Nebraska Form 10 Instructions

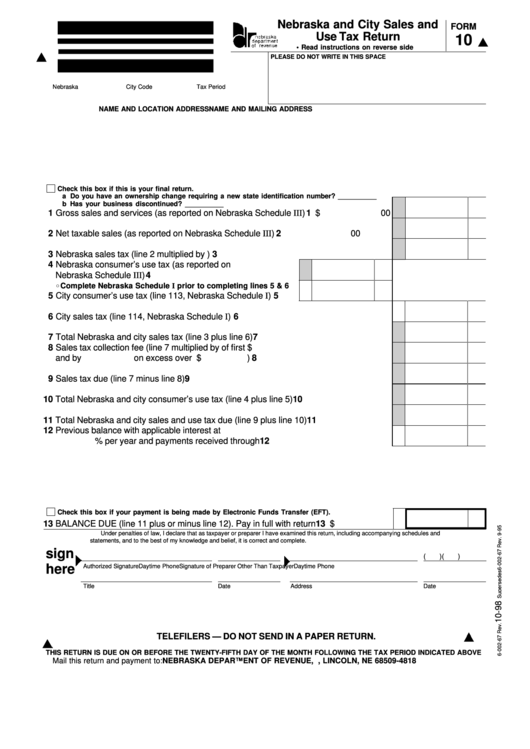

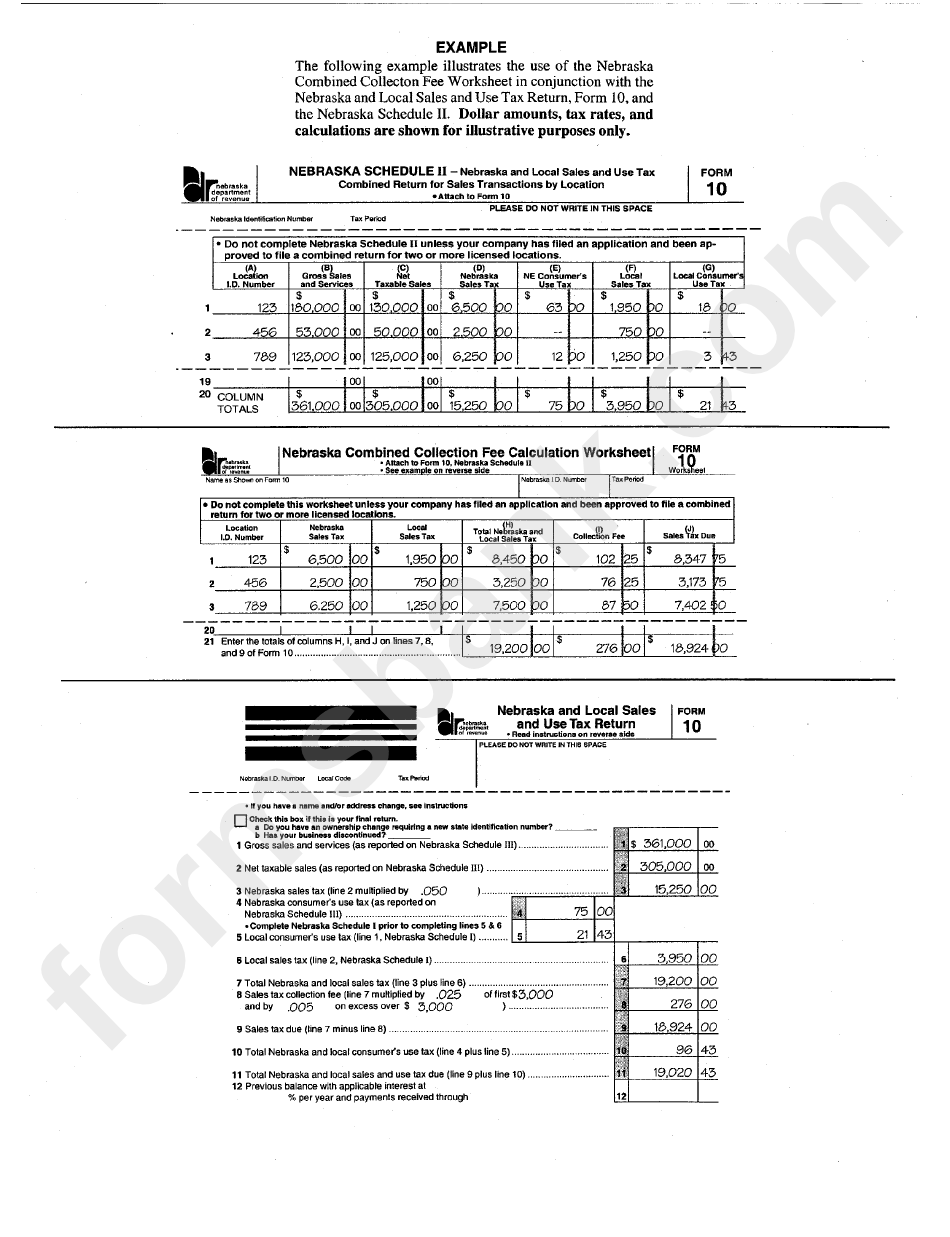

Nebraska Form 10 Instructions - • a form 1040n is filed and the nebraska income tax. Enter the total dollar amount of all sales, leases, rentals, and services made by your business. Record both taxable and exempt gross. 436 nebraska tax forms and templates are collected for any of your. Every permitholder must ile a nebraska and local sales and use tax. Multiply line 24 by 66⅔ % (.667) and enter here. Web if all nebraska income tax is paid and return is filed by march 1, do not complete this form. Web fill online, printable, fillable, blank form 10: Web fiduciary income tax forms specific to the current tax year. Signnow allows users to edit, sign, fill & share all type of documents online. Web 13 name, address, or ownership changes? Web instructions for form 10 line 1. Check this box if your business has. Income tax withholding monthly, quarterly, and annual. Enter the total dollar amount of all sales, leases, rentals, and services made by your business. Income tax withholding monthly, quarterly, and annual. Edit, sign and save ne test accommodations form. Web nebraska form 10 instructions use a nebraska and local sales and use tax form 10 template to make your document workflow more streamlined. If federal agi was more than $150,000 ($75,000 if married,. Cancer benefits received from the firefighter cancer benefits act. Income tax withholding monthly, quarterly, and annual. Enter the total dollar amount of all nebraska sales, leases,. Enter the total dollar amount of all sales, leases, rentals, and services made by your business. Web nebraska form 10 instructions use a nebraska and local sales and use tax form 10 template to make your document workflow more streamlined. Web 2 net. • a form 1040n is filed and the nebraska income tax. Financial institution tax forms specific to the current tax year. Use fill to complete blank online nebraska pdf forms for. Edit, sign and save ne test accommodations form. Web what is a nebraska form 10? Web what is a nebraska form 10? Web 7enter your 2019 nebraska income tax (see instructions). Web form 10 and schedules for amended returns and prior tax periods. If federal agi was more than $150,000 ($75,000 if married,. Financial institution tax forms specific to the current tax year. Enter the total dollar amount of all nebraska sales, leases,. Web follow the simple instructions below: Financial institution tax forms specific to the current tax year. Web what is a nebraska form 10? Today, most americans tend to prefer to do their own income taxes and, moreover, to fill in reports in electronic format. Every permitholder must ile a nebraska and local sales and use tax. Today, most americans tend to prefer to do their own income taxes and, moreover, to fill in reports in electronic format. Every person making taxable sales in nebraska must hold a nebraska sales tax permit. Cancer benefits received from the firefighter cancer benefits act. Enter the total dollar. Web follow the simple instructions below: Web nebraska form 10 instructions use a nebraska and local sales and use tax form 10 template to make your document workflow more streamlined. Web fiduciary income tax forms specific to the current tax year. Web fill online, printable, fillable, blank form 10: If federal agi was more than $150,000 ($75,000 if married,. Enter the total dollar amount of all sales, leases, rentals, and services made by your business. Web nebraska form 10 instructions use a nebraska and local sales and use tax form 10 template to make your document workflow more streamlined. Today, most americans tend to prefer to do their own income taxes and, moreover, to fill in reports in electronic. Every person making taxable sales in nebraska must hold a nebraska sales tax permit. Edit, sign and save ne test accommodations form. Read the following instructions to use cocodoc to start editing and completing your. Multiply line 24 by 66⅔ % (.667) and enter here. Edit, sign and save ne test accommodations form. If federal agi was more than $150,000 ($75,000 if married,. Edit, sign and save ne test accommodations form. Edit, sign and save ne test accommodations form. Web if all nebraska income tax is paid and return is filed by march 1, do not complete this form. Web 13 name, address, or ownership changes? Web follow the simple instructions below: Web fiduciary income tax forms specific to the current tax year. Check this box if your business has. Edit pdfs, create forms, collect data, collaborate with your team, secure docs and more. Web form 10 and schedules for amended returns and prior tax periods. Every permitholder must ile a nebraska and local sales and use tax. You do not owe penalty. Web 2 net nebraska taxable sales as shown on line 2, form 10 worksheets (see instructions) 2 00 3 nebraska sales tax (line 2 multiplied by.055) 3 4 nebraska use tax (see. Retailers include remote sellers and multivendor marketplace platforms (mmps) with more than $100,000 of gross. Enter the total dollar amount of all nebraska sales, leases,. Nebraska and local sales and use tax return (form 10) all nebraska residents and businesses making taxable sales within the state is required to. Record both taxable and exempt gross. Show details we are not. Enter the total dollar amount of all sales, leases, rentals, and services made by your business. Web nebraska form 10 instructions use a nebraska and local sales and use tax form 10 template to make your document workflow more streamlined.Fillable Form 10 Nebraska And City Sales And Use Tax Return printable

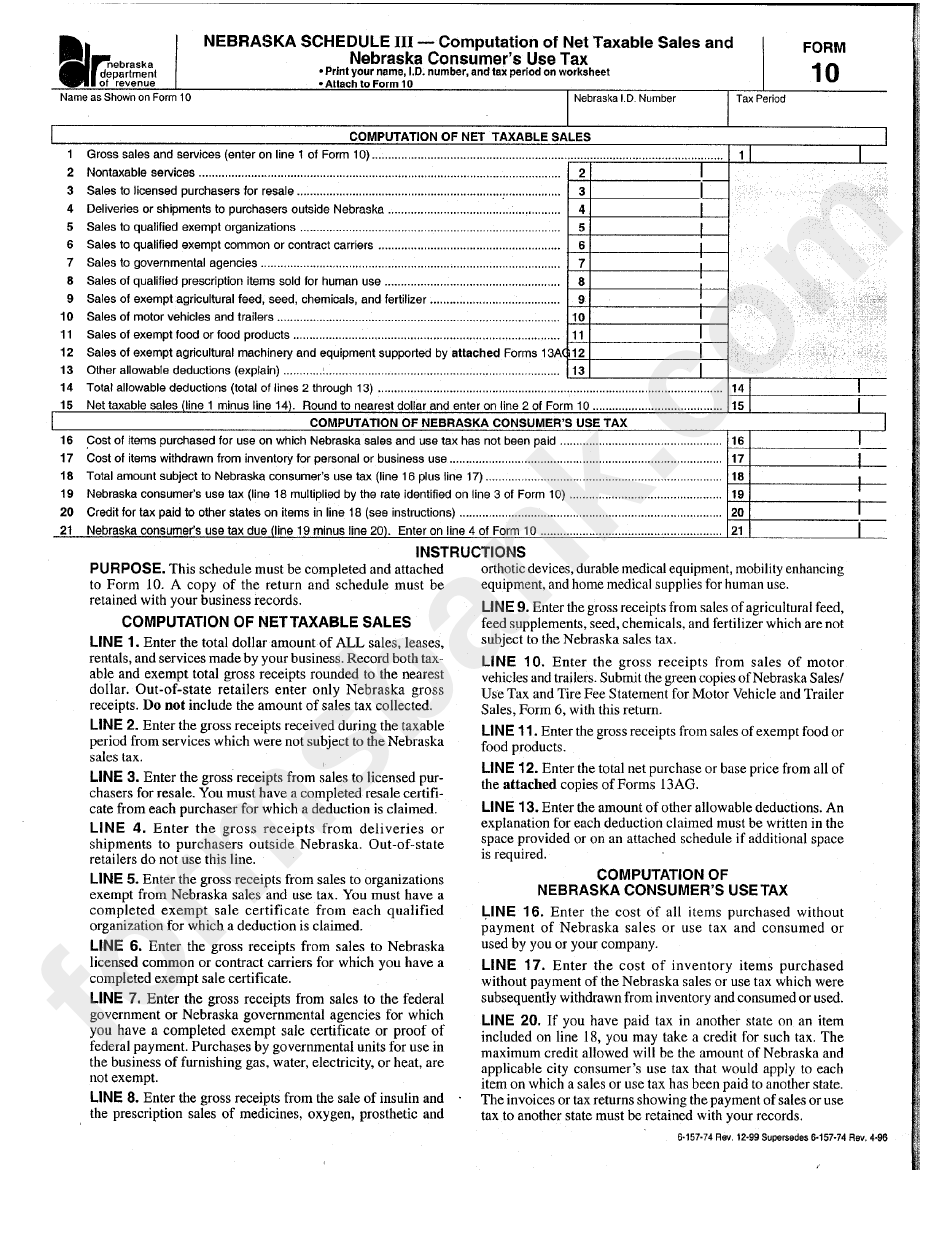

Form 10 Nebraska Schedule 3 Computation Of Net Taxable Sales And

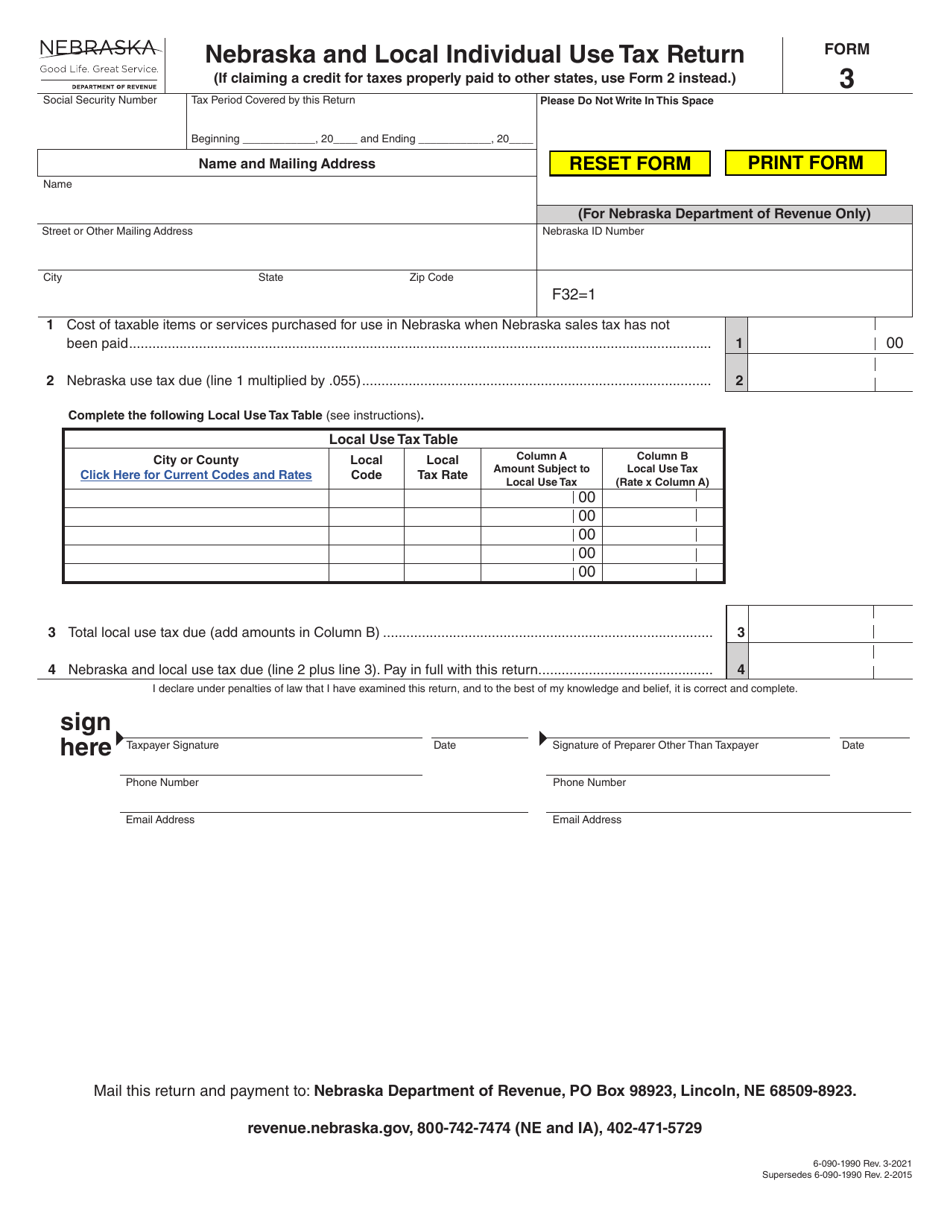

Form 3 Download Fillable PDF or Fill Online Nebraska and Local

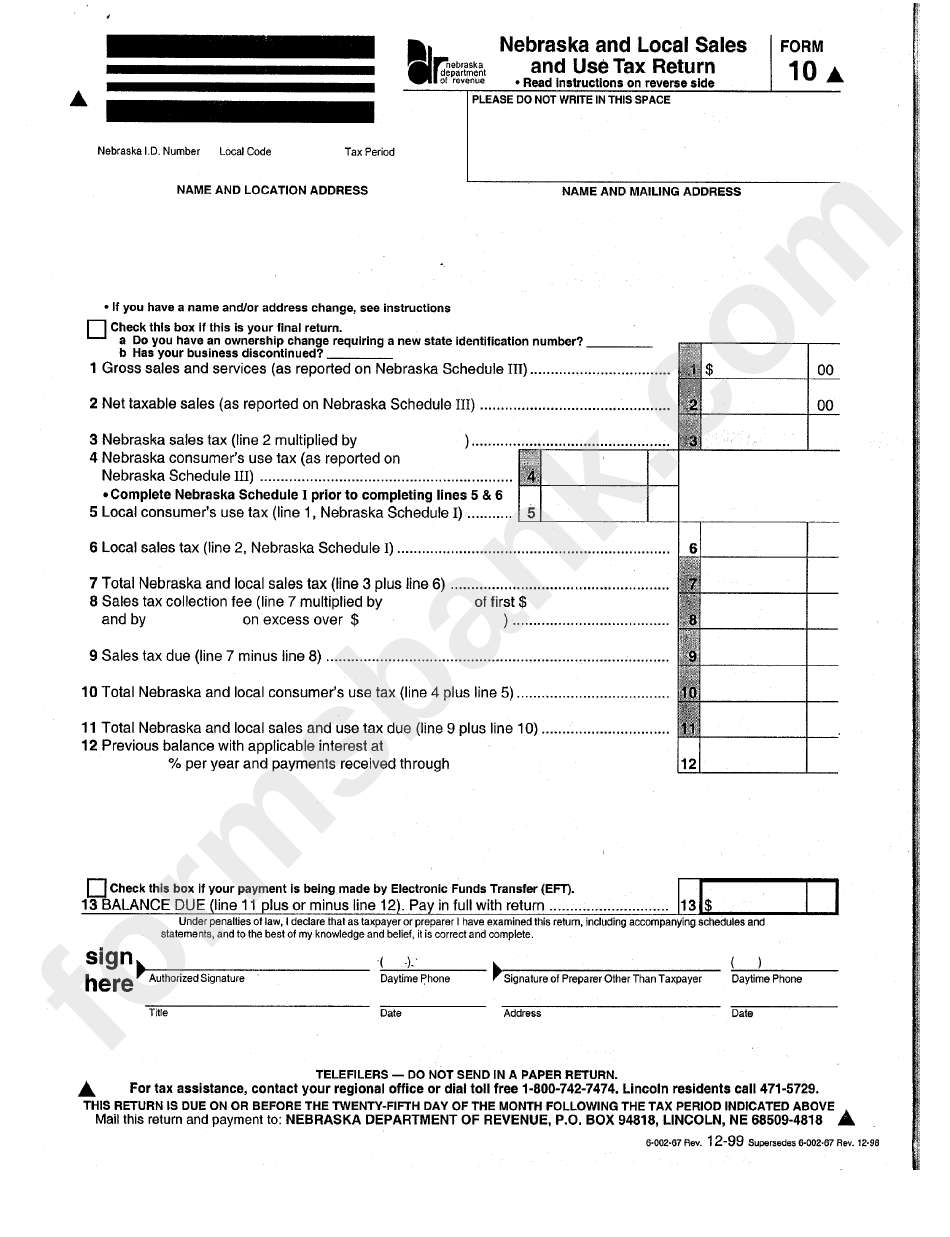

Form 10 Nebraska And Local Sales And Use Tax Return printable pdf

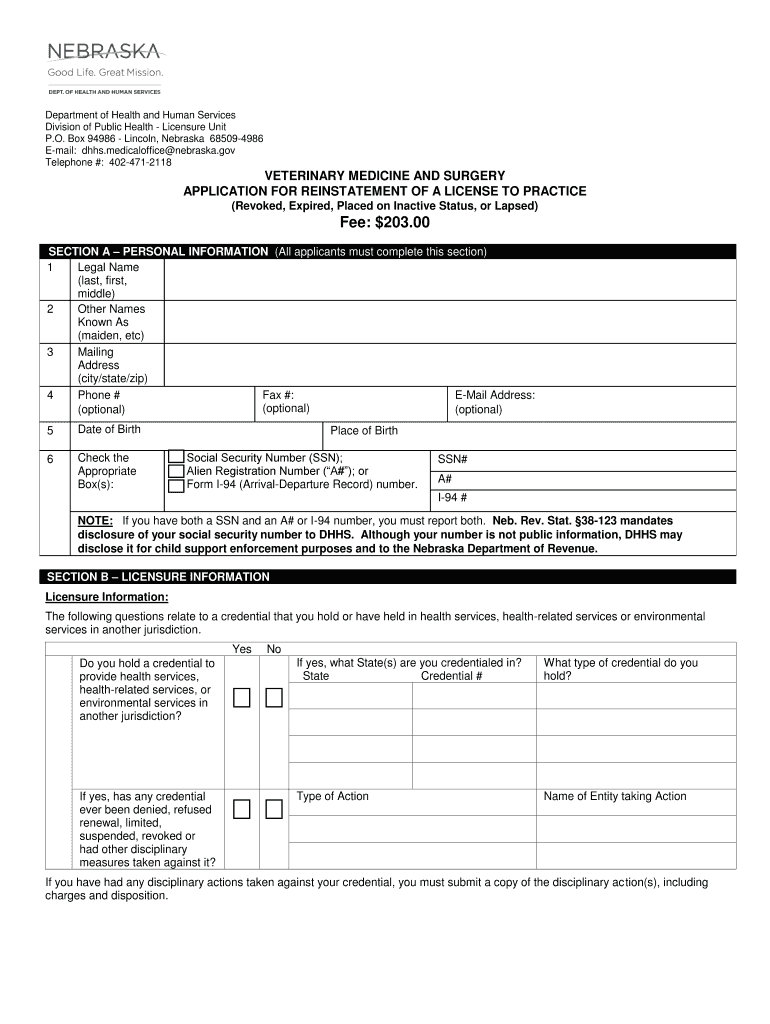

Nebraska Reinstatement License Form Fill Out and Sign Printable PDF

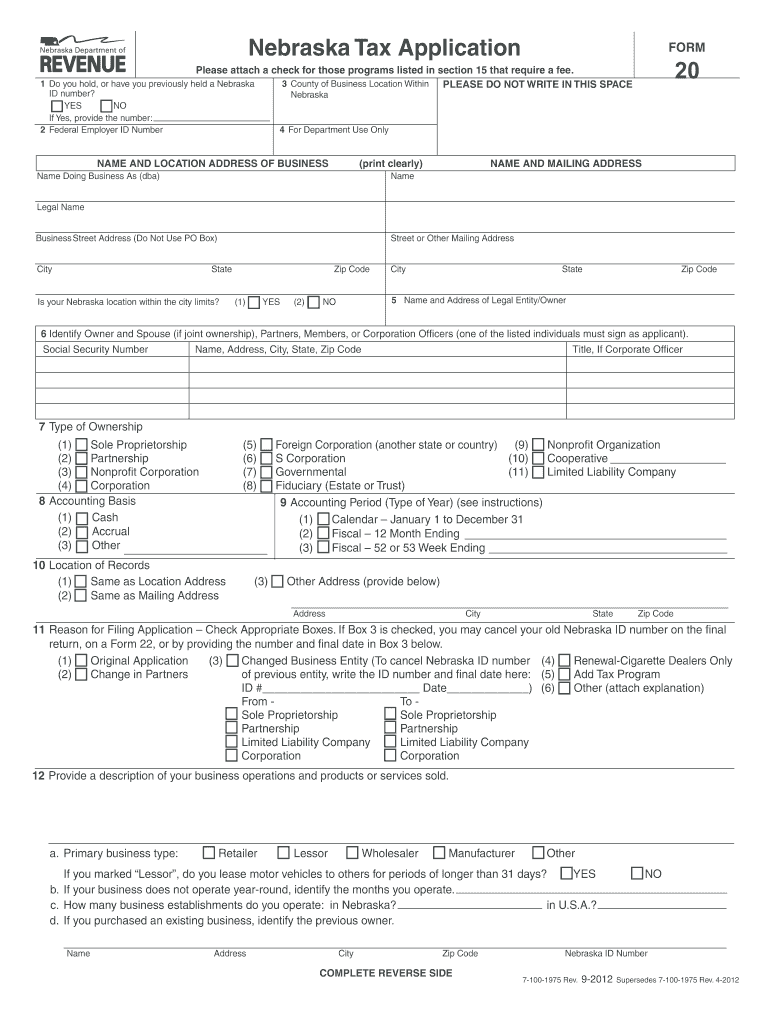

Form 20 Nebraska Fill Out and Sign Printable PDF Template signNow

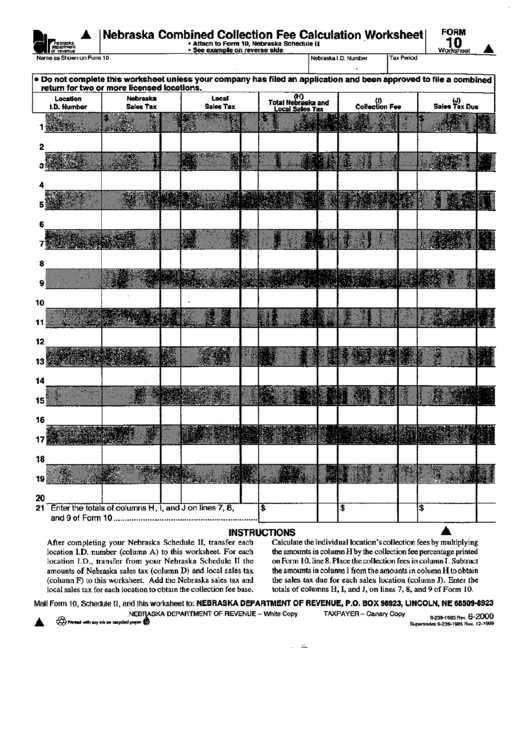

Form 10 Nebraska Combined Collection Fee Calculation Worksheet

Form 10 Nebraska And Local Sales And Use Tax Return Example printable

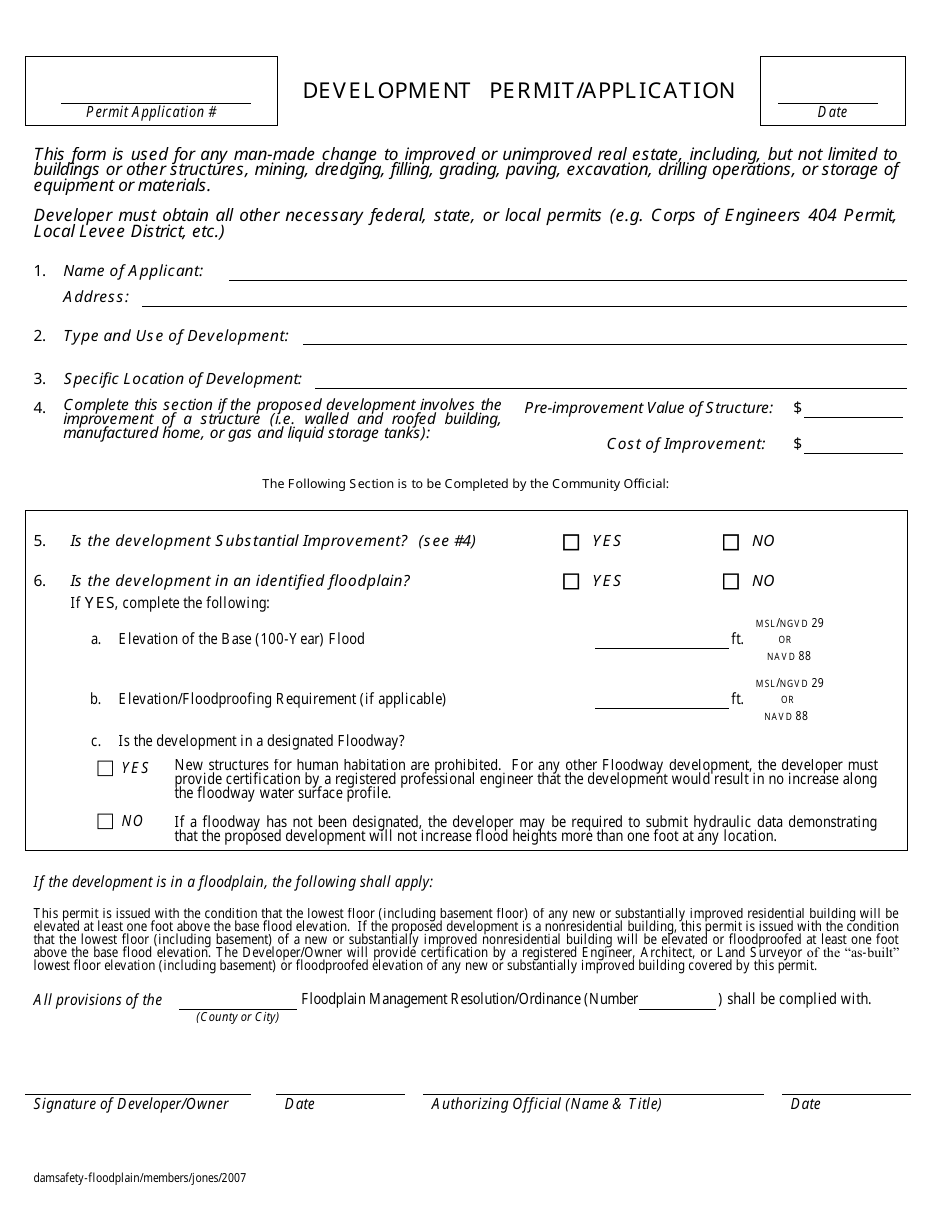

Nebraska Development Permit/Application Form Download Printable PDF

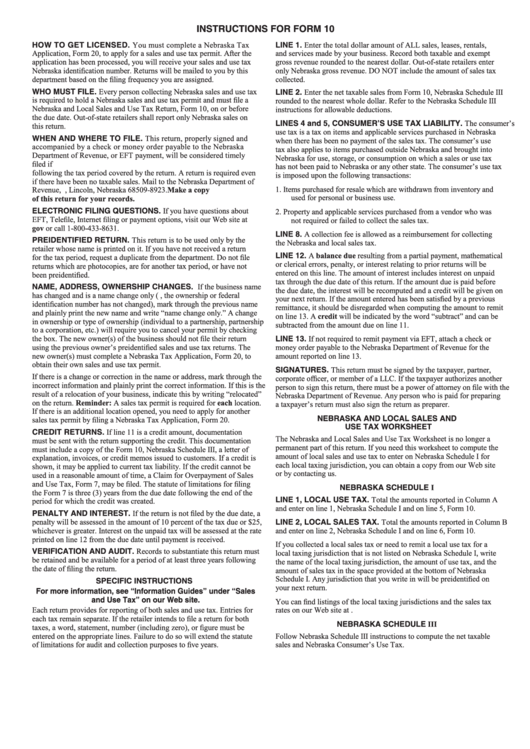

Instructions For Form 10 Nebraska And Local Sales And Use Tax Return

Related Post: