Maryland 1099 G Form

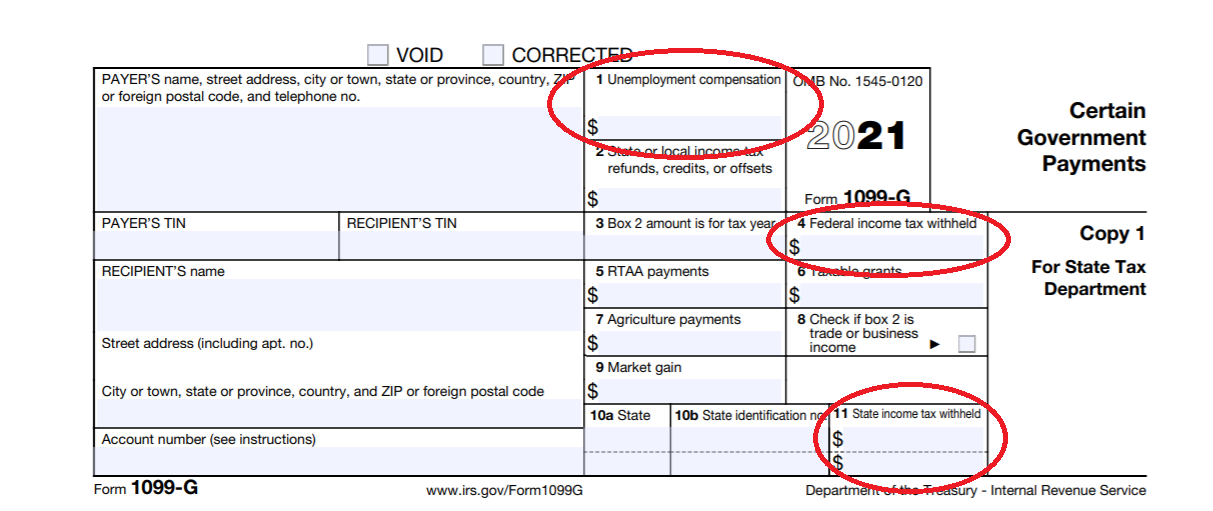

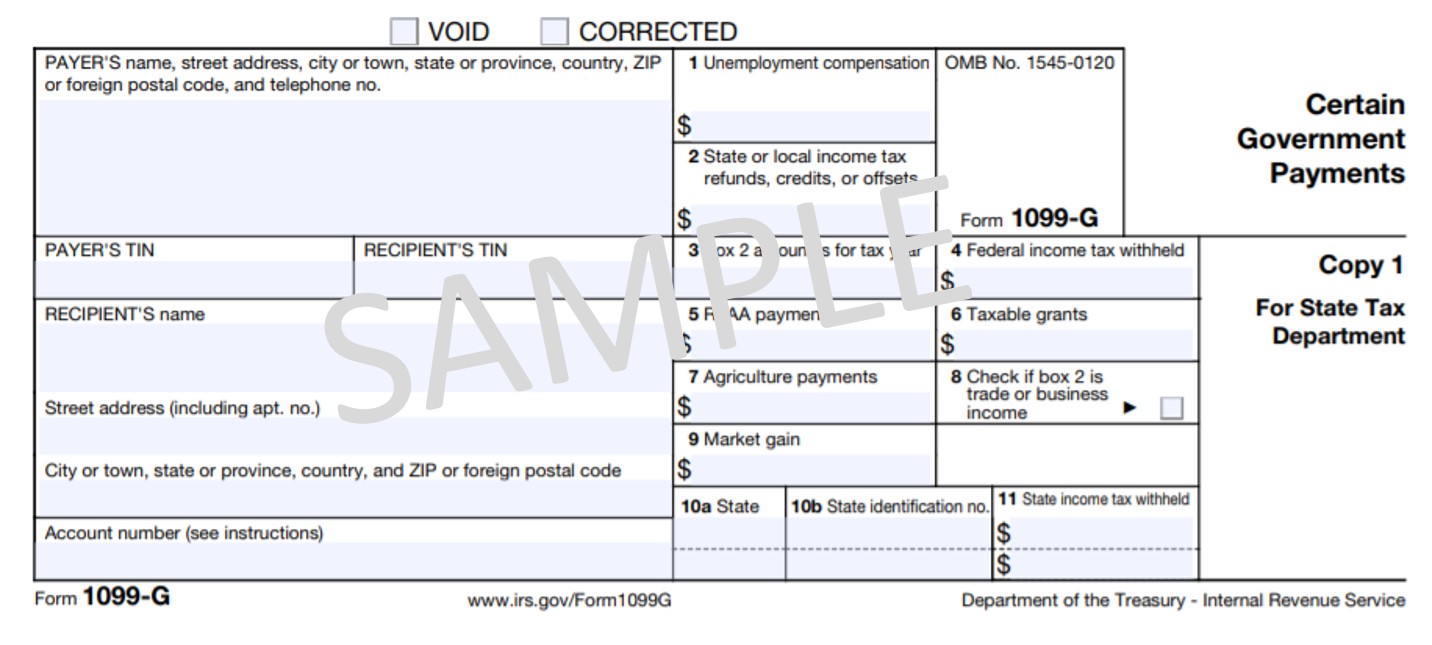

Maryland 1099 G Form - The comptroller of maryland is required by federal law to notify you that the state tax refund. Web i got form 1099g. This refund, offset or credit may be taxable income. Please provide all information requested below, review the certification, and sign and date this form. It is not a bill. A copy of the 1099 is sent to the taxpayer. Web maryland department of labor Web most taxpayers who are eligible and file for a federal eitc can receive the maryland state and/or local eitc tax credits. If you received a maryland income tax refund last year, we're required by federal law to send. Web for assistance, users may contact the taxpayer service section monday through friday from 8:30 am until 4:30 pm via email at [email protected] or by phone at 410. If you received a maryland income tax refund last year, we're required by federal law to send. If you received a maryland income tax refund last year, we're required by federal law to send. Federal, state, or local governments file this form if they made payments of: Web form 1099g is a report of income you received from your maryland. Federal, state, or local governments file this form if they made payments of: If you received a maryland income tax refund last year, we're required by federal law to send. Complete, edit or print tax forms instantly. If you received a maryland income tax refund last year, we're required by federal law to send. Web form 1099g is a report. Complete, edit or print tax forms instantly. If you received a maryland income tax refund last year, we're required by federal law to send. Households may qualify for the federal and state eitc if, in. A copy of the 1099 is sent to the taxpayer. Please provide all information requested below, review the certification, and sign and date this form. This refund, offset or credit may be taxable income. Web form 1099g is a report of income you received from your maryland state taxes as a refund, offset or credit. Complete, edit or print tax forms instantly. A copy of the 1099 is sent to the taxpayer. Web for assistance, users may contact the taxpayer service section monday through friday. The comptroller of maryland is required by federal law to notify you that the state tax refund. Maryland law requires employers to submit their annual withholding reconciliation electronically if the total number of 1099 statements meet or exceed 25. You only need to report 1099g information for a tax refund if you have included it in your federal adjusted gross. Web most taxpayers who are eligible and file for a federal eitc can receive the maryland state and/or local eitc tax credits. The comptroller of maryland is encouraging you to sign up to go paperless this tax season. If you received a maryland income tax refund last year, we're required by federal law to send. Complete, edit or print tax. Annually, federal 1099 reports are informational forms filed with the internal revenue service (irs). Complete, edit or print tax forms instantly. Please provide all information requested below, review the certification, and sign and date this form. Web for assistance, users may contact the taxpayer service section monday through friday from 8:30 am until 4:30 pm via email at [email protected] or. It is not a bill. The comptroller of maryland is encouraging you to sign up to go paperless this tax season. Web for assistance, users may contact the taxpayer service section monday through friday from 8:30 am until 4:30 pm via email at [email protected] or by phone at 410. This refund, offset or credit may be taxable income. You only. Maryland law requires employers to submit their annual withholding reconciliation electronically if the total number of 1099 statements meet or exceed 25. Annually, federal 1099 reports are informational forms filed with the internal revenue service (irs). Web form 1099g is a report of income you received from your maryland state taxes as a refund, offset or credit. Households may qualify. Households may qualify for the federal and state eitc if, in. Web the comptroller of maryland is encouraging you to sign up to go paperless this tax season. The comptroller of maryland is required by federal law to notify you that the state tax refund. If you received a maryland income tax refund last year, we're required by federal law. You only need to report 1099g information for a tax refund if you have included it in your federal adjusted gross income for your current year tax return and if. Web the comptroller of maryland is encouraging you to sign up to go paperless this tax season. Web i got form 1099g. A copy of the 1099 is sent to the taxpayer. Federal, state, or local governments file this form if they made payments of: Households may qualify for the federal and state eitc if, in. Web most taxpayers who are eligible and file for a federal eitc can receive the maryland state and/or local eitc tax credits. Complete, edit or print tax forms instantly. Please provide all information requested below, review the certification, and sign and date this form. Annually, federal 1099 reports are informational forms filed with the internal revenue service (irs). Web for assistance, users may contact the taxpayer service section monday through friday from 8:30 am until 4:30 pm via email at [email protected] or by phone at 410. If you received a maryland income tax refund last year, we're required by federal law to send. Ad get ready for tax season deadlines by completing any required tax forms today. If you received a maryland income tax refund last year, we're required by federal law to send. This refund, offset or credit may be taxable income. The comptroller of maryland is required by federal law to notify you that the state tax refund. It is not a bill. Web form 1099g is a report of income you received from your maryland state taxes as a refund, offset or credit. Maryland law requires employers to submit their annual withholding reconciliation electronically if the total number of 1099 statements meet or exceed 25. Web maryland department of laborIrs.gov Form 1099 G Universal Network

Form 1099 g instructions

1099 G Form 2019 Editable Online Blank in PDF

Did someone drop the ball?

How to Report your Unemployment Benefits on your Federal Tax Return

1099 IRS Tax Form

The 1099 G for Maryland has boxes 15, but the form on turbotax shows

How To Get 1099 G Form Online Indiana Marie Thoma's Template

How To Get Your 1099g Form Online Marie Thoma's Template

Columbia College 1099G Government Payments

Related Post: