Kpers Withdrawal Form

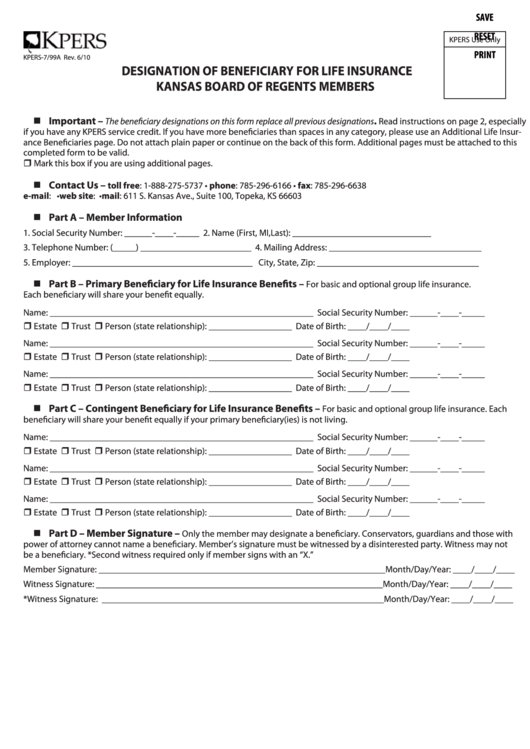

Kpers Withdrawal Form - If you are older than 70 ½, you are. Save or instantly send your ready documents. Depends on how you get the money. If there is a conflict between the information provided on this website and the. Web you'll requirement to withdraw your currency within 5 years the ending employment. Web the following tips will help you fill in kpers phone # form quickly and easily: Web retirement benefit estimate request form. Web to initiate a withdrawal or transfer of funds after termination, the participant must complete the withdrawal or transfer form provided by the retirement provider holding the. Web kpers is not responsible for the use of information obtained on this website. Use this form if you have more retirement beneficiaries. Web your kpers withdrawal payment might be taxable. Web your account earns interest for 5 years (2 years for kpers 3 members). Web your account earns interest for 5 years (2 years for kpers 3 members). Simply click done to confirm the changes. Web complete kpers withdrawal online with us legal forms. Web each cash withdrawal will be taxable to you as income and if you are under age 59 ½, there will be an additional irs penalty of 10%. Your view earns tax for 5 years (2 years for kpers 3 members). Your account earns interest for 5 years (2 per for kpers 3 members). Web the system also oversees kpers. Save or instantly send your ready documents. If you get a direct payment, you’ll owe federal income tax. Submit immediately to the recipient. Web kpers is not responsible for the use of information obtained on this website. Web your account earns interest for 5 years (2 years for kpers 3 members). Your view earns tax for 5 years (2 years for kpers 3 members). Web how do i get my money out of the retirement system (withdraw) you can apply to withdraw your contributions plus interest 31 days after your last day on your employer's. Web kansas public employees retirement sytems (kpers) you can withdraw retirement contributions after 31 days of. Pacific time, and saturdays between 6 a.m. Use this form if you have more retirement beneficiaries. Depends on how you get the money. Your view earns tax for 5 years (2 years for kpers 3 members). If you are older than 70 ½, you are. Your account earns interest for 5 years (2 per for kpers 3 members). Depends on how you get the money. Uncle sam says kpers has to. If you get a direct payment, you’ll owe federal income tax. Web your account earns interest for 5 years (2 years for kpers 3 members). Depends on how you get the money. Use get form or simply click on the template preview to open it in the editor. Uncle sam says kpers has to. If you are older than 70 ½, you are. Web kpers is not responsible for the use of information obtained on this website. Uncle sam says kpers has to. Web kansas public employees retirement system (kpers) : Web to initiate a withdrawal or transfer of funds after termination, the participant must complete the withdrawal or transfer form provided by the retirement provider holding the. Use this form if you have more retirement beneficiaries. Your view earns tax for 5 years (2 years for. Submit immediately to the recipient. Web your account earns interest for 5 years (2 years for kpers 3 members). If there is a conflict between the information provided on this website and the. Your view earns tax for 5 years (2 years for kpers 3 members). If you are older than 70 ½, you are. If there is a conflict between the information provided on this website and the. Pacific time, and saturdays between 6 a.m. Web the system also oversees kpers 457, a voluntary deferred compensation plan for state and many local employees. Uncle sam says kpers has to. All kpers 2 current service and purchased service is included in this category. Web your account earns interest for 5 years (2 years for kpers 3 members). Web use your electronic signature to the pdf page. If you are older than 70 ½, you are. Web kansas public employees retirement sytems (kpers) you can withdraw retirement contributions after 31 days of your termination date through completion of an application. Easily fill out pdf blank, edit, and sign them. If there is a conflict between the information provided on this website and the. Depends on how you get the money. Web each cash withdrawal will be taxable to you as income and if you are under age 59 ½, there will be an additional irs penalty of 10%. Download the data file or print your copy. Use this form if you have more retirement beneficiaries. Your view earns tax for 5 years (2 years for kpers 3 members). Web the system also oversees kpers 457, a voluntary deferred compensation plan for state and many local employees. Web you'll need to withdraw your money included 5 years of ending employment. Use get form or simply click on the template preview to open it in the editor. Web your account earns interest for 5 years (2 years for kpers 3 members). Pacific time, and saturdays between 6 a.m. Simply click done to confirm the changes. Web you'll requirement to withdraw your currency within 5 years the ending employment. All kpers 2 current service and purchased service is included in this category. Save or instantly send your ready documents.Fillable Form Kpers7/99a Designation Of Beneficiary For Life

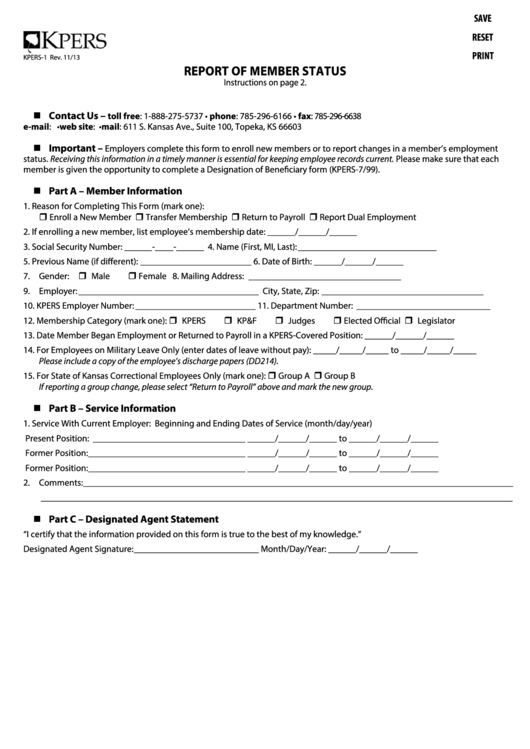

Fillable Form Kpers1 Report Of Member Status printable pdf download

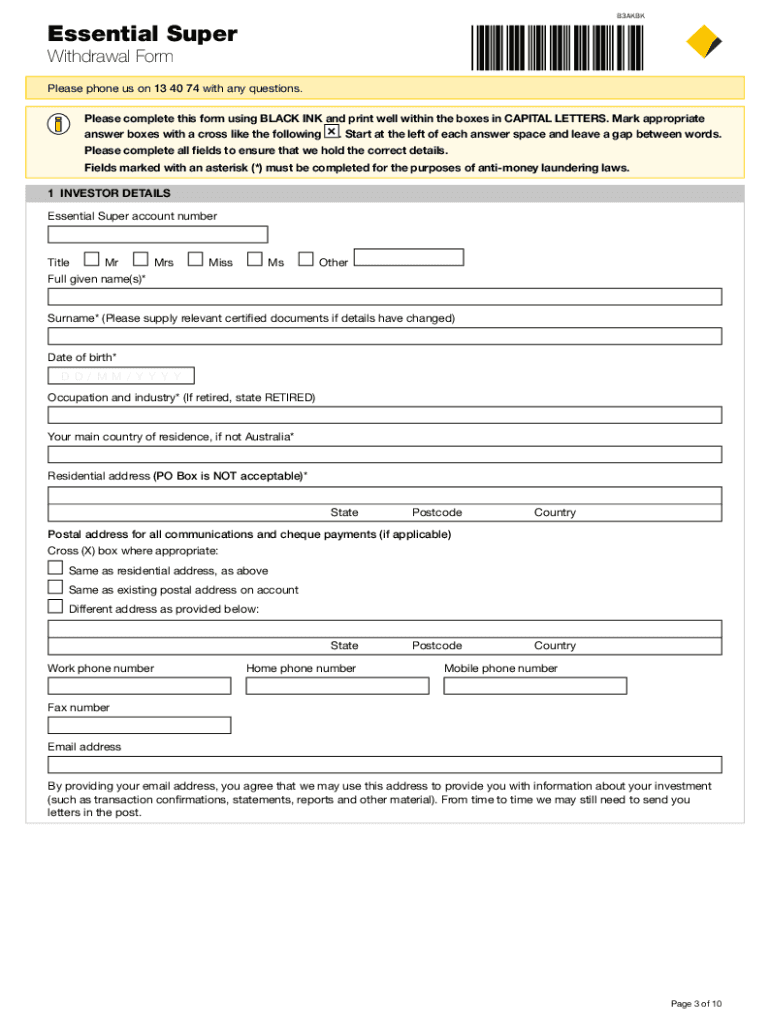

Essential Super Withdrawal Form Fill Out and Sign Printable PDF

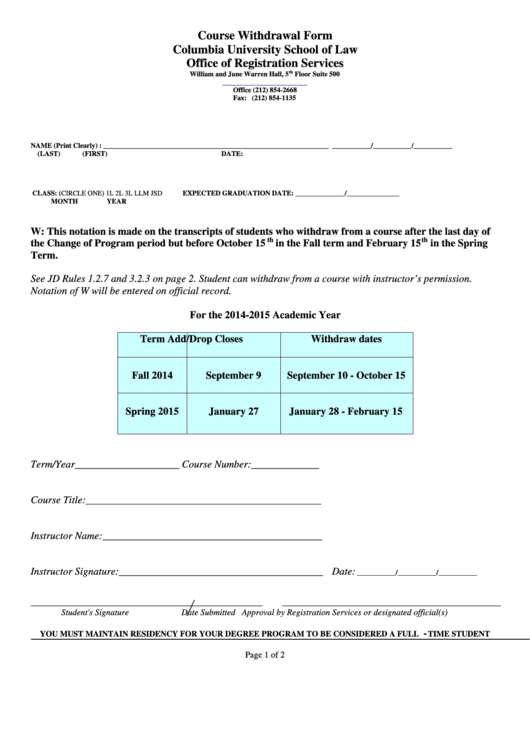

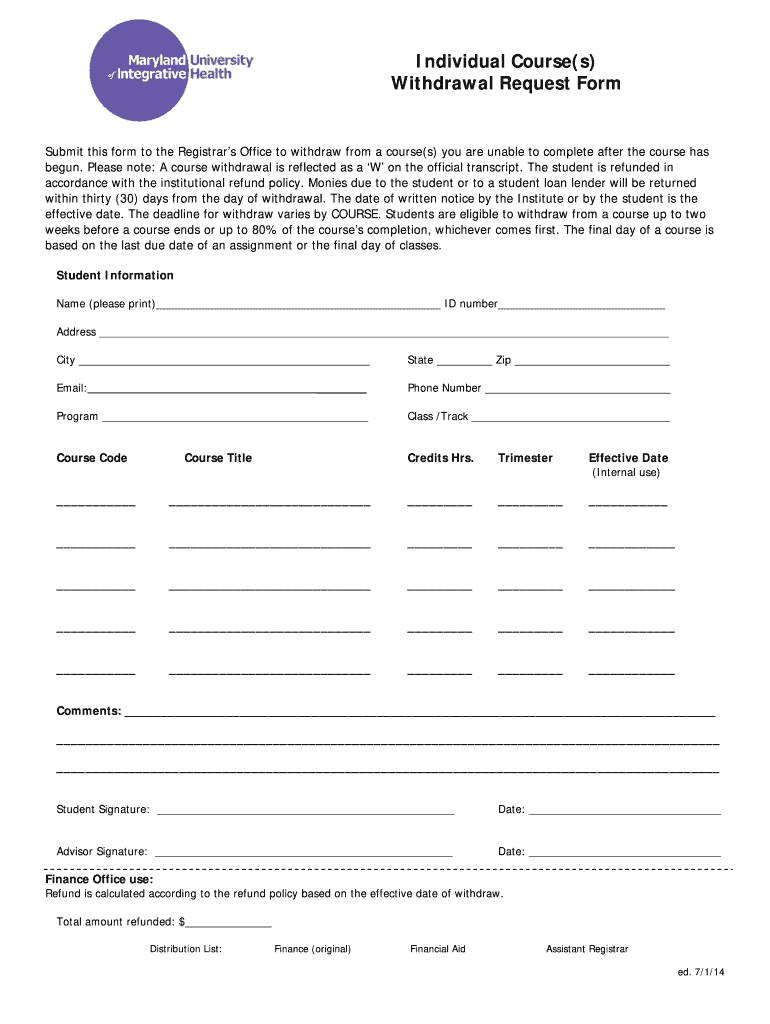

Sample Course Withdrawal Form printable pdf download

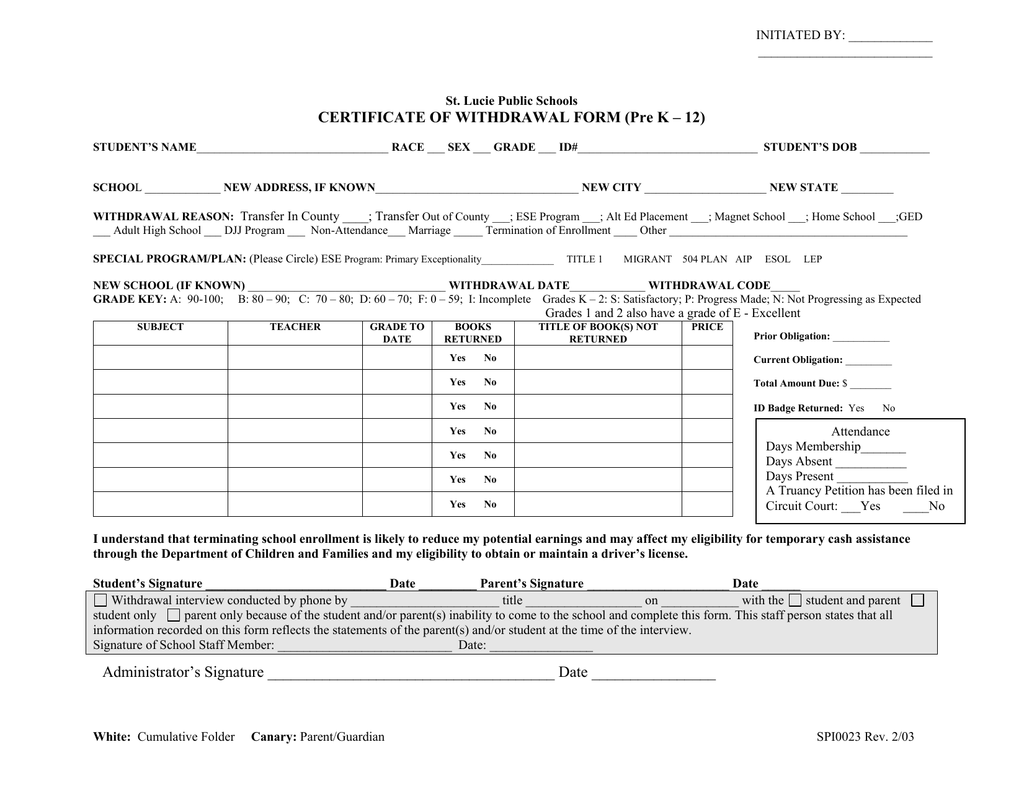

CERTIFICATE OF WITHDRAWAL FORM (Pre K 12)

Cwi Withdrawal Form Fill Out and Sign Printable PDF Template signNow

Does A Withdrawal Look Bad Fill Out and Sign Printable PDF Template

Artifact 5 PF Withdrawal Application.pdf Taxation Payments Free

PF Withdrawal FORM Cheque Payments

Post Office Withdrawal Form Fill Out and Sign Printable PDF Template

Related Post: