Mi Sales Tax Exemption Form

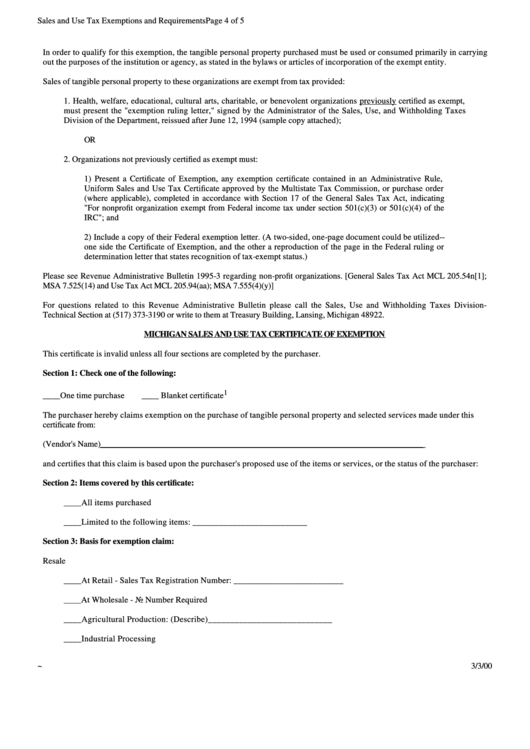

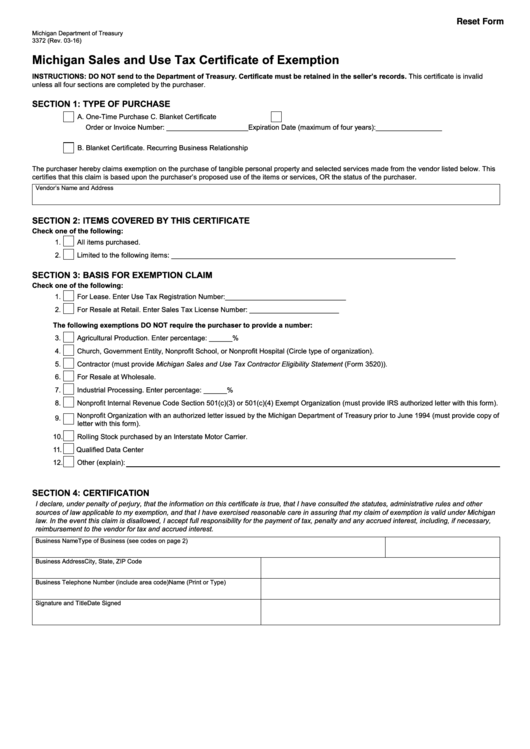

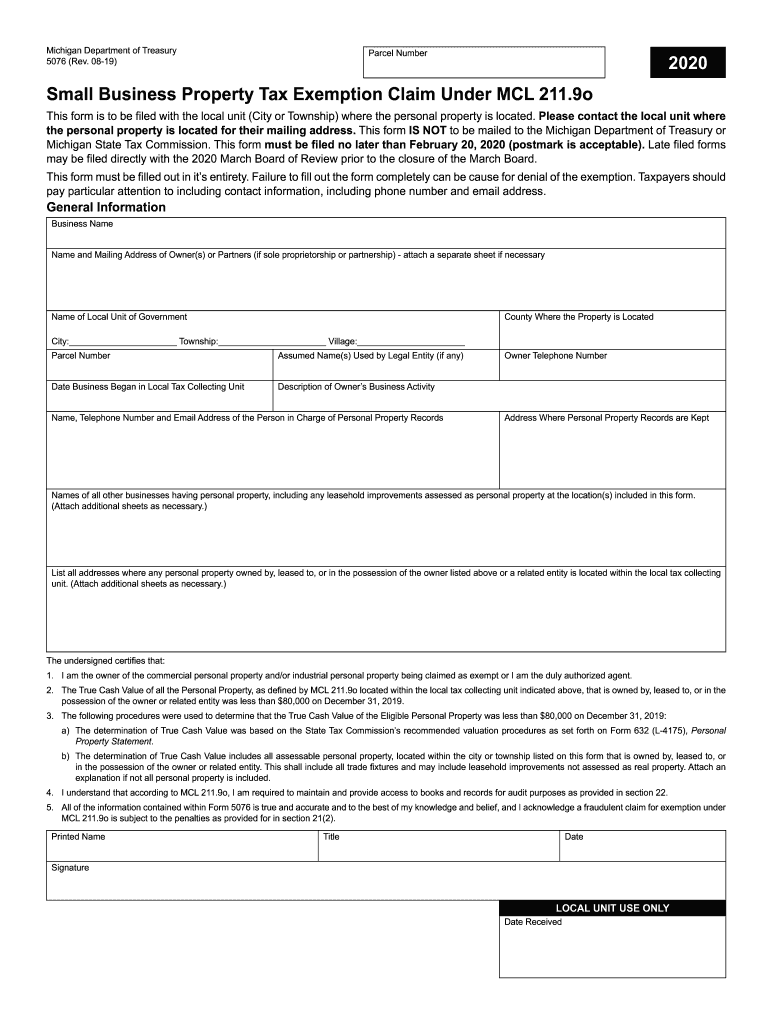

Mi Sales Tax Exemption Form - Michigan sales and use tax certificate of exemption: The purchaser shall complete all four sections of the exemption certificate to establish a. Web included in line 4. Web in order to claim an exemption from sales or use tax, a purchaser must provide a valid claim of exemption to the vendor by completing one of the following: Web purchasers may use this form to claim exemption from michigan sales and use tax on qualified transactions. Edit, sign and save michigan sales ande tax form. Web instructions for completing michigan sales and use tax certificate of exemption (form 3372) purchasers may use this form to claim exemption from michigan sales and use. Web sales, use and withholding tax due dates for holidays and weekends: Streamline the entire lifecycle of exemption certificate management. Edit pdfs, create forms, collect data, collaborate with your team, secure docs and more. Web instructions for completing michigan sales and use tax certificate of exemption. Ad collect and report on exemption certificates quickly to save your company time and money. Web michigan department of treasury 3372 (rev. Sales tax return for special events: However, if provided to the purchaser. Web michigan department of treasury 4507 (rev. Web a sales tax exemption certificate is a document that allows a business, organization, or individual to purchase normally taxable goods or services tax free. Web the certificate that qualifying agricultural producers, organizations and other exempt entities may use, is the michigan sales and use tax certificate of exemption. It is the purchaser’s. Edit pdfs, create forms, collect data, collaborate with your team, secure docs and more. Web included in line 4. Web michigan department of treasury 3372 (rev. 2021 sales, use and withholding taxes monthly/quarterly return. Web sales and use tax exemption for transformational brownfield plans. It is the purchaser’s responsibility to ensure the eligibility of the. Web purchasers may use this form to claim exemption from michigan sales and use tax on qualified transactions. Web purchasers may use this form to claim exemption from michigan sales and use tax on qualified transactions. All fields must be completed; Web instructions for completing michigan sales and use. Do not send to the department of. Web included in line 4. Form 3372, michigan sales and use. Web instructions for completing michigan sales and use tax certificate of exemption (form 3372) purchasers may use this form to claim exemption from michigan sales and use. Web sales, use and withholding tax due dates for holidays and weekends: It is the purchaser’s responsibility to ensure the eligibility of the. The purchaser shall complete all four sections of the exemption certificate. Sales tax return for special. Web the certificate that qualifying agricultural producers, organizations and other exempt entities may use, is the michigan sales and use tax certificate of exemption. It is the purchaser’s responsibility to ensure the eligibility. I am facilitating a purchase for msu, and i need to provide the vendor with a michigan sales and use tax certificate of exemption. Web section 50 sales and use tax. Edit, sign and save michigan sales ande tax form. However, if provided to the purchaser. Michigan sales and use tax contractor eligibility statement: Streamline the entire lifecycle of exemption certificate management. Web purchasers may use this form to claim exemption from michigan sales and use tax on qualified transactions. Michigan sales and use tax certificate of exemption. Web michigan department of treasury 3372 (rev. 4date received application for commercial rehabilitation. Web michigan department of treasury 4507 (rev. Web included in line 4. 2021 sales, use and withholding taxes annual. All fields must be completed; Web purchasers may use this form to claim exemption from michigan sales and use tax on qualified transactions. Web in order to claim an exemption from sales or use tax, a purchaser must provide a valid claim of exemption to the vendor by completing one of the following: 2021 sales, use and withholding taxes annual. Edit, sign and save michigan sales ande tax form. It is the purchaser’s responsibility to ensure the eligibility of the. Web purchasers may. Michigan sales and use tax contractor eligibility statement: The purchaser shall complete all four sections of the exemption certificate to establish a. Therefore, you can complete the 3372 tax exemption certificate form by providing your michigan sales. Web instructions for completing michigan sales and use tax certificate of exemption (form 3372) purchasers may use this form to claim exemption from michigan sales and use. Ad uslegalforms.com has been visited by 100k+ users in the past month Web sales and use tax exemption for transformational brownfield plans. Deductions taken for tax exempt sales must be substantiated in business records. Web the certificate that qualifying agricultural producers, organizations and other exempt entities may use, is the michigan sales and use tax certificate of exemption. The purchaser shall complete all four sections of the exemption certificate. Do not send to the department of. Web purchasers may use this form to claim exemption from michigan sales and use tax on qualified transactions. Web section 50 sales and use tax. Sales tax return for special. Web instructions for completing michigan sales and use tax certificate of exemption. Web michigan department of treasury 3372 (rev. 4date received application for commercial rehabilitation. Web michigan sales and use tax certificate of exemption: Edit pdfs, create forms, collect data, collaborate with your team, secure docs and more. Ad collect and report on exemption certificates quickly to save your company time and money. Web purchasers may use this form to claim exemption from michigan sales and use tax on qualified transactions.Michigan Sales And Use Tax Certificate Of Exemption printable pdf download

Printable Michigan Sales Tax Exemption Certificates

Michigan certificate of tax exemption from 3372 Fill out & sign online

Michigan Sales And Use Tax Certificate Of Exemption Form March 2000

Form 3372 Fill Out, Sign Online and Download Fillable PDF, Michigan

Fillable Form 3372 Michigan Sales And Use Tax Certificate Of

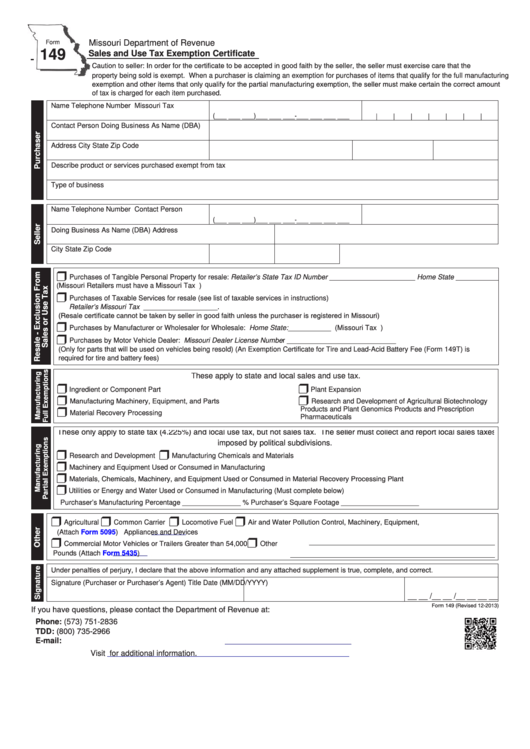

Fillable Form 149 Sales And Use Tax Exemption Certificate printable

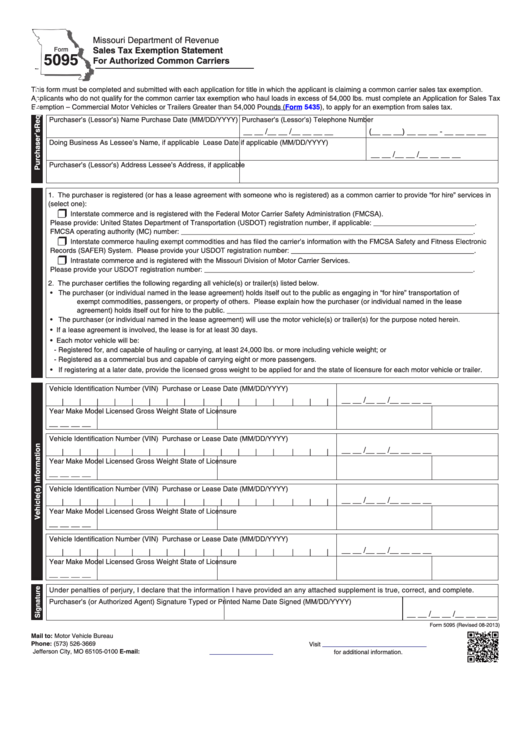

Fillable Form 5095 Sales Tax Exemption Statement For Authorized

mi exemption form Fill out & sign online DocHub

Fillable Tax Exemption Form Printable Forms Free Online

Related Post: