Form 4972 Instructions

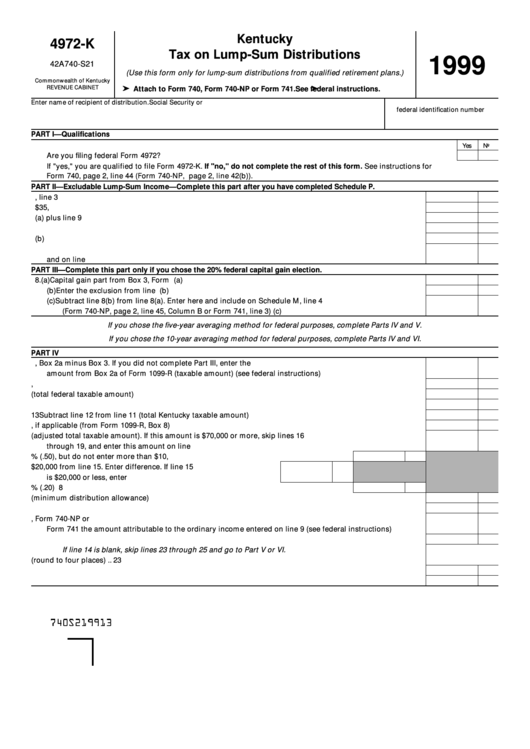

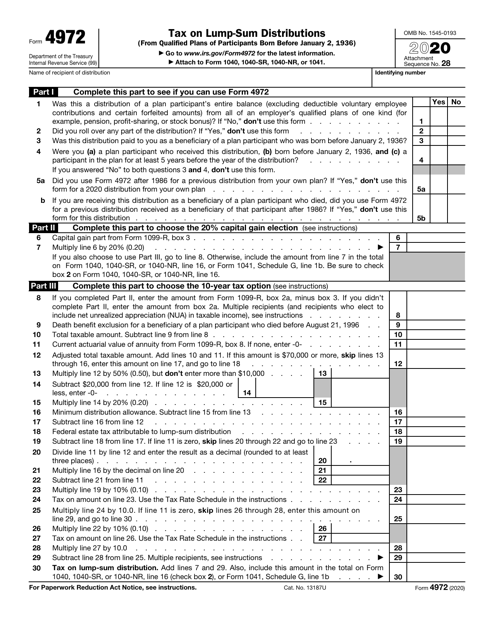

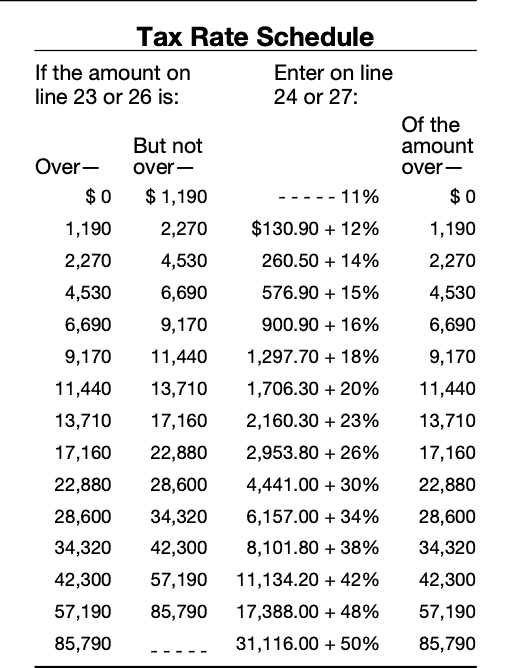

Form 4972 Instructions - Who can use the form c. Web use this form if you elect to report your child’s income on your return. Addition from line 7 of schedule m1home (enclose schedule. Web form 4972 (2010) page 2 section references are to the internal revenue code. If you do, your child will not have to file a return. Web use this form to figure the amount of investment interest expense you can deduct for the current year and the amount you can carry forward to future years. Web treat this amount as a capital gain on form 4972 (not on schedule d (form 1040)). Web help deciphering tax forms and instructions provided by the internal revenue service (irs) can be daunting. Web what is irs form 4972 used for? Be sure to check box. Irs form 4972 is considered one of the more complex forms for. Who can use the form c. Web help deciphering tax forms and instructions provided by the internal revenue service (irs) can be daunting. Web use this form if you elect to report your child’s income on your return. Web treat this amount as a capital gain on form. Use distribution code a and answer. Web form 4972 is an irs form with stipulated terms and conditions that is filled out to reduce the taxes that may be incurred on huge distribution amounts. Web gain on form 4972. Web use this form to figure the amount of investment interest expense you can deduct for the current year and the. Web form 4972 (2010) page 2 section references are to the internal revenue code. Taxpayers may use irs form 4972 to calculate the tax on a qualified lump sum distribution using the 20% capital gains. Web use this form if you elect to report your child’s income on your return. Web gain on form 4972. If the amount is greater. If you do, your child will not have to file a return. This is the amount of federal income tax withheld. Use distribution code a and answer. See the form 4972 instructions for more information. Addition from line 7 of schedule m1home (enclose schedule. Complete only part 2, line 1, and. If you're an eligible retired public safety officer who elected to exclude from income distributions from your eligible. Web help deciphering tax forms and instructions provided by the internal revenue service (irs) can be daunting. Web use this form to figure the amount of investment interest expense you can deduct for the current. See the form 4972 instructions. If the amount is greater than zero, attach. If you do, your child will not have to file a return. Web use this form if you elect to report your child’s income on your return. Or form 1041, schedule g, line 1b. See the form 4972 instructions. Web use this form to figure the amount of investment interest expense you can deduct for the current year and the amount you can carry forward to future years. Web treat this amount as a capital gain on form 4972 (not on schedule d (form 1040)). If the amount is greater than zero, attach. Complete. Web form 4972 (2010) page 2 section references are to the internal revenue code. Web use this form to figure the amount of investment interest expense you can deduct for the current year and the amount you can carry forward to future years. See the form 4972 instructions. Complete only part 2, line 1, and. Irs form 4972 is considered. Web what is irs form 4972 used for? Irs form 4972 is considered one of the more complex forms for. Be sure to check box. If you're an eligible retired public safety officer who elected to exclude from income distributions from your eligible. If you do, your child will not have to file a return. Addition from line 7 of schedule m1home (enclose schedule. Taxpayers may use irs form 4972 to calculate the tax on a qualified lump sum distribution using the 20% capital gains. Complete only part 2, line 1, and. Be sure to check box. If you do, your child will not have to file a return. Be sure to check box. Web complete part 3 using information reported on federal form 4972 for the period of new york residence only (see instructions). If you do, your child will not have to file a return. Use distribution code a and answer. You can make this election if your. Web what is irs form 4972 used for? Web gain on form 4972. Web form 4972 is an irs form with stipulated terms and conditions that is filled out to reduce the taxes that may be incurred on huge distribution amounts. Or form 1041, schedule g, line 1b. Web form 4972 (2010) page 2 section references are to the internal revenue code. Complete only part 2, line 1, and. Taxpayers may use irs form 4972 to calculate the tax on a qualified lump sum distribution using the 20% capital gains. Web help deciphering tax forms and instructions provided by the internal revenue service (irs) can be daunting. If the amount is greater than zero, attach. Web treat this amount as a capital gain on form 4972 (not on schedule d (form 1040)). See the form 4972 instructions. Web the taxpayer makes the election by attaching a statement to the tax return and by including the net unrealized appreciation on the tax return, either as part of a distribution reported. Addition from line 7 of schedule m1home (enclose schedule. Web use this form to figure the amount of investment interest expense you can deduct for the current year and the amount you can carry forward to future years. Web instructions for form 5472 department of the treasury internal revenue service (rev.Kentucky Tax On LumpSum Distributions (Form 4972K 1999) printable pdf

IRS Form 4972 Download Fillable PDF or Fill Online Tax on LumpSum

Form 4972 Tax on LumpSum Distributions (2015) Free Download

Form 4972 K ≡ Fill Out Printable PDF Forms Online

IRS Form 4972 Instructions Lump Sum Distributions

Publication 575 Pension and Annuity Taxation of Nonperiodic

IRS Form 4972A Guide to Tax on LumpSum Distributions

Form 4972 Turbotax Fill Out and Sign Printable PDF Template signNow

IRS Form 4972 Instructions Lump Sum Distributions

2019 IRS Form 4972 Fill Out Digital PDF Sample

Related Post: