S Corporation Extension Form

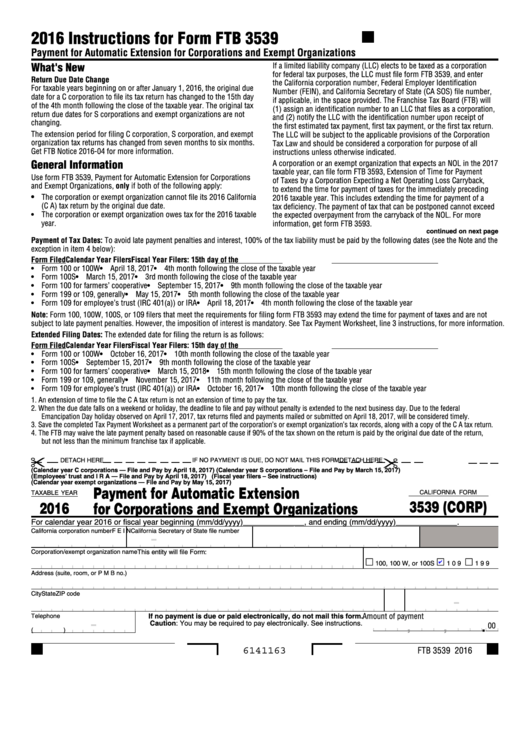

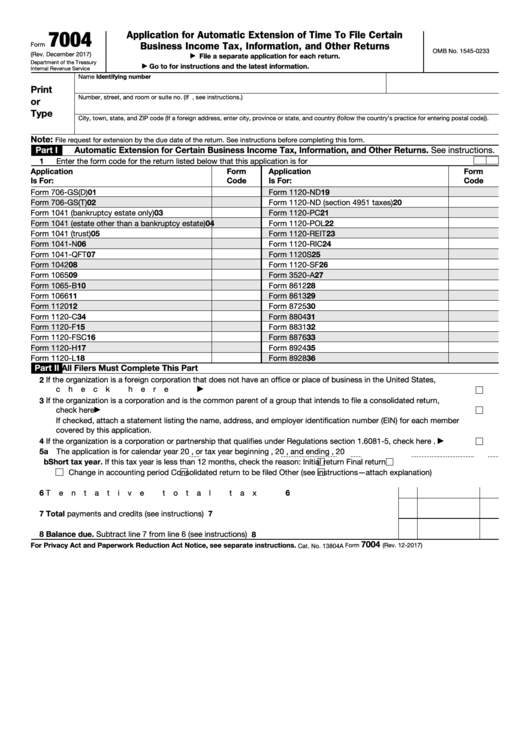

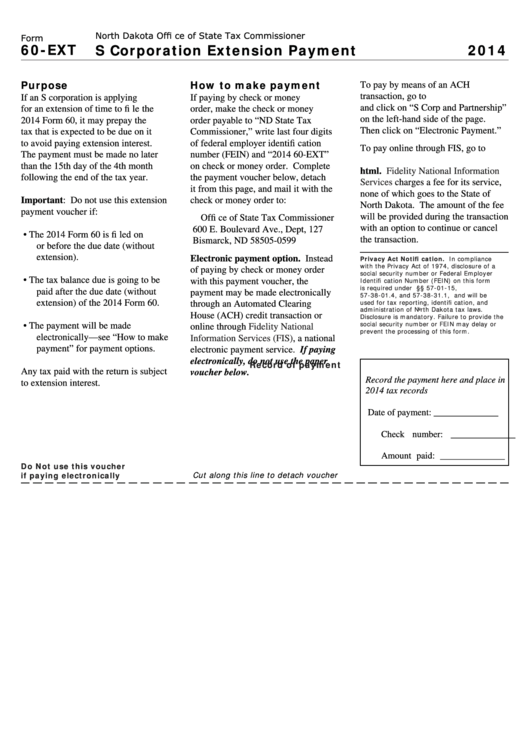

S Corporation Extension Form - Millions of people file every year for an. Web comptroller's office 1600 west monroe phoenix, az 85007 filing an extension. The maximum length of time for an extension granted to an s corporation remains 6 months. • an s corporation that pays wages to employees typically files irs form 941 for. To file an extension on a return, corporations use arizona form 120ext. References in these instructions are to the internal revenue code (irc) as of january 1, 2015, and. Income tax return for an s corporation, including recent updates, related forms, and instructions on how to file. The original due date for this. Web file your business federal tax extension. Web • an s corporation can obtain an extension of time to file by filing irs form 7004. Time’s up for millions of americans: Millions of people file every year for an. Web in order to become an s corporation, the corporation must submit form 2553, election by a small business corporation signed by all the shareholders. Web you can extend filing form 1120s when you file form 7004. Arizona corporate income tax highlights. Web there are three steps to filing an extension for s corporation taxes: Starting with the 2020 taxable year, electronic filing of arizona corporate. Web 20 rows home. Web comptroller's office 1600 west monroe phoenix, az 85007 filing an extension. Web here’s an overview of the 10 steps to forming a corporation with maxfilings: Arizona corporate income tax highlights. The final deadline to file your 2022 taxes is october 16. Millions of people file every year for an. Complete either a form 7004 or 1120. • an s corporation that pays wages to employees typically files irs form 941 for. Web there are three steps to filing an extension for s corporation taxes: Web comptroller's office 1600 west monroe phoenix, az 85007 filing an extension. Complete either a form 7004 or 1120. Time’s up for millions of americans: To file an extension on a return, corporations use arizona form 120ext. Application for automatic extension of time to file by the original due date of the return. Income tax return for an s corporation, including recent updates, related forms, and instructions on how to file. December 2018) department of the treasury internal revenue service. Web information about form 7004, application for automatic extension of time to file certain business income tax,. The final deadline to file your 2022 taxes is october 16. Time’s up for millions of americans: File your articles of incorporation. Web • an s corporation can obtain an extension of time to file by filing irs form 7004. Millions of people file every year for an. Millions of people file every year for an. Application for automatic extension of time to file corporation, partnership, and exempt organization returns. Web information about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, including recent updates, related. Application for automatic extension of time to file by the original due date. The final deadline to file your 2022 taxes is october 16. Web most business tax returns can be extended by filing form 7004: • an s corporation that pays wages to employees typically files irs form 941 for. Electronic filing an extension for business returns (1120, 1120s, 1065, and 1041) updated november 18, 2022. Enter code 25 in the box. Web most business tax returns can be extended by filing form 7004: Web extension forms by filing status. To file an extension on a return, corporations use arizona form 120ext. Inclusion of federal return with arizona return the department requests that. References in these instructions are to the internal revenue code (irc) as of january 1, 2015, and. • an s corporation that pays wages to employees typically files irs form 941 for. The maximum length of time for an extension granted to an s corporation remains 6 months. Form 4868, application for automatic extension of time to file u.s. Application for automatic extension of time to file corporation, partnership, and exempt organization returns. Inclusion of federal return. Web extension forms by filing status. Application for automatic extension of time to file corporation, partnership, and exempt organization returns. Income tax return for an s corporation, including recent updates, related forms, and instructions on how to file. Use form 120ext (application for automatic extension of time to file corporation,. Enter code 25 in the box on form 7004, line 1. Web you can extend filing form 1120s when you file form 7004. Inclusion of federal return with arizona return the department requests that. Web amending an individual return (1040x) in proseries. Time’s up for millions of americans: Starting with the 2020 taxable year, electronic filing of arizona corporate. The maximum length of time for an extension granted to an s corporation remains 6 months. Enjoy seamless extension filing from expressextension! Web most business tax returns can be extended by filing form 7004: Web • an s corporation can obtain an extension of time to file by filing irs form 7004. December 2018) department of the treasury internal revenue service. Complete either a form 7004 or 1120. To file an extension on a return, corporations use arizona form 120ext. For calendar year corporations, the due date is march 15, 2023. File this form to request. File your articles of incorporation.2016 tax extension form corporations dialockq

How to File an Extension for Your SubChapter S Corporation

Corporation return due date is March 16, 2015Cary NC CPA

Fillable Form 7004 Application For Automatic Extension Of Time To

2016 tax extension form corporations pipeolpor

Form 60Ext Instructions S Corporation Extension Payment 2014

Application Affidavit Emissions Extension Pdf Fill Online, Printable

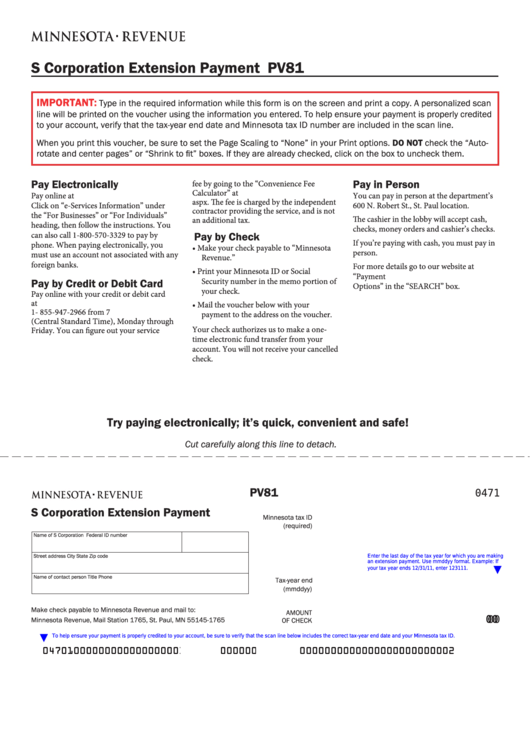

Fillable Form Pv81 S Corporation Extension Payment printable pdf download

Delaware S Corp Extension Form Best Reviews

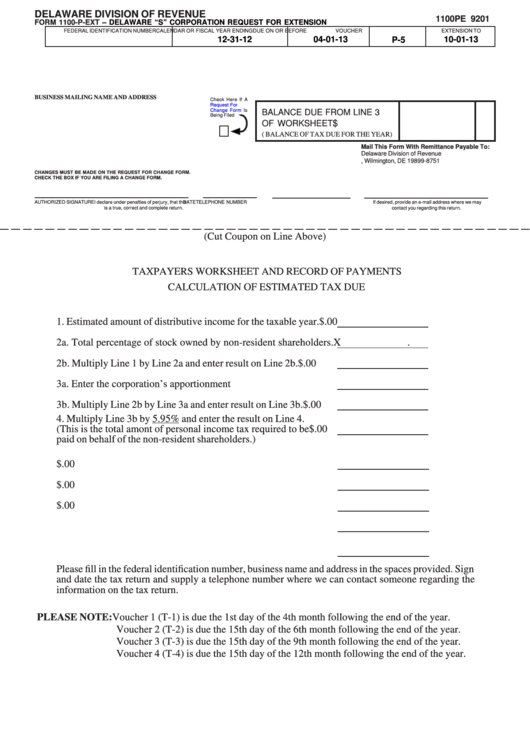

Fillable Form 1100PExt Delaware "S" Corporation Request For

Related Post: