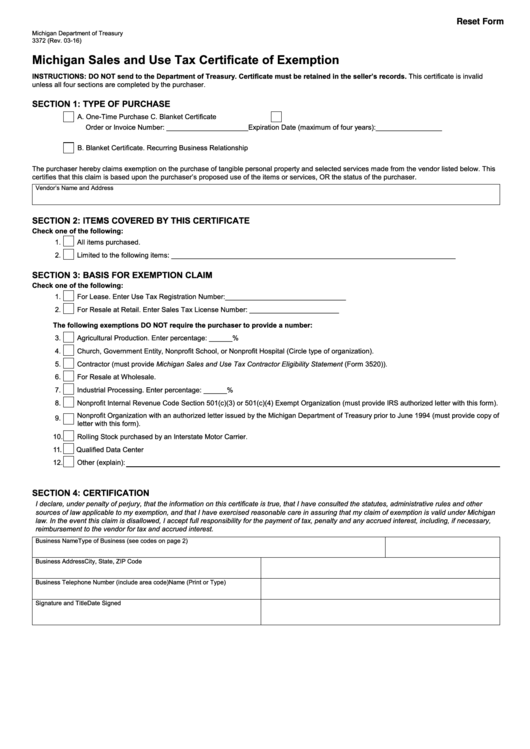

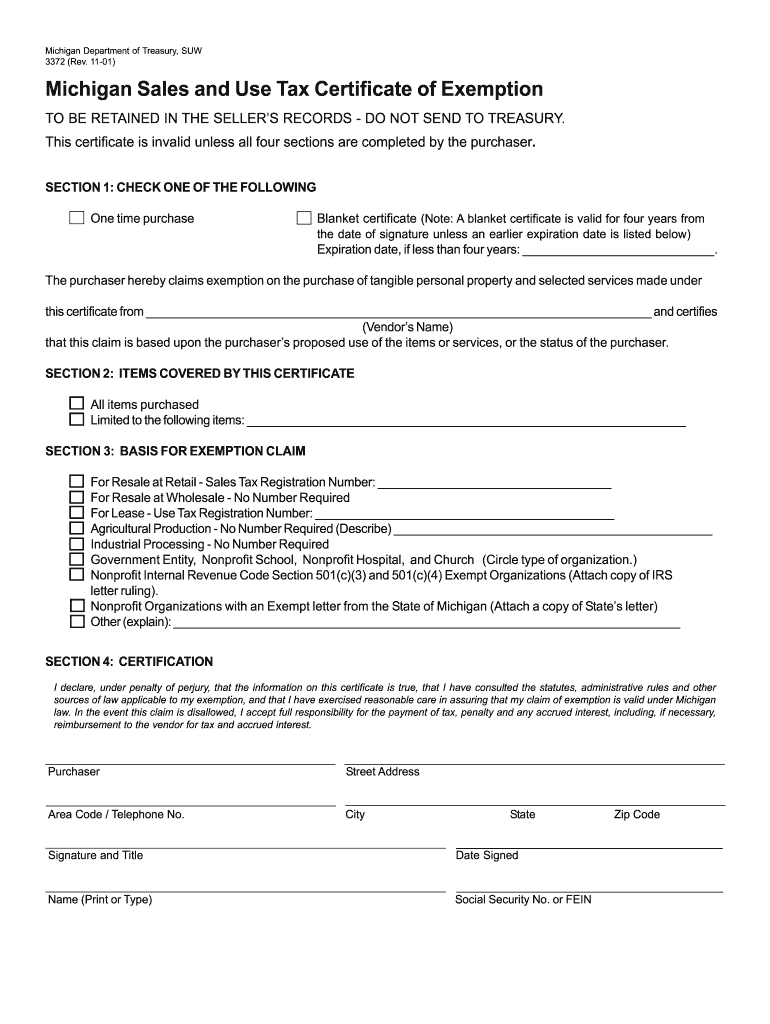

Michigan Sales And Use Tax Certificate Of Exemption Form 3372

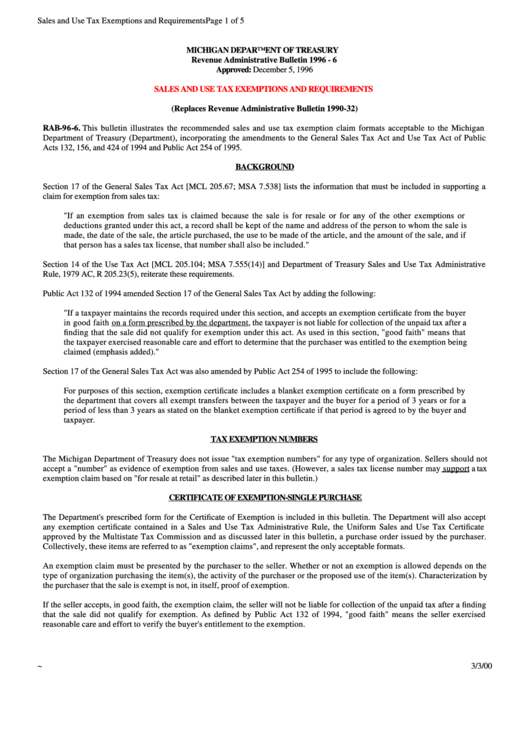

Michigan Sales And Use Tax Certificate Of Exemption Form 3372 - Ad new state sales tax registration. Web therefore, you can complete the 3372 tax exemption certificate form by providing your michigan sales tax number. Obtain a michigan sales tax license step 2 :. All required attachments listed under part 2 c. Web instructions for completing michigan sales and use tax certificate of exemption (form 3372) purchasers may use this form to claim exemption from michigan sales and use. Web michigan department of treasury 3372 (rev. Web in order to claim an exemption from sales or use tax, a purchaser must provide a valid claim of exemption to the vendor by completing one of the following: Sales tax exemption information, registration, support. Certificate must be retained in the seller’s records. Web michigan department of treasury form 3372 (rev. Streamline the entire lifecycle of exemption certificate management. Web in order to claim an exemption from sales or use tax, a purchaser must provide a valid claim of exemption to the vendor by completing one of the following: Ad new state sales tax registration. Sales tax exemption information, registration, support. Web instructions for completing form 3372, michigan sales and use. Do not send to the department of treasury. Web instructions for completing michigan sales and use tax certificate of exemption (form 3372) purchasers may use this form to claim exemption from michigan sales and use. Ad fill, sign, email mi dot 3372 & more fillable forms, register and subscribe now! Web michigan department of treasury 3372 (rev. Sales tax return. Web michigan department of treasury form 3372 (rev. Web form 3372, michigan sales and use tax certificate of exemption get form 3372, michigan sales and use tax certificate of exemption how it works open form. A copy of the resolution by the. Web sales, use and withholding tax due dates for holidays and weekends: Certificate must be retained in the. Sales tax exemption information, registration, support. Web michigan department of treasury 3372 (rev. A copy of the resolution by the. Web es that the claim is based upon the purchaser’s proposed use of the items or services, the activity of the purchase, stec b rev. Ad new state sales tax registration. Web therefore, you can complete the 3372 tax exemption certificate form by providing your michigan sales tax number. Web in order to claim an exemption from sales or use tax, a purchaser must provide a valid claim of exemption to the vendor by completing one of the following: Web instructions for completing michigan sales and use tax certificate of exemption. Web form 3372, michigan sales and use tax certificate of exemption get form 3372, michigan sales and use tax certificate of exemption how it works open form. A copy of the resolution by the. Web michigan sales and use tax certifi cate of exemption do not send to the department of treasury. Web michigan department of treasury 3372 (rev. This. Web michigan department of treasury 3372 (rev. A copy of the resolution by the. Web michigan department of treasury 3372 (rev. Web steps for filling out the michigan sales and use tax certificate exemption (form 3372) michigan sales and use tax certificate of exemption form 3372. Ad collect and report on exemption certificates quickly to save your company time and. Web michigan department of treasury 3372 (rev. All required attachments listed under part 2 c. Web steps for filling out the michigan sales and use tax certificate exemption (form 3372) michigan sales and use tax certificate of exemption form 3372. Streamline the entire lifecycle of exemption certificate management. Web michigan sales and use tax certificate of exemption instructions: Web instructions for completing michigan sales and use tax certificate of exemption (form 3372) purchasers may use this form to claim exemption from michigan sales and use. Do not send to the department of. Web michigan department of treasury 3372 (rev. Streamline the entire lifecycle of exemption certificate management. Web michigan department of treasury 3372 (rev. Michigan sales and use tax certificate of exemption: This exemption claim should be completed by the purchaser, provided to the seller, and is. Web michigan department of treasury 3372 (rev. Web michigan department of treasury 3372 (rev. Web es that the claim is based upon the purchaser’s proposed use of the items or services, the activity of the purchase, stec. Do not send to the department of treasury. Web instructions for completing michigan sales and use tax certificate of exemption (form 3372) purchasers may use this form to claim exemption from michigan sales and use. Streamline the entire lifecycle of exemption certificate management. Web steps for filling out the michigan sales and use tax certificate exemption (form 3372) michigan sales and use tax certificate of exemption form 3372. Certificate must be retained in the seller’s records. Completed application for commercial rehabilitation exemption certificate (form 4507) b. Streamline the entire lifecycle of exemption certificate management. Sales tax exemption information, registration, support. Web in order to claim an exemption from sales or use tax, a purchaser must provide a valid claim of exemption to the vendor by completing one of the following: Web 3372, page 2 instructions for completing michigan sales and use tax certifi cate of exemption purchasers may use this form to claim exemption from michigan sales. Web michigan department of treasury 3372 (rev. Do not send to the department of. Web michigan sales and use tax certificate of exemption instructions: Obtain a michigan sales tax license step 2 :. Web michigan department of treasury 3372 (rev. Sales and use tax blanket. Web instructions for completing form 3372, michigan sales and use tax certificate of exemption the purchaser shall complete all four sections of the exemption certificate. All required attachments listed under part 2 c. Web therefore, you can complete the 3372 tax exemption certificate form by providing your michigan sales tax number. Certifi cate must be retained in the seller’s records.Fillable Form 3372 Michigan Sales And Use Tax Certificate Of

Fill Free Fillable Application For Sales Tax Certificate Of Exemption

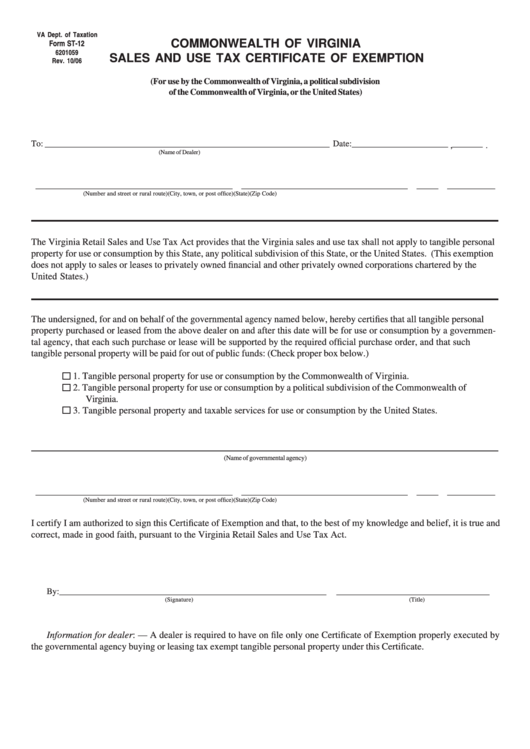

Fillable Form St12 Sales And Use Tax Certificate Of Exemption

How To Get A Michigan Certificate of Exemption [2023 Guide

Michigan Sales And Use Tax Certificate Of Exemption printable pdf download

Fillable Tax Exemption Form Printable Forms Free Online

Michigan Form 3372 Fillable Printable Forms Free Online

Michigan certificate of tax exemption from 3372 Fill out & sign online

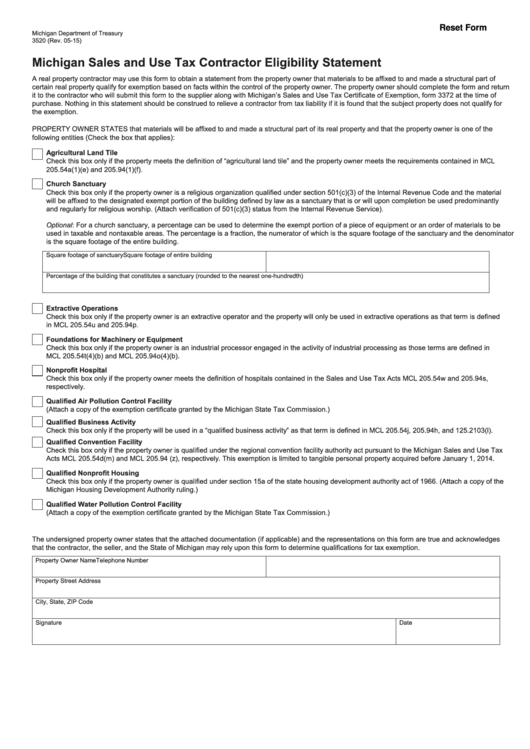

Fillable Form 3520 Michigan Sales And Use Tax Contractor Eligibility

Fill Free fillable Form 3372, Michigan Sales And Use Tax Certificate

Related Post: