K1 Form 1065 Instructions

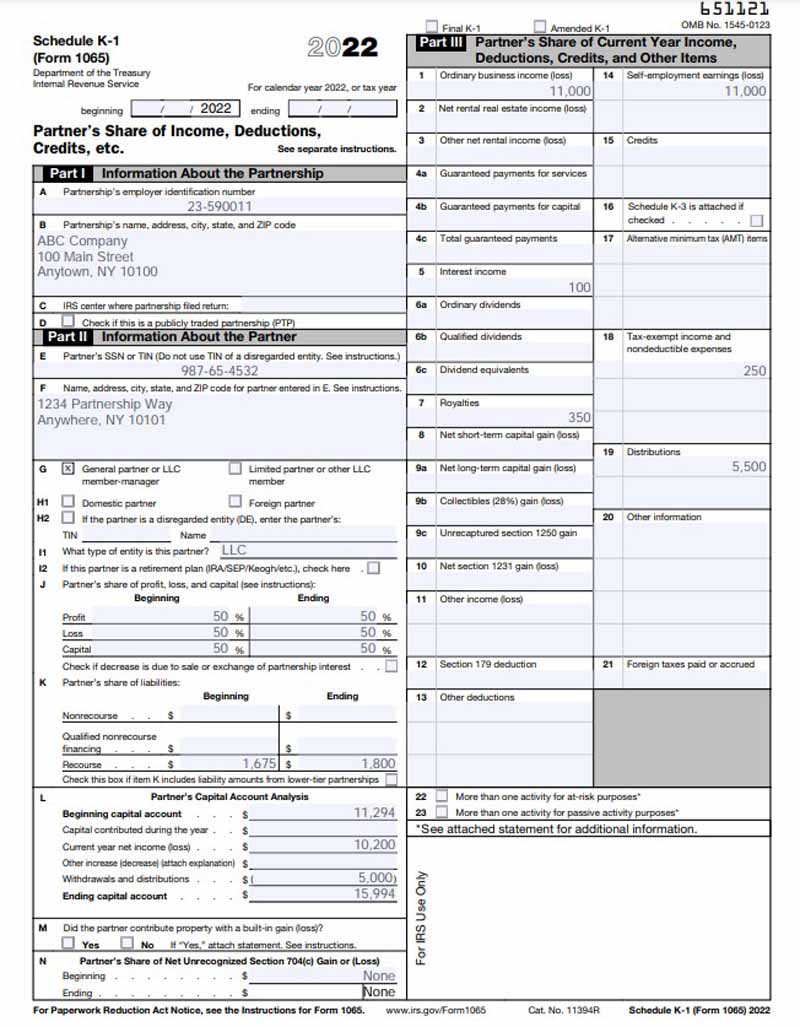

K1 Form 1065 Instructions - For calendar year 2022, or tax year beginning / / 2022. Upload, modify or create forms. Ad get ready for tax season deadlines by completing any required tax forms today. Department of the treasury internal revenue service. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. For instructions and the latest information. As mike9241 posted you have until 4/15/26 to amend your 2022. Web department of the treasury internal revenue service. It’s provided to partners in a business partnership to report their share of a. This instruction provides additional information needed. For a fiscal year or a short tax year, fill in the tax year. It’s provided to partners in a business partnership to report their share of a. Web department of the treasury internal revenue service. Income tax liability with respect to items of. Determine whether the income (loss) is passive or nonpassive and enter on. Try it for free now! Ending / / partner’s share of. Ad get ready for tax season deadlines by completing any required tax forms today. It’s provided to partners in a business partnership to report their share of a. Web department of the treasury internal revenue service. Ending / / partner’s share of. For calendar year 2022, or tax year beginning / / 2022. Income tax liability with respect to items of. Department of the treasury internal revenue service. For calendar year 2021, or tax year beginning / / 2021. Upload, modify or create forms. Ending / / partner’s share of. Web department of the treasury internal revenue service. The new schedules are designed to provide greater clarity for partners on how to compute their u.s. This instruction provides additional information needed. Determine whether the income (loss) is passive or nonpassive and enter on. These instructions will guide you through the process and provide important. For calendar year 2022, or tax year beginning / / 2022. 4 digit code used to identify the software developer whose application produced the bar code. Ad file partnership and llc form 1065 fed and state taxes. Department of the treasury internal revenue service. As mike9241 posted you have until 4/15/26 to amend your 2022. Determine whether the income (loss) is passive or nonpassive and enter on. Ending / / partner’s share of. For calendar year 2021, or tax year beginning / / 2021. For calendar year 2021, or tax year beginning / / 2021. Department of the treasury internal revenue service. Web department of the treasury internal revenue service. This instruction provides additional information needed. For a fiscal year or a short tax year, fill in the tax year. For instructions and the latest information. These instructions will guide you through the process and provide important. 4 digit code used to identify the software developer whose application produced the bar code. For a fiscal year or a short tax year, fill in the tax year. For calendar year 2021, or tax year beginning / / 2021. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. For instructions and the latest information. Determine whether the income (loss) is passive or nonpassive and enter on. For calendar year 2022, or tax year beginning / / 2022. Upload, modify or create forms. 4 digit code used to identify the software developer whose application produced the bar code. Ending / / partner’s share of. Ad get ready for tax season deadlines by completing any required tax forms today. As mike9241 posted you have until 4/15/26 to amend your 2022. For calendar year 2021, or tax year beginning / / 2021. It’s provided to partners in a business partnership to report their share of a. For calendar year 2022, or tax year beginning / / 2022. Income tax liability with respect to items of. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. Determine whether the income (loss) is passive or nonpassive and enter on. For instructions and the latest information. Ending / / partner’s share of. For calendar year 2022, or. Try it for free now! Upload, modify or create forms. Department of the treasury internal revenue service. Ending / / partner’s share of. These instructions will guide you through the process and provide important. For a fiscal year or a short tax year, fill in the tax year. Department of the treasury internal revenue service. The new schedules are designed to provide greater clarity for partners on how to compute their u.s. This instruction provides additional information needed. Ad get ready for tax season deadlines by completing any required tax forms today. For calendar year 2021, or tax year beginning / / 2021. 4 digit code used to identify the software developer whose application produced the bar code.Form 1065 Instructions U.S. Return of Partnership

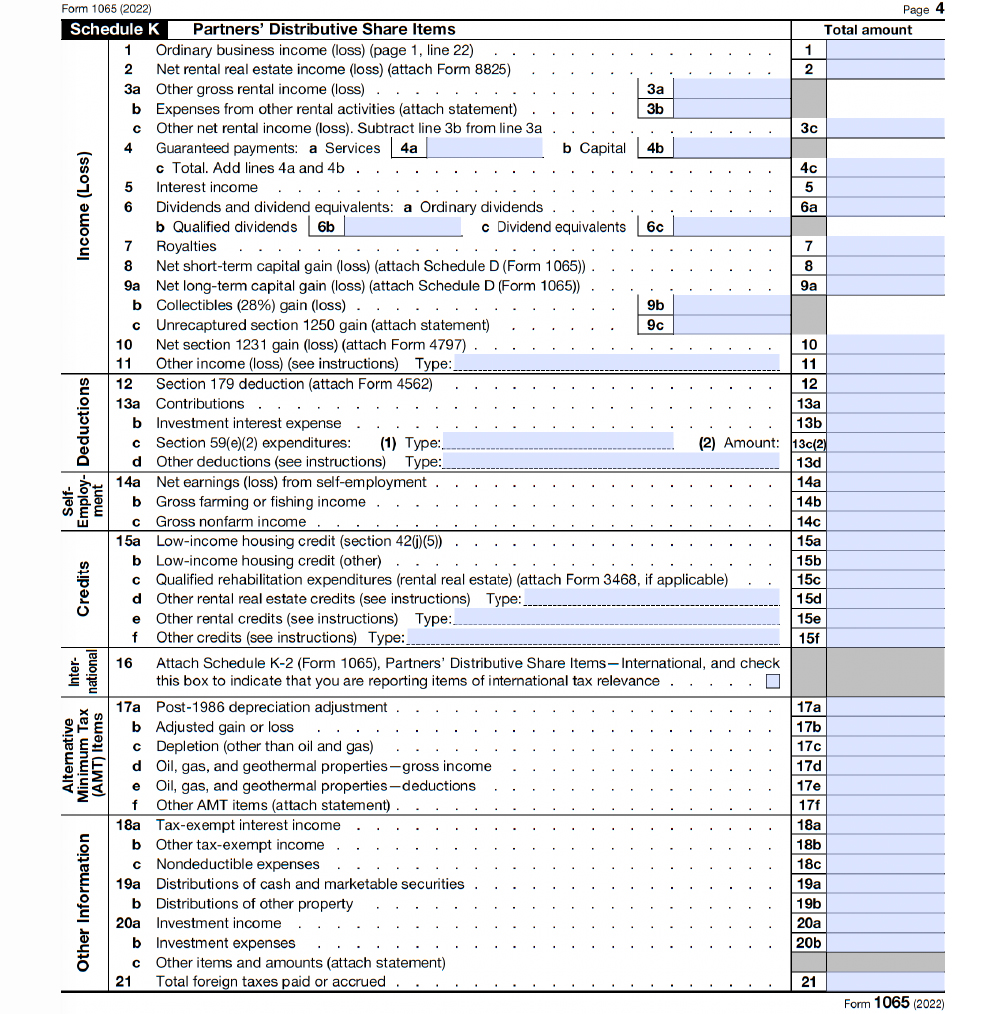

Fillable Schedule K1 (Form 1065) Partner'S Share Of

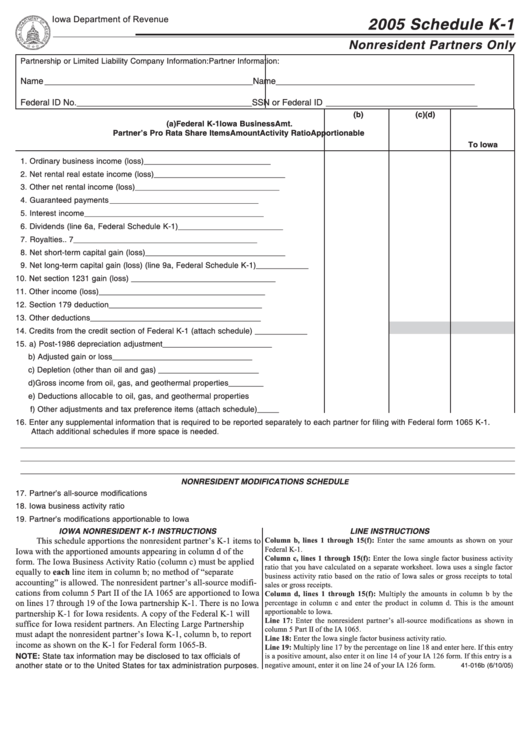

Fillable Form Ia 1065 Schedule K1 Nonresident Partners Only 2005

IRS Form 1065 (Schedule K1) 2019 Fill out and Edit Online PDF Template

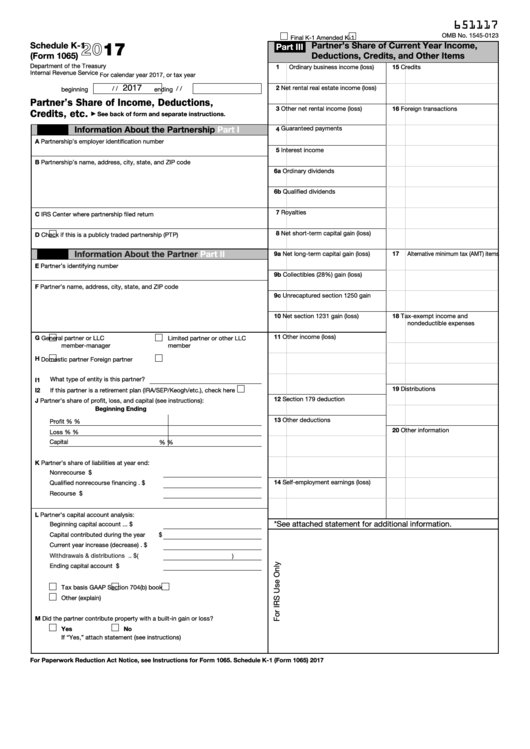

2017 Form 1065 Instructions Fill Out and Sign Printable PDF Template

schedule k1 instructions 2022 Choosing Your Gold IRA

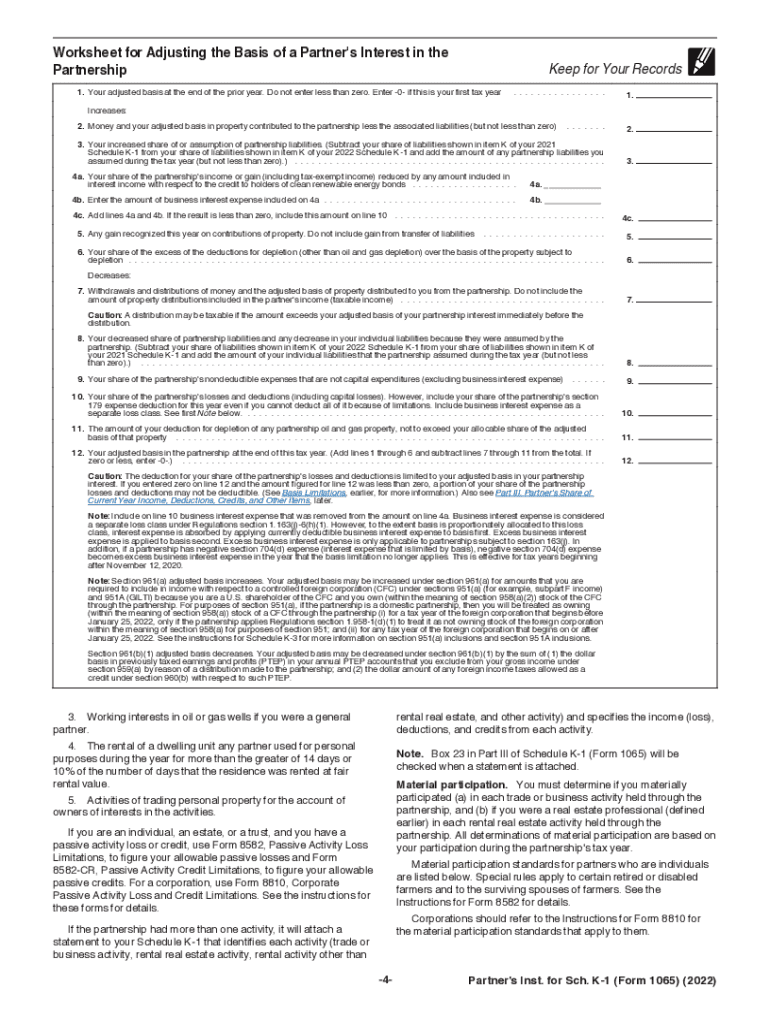

Instructions For Schedule K1 (Form 1065) Partner'S Share Of

Form 1065 StepbyStep Instructions (+Free Checklist)

How to fill out an LLC 1065 IRS Tax form

Inst 1065B (Schedule K1)Instructions for Schedule K1 (Form 1065B…

Related Post: