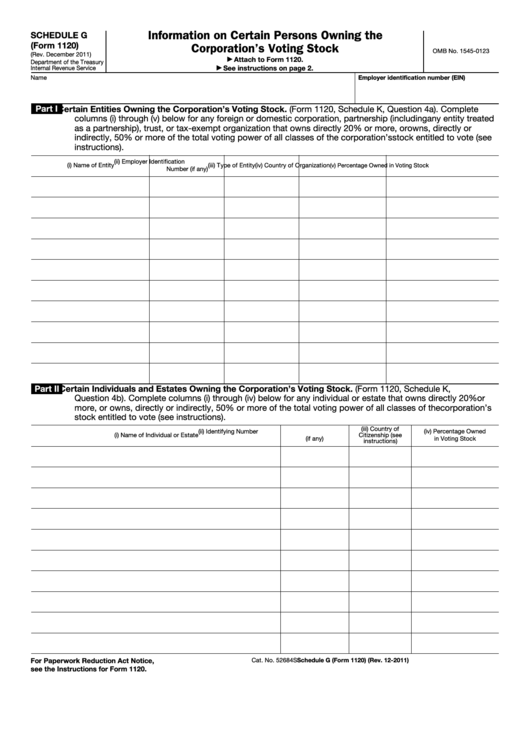

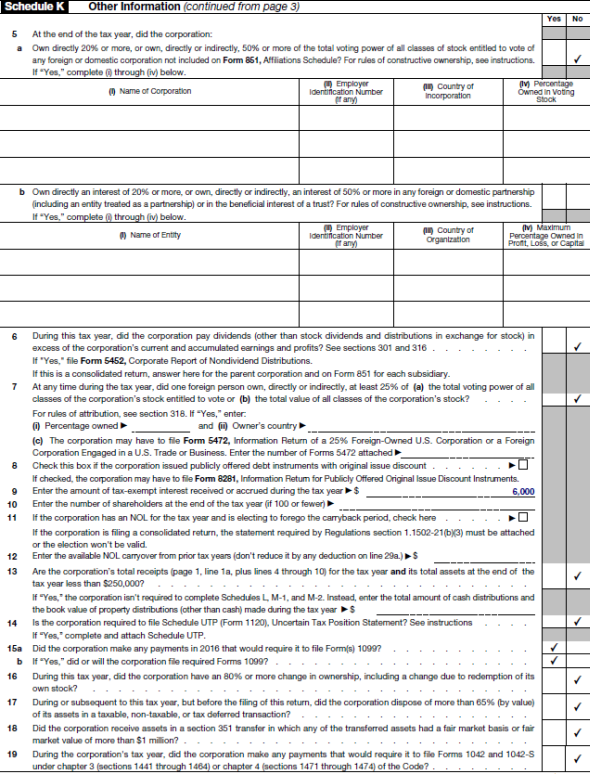

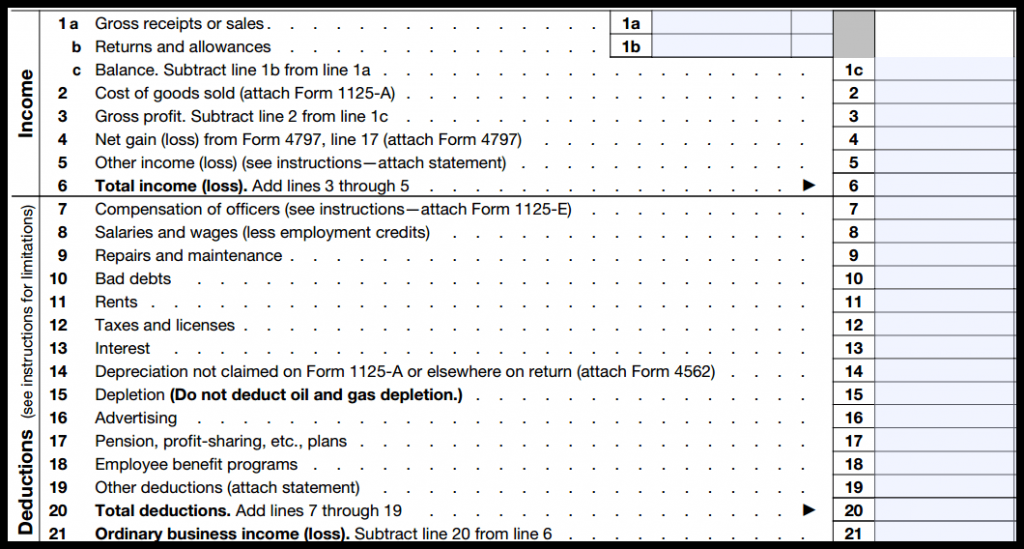

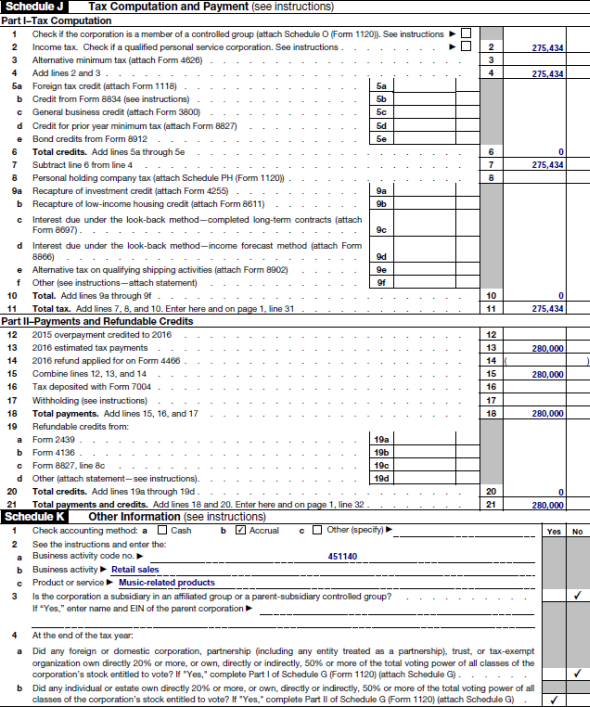

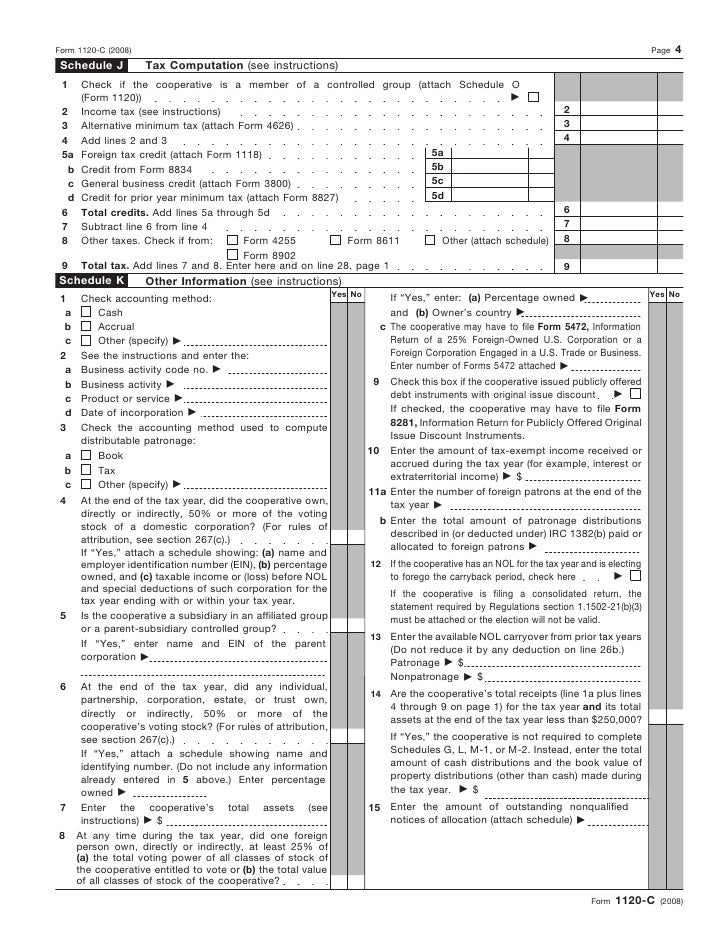

Form 1120 Schedule G

Form 1120 Schedule G - 721) amends the internal revenue. Schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or. Form 7004 (automatic extension of time to file); Complete, edit or print tax forms instantly. Taxact® business 1120 (2022 online edition) is the easiest way to file a 1120! Web complete and attach schedule o (form 1120), consent plan and apportionment schedule for a controlled group. October 05, 2023 tax year 2023 1120 mef ats scenario 3: (form 1120, schedule k, question 4a). This form is for income earned in tax year 2022, with tax returns due. Web use schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or own, directly or. Web if yes, complete part i of schedule g (form 1120) (attach schedule g) did any individual or estate own directly 20% or more, or own, directly or indirectly, 50%. We last updated the information on certain persons owning the corporation's voting stock. Web schedule g (form 1120) and instructions. Web schedule g is prepared when the cooperative's total receipts. Web complete and attach schedule o (form 1120), consent plan and apportionment schedule for a controlled group. Schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or. We last updated the information on certain persons owning the corporation's voting stock. October 05, 2023 tax year 2023 1120 mef ats. Web if yes, complete part i of schedule g (form 1120) (attach schedule g) did any individual or estate own directly 20% or more, or own, directly or indirectly, 50%. You may force or prevent the preparation of schedule g by. Web complete and attach schedule o (form 1120), consent plan and apportionment schedule for a controlled group. Get ready. Web we last updated federal 1120 (schedule g) in february 2023 from the federal internal revenue service. Web more about the federal 1120 (schedule g) individual income tax tax credit ty 2022. (form 1120, schedule k, question 4a). Expenses allocated to effectively connected income under. October 05, 2023 tax year 2023 1120 mef ats scenario 3: (form 1120, schedule k, question 4a). Form 7004 (automatic extension of time to file); Taxact® business 1120 (2022 online edition) is the easiest way to file a 1120! 52684s schedule g (form 1120) (rev. Web if yes, complete part i of schedule g (form 1120) (attach schedule g) did any individual or estate own directly 20% or more, or own,. Department of the treasury internal revenue service. Web inst 1120 (schedule d) instructions for schedule d (form 1120), capital gains and losses 2022 01/05/2023 form 1120 (schedule g) information on certain persons owning the. Use schedule g (form 1120) to provide. Taxact® business 1120 (2022 online edition) is the easiest way to file a 1120! Schedule g (form 1120) to. (form 1120, schedule k, question 4a). Component members of a controlled group must use. Certain entities owning the corporation’s voting stock. October 05, 2023 tax year 2023 1120 mef ats scenario 3: Web if yes, complete part i of schedule g (form 1120) (attach schedule g) did any individual or estate own directly 20% or more, or own, directly or. Web inst 1120 (schedule d) instructions for schedule d (form 1120), capital gains and losses 2022 01/05/2023 form 1120 (schedule g) information on certain persons owning the. For calendar year 2022 or tax year beginning, 2022, ending. Web complete and attach schedule o (form 1120), consent plan and apportionment schedule for a controlled group. Irs instructions for form 1120. Schedule. Certain entities owning the corporation’s voting stock. This form is for income earned in tax year 2022, with tax returns due. Web we last updated federal 1120 (schedule g) in february 2023 from the federal internal revenue service. Select the button get form to open it. Web what is the form used for? Web use schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or own, directly or. We last updated the information on certain persons owning the corporation's voting stock. Expenses allocated to effectively connected income under. This form is for income earned in tax year 2022, with tax returns due.. Certain entities owning the corporation’s voting stock. Web inst 1120 (schedule d) instructions for schedule d (form 1120), capital gains and losses 2022 01/05/2023 form 1120 (schedule g) information on certain persons owning the. We last updated the information on certain persons owning the corporation's voting stock. Complete, edit or print tax forms instantly. Form 7004 (automatic extension of time to file); Select the button get form to open it. This form is for income earned in tax year 2022, with tax returns due. Ad easy guidance & tools for c corporation tax returns. Web what is the form used for? Web we last updated federal 1120 (schedule g) in february 2023 from the federal internal revenue service. October 05, 2023 tax year 2023 1120 mef ats scenario 3: Web use schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or own, directly or. Web irs form 1120 schedule g is used to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or own, directly or indirectly,. You may force or prevent the preparation of schedule g by. 721) amends the internal revenue. Complete columns (i) through (v) below for any foreign or domestic. Web schedule g (form 1120) and instructions. Schedule g is included with your form 1120 filing if you have shareholders that own more than 20% of the voting stock in a corporation. Department of the treasury internal revenue service. Schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or.What is Form 1120S and How Do I File It? Ask Gusto

Fillable Schedule G (Form 1120) Information On Certain Persons Owning

Form 1120 Schedule G ≡ Fill Out Printable PDF Forms Online

General InstructionsPurpose of FormUse Schedule G (Form...

IRS Form 1120S Definition, Download, & 1120S Instructions

General InstructionsPurpose of FormUse Schedule G (Form...

General InstructionsPurpose of FormUse Schedule G (Form 11...

Form 1120 schedule g 2017 Fill out & sign online DocHub

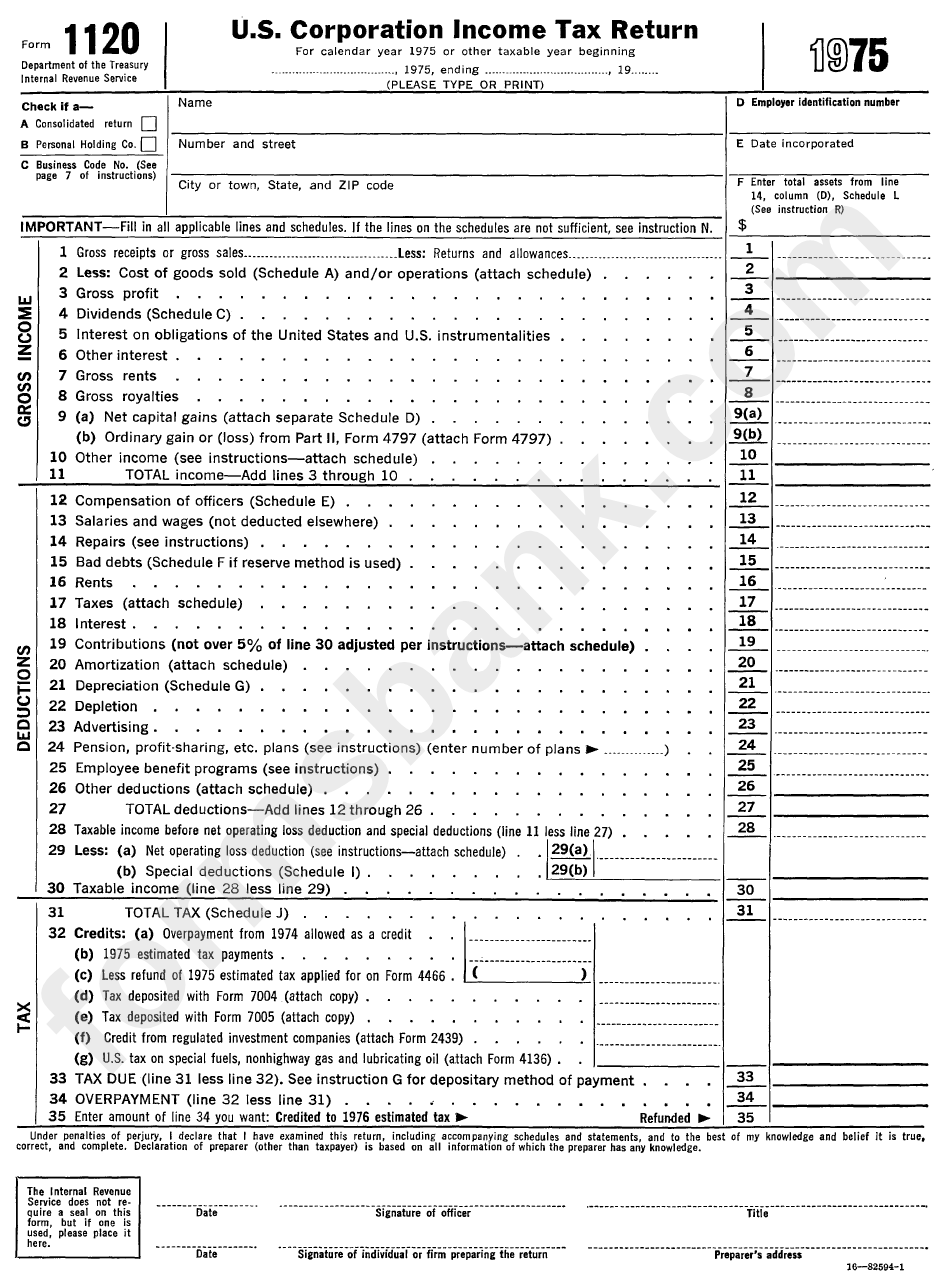

Form 1120 U.s. Corporation Tax Return 1975 printable pdf

form 1120 schedule g

Related Post: