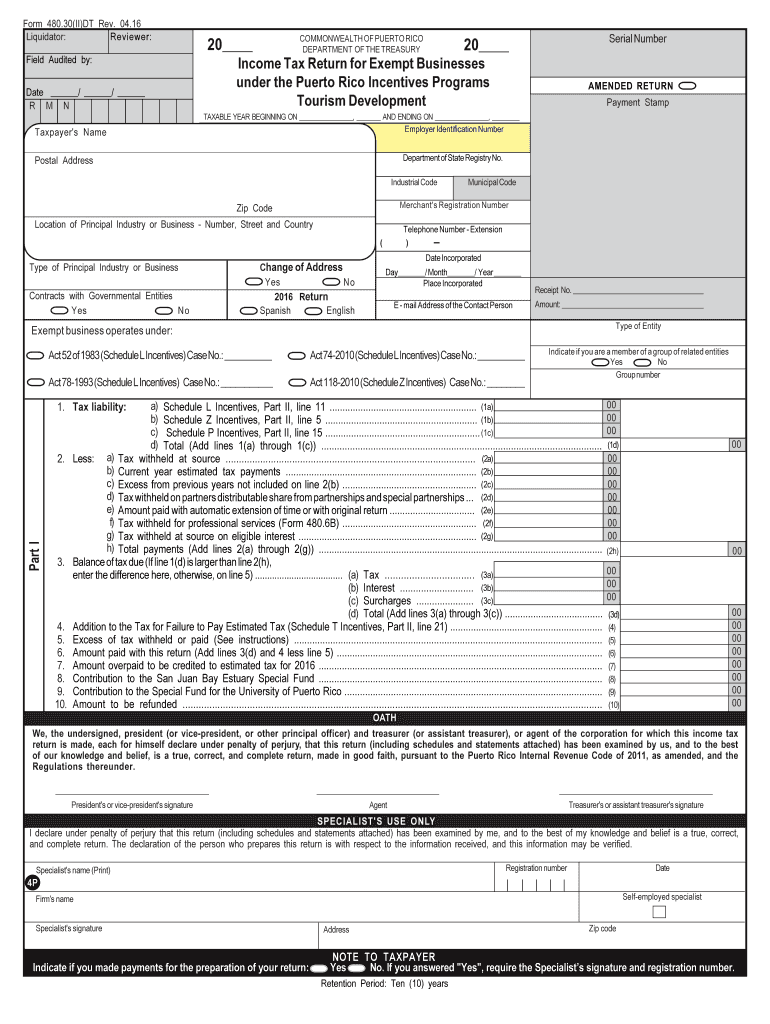

480.6 Tax Form

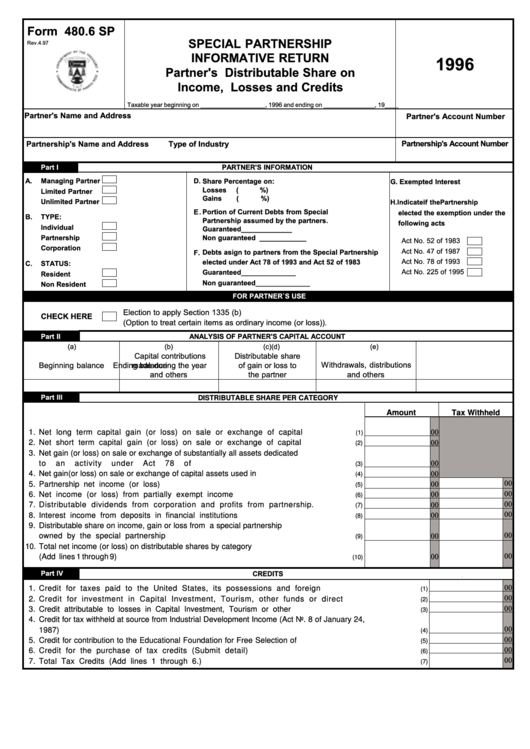

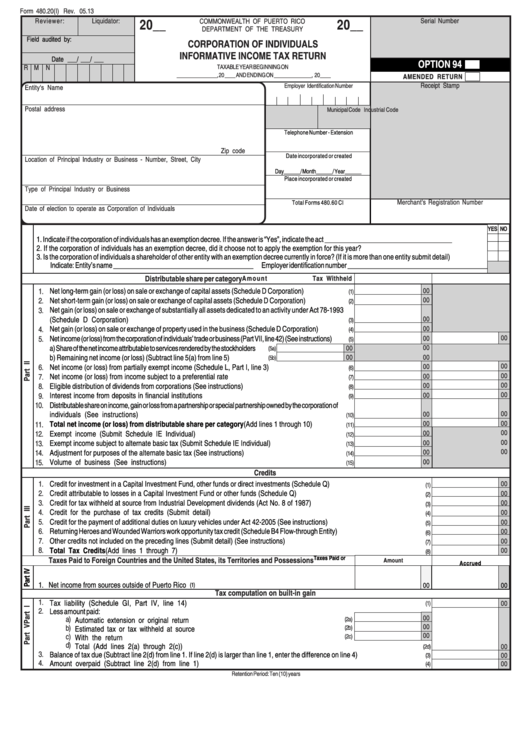

480.6 Tax Form - Web 16 rows puerto rico informative returns. Every person required to deduct and withhold any tax under section 1062.03 of the puerto. Form 480.60 ec must be filed electronically. Web corporate and business income tax form changes for tax year 2023. It covers investment income that has been subject to puerto rico source withholding. Esto es debido a que la naturaleza, fuente y carácter de las partidas de ingresos, ganancias, pérdidas o créditos incluidos en la Personal exemptions are offered to eligible widows, widowers,. Web forms 480.6a and 480.6d. According to the internal revenue circular letter no. The preparation of form 480.6a will be required when the payment. Rather than use the official. The preparation of form 480.6a will be required when the payment. According to the internal revenue circular letter no. Web as established by the puerto rico internal revenue code of 2011, as amended (code), must file this form. Form 480.60 ec must be filed electronically. It covers investment income that has been subject to puerto rico source withholding. Web as established by the puerto rico internal revenue code of 2011, as amended (code), must file this form. Web where should form 480.60 ec be filed? Web 16 rows puerto rico informative returns. Web forms 480.6a and 480.6d. There are a lot of concerns and confusion throughout the tax. It covers exempt income and income subject to the puerto rico alternate basic tax (abt). Bppr is required by law to send informative statements about any amount of money forgiven to a mortgage customer. Personal exemptions are part of the office’s valuation relief programs division: Web where should form. If you receive these forms, it is. Rather than use the official. It covers exempt income and income subject to the puerto rico alternate basic tax (abt). It covers investment income that has been subject to puerto rico source withholding. Bppr is required by law to send informative statements about any amount of money forgiven to a mortgage customer. If you receive these forms, it is. According to the internal revenue circular letter no. Web tax gap $688 billion. There are a lot of concerns and confusion throughout the tax. Bppr is required by law to send informative statements about any amount of money forgiven to a mortgage customer. Web as established by the puerto rico internal revenue code of 2011, as amended (code), must file this form. If you receive these forms, it is. Rather than use the official. Bppr is required by law to send informative statements about any amount of money forgiven to a mortgage customer. According to the internal revenue circular letter no. Personal exemptions are offered to eligible widows, widowers,. Voluntary withholding request for arizona resident employed outside of arizona. Bppr is required by law to send informative statements about any amount of money forgiven to a mortgage customer. Individual estimated tax payment booklet. Esto es debido a que la naturaleza, fuente y carácter de las partidas de ingresos, ganancias, pérdidas o. Web there are two separate series 480 forms that wealthfront generates for clients who reside in puerto rico: Personal exemptions are part of the office’s valuation relief programs division: It covers exempt income and income subject to the puerto rico alternate basic tax (abt). Rather than use the official. Esto es debido a que la naturaleza, fuente y carácter de. Every person required to deduct and withhold any tax under section 1062.03 of the puerto. Series 480.6a and series 480.6d. Web corporate and business income tax form changes for tax year 2023. Rather than use the official. The preparation of form 480.6a will be required when the payment. There are a lot of concerns and confusion throughout the tax. Series 480.6a and series 480.6d. Personal exemptions are offered to eligible widows, widowers,. Copies of applicable income statements. It covers investment income that has been subject to puerto rico source withholding. Web agency finalizing direct file pilot scope, details as work continues this fall; Every person required to deduct and withhold any tax under section 1062.03 of the puerto. Web there are two separate series 480 forms that wealthfront generates for clients who reside in puerto rico: Web tax gap $688 billion. The irs is currently working on building its own free tax filing program. If you receive these forms, it is. 1 beginning in calendar 2019, payments for. The preparation of form 480.6a will be required when the payment. Rather than use the official. Web 16 rows puerto rico informative returns. It covers investment income that has been subject to puerto rico source withholding. There are a lot of concerns and confusion throughout the tax. Individual estimated tax payment booklet. Web as established by the puerto rico internal revenue code of 2011, as amended (code), must file this form. Voluntary withholding request for arizona resident employed outside of arizona. Web forms 480.6a and 480.6d. Copies of applicable income statements. Form 480.60 ec must be filed electronically. Series 480.6a and series 480.6d. According to the internal revenue circular letter no.2018 Form MN DoR M1PRX Fill Online, Printable, Fillable, Blank pdfFiller

Form 480 6c Instructions Fill Out and Sign Printable PDF Template

Form 480.6 Sp Partner'S Distributable Share On Losses And

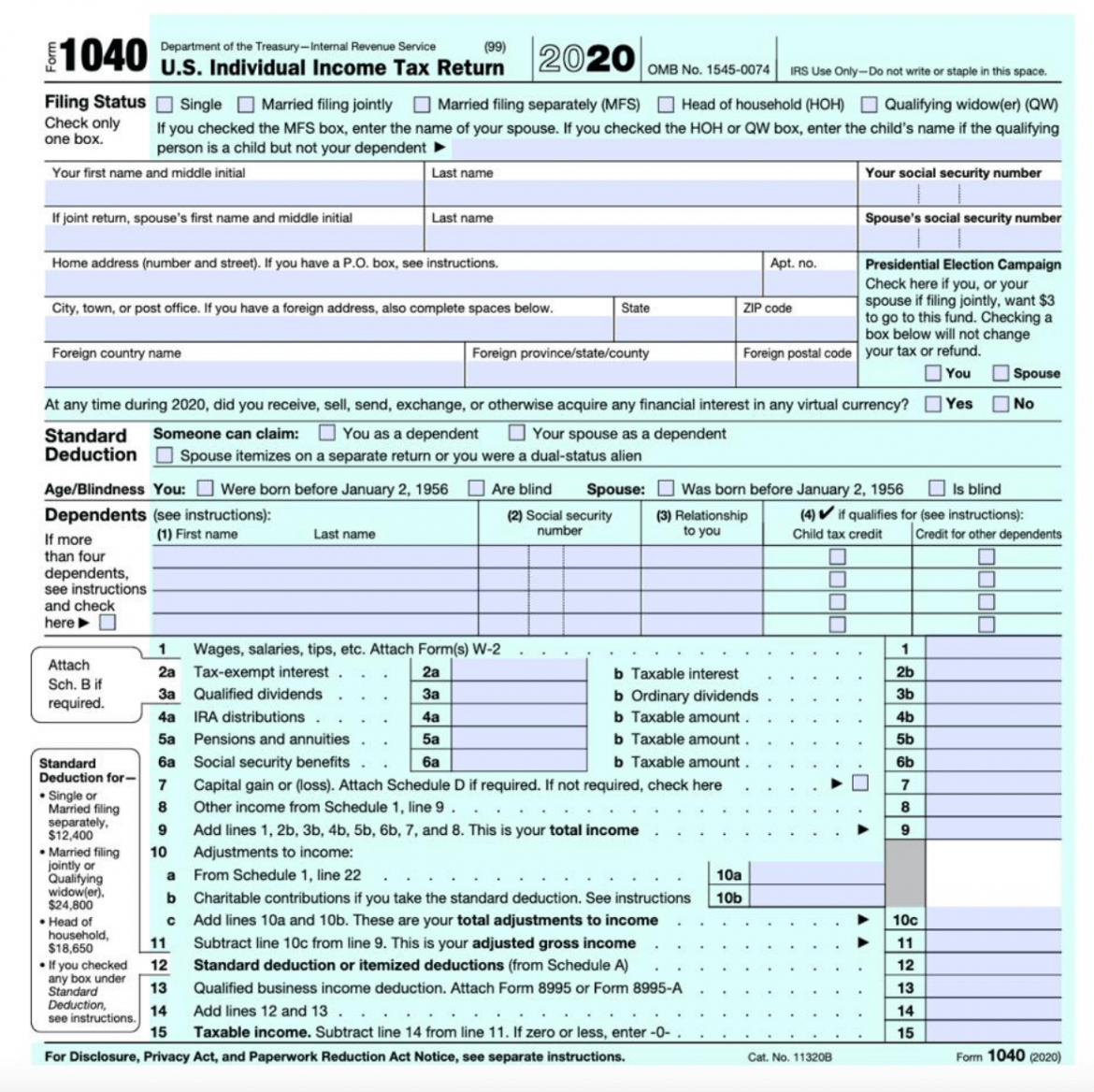

Irs.gov Form 1040a 2016 Form Resume Examples dO3wPXGE8E

6.2 The U.S. Federal Tax Process Personal Finance

Form 480.20 Corporation Of Individuals Informative Tax Return

IRS urges electronic filing as tax season begins Friday, amid mail

IRS Releases Form 1040 For 2020 Tax Year Taxgirl

Pin on 2015 IRS 1040 Form

Top20 US Tax Forms in 2022 Explained PDF.co

Related Post: