Md State Tax Form

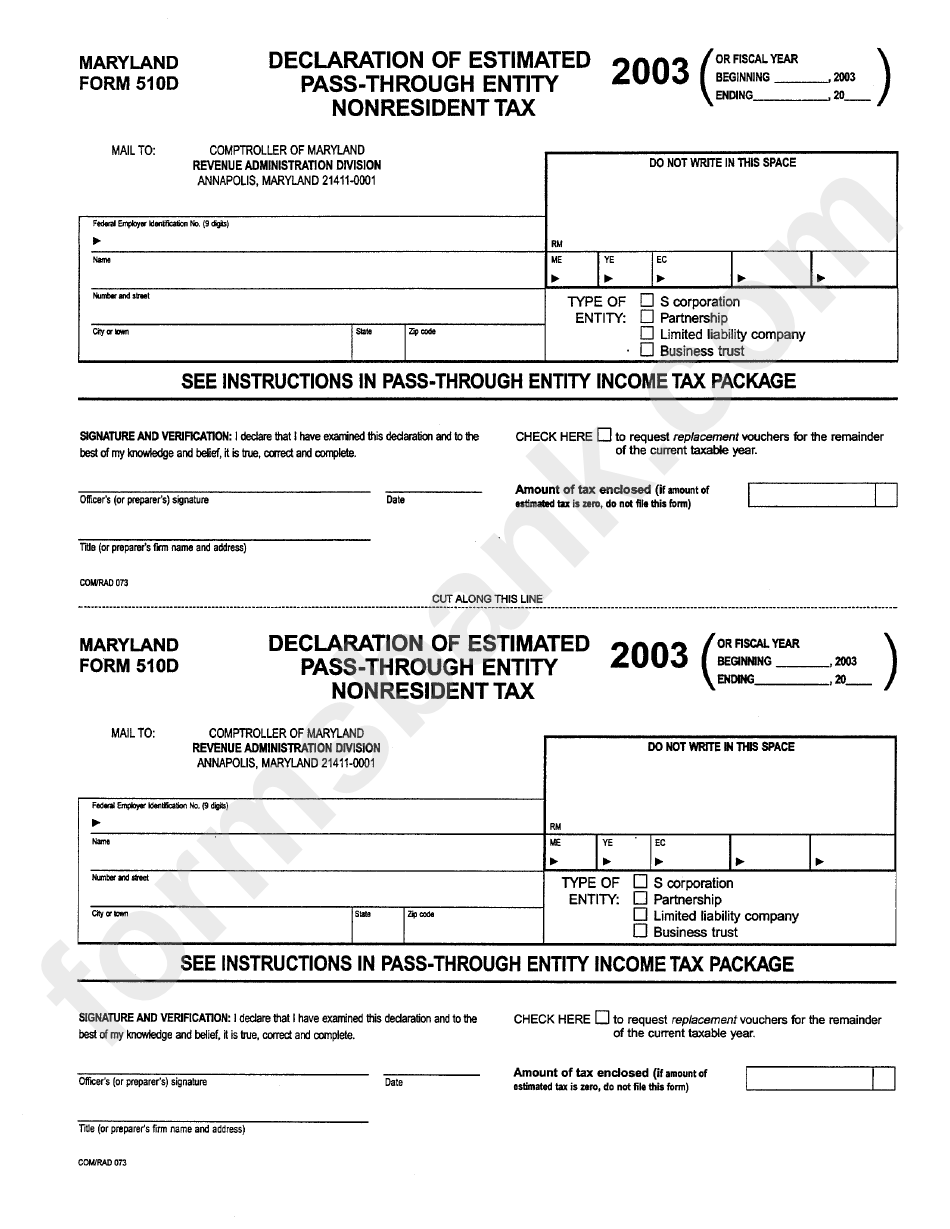

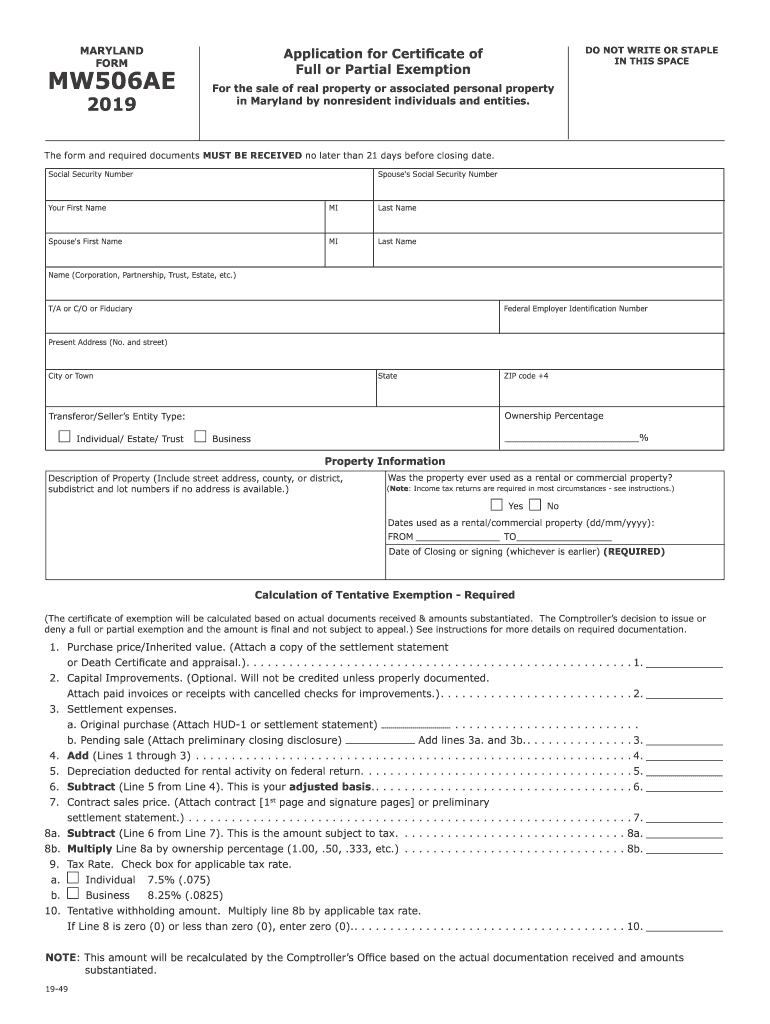

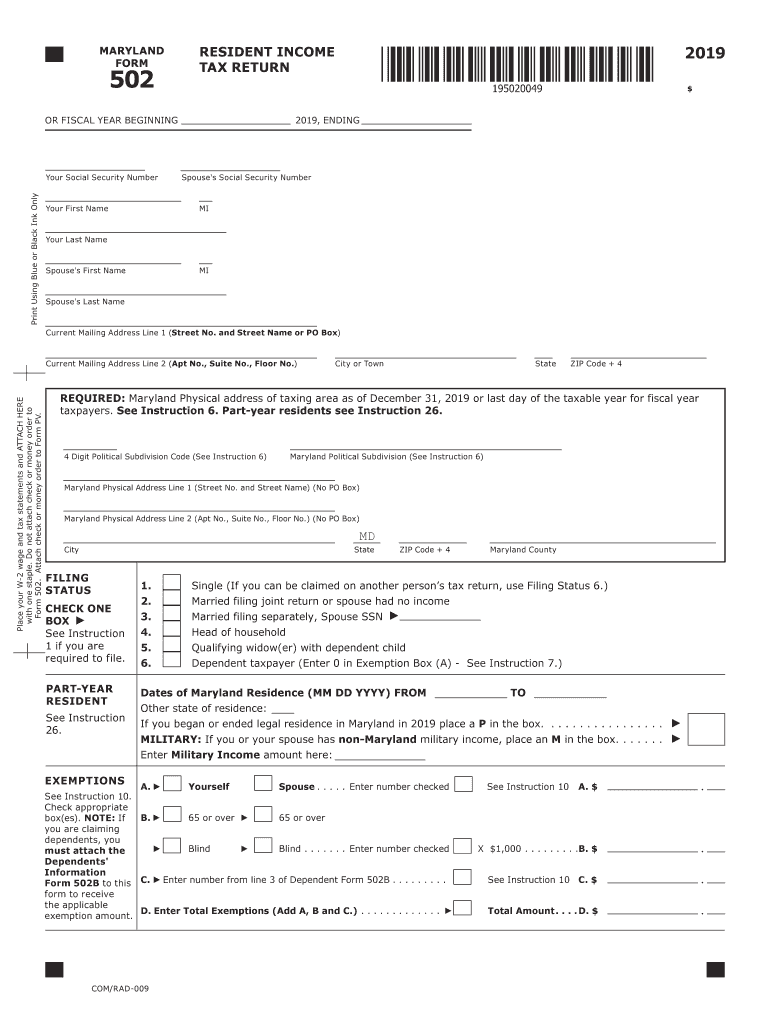

Md State Tax Form - Web the law requires that you complete an employee’s withholding allowance certificate so that your employer, the state of maryland, can withhold federal and state income tax from. Web 36 rows maryland has a state income tax that ranges between 2% and 5.75% , which is administered by the maryland comptroller of maryland. Web maryland state and local nonresident tax forms and instructions for filing nonresident personal state and local income taxes. Web maryland state and local tax forms and instructions. This system allows online electronic filing of resident personal income tax returns along with the most. Due to a database outage from september 10, 2023, to september 11, 2023, any transaction. Explore the collection of software at amazon & take your skills to the next level. We accept completed maryland tax returns and/or requested documents. Web comptroller of maryland's www.marylandtaxes.gov all the information you need for your tax paying needs All first time online users are required to submit a registration. This system allows online electronic filing of resident personal income tax returns along with the most. You can check the status of your current year refund online, or by calling the. Ad tax advocates can provide immediate tax relief. Web choose your tax year & form type; Employee's maryland withholding exemption certificate. Complete, edit or print tax forms instantly. Ad get deals and low prices on turbo tax online at amazon. Web file sales and use tax returns. We answer general tax questions. Central payroll online ptr security form. Form used by individuals to direct their employer to withhold maryland. Web other taxes and regulations resources. Web for maryland state government employees only. In the case of instruments conveying title to property, the recordation tax shall be at the rate of $4.10 per $500.00 rounded, of the actual consideration paid or. We answer general tax questions. Web online payment application options. Central payroll online ptr security form. Web 7 rows income tax withholding. Special payments payroll authorization form. All first time online users are required to submit a registration. We accept completed maryland tax returns and/or requested documents. Sales and use tax forms; Print and mail sales and use tax form 202. Web maryland state and local tax forms and instructions. Special payments payroll authorization form. Central payroll online ptr security form. Explore the collection of software at amazon & take your skills to the next level. Web online payment application options. Web the law requires that you complete an employee’s withholding allowance certificate so that your employer, the state of maryland, can withhold federal and state income tax from. Web choosing the right form; Web for maryland state government employees only. We answer general tax questions. Web 7 rows income tax withholding. Complete, edit or print tax forms instantly. Web state tax forms and filing options. Central payroll online ptr security form. Explore the collection of software at amazon & take your skills to the next level. Complete, edit or print tax forms instantly. Estimate your tax forgiveness today! Web maryland state and local nonresident tax forms and instructions for filing nonresident personal state and local income taxes. Sales and use tax forms; Web choose your tax year & form type; Central payroll online ptr security form. Web state tax forms and filing options. Web maryland state and local tax forms and instructions. Web city _____state _____ nine digit zip code_____ federal identification # permit/license # complete this. Complete, edit or print tax forms instantly. Sales and use tax forms; Download or email 500d & more fillable forms, register and subscribe now! Comptroller of maryland revenue administration alcohol and tobacco. Division of state documents (sos) filing maryland withholding reports. Download or email form 502 & more fillable forms, register and subscribe now! Web maryland state and local nonresident tax forms and instructions for filing nonresident personal state and local income taxes. This system allows online electronic filing of resident personal income tax returns along with the most. Download or email 500d & more fillable forms, register and subscribe now! Web welcome to the comptroller of maryland's internet tax filing system. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. In the case of instruments conveying title to property, the recordation tax shall be at the rate of $4.10 per $500.00 rounded, of the actual consideration paid or. Due to a database outage from september 10, 2023, to september 11, 2023, any transaction. Web the law requires that you complete an employee’s withholding allowance certificate so that your employer, the state of maryland, can withhold federal and state income tax from. Web file sales and use tax returns. Web other taxes and regulations resources. Explore the collection of software at amazon & take your skills to the next level. Web we provide blank maryland state tax forms and/or tax booklets. Sales and use tax forms; If required to submit any schedules, forms, or. View history of payments filed via this system. Web 36 rows maryland has a state income tax that ranges between 2% and 5.75% , which is administered by the maryland comptroller of maryland. Web online payment application options.Maryland Form 202 20202022 Fill and Sign Printable Template Online

Maryland Withholding

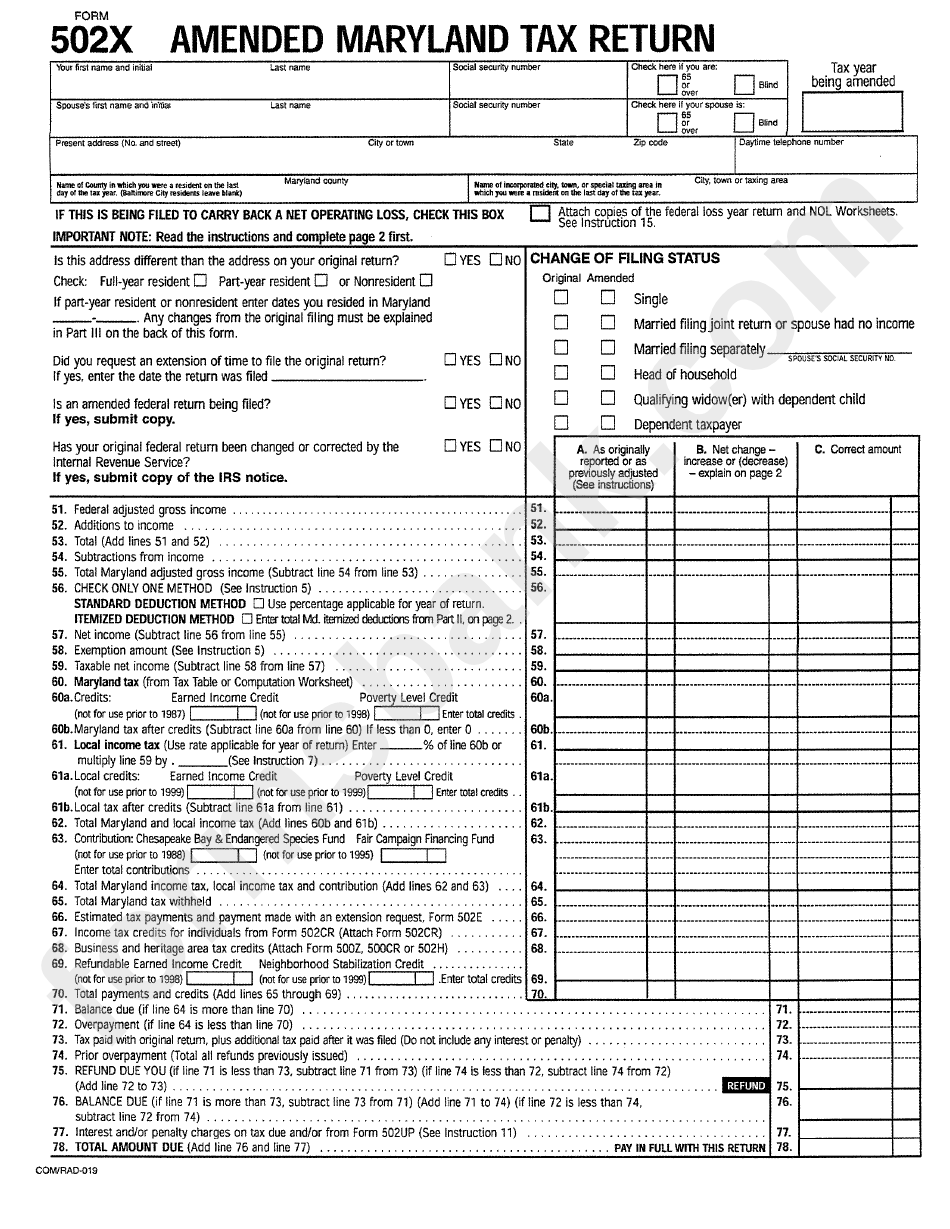

Form 502x Amended Maryland Tax Return printable pdf download

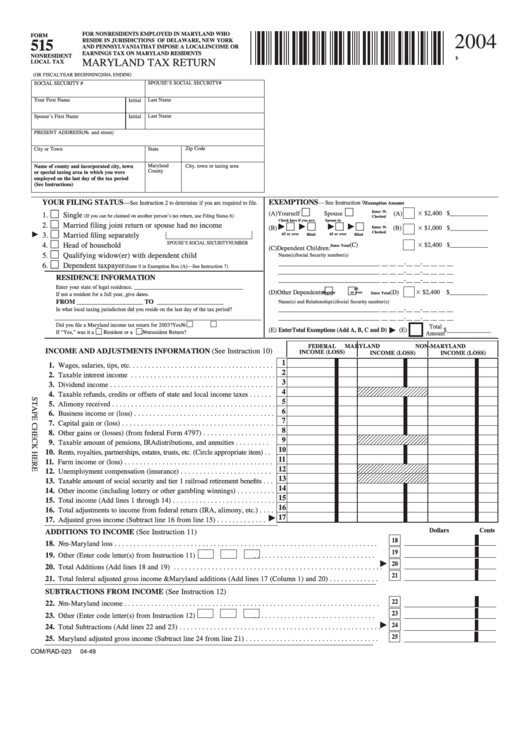

Fillable Form 515 Maryland Tax Return 2004 printable pdf download

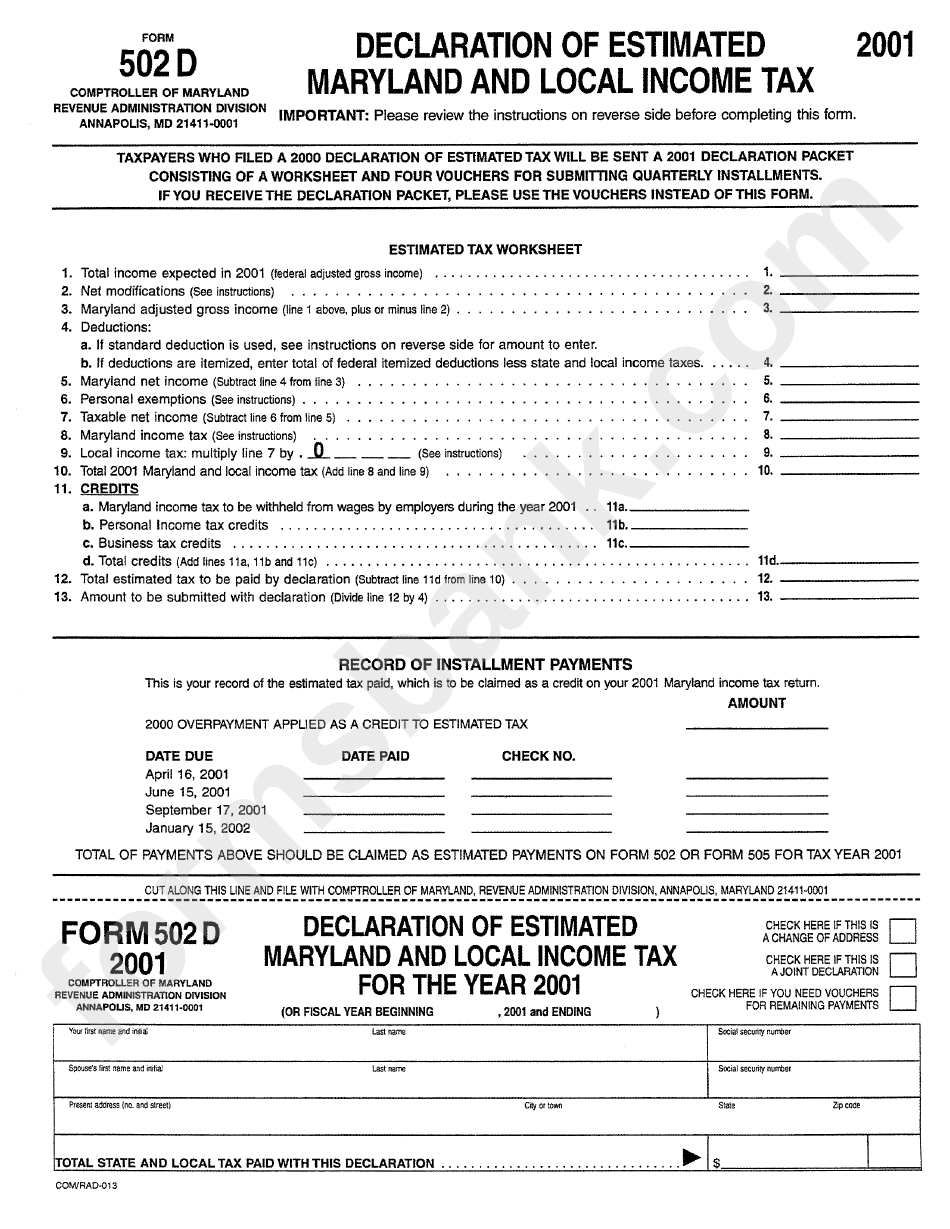

Form 502d Declaration Of Estimated Maryland And Local Tax

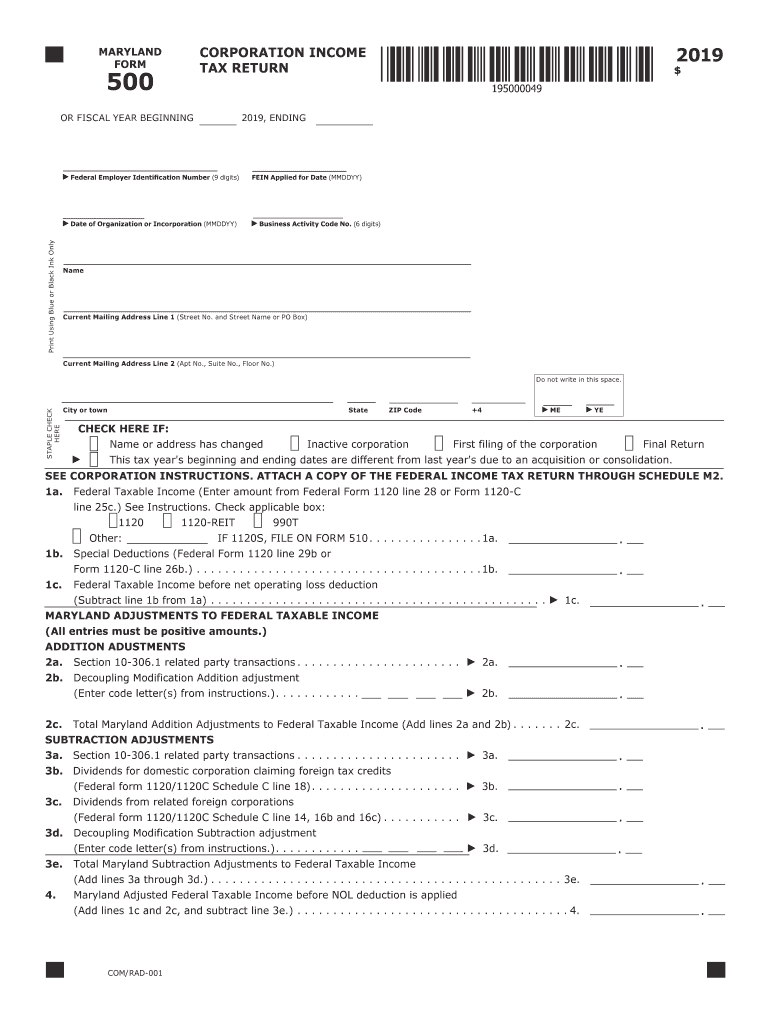

MD Form 500 2019 Fill out Tax Template Online US Legal Forms

Maryland Printable Tax Forms Printable Form 2022

Mw506Ae Fill Out and Sign Printable PDF Template signNow

Maryland Request Tax Form Fill Online, Printable, Fillable, Blank

Maryland Tax Form 502 2019 Fill Out and Sign Printable PDF Template

Related Post: