Llc Extension Form

Llc Extension Form - Web use an automatic extension form to make a payment if both of the following apply: The irs will grant a reasonable extension of time. Launch for free—just pay state fees. $0 + state filing fees. Web use form ftb 3537, payment for automatic extension for llcs, only if both of the following apply: Comprehensive support to start, run & grow your llc. Ad don't wait any longer to shield yourself from business liabilities. Expert guidance for the best way to open your llc. Taxpayers in certain disaster areas do not need to submit an extension. Web you must file your extension request no later than the regular due date of your return. Ad let us help you open your llc and start your business journey. Web california grants an automatic extension of time to file a return. 16, 2023 — the internal revenue service today further postponed tax deadlines for most california taxpayers to nov. Web if you need an extension for llc with regard to paying your business tax return, you. Try bench because of this flexibility, llcs don’t have a set tax. You cannot file your tax return by the original due date you owe taxes for the current tax year. If the arizona corporate commission approves your llc, you will need to publish a notice of the llc's formation in an approved legal newspaper. Ad let us help you. Web file form 7004 based on the appropriate tax form shown below: The llc cannot file form 568 by the original due date. The llc needs to file a 1065 partnership return and. Web an llc may be eligible for late election relief in certain circumstances. In the wake of last winter’s. Ad don't wait any longer to shield yourself from business liabilities. The llc needs to file a 1065 partnership return and. To request an extension to file income tax returns after the due date, use the form that applies to you. Limited liability company (llc) corporation (c corp, s corp) doing business as (dba) nonprofit. In the wake of last. Web use form ftb 3537, payment for automatic extension for llcs, only if both of the following apply: Web series limited liability company an llc being taxed as a corporation an llc must have the same classification for both california and federal tax purposes. Our business specialists help you incorporate your business. In the wake of last winter’s. You must. Web the california revised uniform limited liability company act (california corporations code sections 17701.01 through 17713.13) authorizes the formation of llcs in. Application for automatic extension of time to file certain business income tax,. Web series limited liability company an llc being taxed as a corporation an llc must have the same classification for both california and federal tax purposes.. You cannot file your tax return by the original due date you owe taxes for the current tax year. Web how to apply for a tax extension other important tax deadlines tired of doing your own books? Please remind your smllc clients. Web use form ftb 3537, payment for automatic extension for llcs, only if both of the following apply:. The llc needs to file a 1065 partnership return and. Expert guidance for the best way to open your llc. Ad let us help you open your llc and start your business journey. Web you must file your extension request no later than the regular due date of your return. Web a limited liability company (llc) is a flexible form. Expert guidance for the best way to open your llc. The llc cannot file form 568 by the original due date. Please remind your smllc clients. Ad let us help you open your llc and start your business journey. Web llc plans start at $0 + filing fees. Please remind your smllc clients. Web a limited liability company (llc) is a flexible form of enterprise that blends elements of the partnership and corporate structures. Web file form 7004 based on the appropriate tax form shown below: Web file irs form 4868 to obtain an extension for a single member llc. You cannot file your tax return by the. If the arizona corporate commission approves your llc, you will need to publish a notice of the llc's formation in an approved legal newspaper. Web file irs form 4868 to obtain an extension for a single member llc. You cannot file your tax return by the original due date you owe taxes for the current tax year. Our business specialists help you incorporate your business. Expert guidance for the best way to open your llc. The irs will grant a reasonable extension of time. Expert guidance for the best way to open your llc. Comprehensive support to start, run & grow your llc. Comprehensive support to start, run & grow your llc. Web use an automatic extension form to make a payment if both of the following apply: Web how to apply for a tax extension other important tax deadlines tired of doing your own books? Page last reviewed or updated: Please remind your smllc clients. Web file form 7004 based on the appropriate tax form shown below: Taxpayers in certain disaster areas do not need to submit an extension. Web about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns. An extension of time to file is not an extension of time to pay the llc tax or fee. Limited liability company (llc) corporation (c corp, s corp) doing business as (dba) nonprofit. Launch for free—just pay state fees. $0 + state filing fees.Corporation return due date is March 16, 2015Cary NC CPA

3.11.212 Applications for Extension of Time to File Internal Revenue

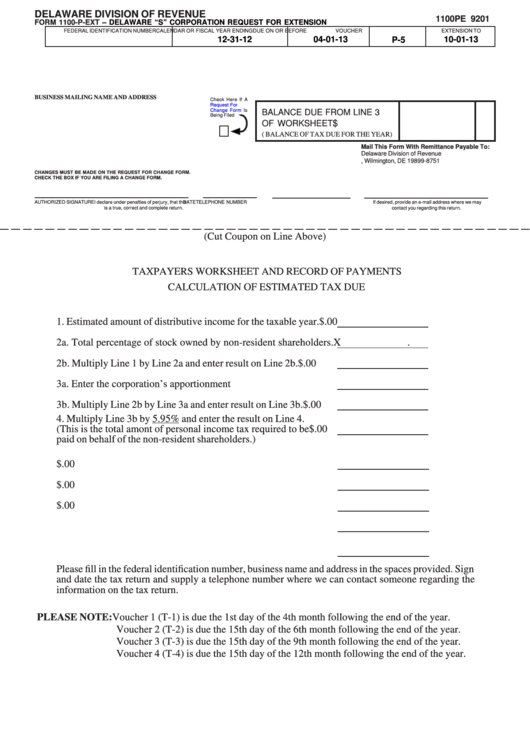

Fillable Form 1100PExt Delaware "S" Corporation Request For

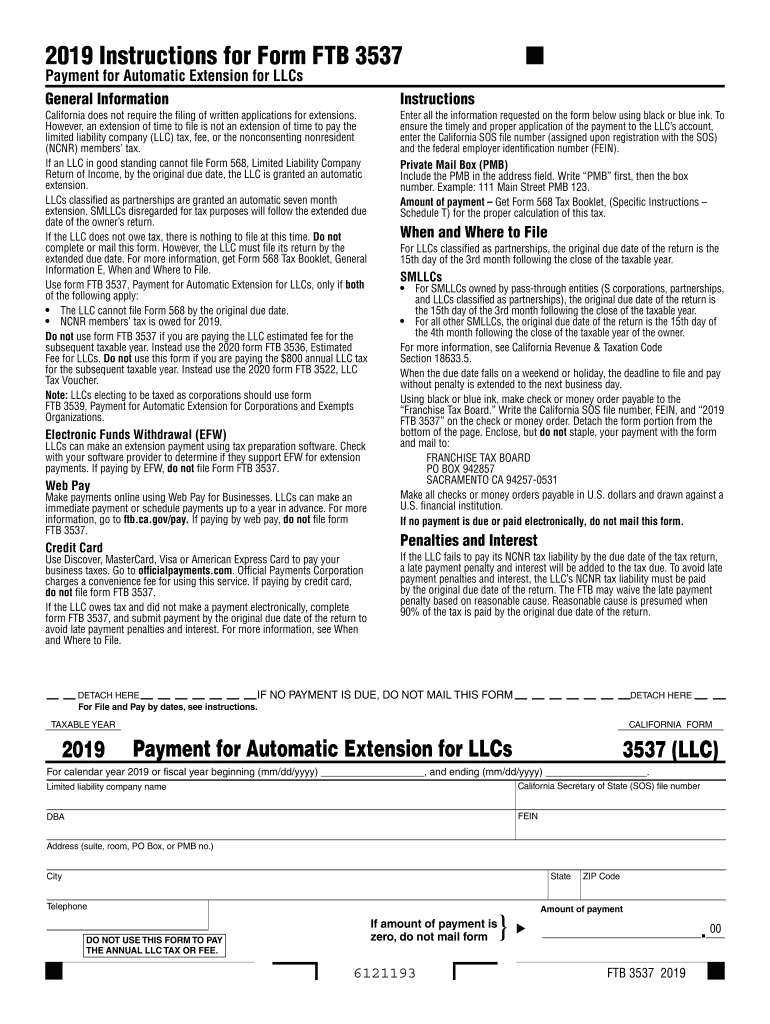

California Form 3537 LLC Payment For Automatic Extension For LLCs

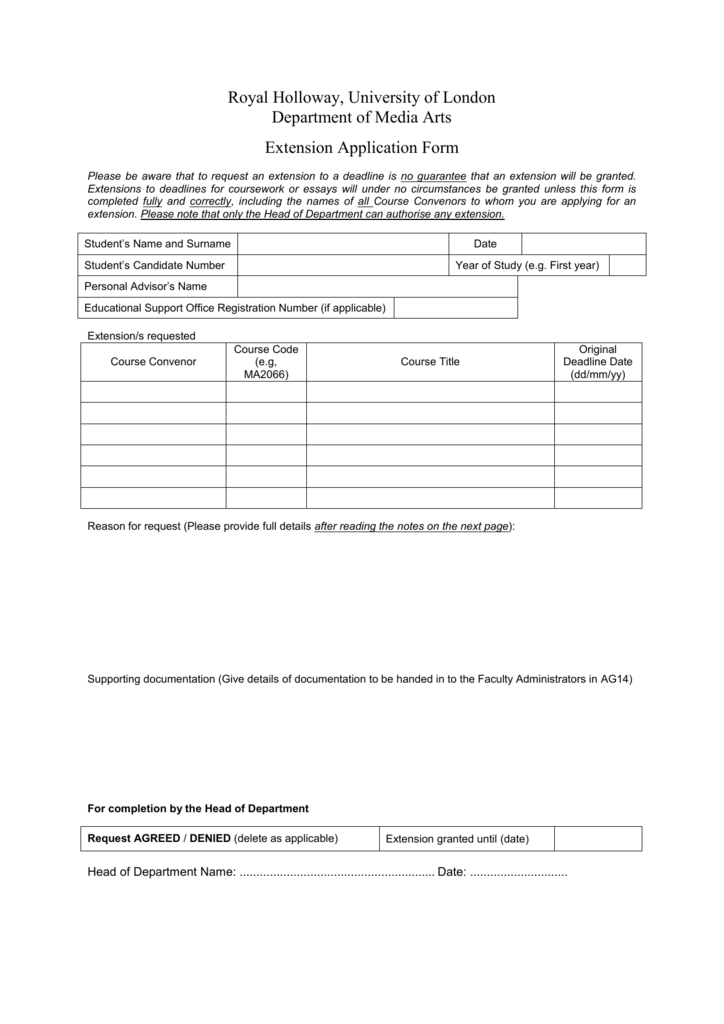

Extension Request Form

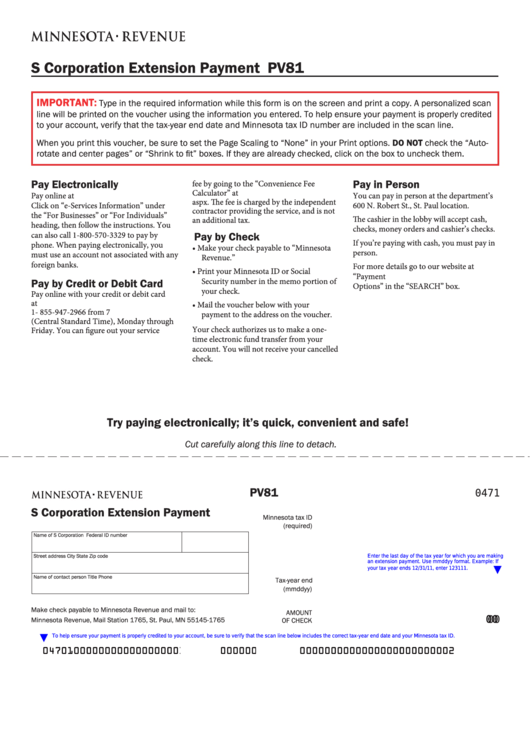

Fillable Form Pv81 S Corporation Extension Payment printable pdf download

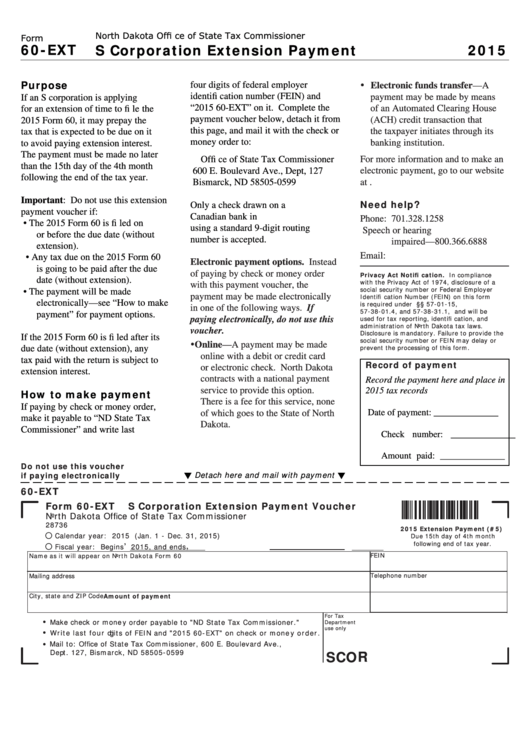

Fillable Form 60Ext S Corporation Extension Payment Voucher 2015

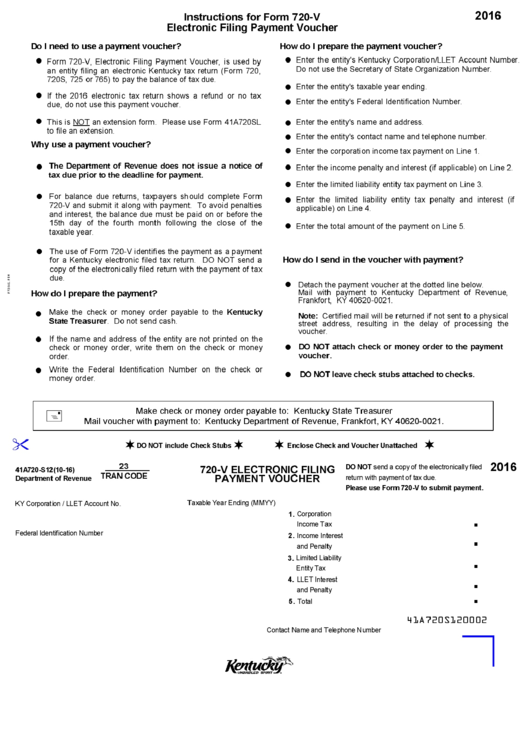

2016 extension form for llc csdad

Irs extension form 4868 Fill out & sign online DocHub

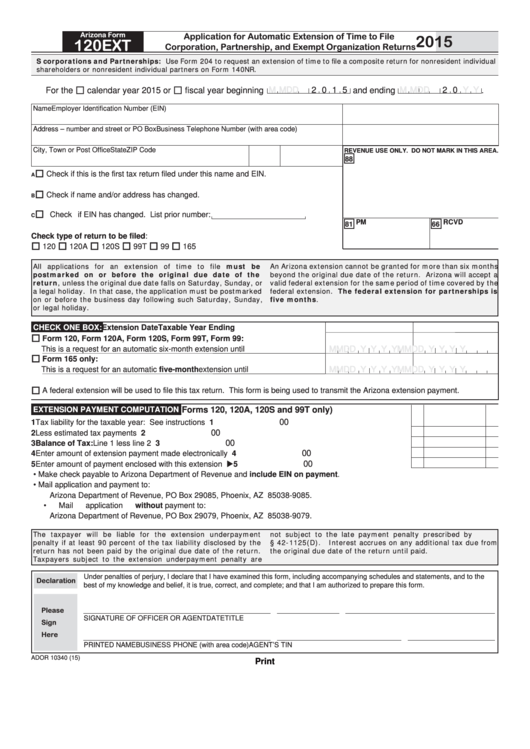

Fillable Arizona Form 120ext Application For Automatic Extension Of

Related Post: