How To Find 941 Form In Quickbooks Online

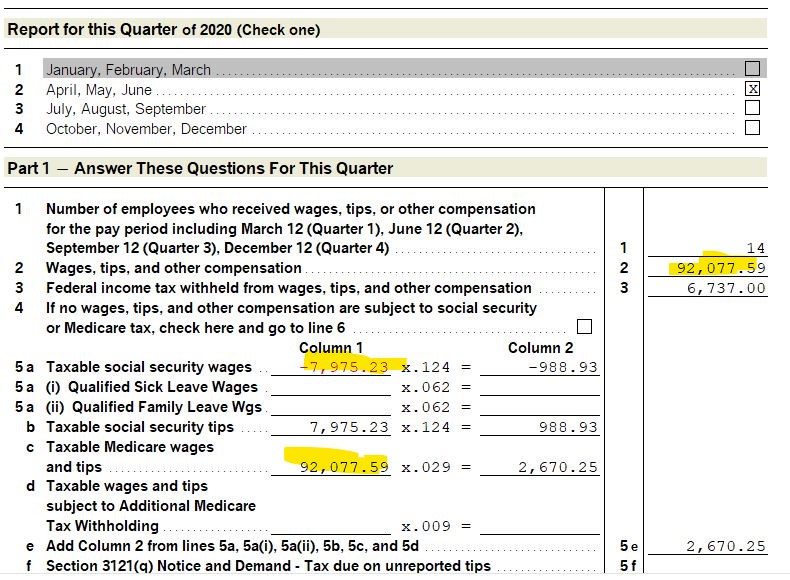

How To Find 941 Form In Quickbooks Online - Web about press copyright contact us creators advertise developers terms privacy policy & safety how youtube works test new features nfl sunday ticket. Calculate the total federal income tax withheld from employees’ paychecks. Get a free guided quickbooks® setup. Report income taxes, social security tax, or medicare tax. Automatically track all your income and expenses. Web how to file federal payroll form 941 in quickbooks online? Where to find 1st quarter 2021 941? Sum up all wages, tips, and other payments made to employees. Mwj consultancy 76 subscribers subscribe 441 views 3 months ago united states you. Go to the employees menu, then choose employee center, and select the payroll tab. Select back to form to get back to. Web i'm here to help ensure you're able to access and send the 941 forms in quickbooks online. Click on reports at the top menu bar. Web where can i see my previously filed 941s? Web go to taxes, then payroll tax. Report income taxes, social security tax, or medicare tax. Mwj consultancy 76 subscribers subscribe 441 views 3 months ago united states you. You might want to check your quarterly or archive forms section. Calculate the total federal income tax withheld from employees’ paychecks. Web where can i see my previously filed 941s? You might want to check your quarterly or archive forms section. Under forms, select quarterly forms or view and print archived forms to see the archived forms from prior periods. It is secure and accurate. Web to print the forms in quickbooks desktop accountant 2020, just follow the steps below: Go to the employees menu, then choose employee center, and. Select trust center from the left menu, then click trust center settings. Web irs form 941 instructions: Click the file forms button. Filing deadlines are in april, july, october and january. Web to print the forms in quickbooks desktop accountant 2020, just follow the steps below: Web where to find the 941 form in quickbooks desktop payroll assisted? Web irs form 941 is a form businesses file quarterly to report taxes they withheld from employee paychecks. Get a free guided quickbooks® setup. Web go to taxes, then payroll tax. Automatically track all your income and expenses. Where to find 1st quarter 2021 941? Web where can i see my previously filed 941s? Web how to file federal payroll form 941 in quickbooks online? Select trust center from the left menu, then click trust center settings. For 941, click the view and print archived forms under quarterly forms. Click on reports at the top menu bar. Report income taxes, social security tax, or medicare tax. Web where to find the 941 form in quickbooks desktop payroll assisted? Click the file forms button. Web about press copyright contact us creators advertise developers terms privacy policy & safety how youtube works test new features nfl sunday ticket. Click create report to start manually copying the. Web from the quickbooks tax worksheets window, select quarterly 941 and enter the specific quarter you have to file from last year. Click on reports at the top menu bar. Web where to find the 941 form in quickbooks desktop payroll assisted? Select the appropriate date from the drop. Report income taxes, social security tax, or medicare tax. Select macro settings, then select the option you. Web click the file tab from the microsoft office. Web let me show you how to print the filed 941 form so you can mail it to the irs. Web irs form 941 is a form businesses file quarterly to report taxes they. Web where can i see my previously filed 941s? Click on the employees menu. Select the appropriate date from the drop. Click on reports at the top menu bar. Web to print the forms in quickbooks desktop accountant 2020, just follow the steps below: Select any any line or box for irs instructions and quickbooks information and troubleshooting steps. Web intuit accountants community industry discussions tax talk where to find 1st quarter 2021 941? Click on reports at the top menu bar. Select macro settings, then select the option you. Web how to file federal payroll form 941 in quickbooks online? Ad guaranteed to reduce errors, increase efficiency and handle large volumes of data. You might want to check your quarterly or archive forms section. Ad manage all your business expenses in one place with quickbooks®. Click the file forms button. Web irs form 941 is a form businesses file quarterly to report taxes they withheld from employee paychecks. Web learn how quickbooks online and desktop populates the lines on the form 941. Web please follow these steps: Where to find 1st quarter 2021 941? Web where to find the 941 form in quickbooks desktop payroll assisted? It is secure and accurate. Web let me show you how to print the filed 941 form so you can mail it to the irs. Web go to taxes, then payroll tax. Calculate the total federal income tax withheld from employees’ paychecks. Employers must file a quarterly form 941 to report wages paid, tips your employees. Web irs form 941 instructions:Create IRS Tax Form 941 in QuickBooks YouTube

Quarterly Payroll Form 941 & Payroll Report Forms From QuickBooks YouTube

Answer How to Change Payment Date on Schedule B Form 941 in QuickBooks

How Do I Efile 941 Tax Forms in QuickBooks Desktop?

2020 QB Desktop Payroll Reports (Form 941) Populat... QuickBooks

How to file your federal payroll forms (941) with QuickBooks Desktop

print 0 wages 941

How do you mark a 941 return FINAL in QBO

How to Complete Form 941 in 5 Simple Steps

form 941 worksheet

Related Post: