Md Tax Form 502

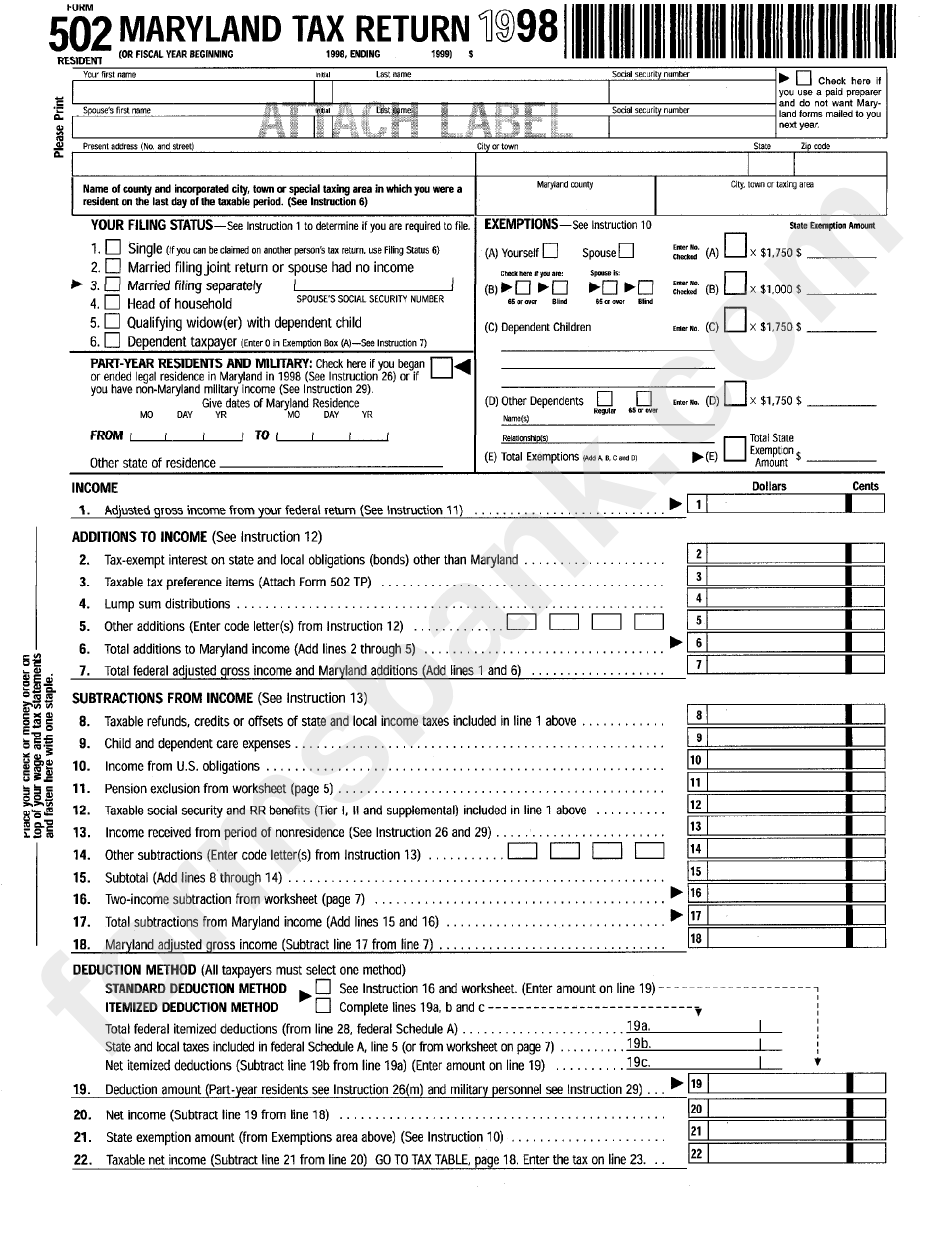

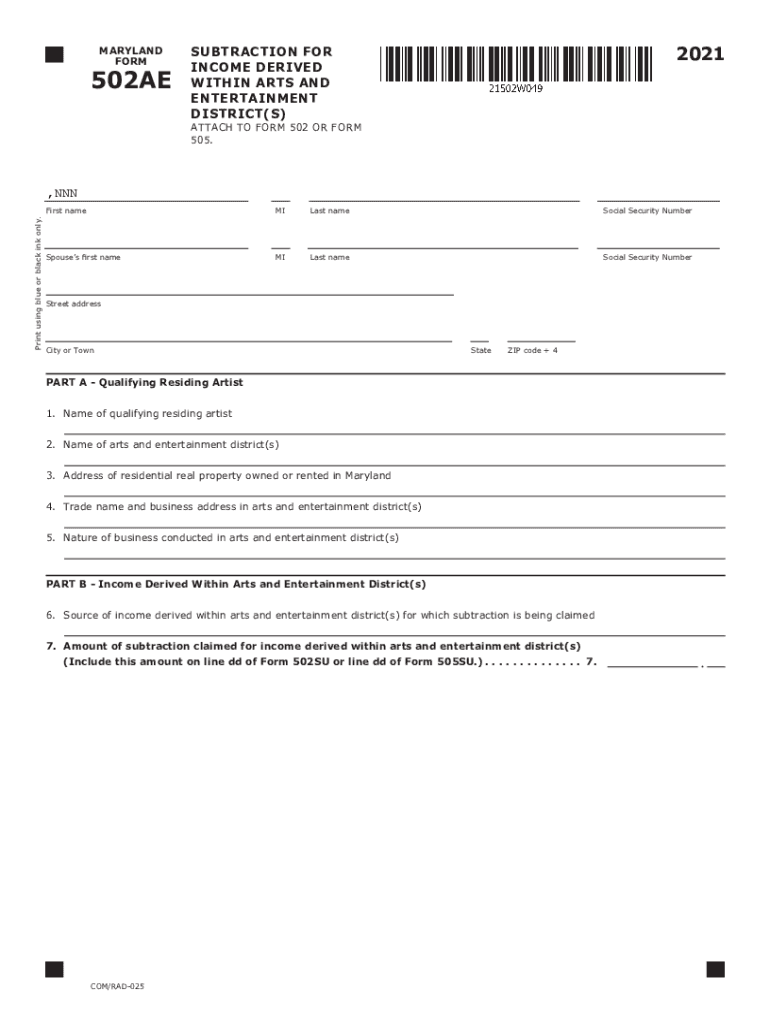

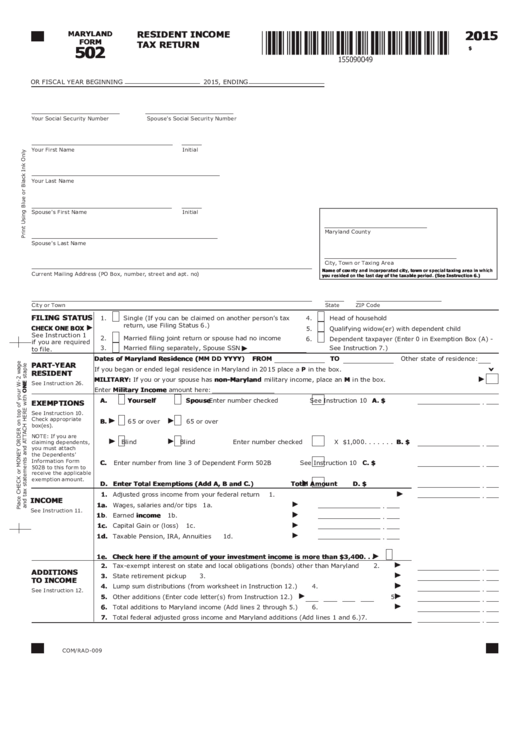

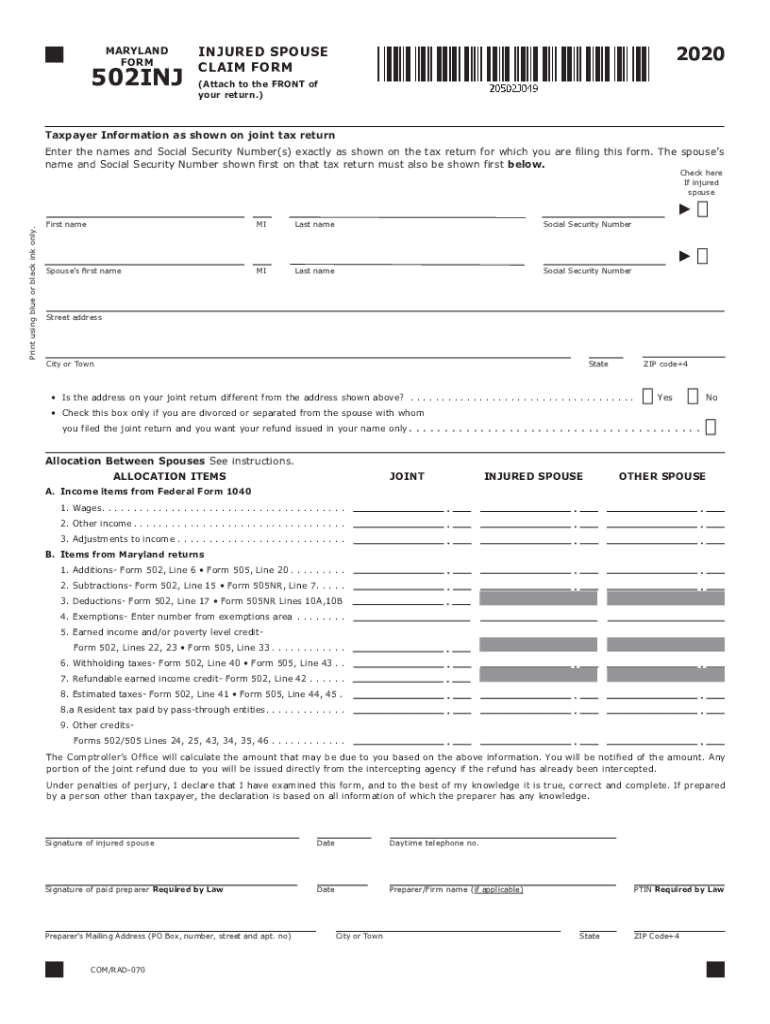

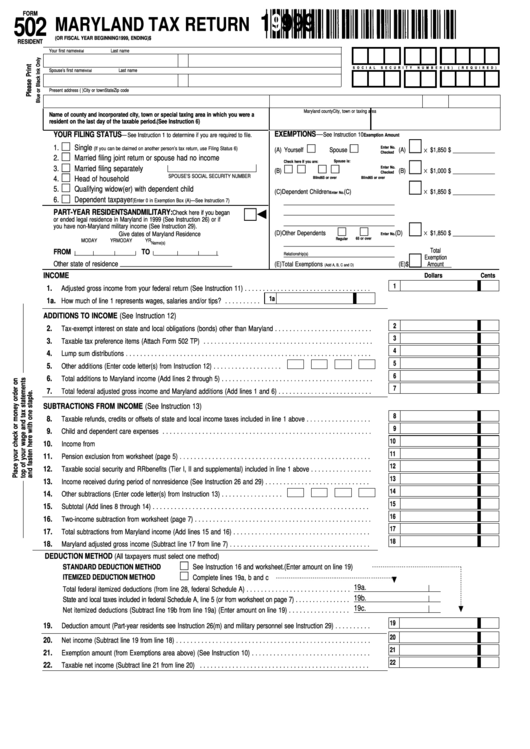

Md Tax Form 502 - Maryland resident income tax return: This form is for income earned in tax year 2022, with tax returns due in april. • 502 maryland resident income tax return • 502cr maryland personal income tax credits for individuals and. You can download or print. If you are sending a form. Web ifile choose form entrance. Web we last updated the maryland resident income tax return in january 2023, so this is the latest version of form 502, fully updated for tax year 2022. To avoid dual taxation, you can get a credit for taxes paid to delaware and/or a locality in. Place form pv with attached check/money order on top of form 502 and mail to: To claim a credit for taxes paid to the other state, and/or. The maryland general assembly enacted house bill 1148 in the 2016 session requiring the collection of information detailing the amount of retirement income reported. To avoid dual taxation, you can get a credit for taxes paid to delaware and/or a locality in. Web download and fill out the current form 502 for maryland income tax return. Get ready for tax. Personal tax payment voucher for form 502/505, estimated tax and extensions. Web maryland residents who work in delaware must file tax returns with both states. Get ready for tax season deadlines by completing any required tax forms today. Maryland resident income tax return: Web form 502 is the individual income tax return form for residents that are not claiming any. Complete, edit or print tax forms instantly. Web a maryland resident having income from one of these states must report the income on the maryland return form 502. Web find maryland form 502 instructions at esmart tax today. If the power of attorney form does not include all the. You can download or print. Web type of maryland tax (income, employment) maryland tax form number (502, mw506) year(s) or period(s) covered; Web form 502 is the individual income tax return form for residents that are not claiming any dependants. The maryland general assembly enacted house bill 1148 in the 2016 session requiring the collection of information detailing the amount of retirement income reported. Complete,. Form to be used when claiming. Payment voucher with instructions and worksheet for individuals sending check or. Web a maryland resident having income from one of these states must report the income on the maryland return form 502. Maryland resident income tax return: This system allows online electronic filing of resident personal income tax. This form is for income earned in tax year 2022, with tax returns due in april. Payment voucher with instructions and worksheet for individuals sending check or. If you are claiming any dependants, use form 502b. If the power of attorney form does not include all the. To avoid dual taxation, you can get a credit for taxes paid to. Web type of maryland tax (income, employment) maryland tax form number (502, mw506) year(s) or period(s) covered; You can download or print. Web you may submit paper tax forms and payments at any of the local branch offices between 8:30 a.m. • 502 maryland resident income tax return • 502cr maryland personal income tax credits for individuals and. Get ready. The maryland general assembly enacted house bill 1148 in the 2016 session requiring the collection of information detailing the amount of retirement income reported. Web ifile choose form entrance. Maryland resident income tax return: Do not attach form pv or check/money order to form 502. Complete, edit or print tax forms instantly. Web download and fill out the current form 502 for maryland income tax return. Web ifile choose form entrance. Do not attach form pv or check/money order to form 502. Place form pv with attached check/money order on top of form 502 and mail to: Ad uslegalforms.com has been visited by 100k+ users in the past month Web we last updated the maryland resident income tax return in january 2023, so this is the latest version of form 502, fully updated for tax year 2022. Web you may submit paper tax forms and payments at any of the local branch offices between 8:30 a.m. Web the new federal limitation impacts your maryland return because you must addback. Web the tax forms ready for use as of today (april 15) are: The maryland general assembly enacted house bill 1148 in the 2016 session requiring the collection of information detailing the amount of retirement income reported. Maryland resident income tax return: Complete, edit or print tax forms instantly. Web download and fill out the current form 502 for maryland income tax return. Web you may submit paper tax forms and payments at any of the local branch offices between 8:30 a.m. Web find maryland form 502 instructions at esmart tax today. Web we last updated the maryland resident income tax return in january 2023, so this is the latest version of form 502, fully updated for tax year 2022. Place form pv with attached check/money order on top of form 502 and mail to: If you are sending a form. Web form 502 is the individual income tax return form for residents that are not claiming any dependants. This system allows online electronic filing of resident personal income tax. Web total maryland income tax, local income tax and contributions (add lines 34 through 38.).39. Web a maryland resident having income from one of these states must report the income on the maryland return form 502. Web ifile choose form entrance. Personal tax payment voucher for form 502/505, estimated tax and extensions. Payment voucher with instructions and worksheet for individuals sending check or. Web we last updated maryland form 502 in january 2023 from the maryland comptroller of maryland. Get ready for tax season deadlines by completing any required tax forms today. Form to be used when claiming.Fillable Form 502 Maryland Tax Return 1998 printable pdf download

Maryland Form 502 Instructions ESmart Tax Fill Out and Sign Printable

Fillable Maryland Form 502 Resident Tax Return 2015

2020 Form MD 502INJ Fill Online, Printable, Fillable, Blank pdfFiller

Form 502 Maryland Tax Return 1999 printable pdf download

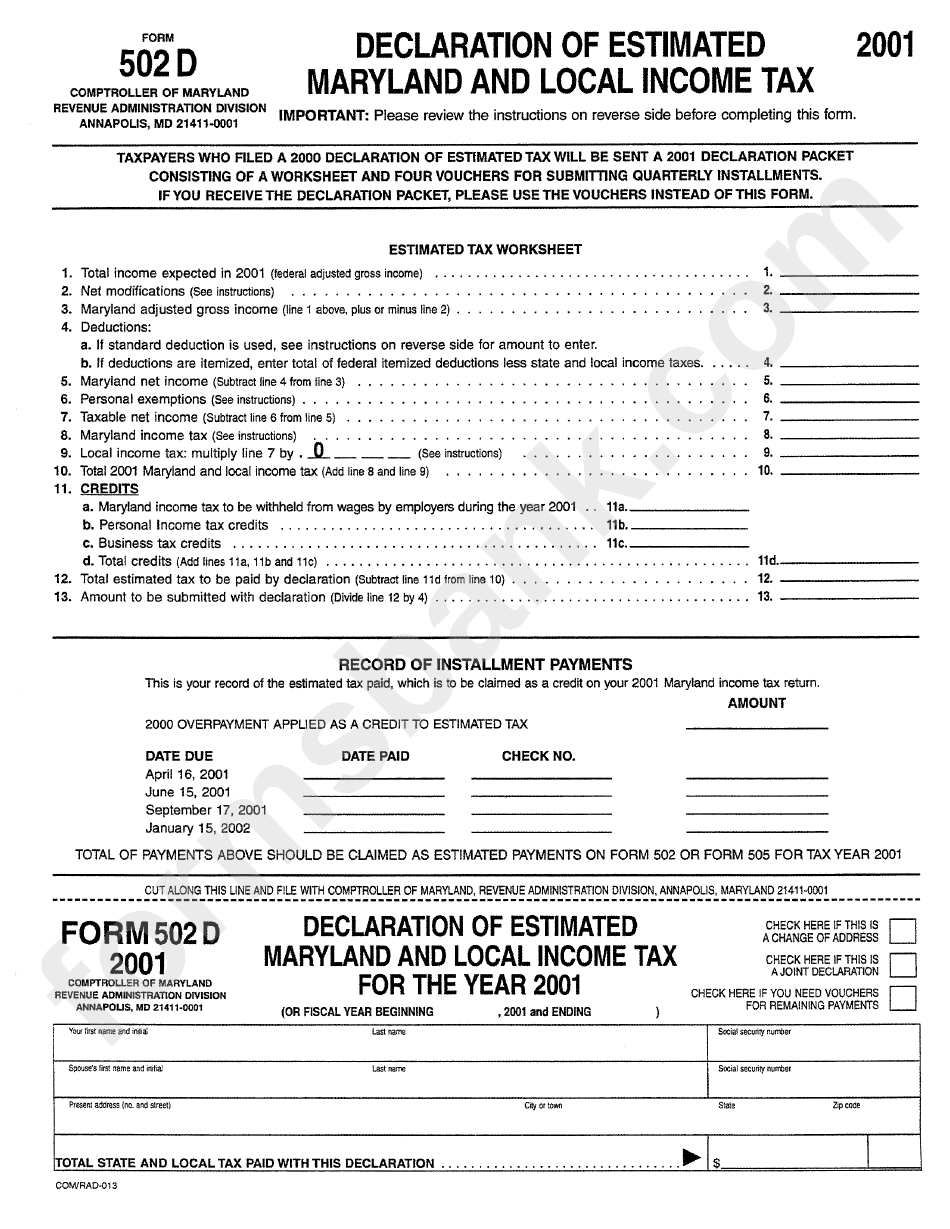

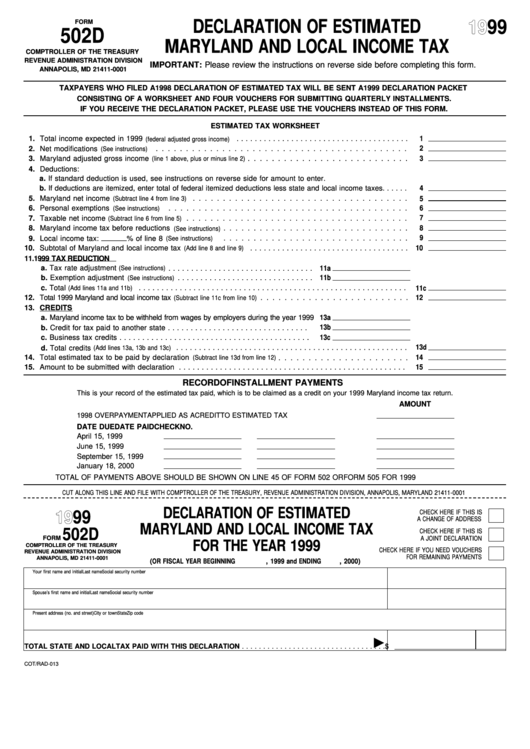

Form 502d Declaration Of Estimated Maryland And Local Tax

Fillable Form 502 D Declaration Of Estimated Maryland And Local

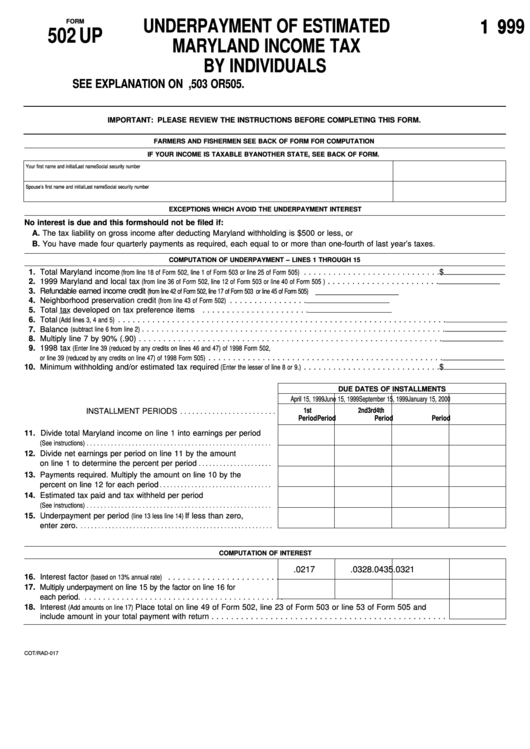

Form 502 Up Underpayment Of Estimated Maryland Tax By

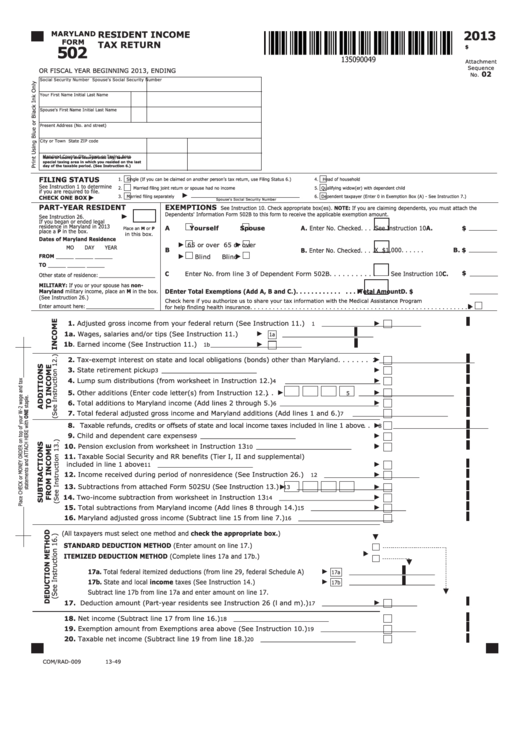

Fillable Maryland Form 502 Resident Tax Return 2013

MD Comptroller 502B 2014 Fill out Tax Template Online US Legal Forms

Related Post: