K-1 Form 1065 Instructions

K-1 Form 1065 Instructions - For calendar year 2022, or tax year beginning / / 2022. Updated on january 24, 2022. Ending / / partner’s share of income, deductions, credits, etc. Per the worksheet instructions for form 1040, schedule 1, line 16: Ad get ready for tax season deadlines by completing any required tax forms today. This article is tax professional approved. Reporting information from columns (d) and (e) d. For calendar year 2021, or tax year beginning / / 2021. Other deductions, for an individual return in i. Department of the treasury internal revenue service. As mike9241 posted you have until 4/15/26 to amend your 2022 returns. The partnership has a tax year of less than 12 months that begins and. Department of the treasury internal revenue service. The 2022 form 1065 may also be used if: You need to enable javascript to run this app. Department of the treasury internal revenue service. Complete, edit or print tax forms instantly. The partnership has a tax year of less than 12 months that begins and. , 2022, ending , 20. See back of form and separate instructions. Web form 1065 instructions: Web the partnership has filed a copy with the irs. Ending / / partner’s share of income, deductions, credits, etc. Ad get ready for tax season deadlines by completing any required tax forms today. Box 13 code w from a natural gas partnership should actually be classified as. Ad get ready for tax season deadlines by completing any required tax forms today. Other deductions, for an individual return in i. See back of form and separate instructions. You need to enable javascript to run this app. 4 digit code used to identify the software developer whose application produced the bar code. You need to enable javascript to run this app. The partnership has a tax year of less than 12 months that begins and. Web recovery startup business, before january 1, 2022). Fact checked by rebecca mcclay. For instructions and the latest information. Web the partnership has filed a copy with the irs. Department of the treasury internal revenue service. For calendar year 2022, or tax year beginning. Box 13 code w from a natural gas partnership should actually be classified as. Employee stock ownership plan (esop) enterprise risk & quantitative advisory. Include your share on your tax return if a return is required. Ad get ready for tax season deadlines by completing any required tax forms today. Department of the treasury internal revenue service. Use these instructions to help you report the items shown on. This article is tax professional approved. Web 2022 565 k 1 instructions. For calendar year 2022, or tax year beginning. This article is tax professional approved. Web the american institute of cpas (aicpa) is pleased to submit suggestions on draft form 1065, u.s. The codes are no longer listed. The codes are no longer listed. Ending / / partner’s share of income, deductions, credits, etc. It’s provided to partners in a business partnership to report their share of a. Ending / / partner’s share of income, deductions, credits, etc. In general, for taxable years beginning on or after january 1, 2015, california law conforms to the irc as of. Ending / / partner’s share of income, deductions, credits, etc. Web the american institute of cpas (aicpa) is pleased to submit suggestions on draft form 1065, u.s. Department of the treasury internal revenue service. Department of the treasury internal revenue service. Complete, edit or print tax forms instantly. Other deductions, for an individual return in i. It’s provided to partners in a business partnership to report their share of a. Web the partnership has filed a copy with the irs. Web form 1065 instructions: Complete, edit or print tax forms instantly. Department of the treasury internal revenue service. Ending / / partner’s share of income, deductions, credits, etc. You need to enable javascript to run this app. , 2022, ending , 20. As mike9241 posted you have until 4/15/26 to amend your 2022 returns. Updated on january 24, 2022. For instructions and the latest information. Department of the treasury internal revenue service. 4 digit code used to identify the software developer whose application produced the bar code. The codes are no longer listed. In general, for taxable years beginning on or after january 1, 2015, california law conforms to the irc as of january 1, 2015. Ending / / partner’s share of income, deductions, credits, etc. For calendar year 2022, or tax year beginning / / 2022. The partnership has a tax year of less than 12 months that begins and. Fact checked by rebecca mcclay.Schedule K1 Form 1065 Self Employment Tax Employment Form

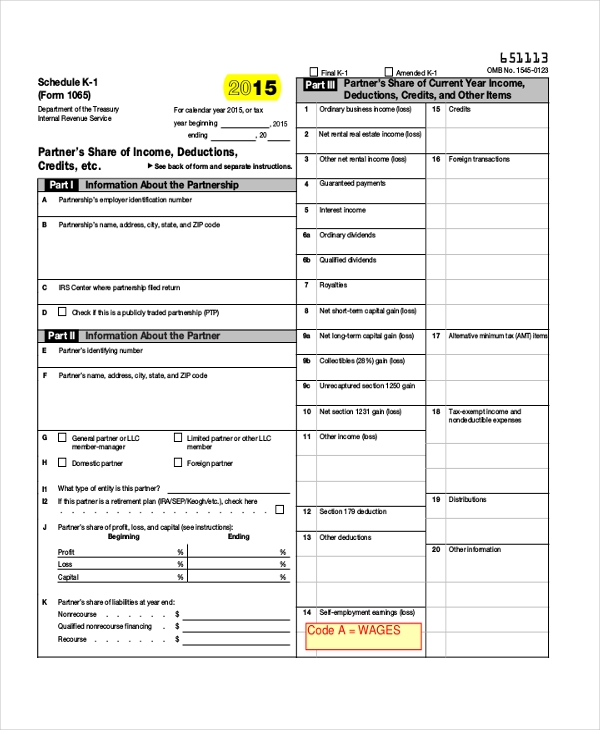

Form 1065 (Schedule K1) Partner's Share of Deductions and

IRS Instructions 1065 (Schedule K1) 2018 2019 Printable & Fillable

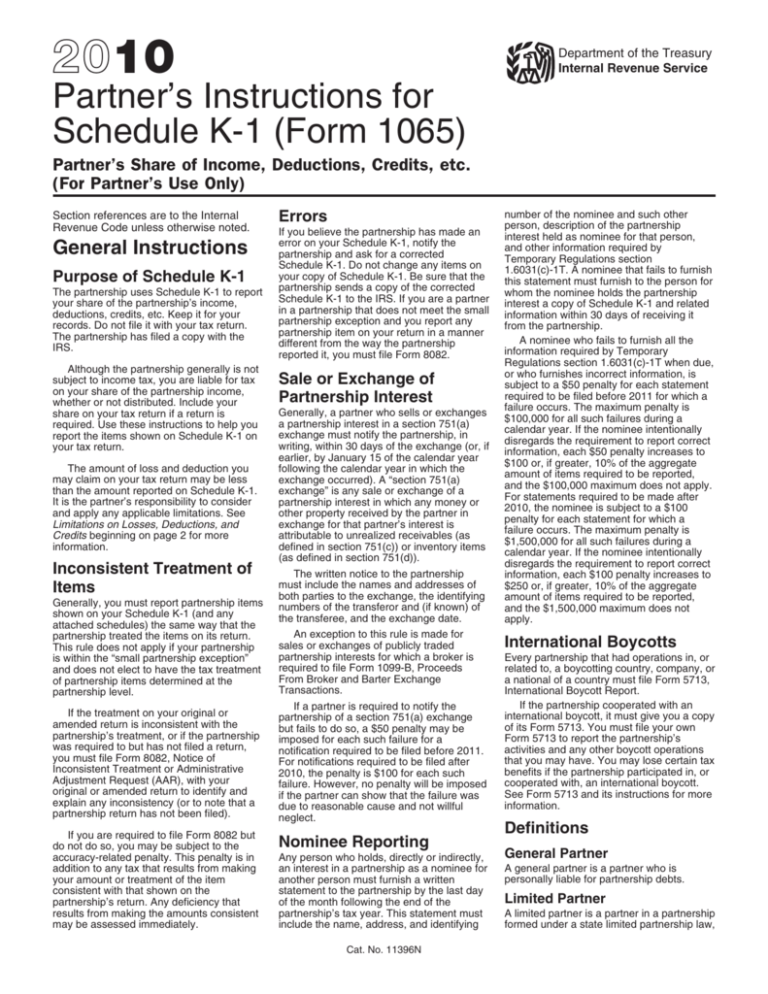

2010 Instruction 1065 Schedule K1

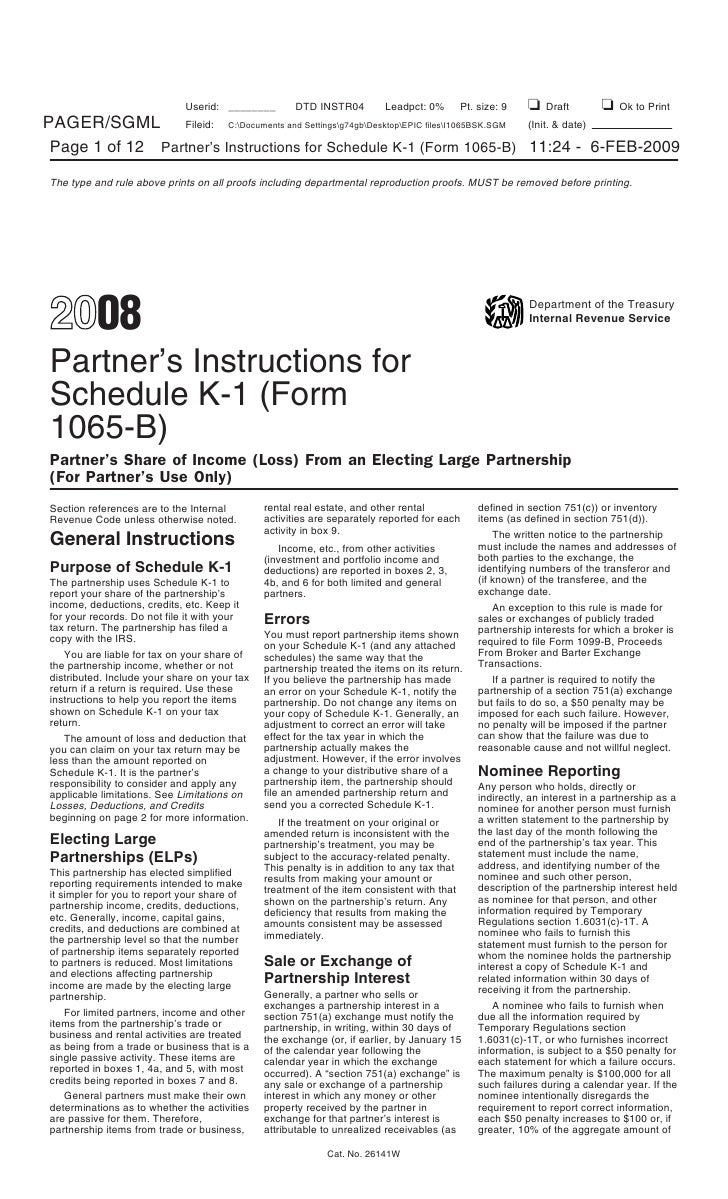

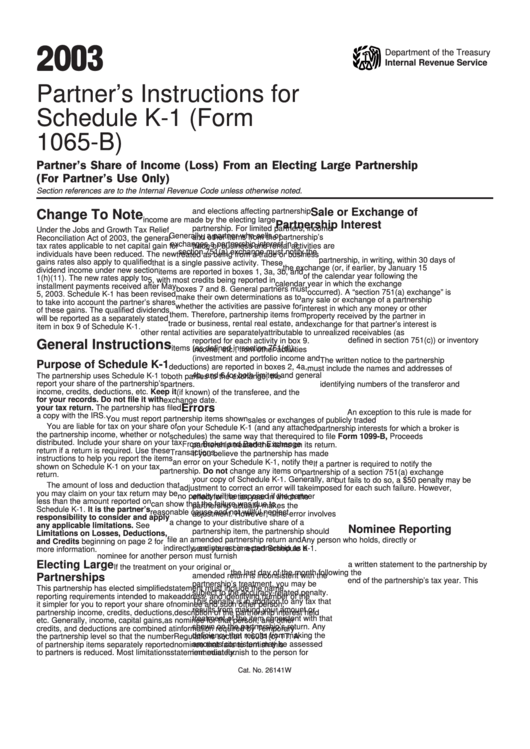

Inst 1065B (Schedule K1)Instructions for Schedule K1 (Form 1065B…

How to fill out an LLC 1065 IRS Tax form

Partner'S Instructions For Schedule K1 (Form 1065) Partner'S Share

Partner'S Instructions For Schedule K1 (Form 1065B) Partner'S Share

Schedule K1 Instructions How to Fill Out a K1 and File It Ask Gusto

Inst 1065B (Schedule K1)Instructions for Schedule K1 (Form 1065B…

Related Post: