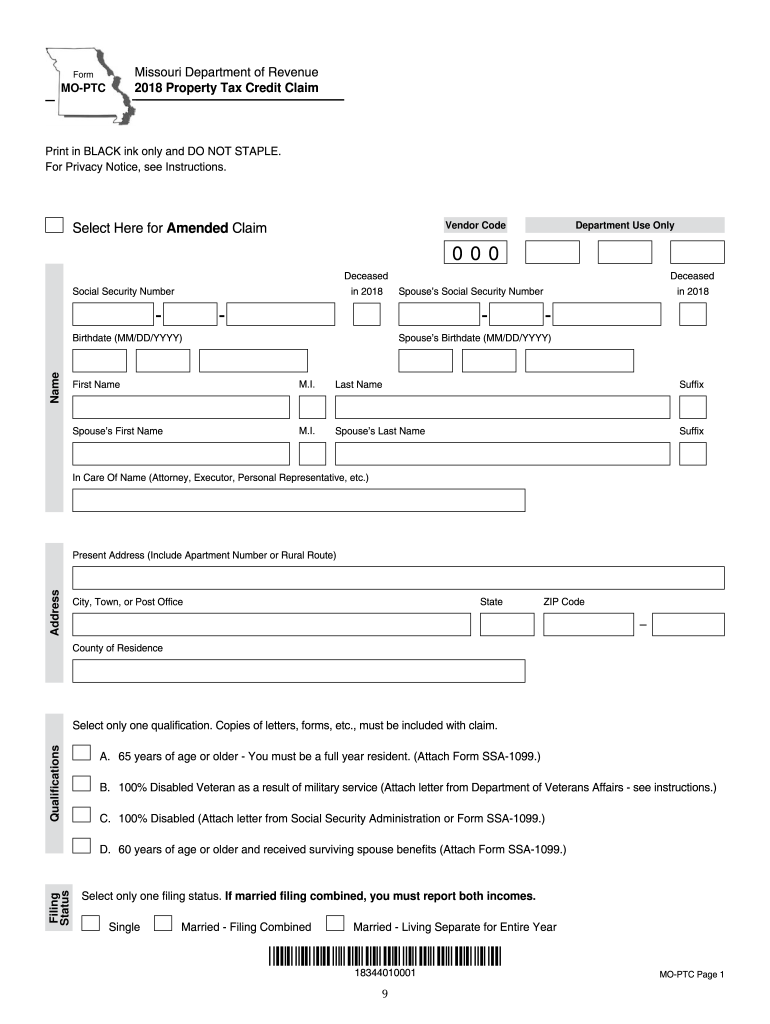

Nebraska Form Ptc - 2021 form ptc, nebraska property tax incentive act credit computation. Web taxpayers who pay property taxes to schools and file nebraska income taxes are eligible to claim a refundable income tax credit on the amount of property taxes paid to schools. You can file those years on. This act provides a refundable income tax credit to any taxpayer that paid nebraska school. Web taxpayers are eligible to claim credits by filing the nebraska property tax incentive act credit computation, form ptc, with their nebraska income or financial. 2021 form ptcx, amended nebraska property tax incentive act. If you did not claim the credit from 2020 or 2021, you can. Part b parcel id number must be 10 digits.”. Web your social security number spouse’s social security number high school district code. I’m getting an error, “form ptc: Part b parcel id number must be 10 digits.”. Web to claim the income tax credit, taxpayers should file the nebraska property tax incentive act credit computation, form ptc, with their income tax or franchise tax. Web to claim the credit, you’ll need to include form ptc 2022 with your taxes. Parcel id number * county parcel id. Web to. Web to claim the income tax credit, taxpayers should file the nebraska property tax incentive act credit computation, form ptc, with their income tax or franchise tax. Web form ptc must be filed with the nebraska income tax or financial institution tax return on which the credit is claimed or the school district property tax paid is distributed. For taxable. Web taxpayers who pay property taxes to schools and file nebraska income taxes are eligible to claim a refundable income tax credit on the amount of property taxes paid to schools. For taxable years beginning on or after january 1, 2020, a property tax incentive act credit. Taxpayers should look up their parcel in the nebraska school district property tax. County name * select one. Part a — computation of the credit. Complete, edit or print tax forms instantly. 2022 amended nebraska property tax incentive act. If you didn’t claim the credit in 2020 or 2021 it’s not too late! Web taxpayers who pay property taxes to schools and file nebraska income taxes are eligible to claim a refundable income tax credit on the amount of property taxes paid to schools. County name * select one. Web for most taxpayers, form ptc can be completed quickly and easily. Web the nebraska property tax incentive act credit computation, form ptc, is. Web taxpayers who pay property taxes to schools and file nebraska income taxes are eligible to claim a refundable income tax credit on the amount of property taxes paid to schools. If you didn’t claim the credit in 2020 or 2021 it’s not too late! Web an individual or entity may claim the credit by filing the appropriate nebraska tax. Complete, edit or print tax forms instantly. 2021 nebraska property tax incentive act credit computation, form ptc. Try it for free now! 2022 amended nebraska property tax incentive act. Taxpayers should look up their parcel in the nebraska school district property tax look. This act provides a refundable income tax credit to any taxpayer that paid nebraska school. Web 2022 nebraska property tax credit, form ptc. Try it for free now! Web taxpayers who pay property taxes to schools and file nebraska income taxes are eligible to claim a refundable income tax credit on the amount of property taxes paid to schools. Web. Web to claim the income tax credit, taxpayers should file the nebraska property tax incentive act credit computation, form ptc, with their income tax or franchise tax. 2021 form ptc, nebraska property tax incentive act credit computation. Web to claim your credit, you must file form ptc and submit it with your nebraska income tax return. This act provides a. 2021 form ptc, nebraska property tax incentive act credit computation. Filing my state of ne taxes. 2022 amended nebraska property tax incentive act. Web form ptc, property tax incentive act credit, is available on turbotax. Web 2022 nebraska property tax credit, form ptc. Web to claim your credit, you must file form ptc and submit it with your nebraska income tax return. Web your social security number spouse’s social security number high school district code. Complete, edit or print tax forms instantly. For taxable years beginning on or after january 1, 2020, a property tax incentive act credit. Ad download or email ne form 21 & more fillable forms, register and subscribe now! County name * select one. If you didn’t claim the credit in 2020 or 2021 it’s not too late! (1) single (2) married, filing jointly. Web taxpayers are eligible to claim credits by filing the nebraska property tax incentive act credit computation, form ptc, with their nebraska income or financial. Taxpayers should look up their parcel in the nebraska school district property tax look. Web the nebraska property tax incentive act credit computation, form ptc, is used to identify parcels and compute a tax credit for school district property tax paid. You can file those years on. Web for most taxpayers, form ptc can be completed quickly and easily. Part b parcel id number must be 10 digits.”. Web the nebraska property tax credit, form ptc, is used to identify parcels and compute a tax credit for nebraska school district and community college property taxes (qualified property taxes) paid. Web form ptc must be filed with the nebraska income tax or financial institution tax return on which the credit is claimed or the school district property tax paid is distributed. 2022 amended nebraska property tax incentive act. Part a — computation of the credit. 2021 form ptc, nebraska property tax incentive act credit computation. If you did not claim the credit from 2020 or 2021, you can.2018 Missouri Property Tax Credit (MOPTC) Form Instructions

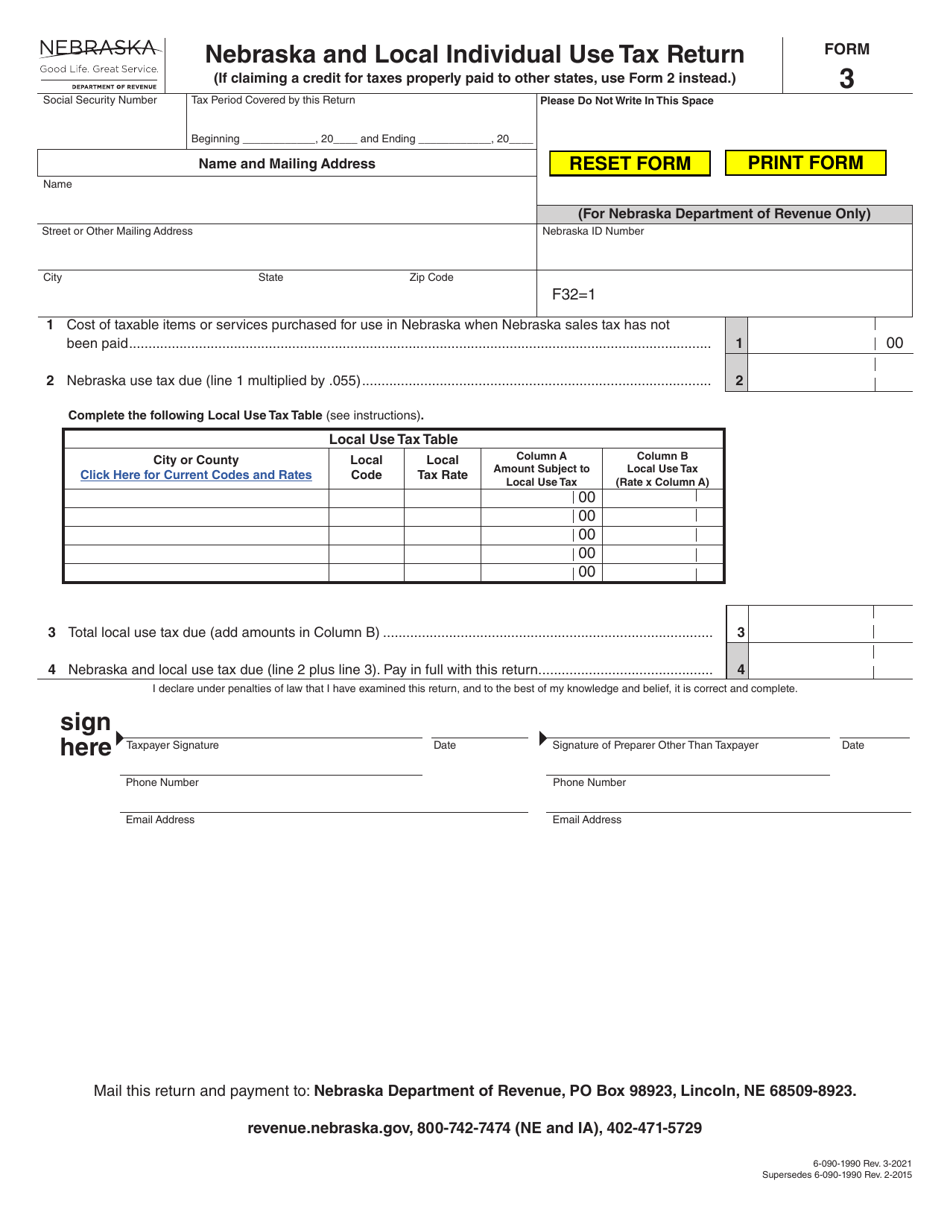

Form 3 Download Fillable PDF or Fill Online Nebraska and Local

mo 1040a fillable 2019 Fill out & sign online DocHub

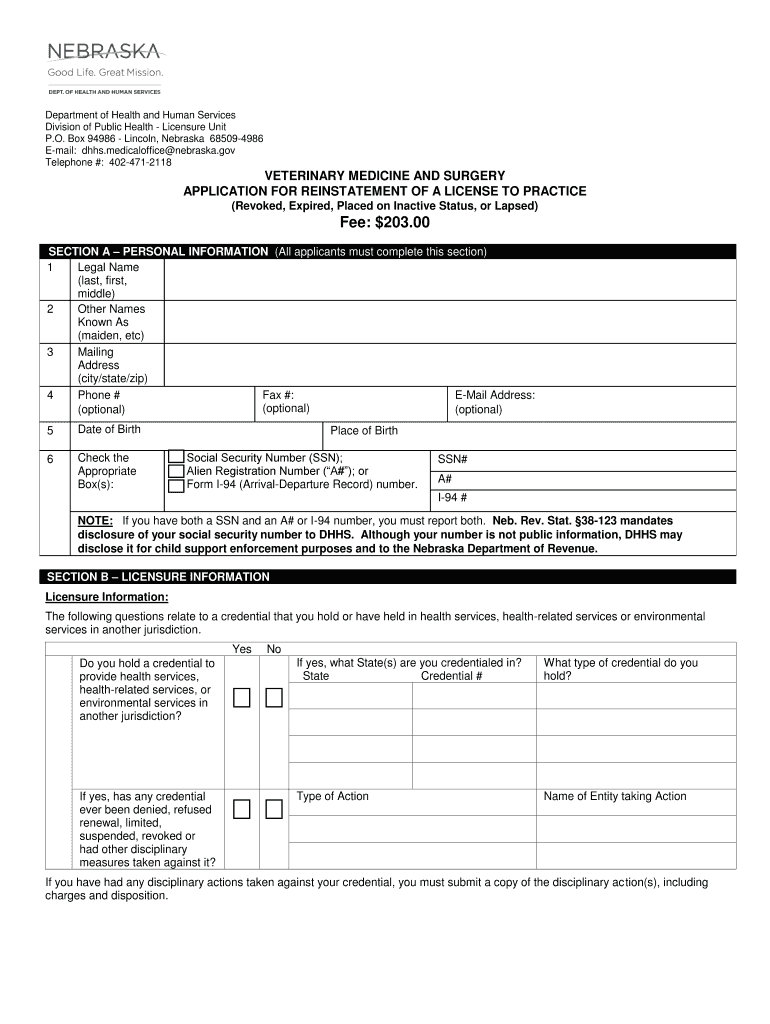

Nebraska Reinstatement License Form Fill Out and Sign Printable PDF

Solved Nebraska form PTC 2020

Nebraska Form 6 20202022 Fill and Sign Printable Template Online

Fill Free fillable forms for the state of Nebraska

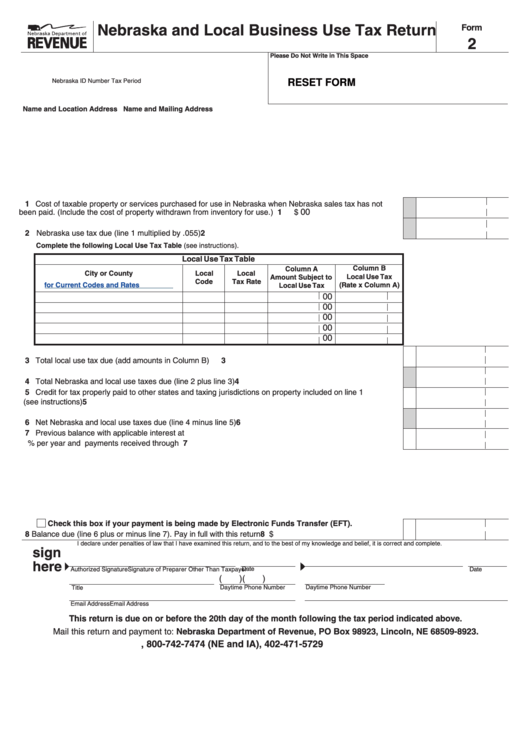

Fillable Form 2 Nebraska And Local Business Use Tax Return printable

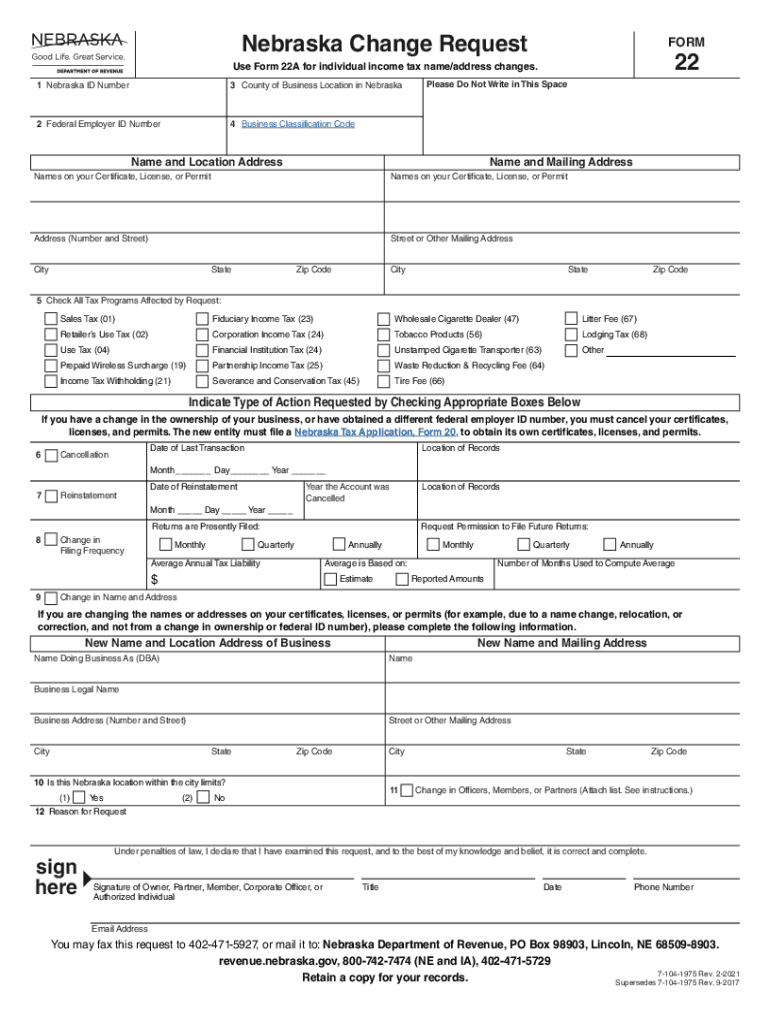

Nebraska form 22 Fill out & sign online DocHub

Form 22 Nebraska Fill Out and Sign Printable PDF Template signNow

Related Post: