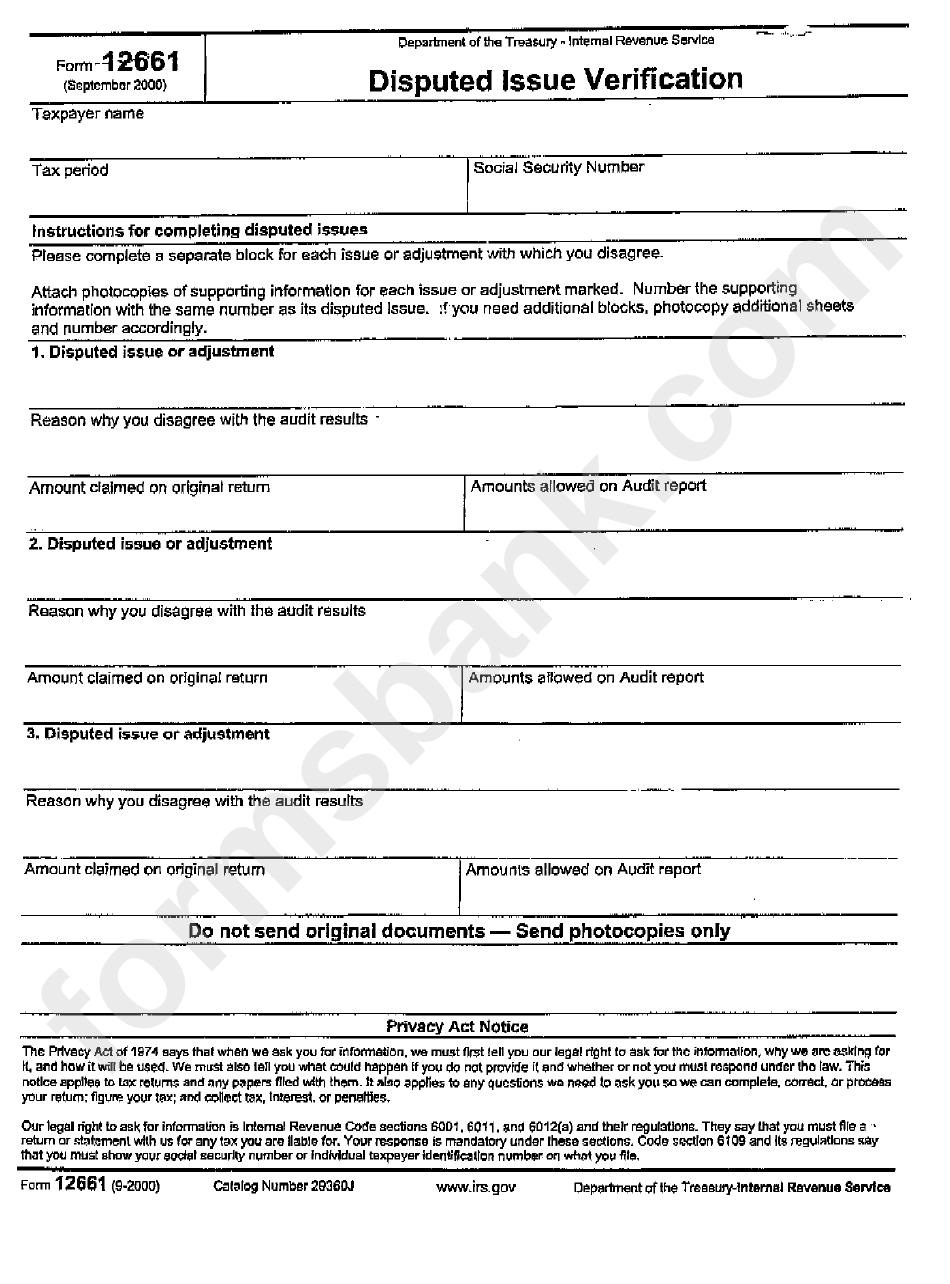

Irs Audit Reconsideration Form 12661

Irs Audit Reconsideration Form 12661 - Web you can file for an audit reconsideration under certain circumstances authorized by the internal revenue code 6020 (b). Here's what you need to know. The irs doesn’t require you to complete a special form, however, form 12661, disputed issue verification, is recommended to explain the issues you. Form 12661 is a form that taxpayers can use to request an audit reconsideration for a return or claim that has already been audited. A process that reopens your irs audit. Web form 12661, disputed issue verification, is recommended to explain the issues you disagree with. Web for most americans, they receive irs form 4549. Top forms to compete and sign. Ad outgrow.us has been visited by 10k+ users in the past month Web an audit reconsideration is a process the irs uses to reevaluate the results of a prior audit when specific criteria have been met. If available, attach a copy of your examination report, form 4549, along. Form 12661 is a form that taxpayers can use to request an audit reconsideration for a return or claim that has already been audited. Web request an audit reconsideration: When can i use an irs. Web what is irs form 12661? Read on to learn more about. Web audit reconsideration requested action: Web the irs audit reconsideration process be used go request with irs audit reconsideration via file irs form 12661. Top forms to compete and sign. If you choose, you can instead write a simple letter addressed to the. Abate tax, penalty, and interest (if restricted) according. I am filling out form 12661 for a client who has been audited, and it says reason why you disagree with the audit results do i have to attach the bank statements. A tax advisor will answer you now! Web how to fill out and sign irs audit reconsideration form 12661 online?. Get your online template and fill it in using progressive features. Web what is irs form 12661? Top forms to compete and sign. Here's what you need to know. The irs doesn’t require you to complete a special form, however, form 12661, disputed issue verification, is recommended to explain the issues you. Web for most americans, they receive irs form 4549. Form 12661 is a form that taxpayers can use to request an audit reconsideration for a return or claim that has already been audited. Web the irs audit reconsideration process be used go request with irs audit reconsideration via file irs form 12661. Web an audit reconsideration is a process the. Get the help you need from top tax relief companies. Ad you don't have to face the irs alone. Web form 12661, disputed issue verification, is recommended to explain the issues you disagree with. Enjoy smart fillable fields and. A process that reopens your irs audit. Top forms to compete and sign. Abate tax, penalty, and interest (if restricted) according. Ad forms, deductions, tax filing and more. Web o copy of audit report (form 4549) o reconsideration request is sent to the campus shown on audit report. But, what is irs form 4549 and what does it mean for the taxpayer who gets it? Web december 16, 2015. The request for reconsideration can help you resolve. Web audit reconsideration requested action: I am filling out form 12661 for a client who has been audited, and it says reason why you disagree with the audit results do i have to attach the bank statements. Web o copy of audit report (form 4549) o reconsideration request. But, what is irs form 4549 and what does it mean for the taxpayer who gets it? Form 12661 is a form that taxpayers can use to request an audit reconsideration for a return or claim that has already been audited. Web request an audit reconsideration: Web for most americans, they receive irs form 4549. Advise the taxpayer to fully. Web request an audit reconsideration: Web form 12661 is the official irs audit letter for reconsideration that gives taxpayers the opportunity to explain which decisions they disagree with upon. I am filling out form 12661 for a client who has been audited, and it says reason why you disagree with the audit results do i have to attach the bank. Here's what you need to know. A process that reopens your irs audit. Avoid penalties and interest by getting your taxes forgiven today • form 12661 is now obsolete and no longer. Web o copy of audit report (form 4549) o reconsideration request is sent to the campus shown on audit report. Web request an audit reconsideration: Advise the taxpayer to fully explain the reason for disagreement with. Web audit reconsideration requested action: Web while the irs provides form 12661 in order to detail your request for reconsideration, it isn’t mandatory. Web december 16, 2015. Web be sure to include paragraph and enclosure for form 12661, disputed issue verification. Web the irs audit reconsideration process be used go request with irs audit reconsideration via file irs form 12661. Questions answered every 9 seconds. Read on to learn more about. Web an audit reconsideration is a process the irs uses to reevaluate the results of a prior audit when specific criteria have been met. In any of the four situations below, you can request an audit reconsideration. Ad you don't have to face the irs alone. Ad outgrow.us has been visited by 10k+ users in the past month Web you can file for an audit reconsideration under certain circumstances authorized by the internal revenue code 6020 (b). When can i use an irs.IRS Audit Reconsideration Process Explained (2023)

IRS Letter 3339C Audit Reconsideration Additional Substantiation

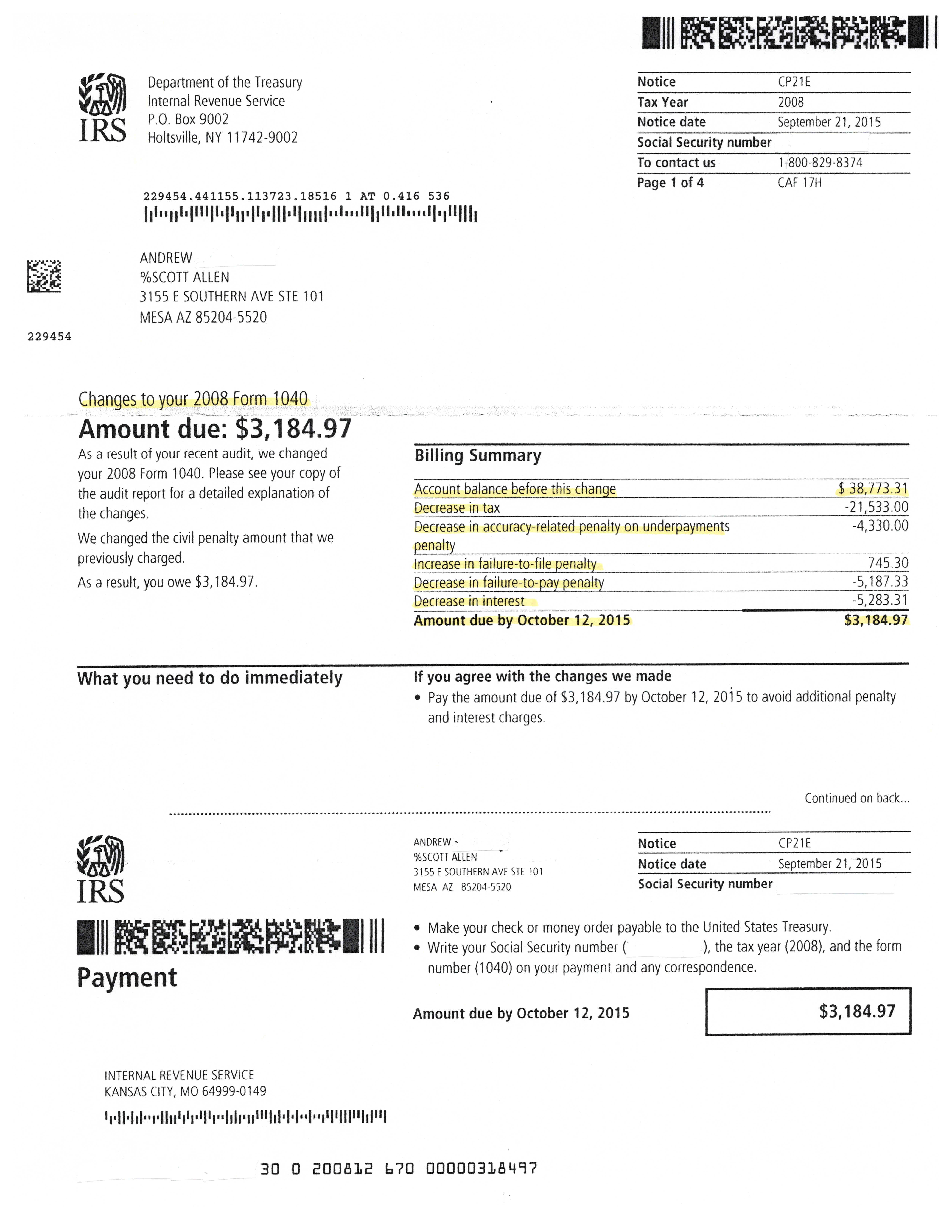

Successful IRS Audit Reconsideration in Phoenix Arizona Tax Debt

Irs Audit Sample Irs Audit Reconsideration Letter

How To Write A Letter Of Reconsideration To Irs Alice Writing

IRS Letter 3338C Audit Reconsideration Acknowledgment H&R Block

IRS Tax Audits SuperMoney

Irs audit reconsideration form 12661 Fill online, Printable, Fillable

IRS Audit Reconsideration Process Explained (2023)

Form 12661 Disputed Issue Verification 2000 printable pdf download

Related Post: