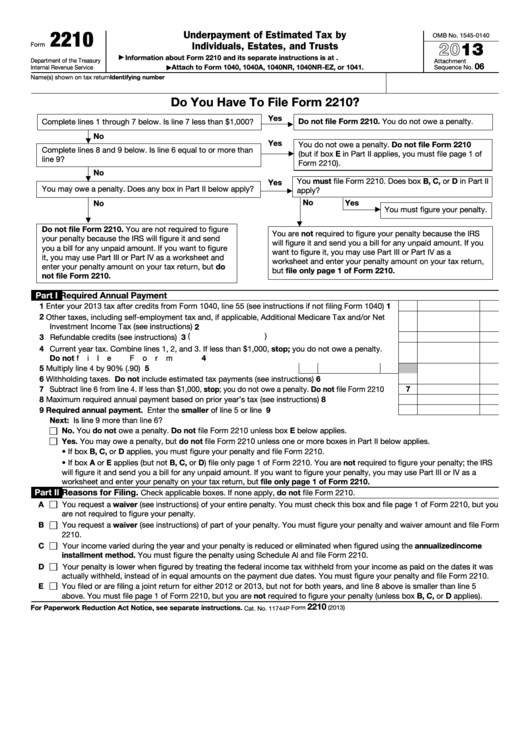

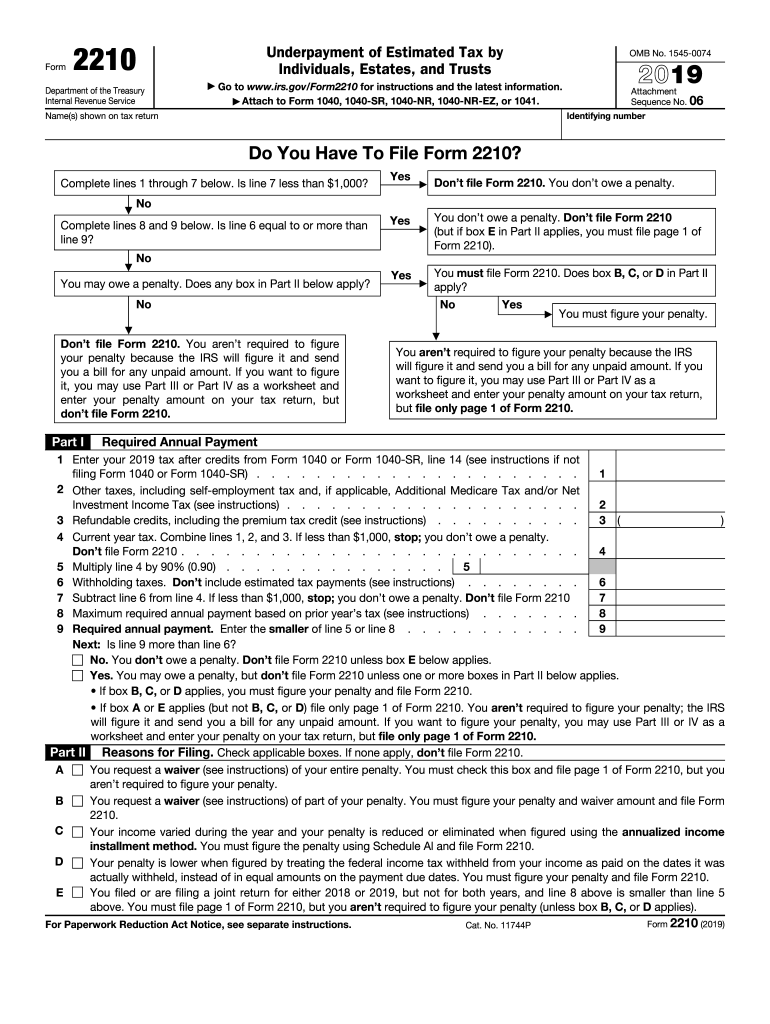

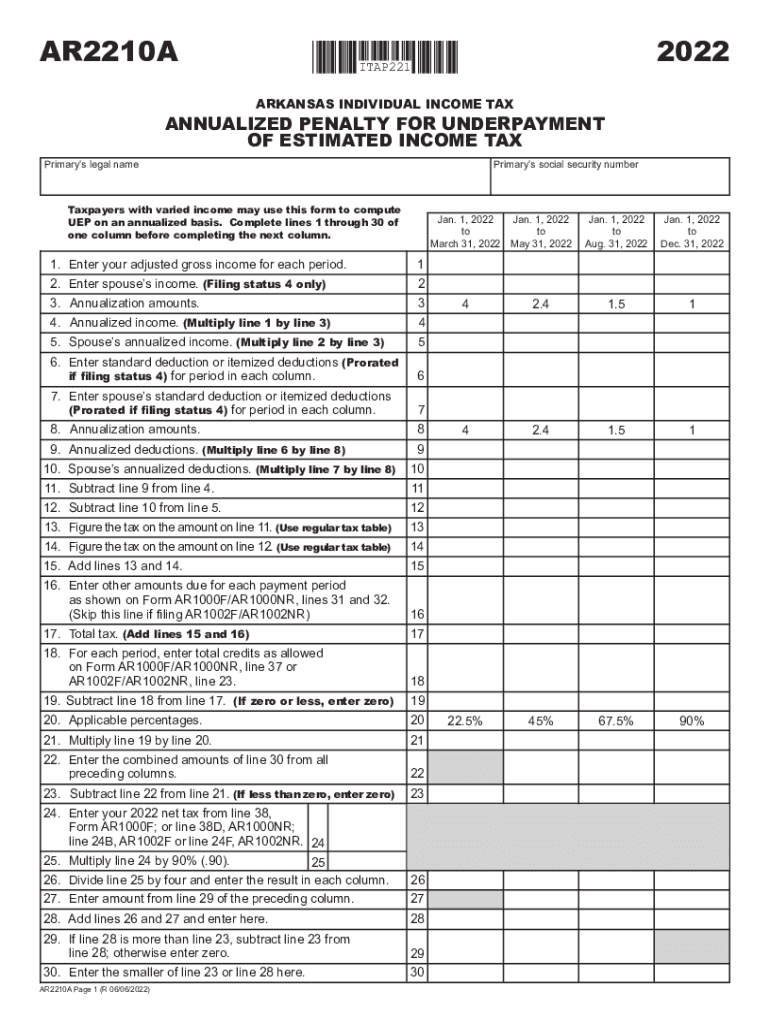

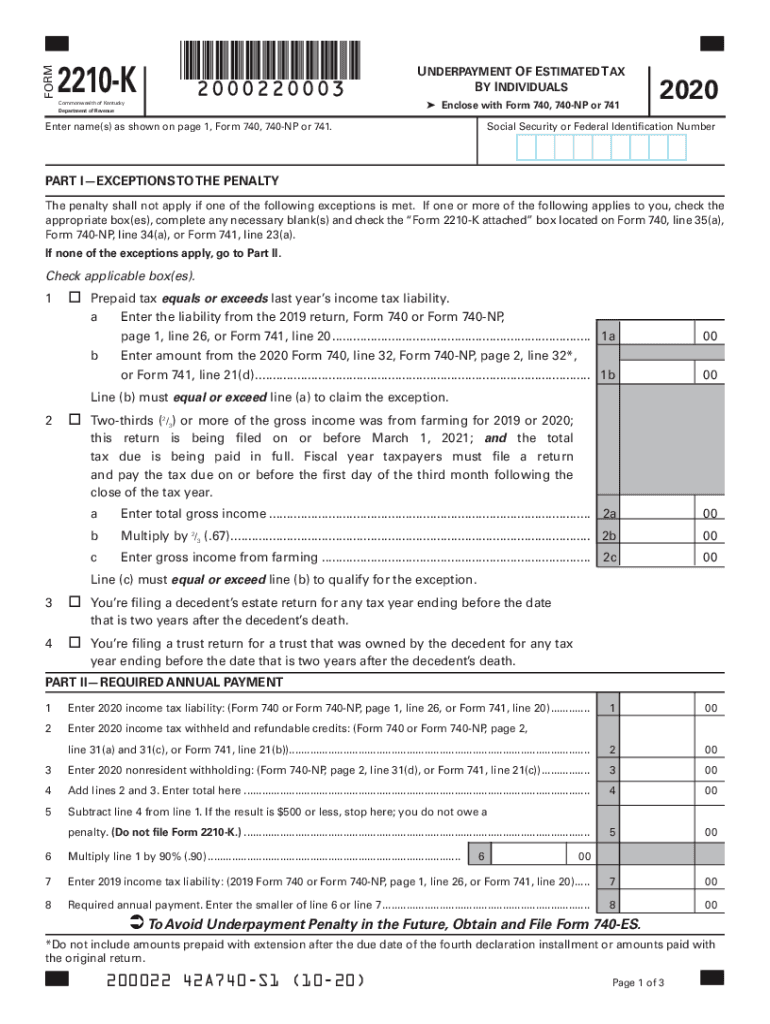

Line 8 Form 2210

Line 8 Form 2210 - Below, you'll find answers to frequently asked questions. Web form 2210 underpayment of estimated tax, is used to calculate any penalties incurred due to underpayment of taxes over the course of the year. 110% of prior year tax for taxpayers with prior. Web complete lines 8 and 9 below. Is line 6 equal to or more than line 9? Web refundable part of the american opportunity credit (form 8863, line 8). Form 2210 is typically used by. Enter the penalty on form 2210, line 19, and on the “estimated tax penalty” line on your tax return. Ad access irs tax forms. Web on line 7, subtract the amount of line 6 from line 4 and enter it, remember if it is less than $1000 you do not have to file form 2210. Don’t file form 2210 (but if box e in part ii applies, you must file page 1 of form. If yes, the taxpayer does not owe a penalty and will not. Yes you don’t owe a penalty. Enter the penalty on form 2210, line 19, and on the “estimated tax penalty” line on your tax return. No d complete lines. Is line 6 equal to or more than line 9? You must figure your penalty and file form 2210. Premium tax credit (form 8962). Web form 2210 underpayment of estimated tax, is used to calculate any penalties incurred due to underpayment of taxes over the course of the year. Web complete lines 8 and 9 below. Web actually withheld, instead of in equal amounts on the payment due dates. Web on line 7, subtract the amount of line 6 from line 4 and enter it, remember if it is less than $1000 you do not have to file form 2210. Credit for federal tax paid on fuels. Don’t file form 2210 unless box e in part. You filed or are filing a joint return for either 2012 or. Premium tax credit (form 8962). Don’t file form 2210 (but. Yes you don’t owe a penalty. Ad access irs tax forms. Don’t file form 2210 unless box e in part ii applies, then file page 1 of form. Web on line 7, subtract the amount of line 6 from line 4 and enter it, remember if it is less than $1000 you do not have to file form 2210. Web worksheet (worksheet for form 2210, part iv, section b—figure the penalty),. Get ready for tax season deadlines by completing any required tax forms today. Don’t file form 2210 unless box e in part ii applies, then file page 1 of form. Common questions about form 2210 in lacerte. No d complete lines 8 and 9 below. Is line 6 equal to or more than line 9? While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn. Web adon’t file form 2210. Yes you don’t owe a penalty. Solved•by intuit•15•updated july 12, 2023. Common questions about form 2210 in lacerte. Web refundable part of the american opportunity credit (form 8863, line 8). If yes, the taxpayer does not owe a penalty and will not. Yes adon’t file form 2210. You must figure your penalty and file form 2210. Common questions about form 2210 in lacerte. Web adon’t file form 2210. Web form 2210 is a federal individual income tax form. Yes you don’t owe a penalty. Common questions about form 2210 in lacerte. Web form 2210 is used to determine how much you owe in underpayment penalties on your balance due. Web for form 2210, part iii, section b—figure the penalty), later. Enter the penalty on form 2210, line 27, and on the “estimated tax penalty” line on your tax. Web on line 7, subtract the amount of line 6 from line 4 and enter it, remember if it is less than $1000 you do not have to file form 2210.. Web form 2210 line 8 underpayment penalty hi, i'm trying to match my software's calculation of my underpayment penalty with instructions for form 2210 line. After completing lines 8 and 9 on irs form 2210, is the value on line 6 equal to or greater than the value on line 9? Don’t file form 2210 unless box e in part ii applies, then file page 1 of form. Web form 2210 underpayment of estimated tax, is used to calculate any penalties incurred due to underpayment of taxes over the course of the year. Is line 6 equal to or more than line 9? Web on line 7, subtract the amount of line 6 from line 4 and enter it, remember if it is less than $1000 you do not have to file form 2210. Qualified sick and family leave credits. Is line 6 equal to or more than line 9? Yes a you don’t owe a penalty. Web complete lines 8 and 9 below. On line 8, enter the amount of. Web refundable part of the american opportunity credit (form 8863, line 8). You must figure your penalty and file form 2210. You don’t owe a penalty. Form 2210 is typically used by. Complete lines 1 through 7 below. Web complete lines 8 and 9 below. Complete, edit or print tax forms instantly. Is line 6 equal to or more than line 9? Yes you don’t owe a penalty.Fill Free fillable F2210 2019 Form 2210 PDF form

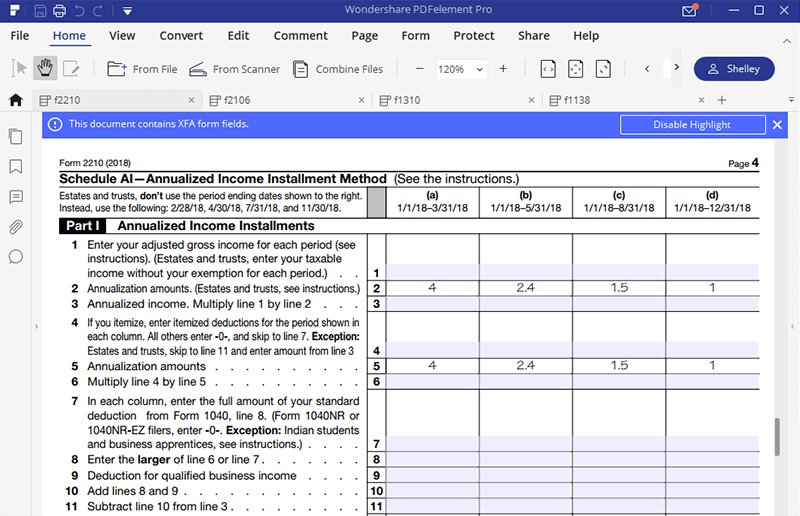

Fillable Form 2210 Underpayment Of Estimated Tax By Individuals

Instructions For Form 2210 Underpayment Of Estimated Tax By

2210 Fill Out and Sign Printable PDF Template signNow

IRS Form 2210Fill it with the Best Form Filler

2210 Form 2022 2023

Instructions for Form 2210 (2022)Internal Revenue Service Fill out

Form 2210 K Fill Out and Sign Printable PDF Template signNow

Ssurvivor Form 2210 Line 8 2018

Ssurvivor Form 2210 Line 8 2018

Related Post: