Mo Form 5695

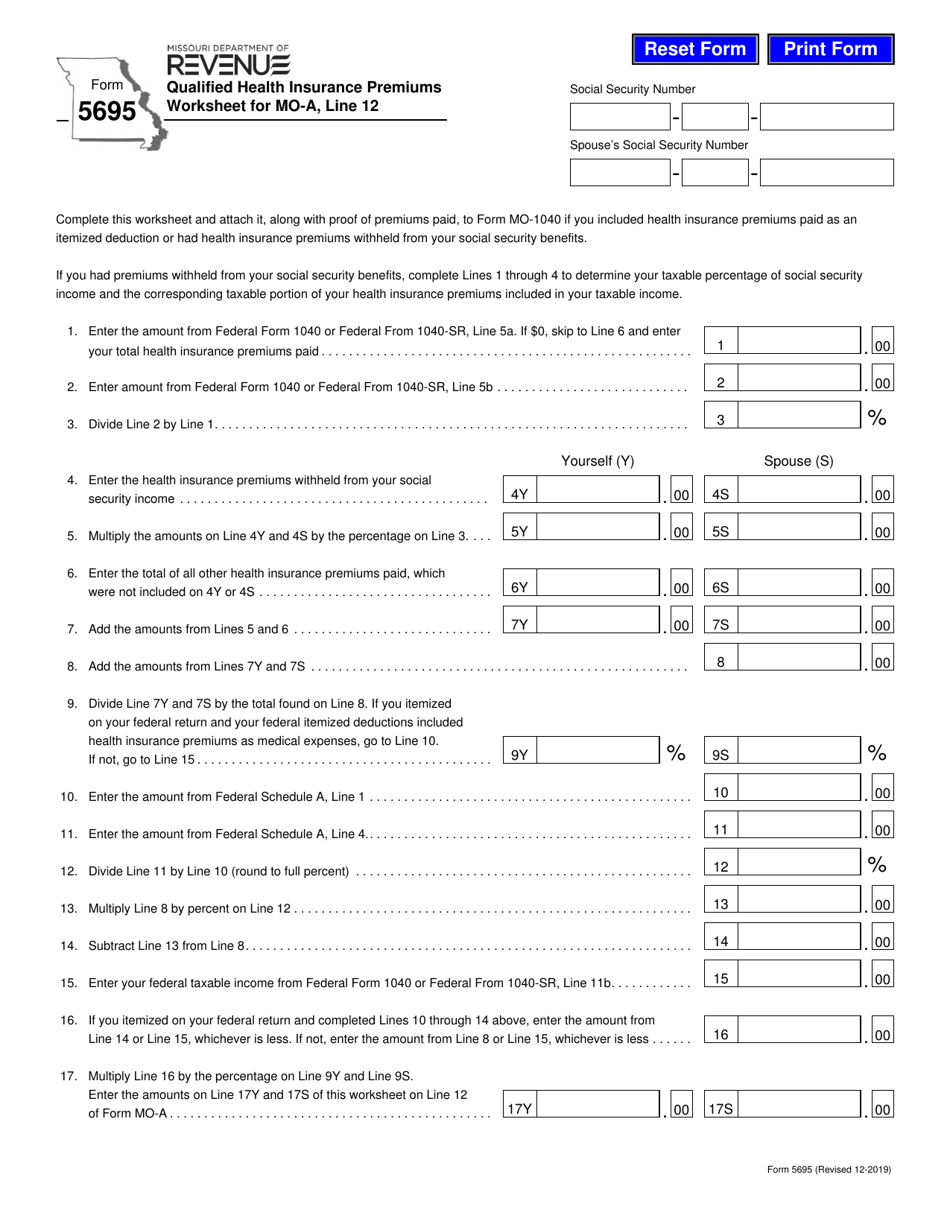

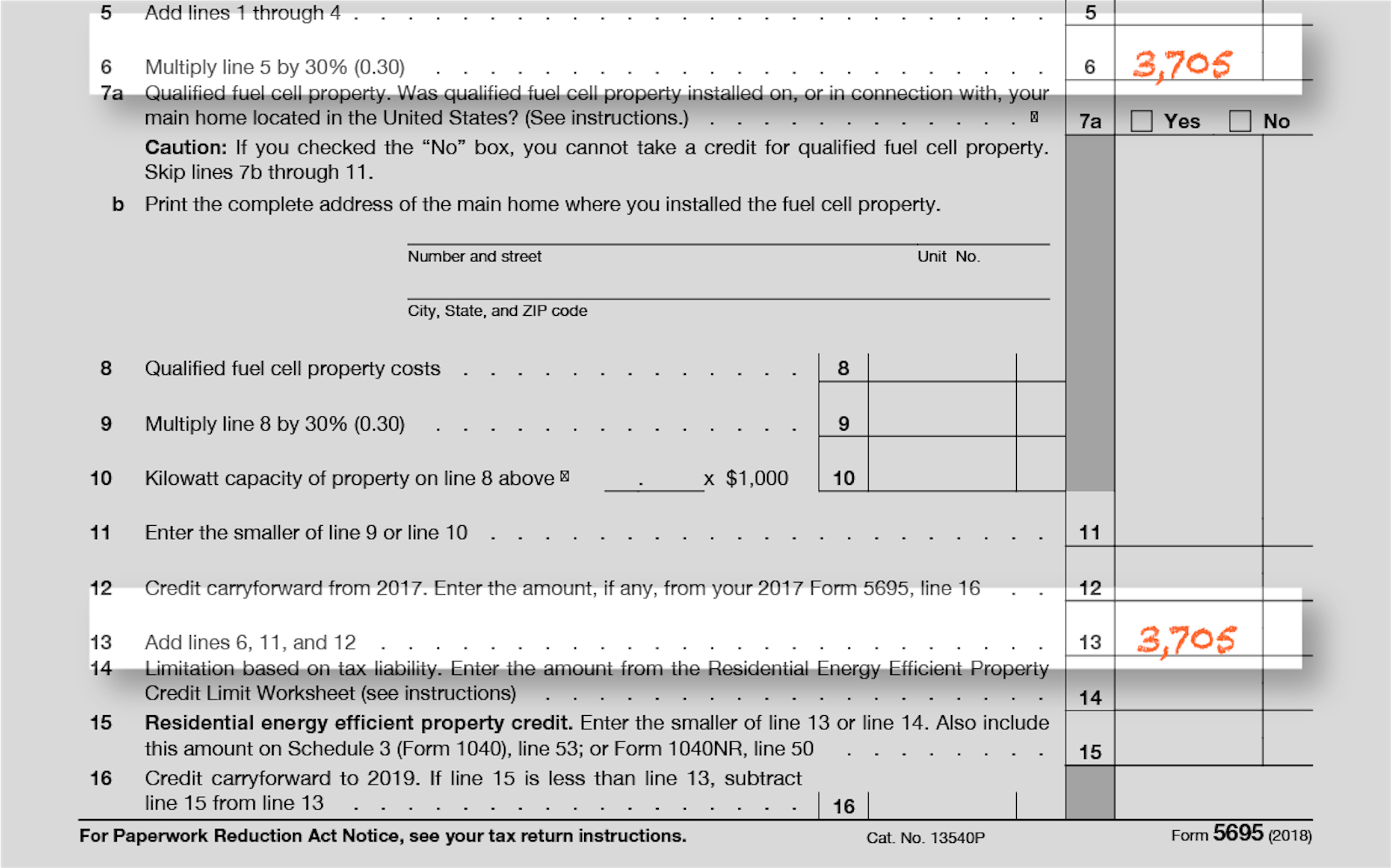

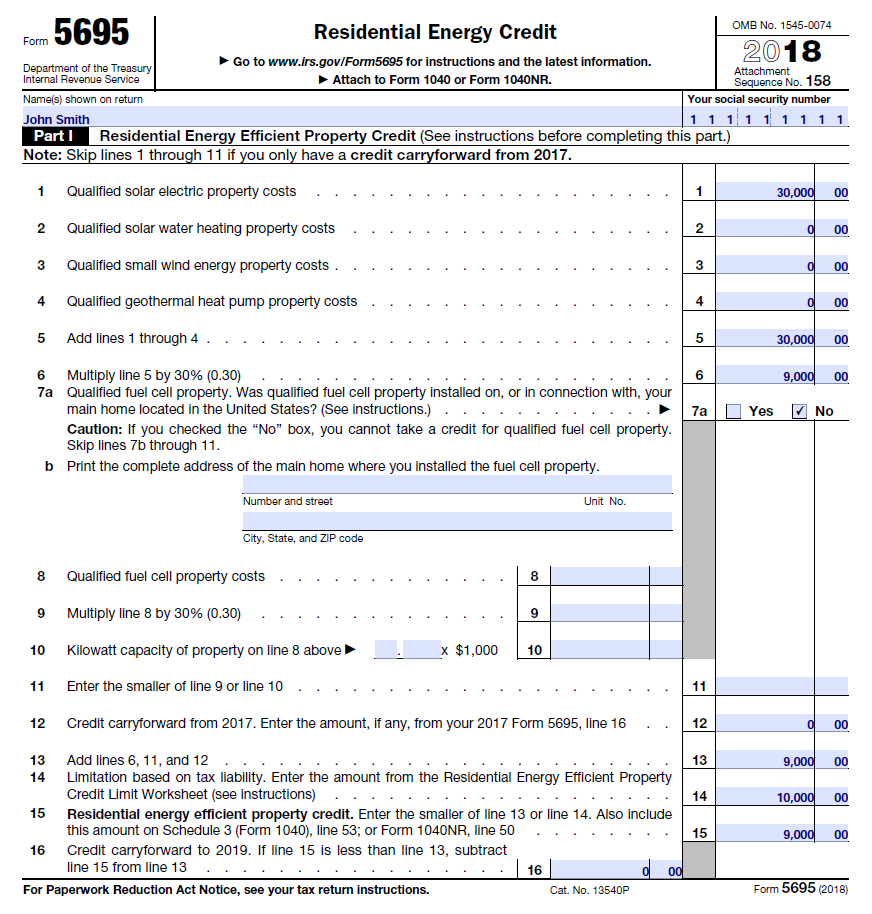

Mo Form 5695 - 24 released form 5695, qualified health insurance premiums worksheet, for individual income tax purposes. You need to submit it alongside form 1040. Form 5695 is what you need to fill out to calculate your residential energy tax credits. See information beginning on page 12 to assist you in completing this. Also use form 5695 to take any residential energy. The energy efficient home improvement credit. Web the missouri department of revenue dec. Estimate initial costs and future savings. Web short forms help you avoid becoming confused by tax laws and procedures that do not apply to you. Web also use form 5695 to take any residential energy efficient property credit carryforward from 2021 or to carry the unused portion of the residential clean energy credit to 2023. Web also use form 5695 to take any residential energy efficient property credit carryforward from 2021 or to carry the unused portion of the residential clean energy credit to 2023. See information beginning on page 13 to assist you in completing this. Web the missouri department of revenue dec. Web what’s form 5695? Web department of the treasury internal revenue. Information about form 5695, residential energy credits, including recent updates, related forms and. Form 5695 is what you need to fill out to calculate your residential energy tax credits. Web page last reviewed or updated: Web the residential energy credits are: Missouri department of revenue, find information about motor. Web also use form 5695 to take any residential energy efficient property credit carryforward from 2021 or to carry the unused portion of the residential clean energy credit to 2023. Web what’s form 5695? Web department of the treasury internal revenue service residential energy credits go to www.irs.gov/form5695 for instructions and the latest information. Ad only 3 requirements to qualify:. Also use form 5695 to take any residential energy. See information beginning on page 12 to assist you in completing this. You need to submit it alongside form 1040. Web department of the treasury internal revenue service residential energy credits go to www.irs.gov/form5695 for instructions and the latest information. Information about form 5695, residential energy credits, including recent updates, related. Web also use form 5695 to take any residential energy efficient property credit carryforward from 2021 or to carry the unused portion of the residential clean energy credit to 2023. Web short forms help you avoid becoming confused by tax laws and procedures that do not apply to you. You need to submit it alongside form 1040. See information beginning. Web also use form 5695 to take any residential energy efficient property credit carryforward from 2021 or to carry the unused portion of the residential clean energy credit to 2023. The energy efficient home improvement credit. You need to submit it alongside form 1040. Web the missouri department of revenue dec. Ad only 3 requirements to qualify: See information beginning on page 13 to assist you in completing this. Information about form 5695, residential energy credits, including recent updates, related forms and. 24 released form 5695, qualified health insurance premiums worksheet, for individual income tax purposes. Homeowner, avg bill of $99+, & live in eligible zip code. Missouri department of revenue, find information about motor. I got an answer from turbotax. Ad only 3 requirements to qualify: Web also use form 5695 to take any residential energy efficient property credit carryforward from 2021 or to carry the unused portion of the residential clean energy credit to 2023. You need to submit it alongside form 1040. Information about form 5695, residential energy credits, including recent updates,. See information beginning on page 13 to assist you in completing this. Missouri department of revenue, find information about motor. Web what’s form 5695? Web the residential energy credits are: Homeowner, avg bill of $99+, & live in eligible zip code. Web also use form 5695 to take any residential energy efficient property credit carryforward from 2021 or to carry the unused portion of the residential clean energy credit to 2023. Homeowner, avg bill of $99+, & live in eligible zip code. Web the residential energy credits are: Web department of the treasury internal revenue service residential energy credits go to. Web the residential energy credits are: Ad only 3 requirements to qualify: Web the missouri department of revenue dec. Form 5695 is what you need to fill out to calculate your residential energy tax credits. Estimate initial costs and future savings. See information beginning on page 13 to assist you in completing this. See information beginning on page 12 to assist you in completing this. The energy efficient home improvement credit. Web short forms help you avoid becoming confused by tax laws and procedures that do not apply to you. Homeowner, avg bill of $99+, & live in eligible zip code. All missouri short forms allow the standard or itemized deduction. You need to submit it alongside form 1040. Web page last reviewed or updated: I got an answer from turbotax. Web also use form 5695 to take any residential energy efficient property credit carryforward from 2021 or to carry the unused portion of the residential clean energy credit to 2023. The residential clean energy credit, and. 24 released form 5695, qualified health insurance premiums worksheet, for individual income tax purposes. Web department of the treasury internal revenue service residential energy credits go to www.irs.gov/form5695 for instructions and the latest information. Also use form 5695 to take any residential energy. Missouri department of revenue, find information about motor.How To Fill Out IRS Form 5695 to Claim the Solar Tax Credit Fill out

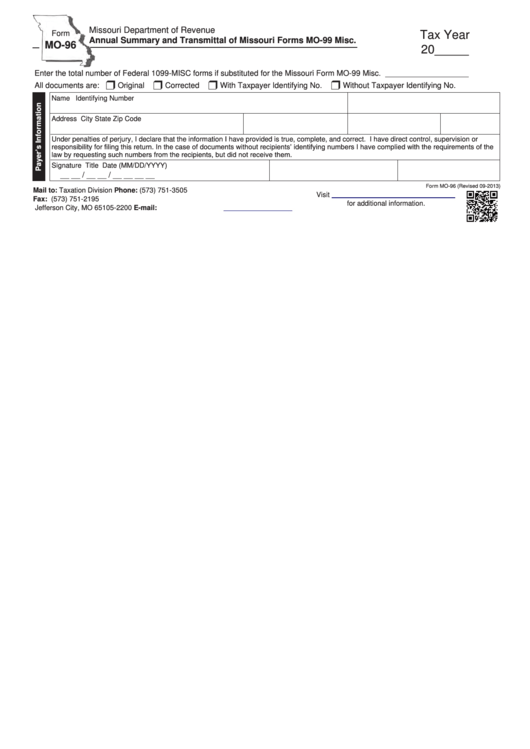

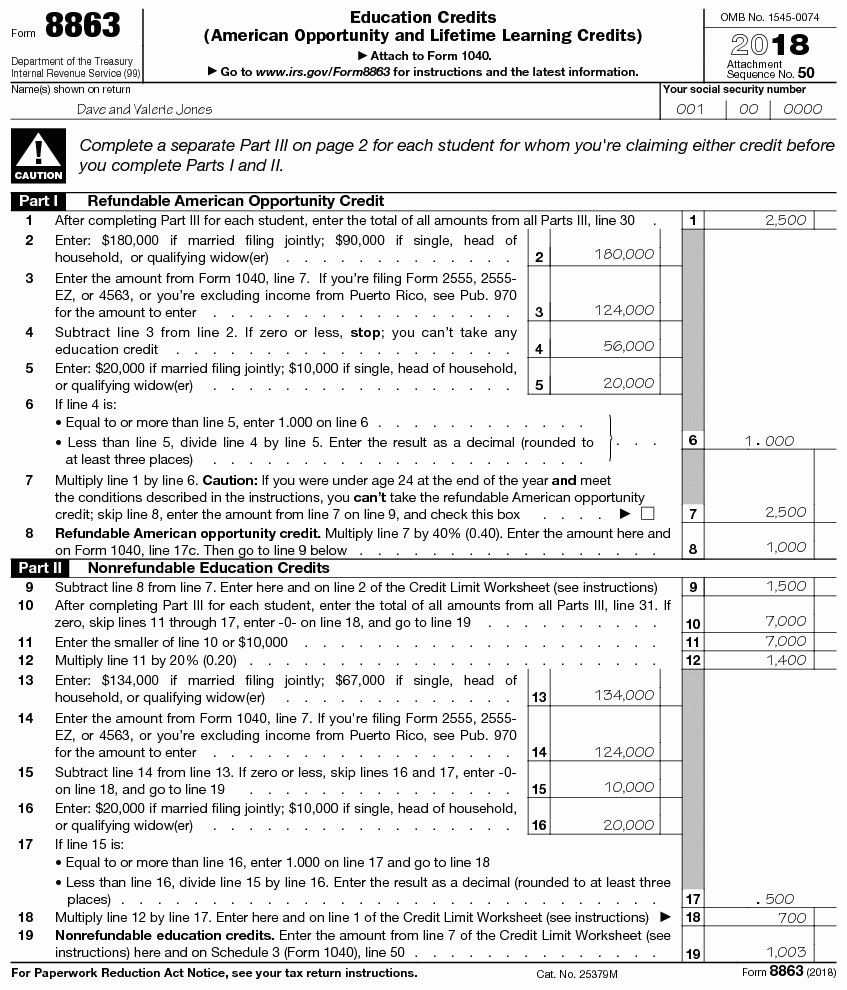

Form Mo Mss Download Fillable Pdf Or Fill Online S Corporation Riset

Form 5695 Fill Out, Sign Online and Download Fillable PDF, Missouri

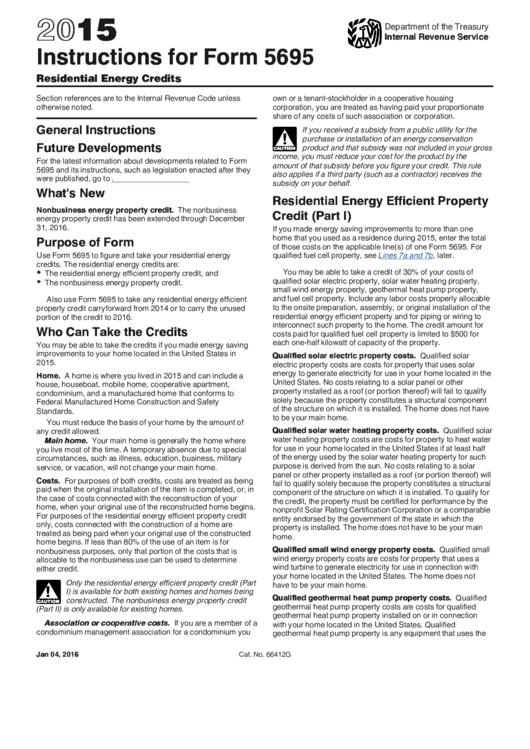

Instructions For Form 5695 Residential Energy Credits 2015

2016 Form 5695 Fill Online, Printable, Fillable, Blank pdfFiller

How to File IRS Form 5695 To Claim Your Renewable Energy Credits

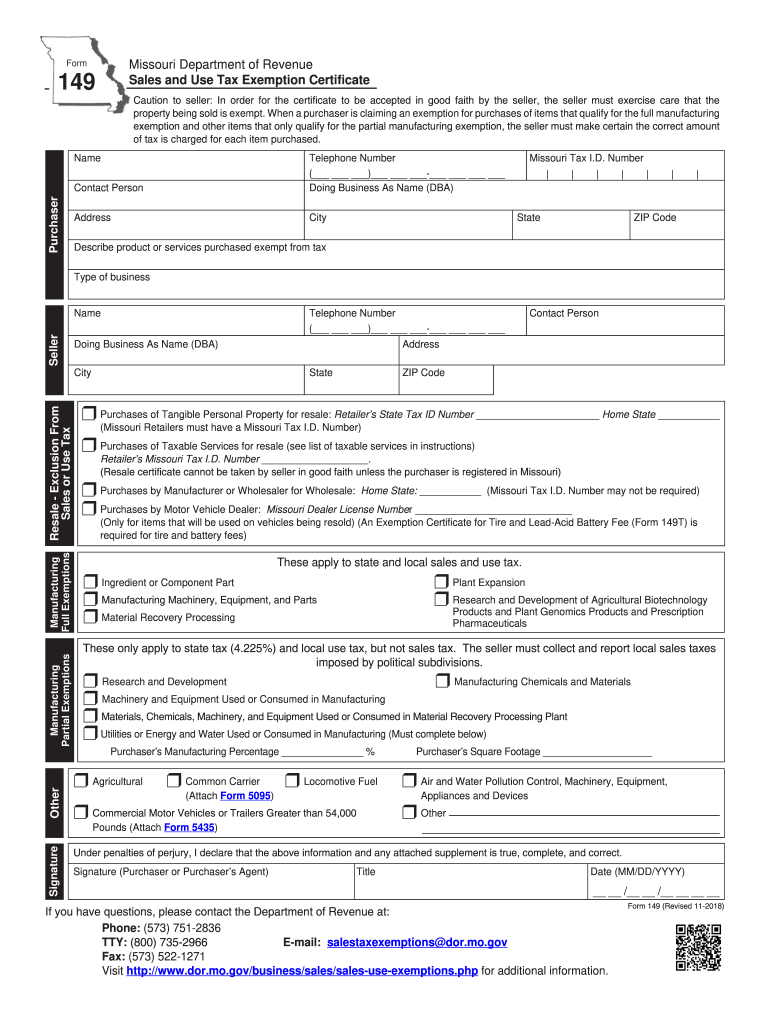

Form 149 Missouri Fill Out and Sign Printable PDF Template signNow

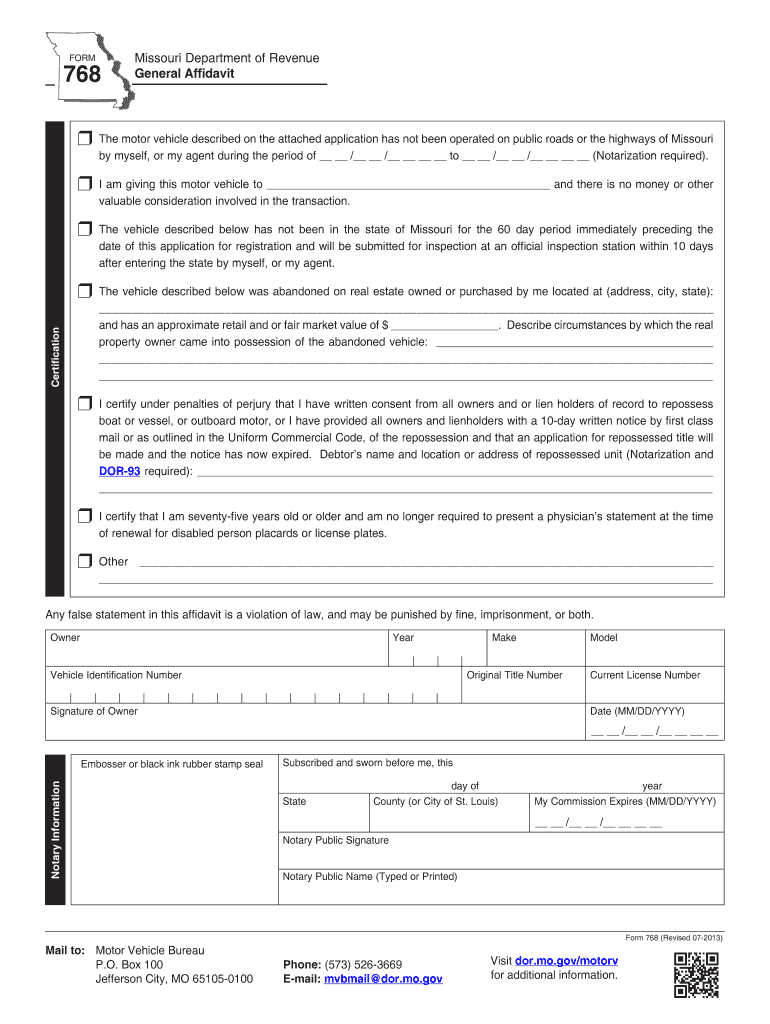

General Affidavit Mo Form Fill Out and Sign Printable PDF Template

Completed Form 5695 Residential Energy Credit Capital City Solar

Form Instructions Is Available For How To File 5695 2018 —

Related Post: