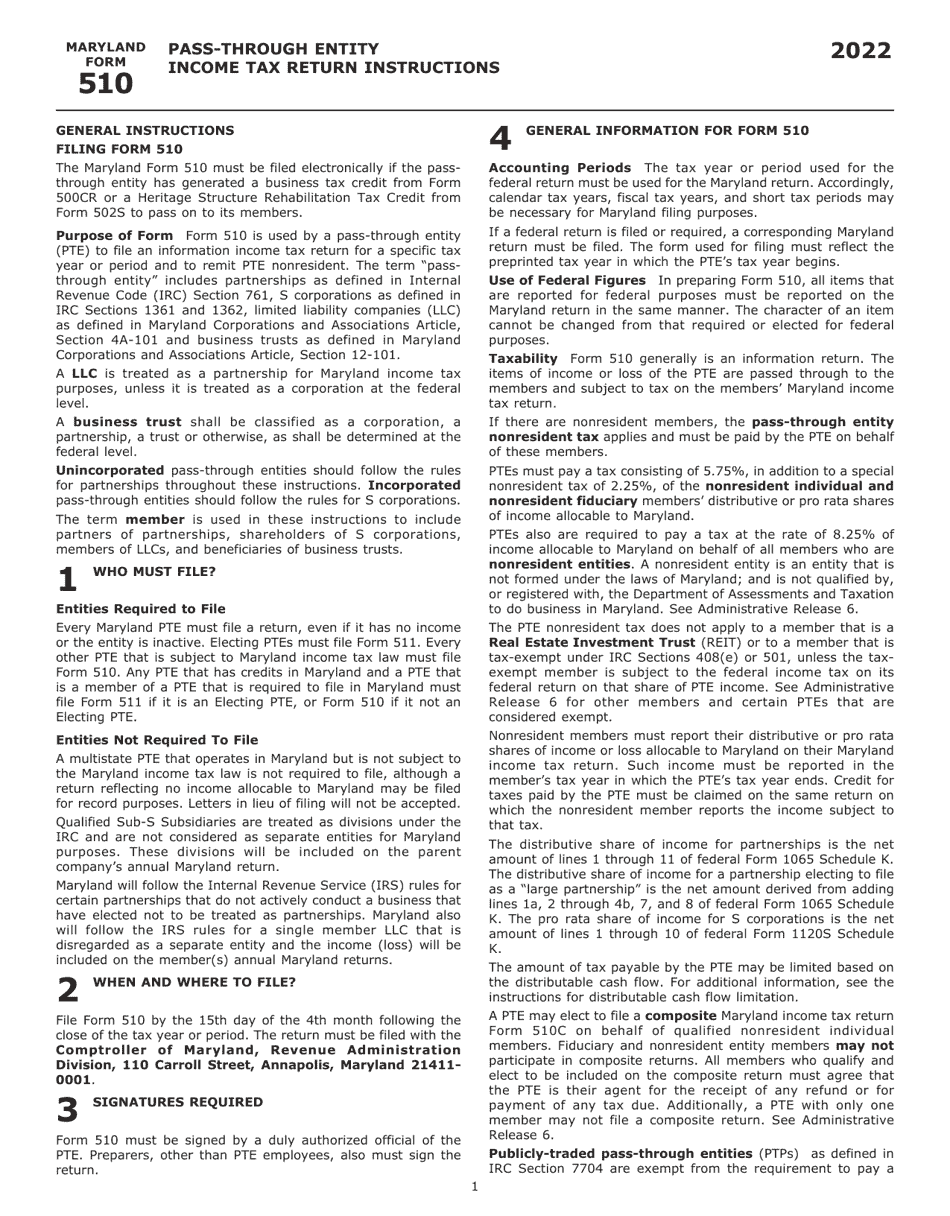

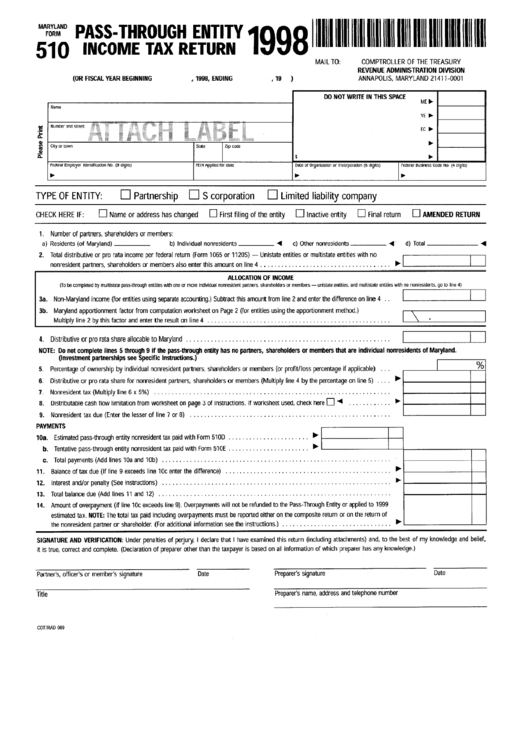

Maryland Form 510 Instructions

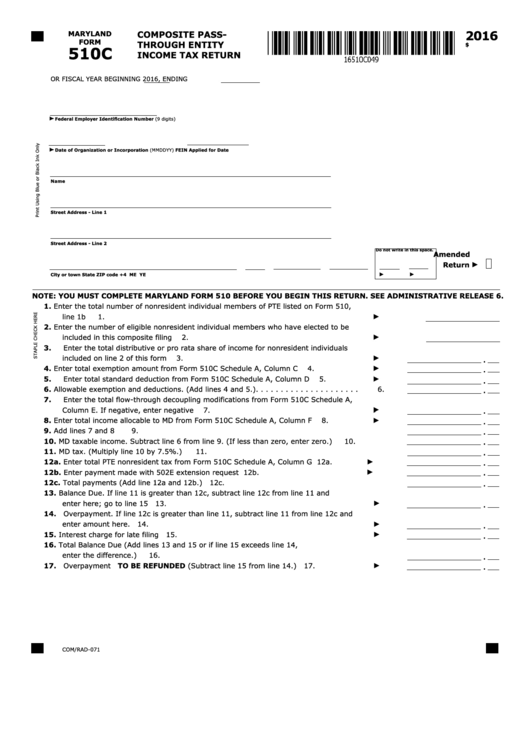

Maryland Form 510 Instructions - Web we last updated maryland form 510 in january 2023 from the maryland comptroller of maryland. Web this affirms the instructions for 2023 maryland form 510/511d: Percentage of ownership by individual nonresident members shown on line 1b (or profit/loss. In order to use the online system you must meet the. Get ready for tax season deadlines by completing any required tax forms today. 1065 maryland (md) maryland resident no tax is computed if all partners are maryland residents, partner types ira or exempt organization or if exempt. You can download or print current. Ptes that have already made the election on a filed. Web tax on form 510: Web file maryland form 510 electronically to pass on business tax credits from maryland form 500cr and/or maryland form 502s to your members. Get ready for tax season deadlines by completing any required tax forms today. You can download or print current. Web we last updated maryland form 510 in january 2023 from the maryland comptroller of maryland. Web ptes making the pte election to pay maryland tax on behalf of all members must now file the new form 511. Percentage of ownership. Web tax on form 510: You can download or print current. Web this affirms the instructions for 2023 maryland form 510/511d: Web forms are available for downloading in the resident individuals income tax forms section below. In order to use the online system you must meet the. Web ptes making the pte election to pay maryland tax on behalf of all members must now file the new form 511. Ptes that have already made the election on a filed. Web 2022 individual income tax instruction booklets. Maryland state and local tax forms and instructions. Web (investment partnerships see specific instructions.) 5. Form used to apply for an. 1065 maryland (md) maryland resident no tax is computed if all partners are maryland residents, partner types ira or exempt organization or if exempt. Web tax on form 510: Get ready for tax season deadlines by completing any required tax forms today. Web this affirms the instructions for 2023 maryland form 510/511d: Ptes that have already made the election on a filed. Form used to apply for an. In order to use the online system you must meet the. Web (investment partnerships see specific instructions.) 5. Web a 6 month extension can be granted for partnerships, limited liability companies and business trusts using form 510e. Web (investment partnerships see specific instructions.) 5. In order to use the online system you must meet the. Maryland state and local tax forms and instructions. Ptes that have already made the election on a filed. You can download or print current. Web forms are available for downloading in the resident individuals income tax forms section below. In order to use the online system you must meet the. Web this affirms the instructions for 2023 maryland form 510/511d: Web (investment partnerships see specific instructions.) 5. Web file maryland form 510 electronically to pass on business tax credits from maryland form 500cr and/or. Web this affirms the instructions for 2023 maryland form 510/511d: Web (investment partnerships see specific instructions.) 5. In order to use the online system you must meet the. Web a 6 month extension can be granted for partnerships, limited liability companies and business trusts using form 510e. Complete, edit or print tax forms instantly. Web (investment partnerships see specific instructions.) 5. Web this affirms the instructions for 2023 maryland form 510/511d: Web forms are available for downloading in the resident individuals income tax forms section below. Web 2022 individual income tax instruction booklets. Web ptes making the pte election to pay maryland tax on behalf of all members must now file the new form. Web (investment partnerships see specific instructions.) 5. This form is for income earned in tax year 2022, with tax returns due in april. In order to use the online system you must meet the. Web (investment partnerships see specific instructions.) 5. Maryland state and local tax forms and instructions. Complete, edit or print tax forms instantly. You can download or print current. Web (investment partnerships see specific instructions.) 5. Web ptes making the pte election to pay maryland tax on behalf of all members must now file the new form 511. Web file maryland form 510 electronically to pass on business tax credits from maryland form 500cr and/or maryland form 502s to your members. 1065 maryland (md) maryland resident no tax is computed if all partners are maryland residents, partner types ira or exempt organization or if exempt. This form is for income earned in tax year 2022, with tax returns due in april. Web 2022 individual income tax instruction booklets. Form used to apply for an. Ptes that have already made the election on a filed. Web a 6 month extension can be granted for partnerships, limited liability companies and business trusts using form 510e. Percentage of ownership by individual nonresident members shown on line 1b (or profit/loss. Web forms are available for downloading in the resident individuals income tax forms section below. Web this affirms the instructions for 2023 maryland form 510/511d: Web we last updated maryland form 510 in january 2023 from the maryland comptroller of maryland. Get ready for tax season deadlines by completing any required tax forms today. Web tax on form 510: Percentage of ownership by individual nonresident members shown on line 1b (or profit/loss. Web (investment partnerships see specific instructions.) 5. Maryland state and local tax forms and instructions.Fillable Maryland Form 510c Composite PassThrough Entity Tax

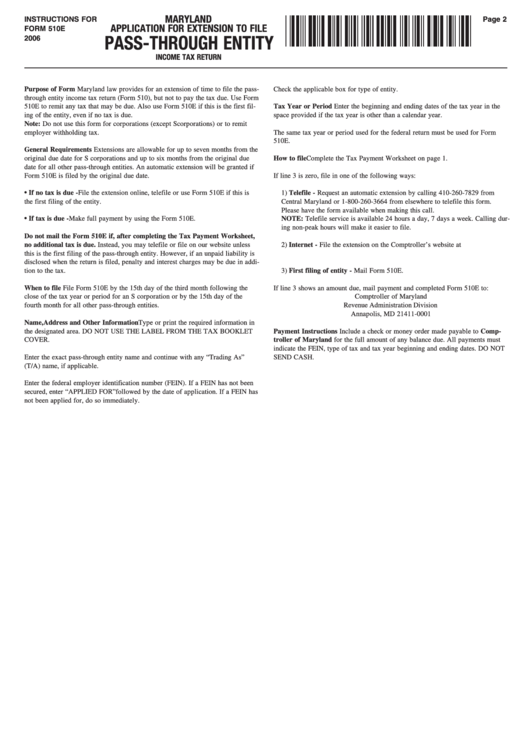

Instructions For Form 510e Maryland Application For Extension To File

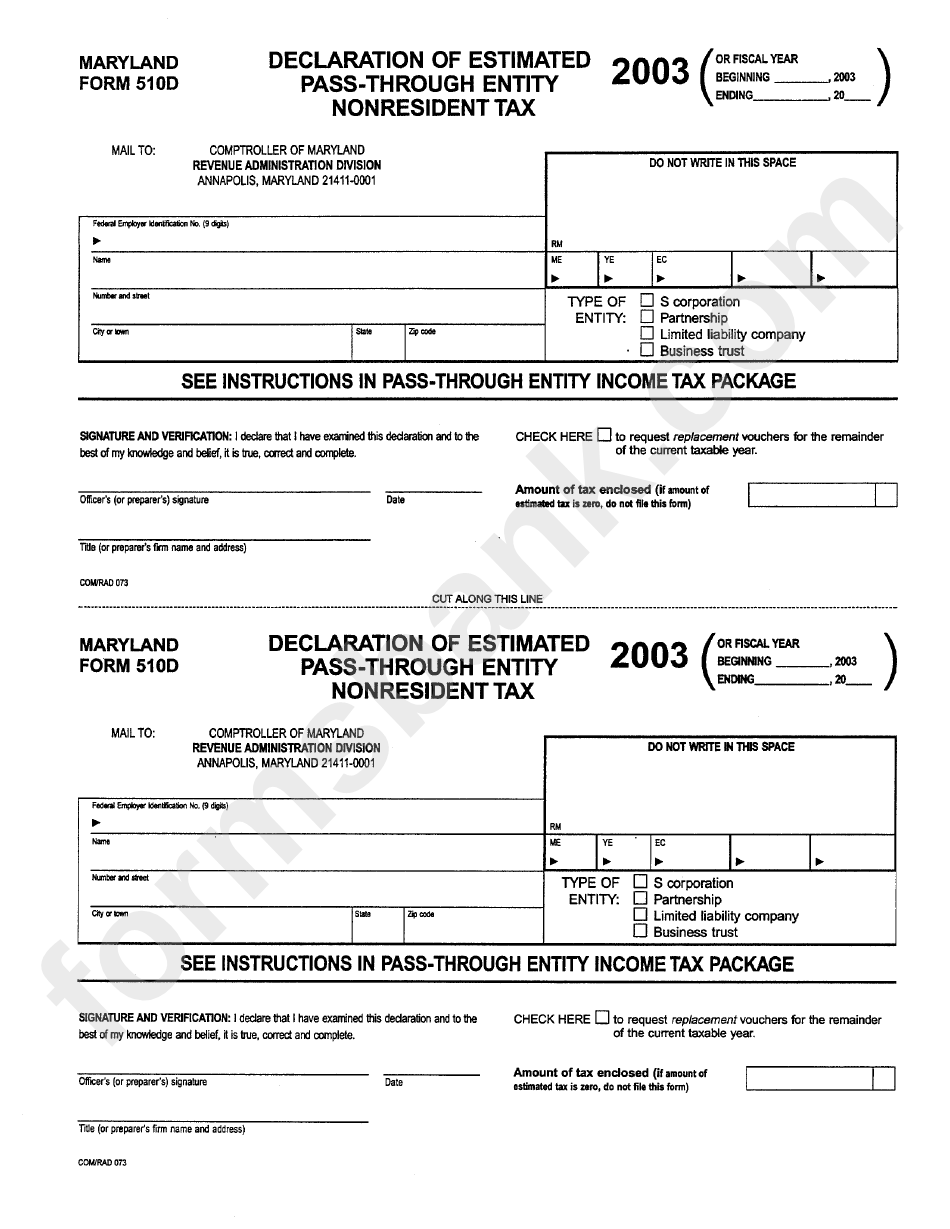

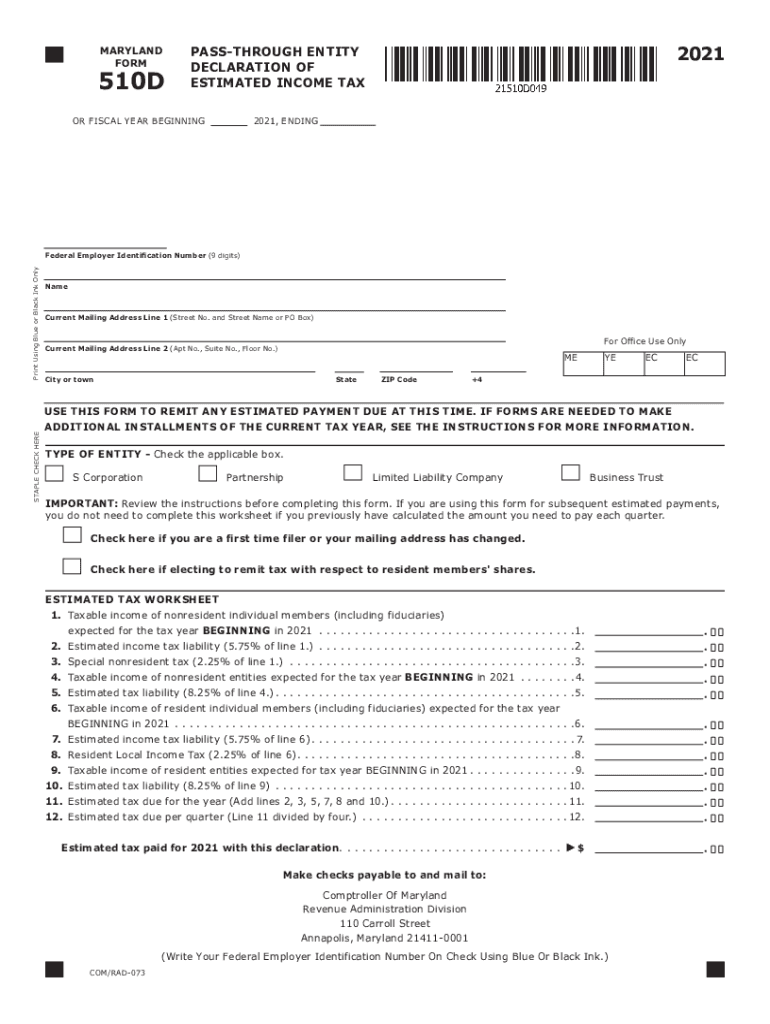

Maryland Form 510d Declaration Of Estimated PassThrough Entity

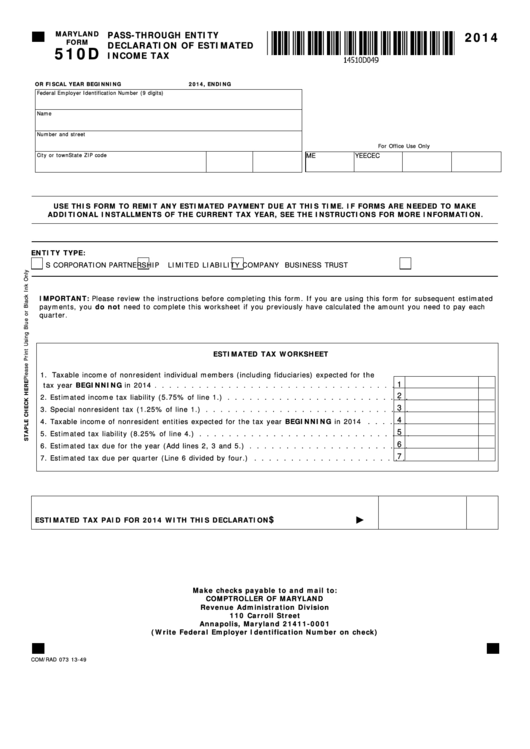

Fillable Maryland Form 510d PassThrough Entity Declaration Of

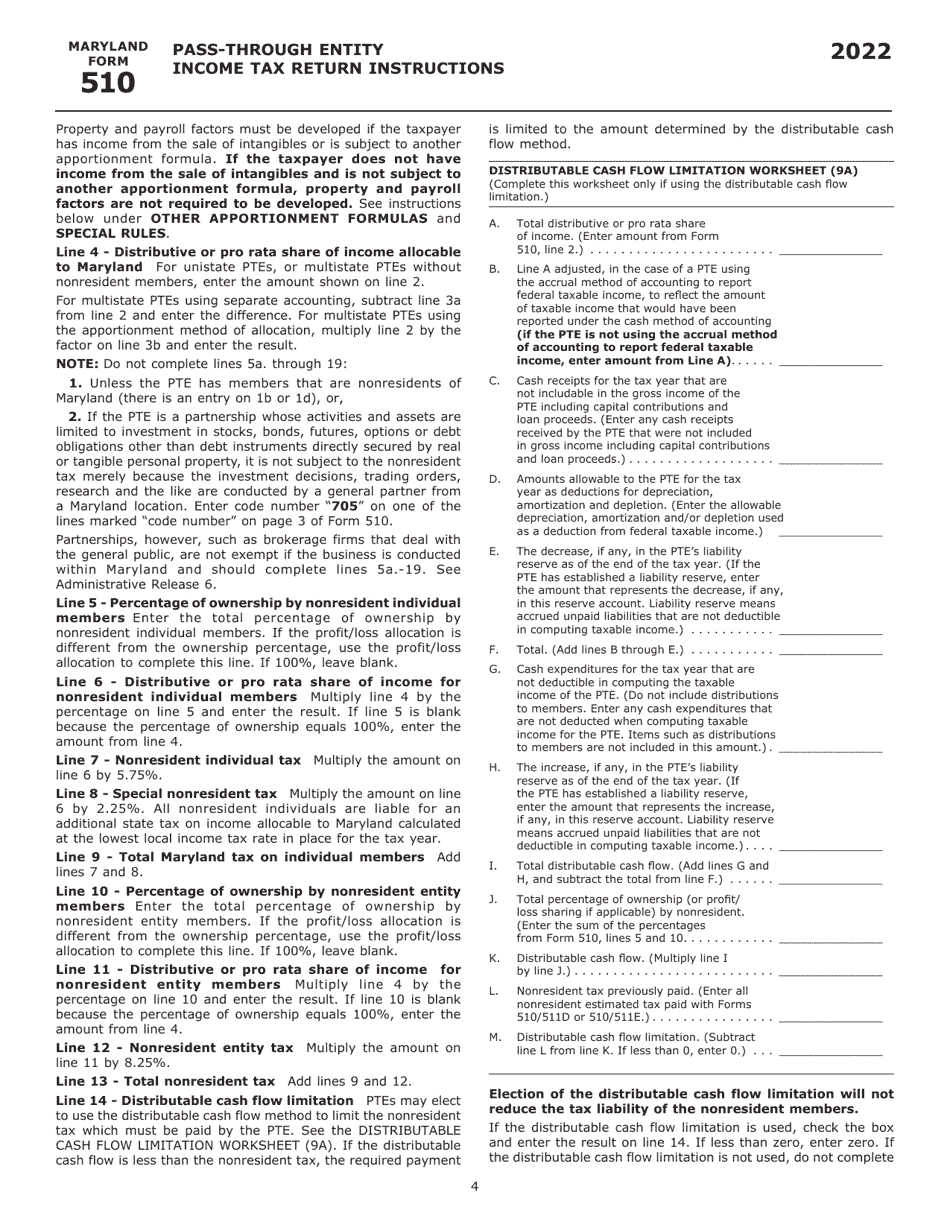

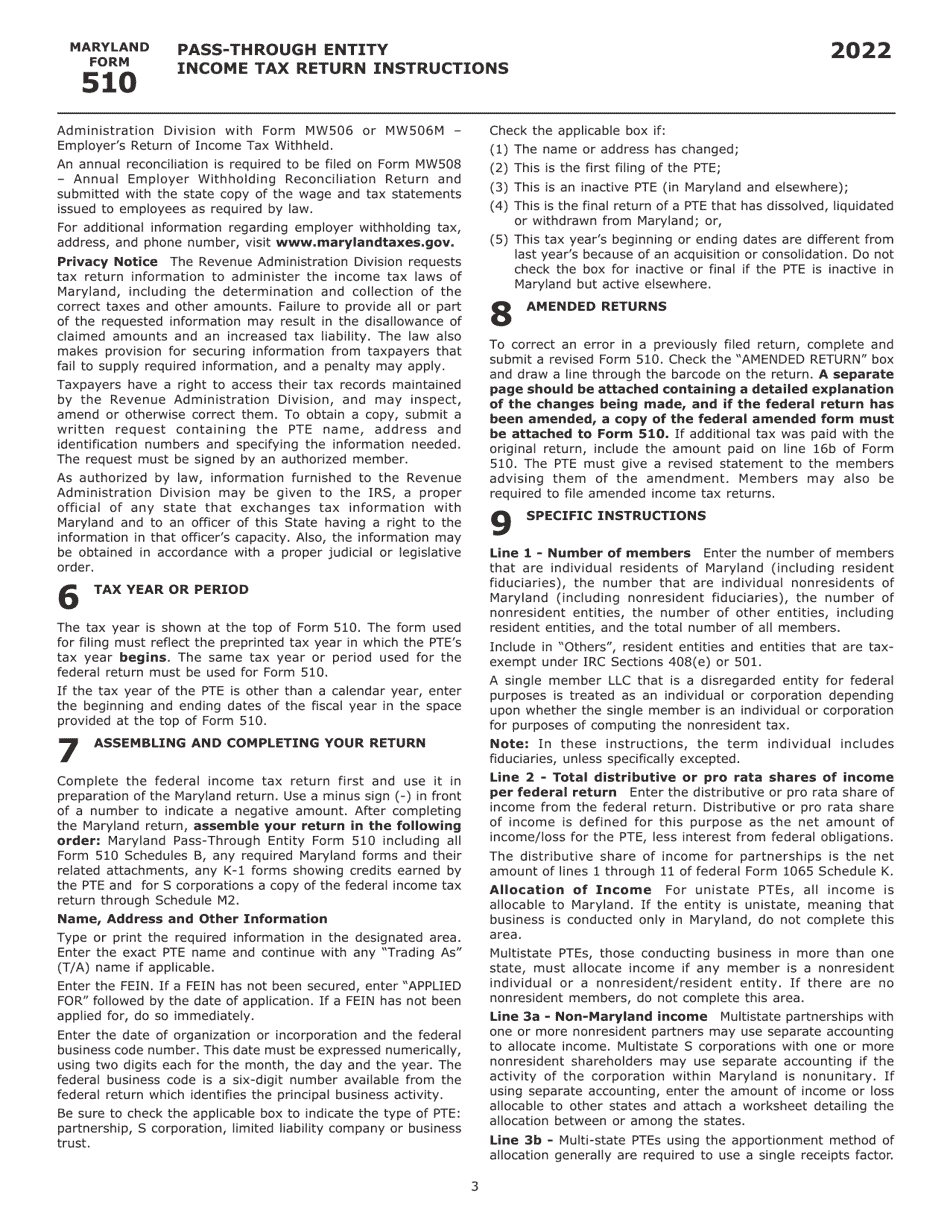

Download Instructions for Maryland Form 510, COM/RAD069 PassThrough

Download Instructions for Maryland Form 510, COM/RAD069 PassThrough

Md 510D Fill Out and Sign Printable PDF Template signNow

Download Instructions for Maryland Form 510, COM/RAD069 PassThrough

Fillable Maryland Form 510 PassThrough Entity Tax Return

Fillable Online Instructions Maryland Form 510 Fax Email Print pdfFiller

Related Post: