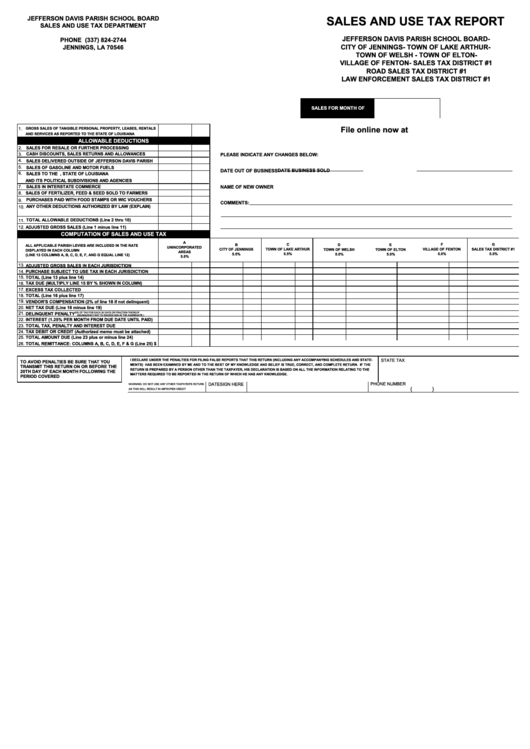

Jefferson Parish Sales Tax Form

Jefferson Parish Sales Tax Form - Web what is the rate of jefferson parish sales/use tax? Web the following local sales tax rates apply in jefferson parish: Web a manufacturer in jefferson parish. Law enforcement sales tax district #1. Web the sales/license tax division collects local sales and use taxes, occupational license tax, chain store tax, insurance premium tax, alcohol beverage permits, and. Web sales delivered outside of jefferson davis parish 5. Sales & use tax report (effective 1/1/2023) sales & use tax report (effective 7/1/2014) hotel motel tax report. If your resale certificate is expiring, or you want to apply for a resale certificate, you must apply online through. Ad pdffiller.com has been visited by 1m+ users in the past month Jefferson parish sales tax form. Streamline the entire lifecycle of exemption certificate management. Web a manufacturer in jefferson parish. Web the following local sales tax rates apply in jefferson parish: 3.50% on the sale of food items purchased for. Jefferson parish sales tax exemption certificate. 4.75% on the sale of general merchandise and certain services. Bureau of revenue and taxation sales tax division p. Taxpayers should be collecting and remitting both state and. Web what is the rate of jefferson parish sales/use tax? The following local sales tax rates apply in jefferson parish: Ad pdffiller.com has been visited by 1m+ users in the past month Ad collect and report on exemption certificates quickly to save your company time and money. Box 248, gretna, la 70054. Get jefferson parish sales tax form. 4.75% on the sale of general merchandise and certain services;. What does this sales tax rate breakdown mean? Ad collect and report on exemption certificates quickly to save your company time and money. Box 248, gretna, la 70054. The following local sales tax rates apply in jefferson parish: Sales & use tax report (effective 1/1/2023) sales & use tax report (effective 7/1/2014) hotel motel tax report. Try using our sales tax explorer tool. 4.75% on the sale of general merchandise and certain services;. Streamline the entire lifecycle of exemption certificate management. What is the mailing address to submit sales/use tax returns? Taxpayers should be collecting and remitting both state and. Web request to renew jefferson parish sales tax certificates. Taxpayers should be collecting and remitting both state and. Sales & use tax report (effective through. 4.75% on the sale of general merchandise and certain services;. If your resale certificate is expiring, or you want to apply for a resale certificate, you must apply online through. 3.50% on the sale of food items purchased for. Jefferson parish sales tax exemption certificate. Ad pdffiller.com has been visited by 1m+ users in the past month Web sales delivered outside of jefferson davis parish 5. Web the sales/license tax division collects local sales and use taxes, occupational license tax, chain store tax, insurance premium tax, alcohol beverage permits, and. The following local sales tax rates apply in jefferson parish: 3.50% on the sale of food items purchased for. Web the following local sales tax rates apply in jefferson parish: Web request to renew jefferson parish sales tax certificates. Get jefferson parish sales tax form. Jefferson parish tax jurisdiction breakdown for 2023. General government building 200 derbigny street, suite 4400 gretna, la 70053 phone: To the louisiana department of revenue special tax programs department, [email protected] for additional state sales tax information. Ad collect and report on exemption certificates quickly to save your company time and money. Need to lookup a louisiana sales tax rate by. The following local sales tax rates apply in jefferson parish: 3.50% on the sale of food items purchased for. Get jefferson parish sales tax form. 4.75% on the sale of general merchandise and certain services. Streamline the entire lifecycle of exemption certificate management. Web jefferson parish sheriff's office. To the louisiana department of revenue special tax programs department, [email protected] for additional state sales tax information. Where can i file and pay in person jefferson parish sales/use. Web request to renew jefferson parish sales tax certificates. Sales & use tax report (effective through. Web what is the rate of jefferson parish sales/use tax? Web a manufacturer in jefferson parish. Taxpayers should be collecting and remitting both state and. Box 248, gretna, la 70054. Web these online services are available 24 hours a day, 7 days a week, and provide a secure, fast, and convenient way to pay traffic tickets, and file and remit jefferson parish sales,. Streamline the entire lifecycle of exemption certificate management. Law enforcement sales tax district #1. What is the mailing address to submit sales/use tax returns? Sales & use tax report (effective 1/1/2023) sales & use tax report (effective 7/1/2014) hotel motel tax report. Need to lookup a louisiana sales tax rate by address or geographical coordinates? 4.75% on the sale of general merchandise and certain services;. Bureau of revenue and taxation sales tax division p. General government building 200 derbigny street, suite 4400 gretna, la 70053 phone: Streamline the entire lifecycle of exemption certificate management. Sales of gasoline and motor fuels 6.Jefferson Parish Sales Tax Form

Top Jefferson Parish Sales Tax Form Templates free to download in PDF

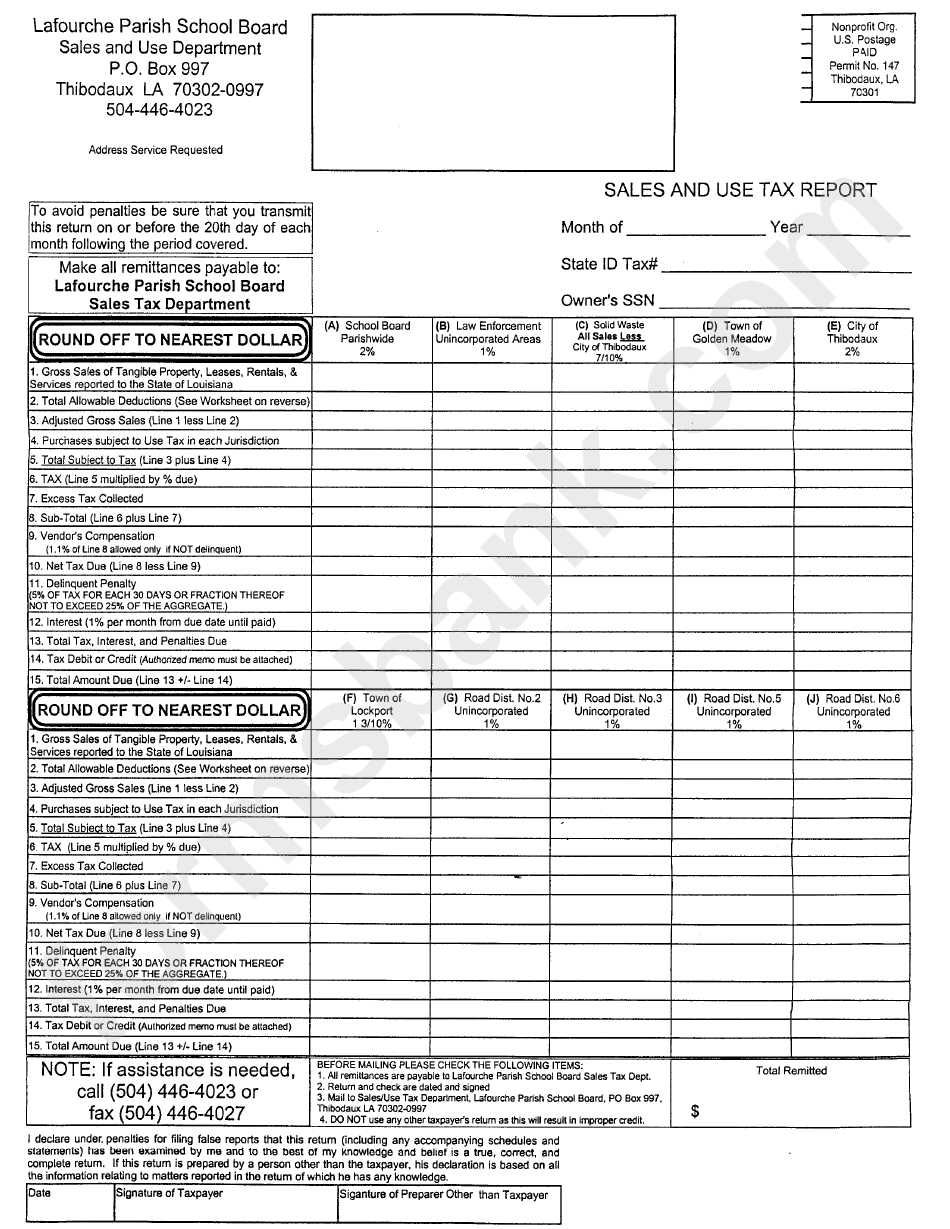

Sales And Use Tax Report Lafourche Parish printable pdf download

jefferson parish sales tax rate Jacklyn Stjohn

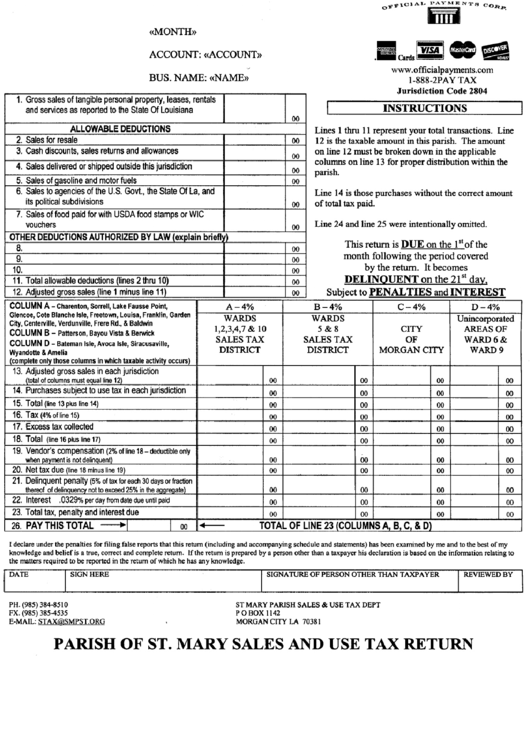

Sales And Use Tax Return Form Parish Of St Mary Printable Pdf Download

Jefferson Parish Sales Tax Form

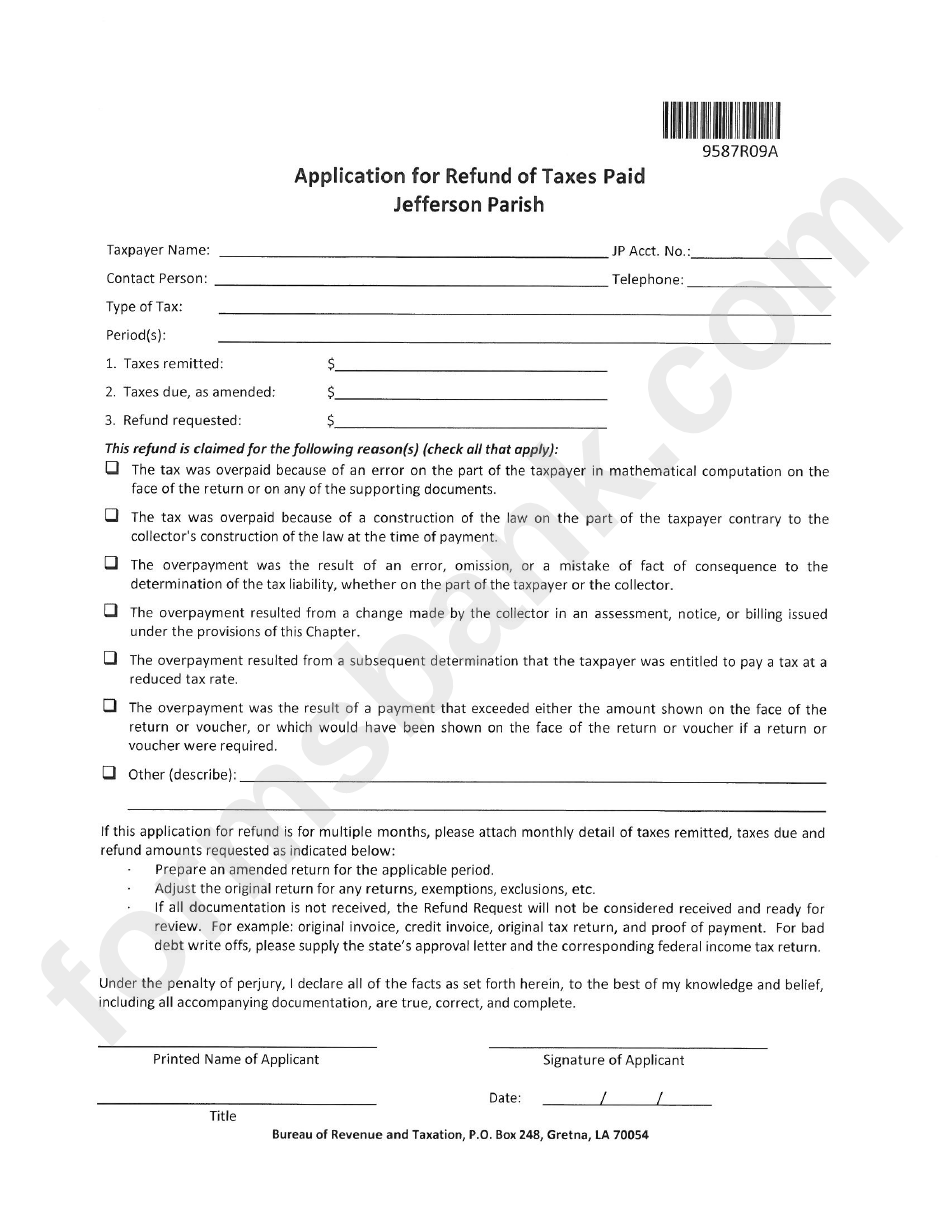

Application For Refund Of Taxes Paid Form Jefferson Parish printable

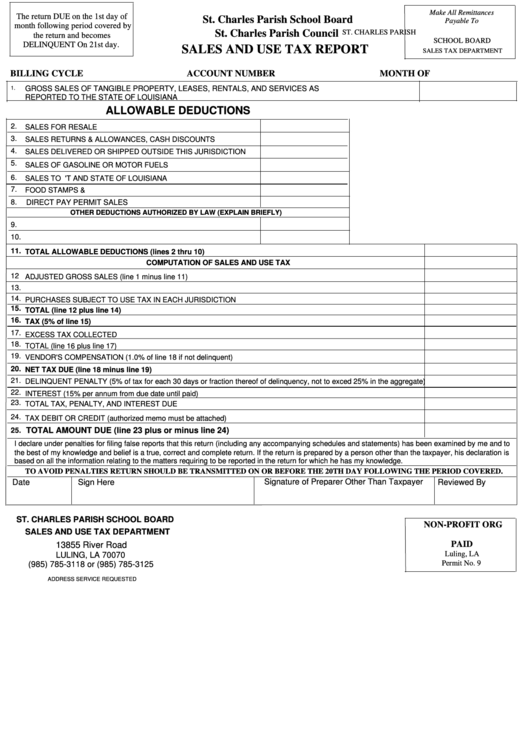

Sales And Use Tax Report St. Charles Parish printable pdf download

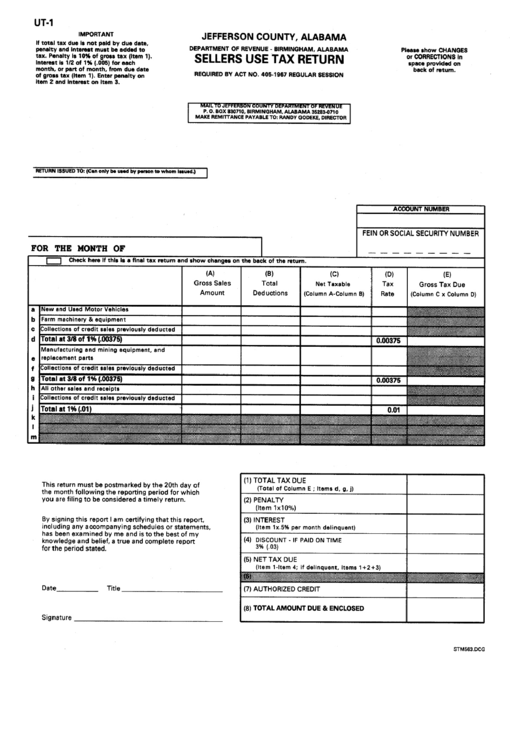

Form Ut1 Sellers Use Tax Return Department Of Revenue Jefferson

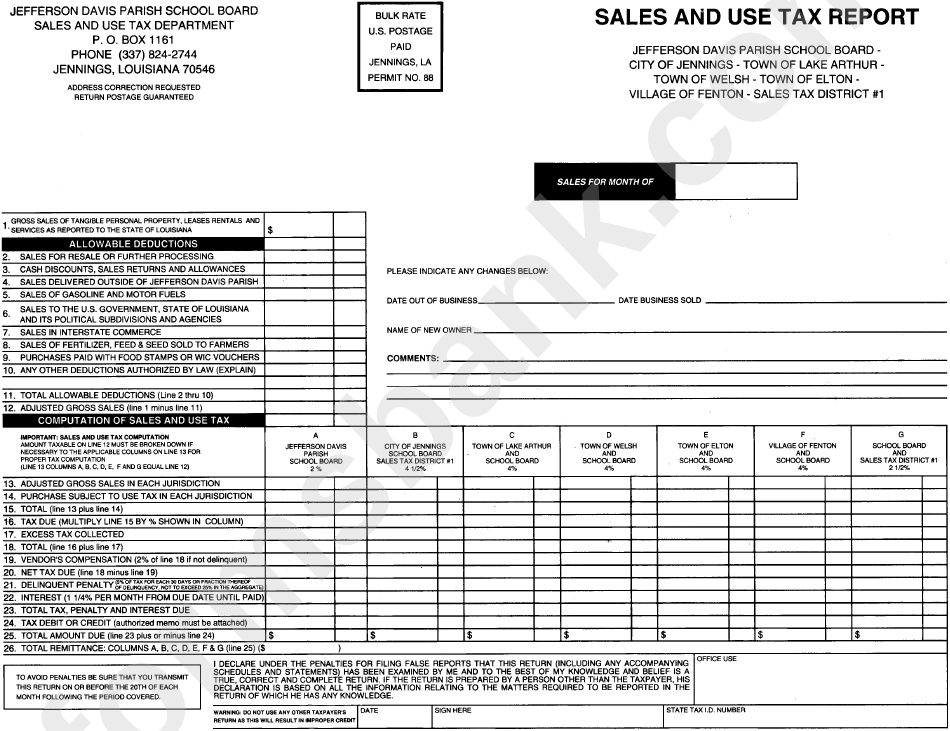

Sales And Use Tax Report Form Jefferson Davis Parish School Board

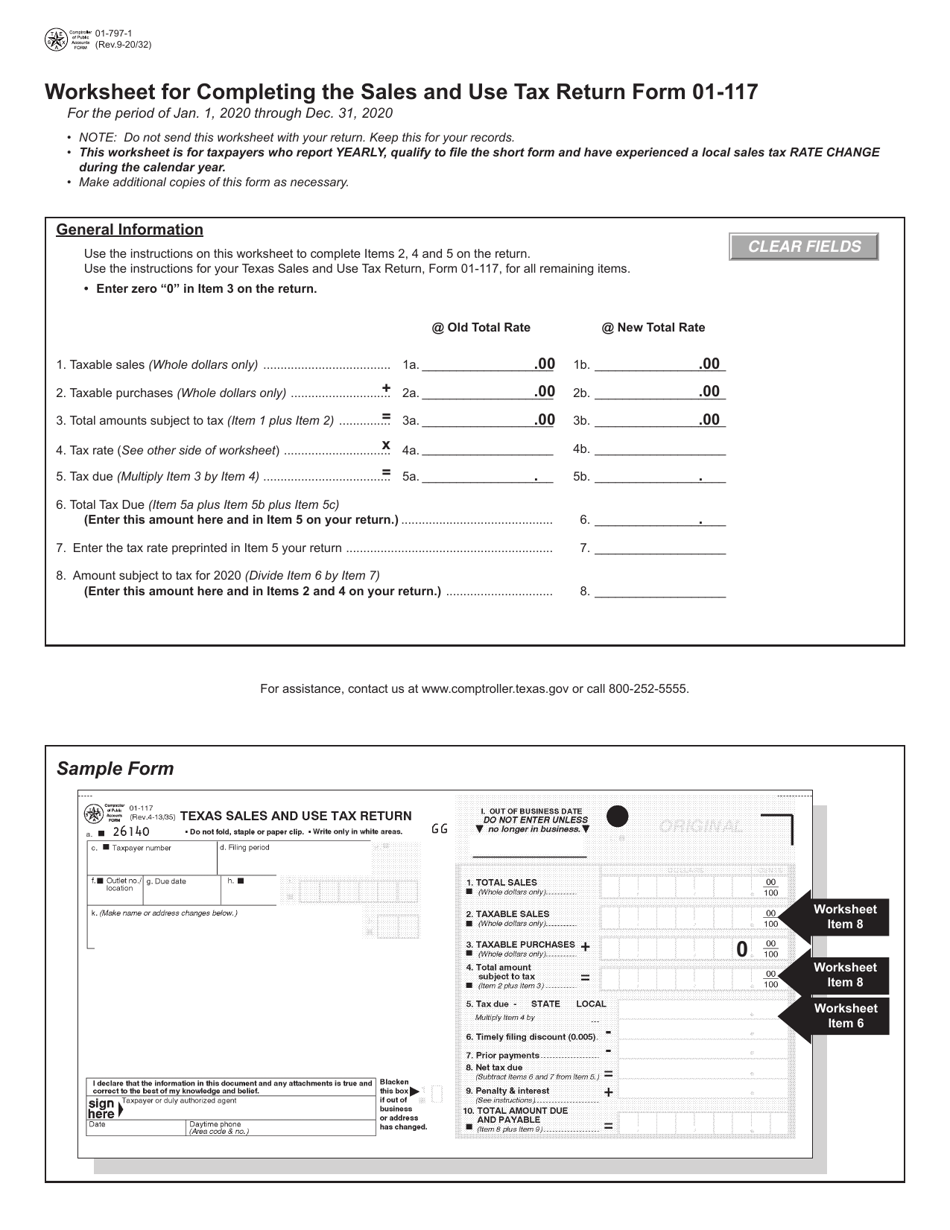

Related Post: