3922 Form Turbotax

3922 Form Turbotax - Click on take me to my return. Web if you didn't sell any espp stock, you do not need to enter anything from your form 3922. You have received this form because (1) your employer (or its transfer agent) has recorded a first transfer of legal title of stock you acquired pursuant to your. Web form 3922 is an irs tax form used by corporations to report the transfer of stock options acquired by employees under the employment stock purchase plan. Your employer (or its transfer agent) has recorded a first transfer of legal title of stock you acquired pursuant to. To get or to order these instructions, go to www.irs.gov/form3922. Ad access irs tax forms. Web form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c) solved • by intuit • 433 • updated 1 year ago. Information about form 3922, transfer of stock acquired through an employee stock purchase plan under section. Ad dochub.com has been visited by 10k+ users in the past month Solved•by turbotax•16130•updated march 13, 2023. Web form 3922, transfer of stock acquired through an employee stock purchase plan, is for informational purposes only, for your employer to report to you information on. Web 1 best answer. Ad dochub.com has been visited by 10k+ users in the past month Web only if you soldstock that was purchased through an espp (employee. Web if you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. Web page last reviewed or updated: Web form 3922 is an irs tax form used by corporations to report the transfer of stock options acquired by employees under the employment stock purchase plan. Solved•by turbotax•16130•updated march 13,. Your employer (or its transfer agent) has recorded a first transfer of legal title of stock you acquired pursuant to. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your return. Your employer will send you form 3922,. Web 1 best answer. Solved•by. Complete, edit or print tax forms instantly. Sign in or open turbotax. Web 1 best answer. You have received this form because (1) your employer (or its transfer agent) has recorded a first transfer of legal title of stock you acquired pursuant to your. Ad dochub.com has been visited by 10k+ users in the past month Information about form 3922, transfer of stock acquired through an employee stock purchase plan under section. You don't need to enter this form. Where do i enter form 3922? Click on take me to my return. Web only if you soldstock that was purchased through an espp (employee stock purchase plan). Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your return. Ad dochub.com has been visited by 10k+ users in the past month Web irs form 3922 is for informational purposes only and isn't entered into your return. Keep the form for your. Web every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option described in section. Your employer (or its transfer agent) has recorded a first transfer of legal title of stock you acquired pursuant to. Keep the form for your records because you’ll need the information. Web irs form 3922 is for informational purposes only and isn't entered into your return. Web to add form 3922 (transfer of stock acquired through employee stock purchase plan.): Web form 3922, transfer of stock acquired through an employee stock purchase plan, is for informational purposes only, for your employer to report to you information on. Signnow allows users to. Web to add form 3922 (transfer of stock acquired through employee stock purchase plan.): Web every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option described in section. If you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through. To get or to order these instructions, go to www.irs.gov/form3922. Web the instructions for form 3922 provide that there will be a value in box 8 on form 3922 if the exercise price was not fixed or determinable on the date the option was. Web irs form 3922 is for informational purposes only and isn't entered into your return. Simply. Web page last reviewed or updated: Click on take me to my return. Your employer will send you form 3922,. Information about form 3922, transfer of stock acquired through an employee stock purchase plan under section. If you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee. If you did sell any shares, you will. If you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. Web form 3922 is an irs tax form used by corporations to report the transfer of stock options acquired by employees under the employment stock purchase plan. Complete, edit or print tax forms instantly. Web form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c) solved • by intuit • 433 • updated 1 year ago. Web • the current instructions for forms 3921 and 3922. Where do i enter form 3922? Web irs form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c), is a form a taxpayer receives if they have. Web to add form 3922 (transfer of stock acquired through employee stock purchase plan.): Web the instructions for form 3922 provide that there will be a value in box 8 on form 3922 if the exercise price was not fixed or determinable on the date the option was. If you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. Sign in or open turbotax. Web if you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. Web 1 best answer. Web 1 best answer.IRS Form 3922

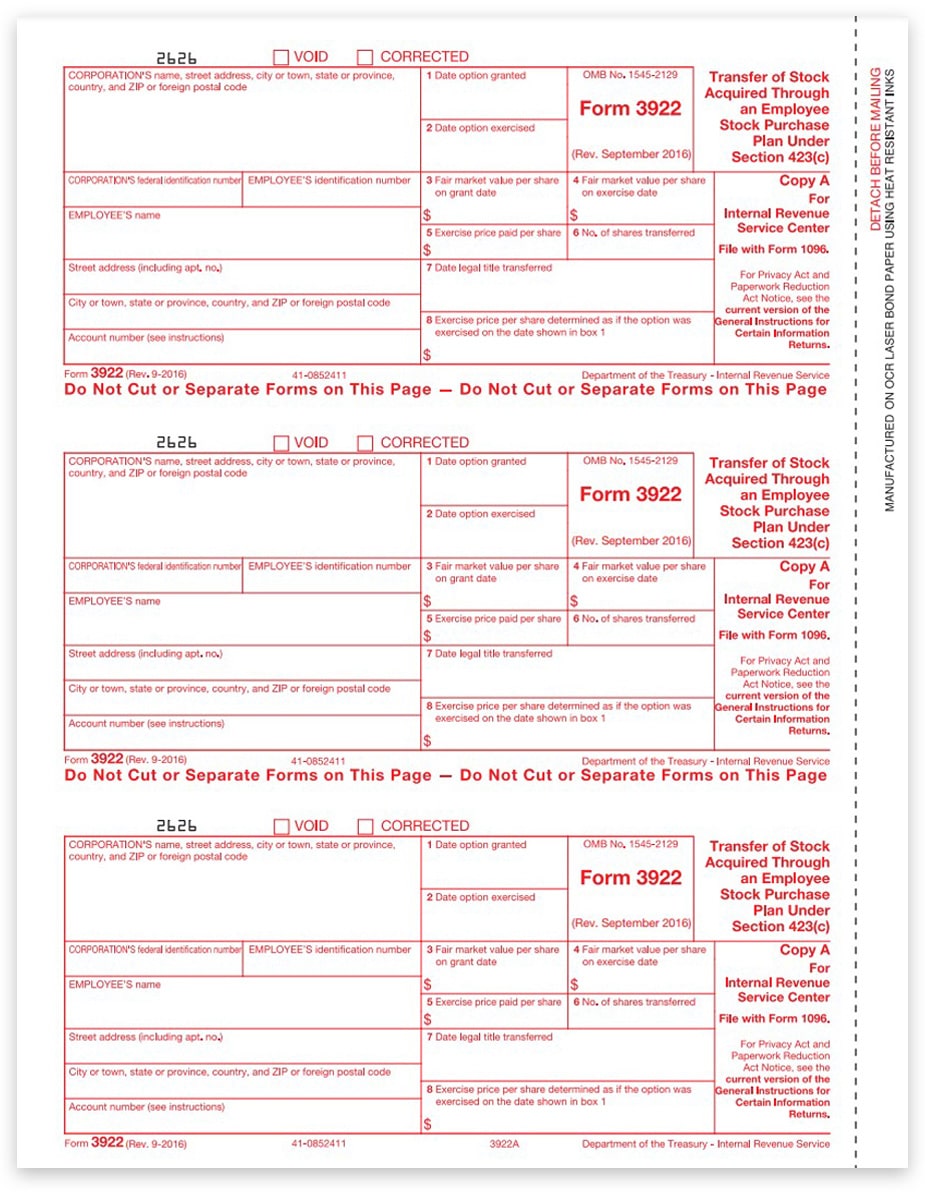

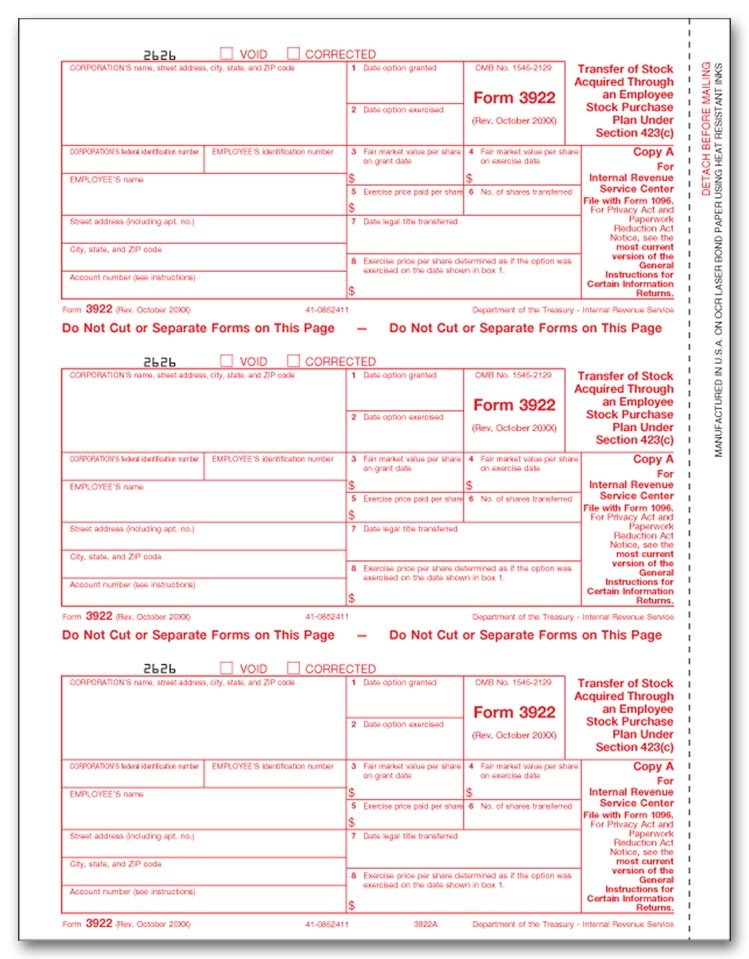

3922 Laser Tax Forms, Copy A

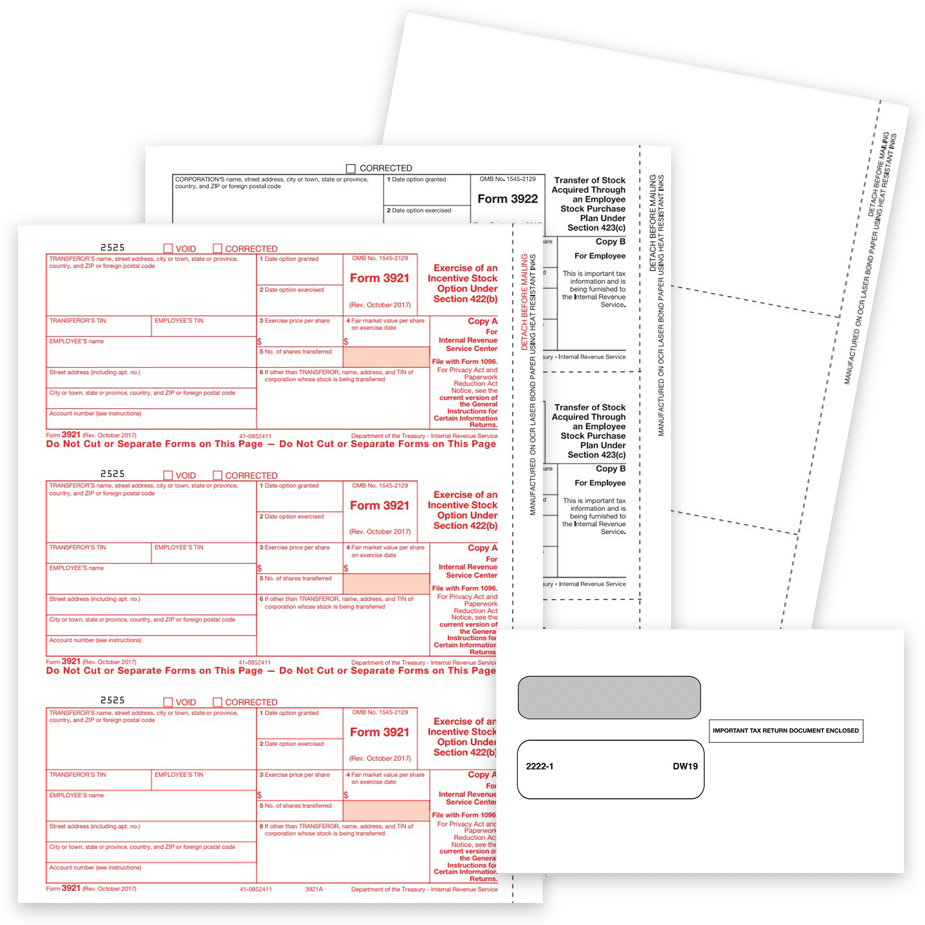

3921 & 3922 Tax Forms Discount Tax Forms

File IRS Form 3922 Online EFile Form 3922 for 2022

3922 Forms, Employee Stock Purchase, Employee Copy B DiscountTaxForms

IRS Form 3922 Instructions 2022 How to Fill out Form 3922

Form 8862 TurboTax How To Claim The EITC [The Complete Guide]

IRS Form 3922 Software 289 eFile 3922 Software

3922 Forms, Employee Stock Purchase, IRS Copy A DiscountTaxForms

3922 2020 Public Documents 1099 Pro Wiki

Related Post:

![Form 8862 TurboTax How To Claim The EITC [The Complete Guide]](https://mwjconsultancy.com/wp-content/uploads/2022/08/Screenshot-2022-08-25-170516.jpg)