Irs Form 8825 Instructions

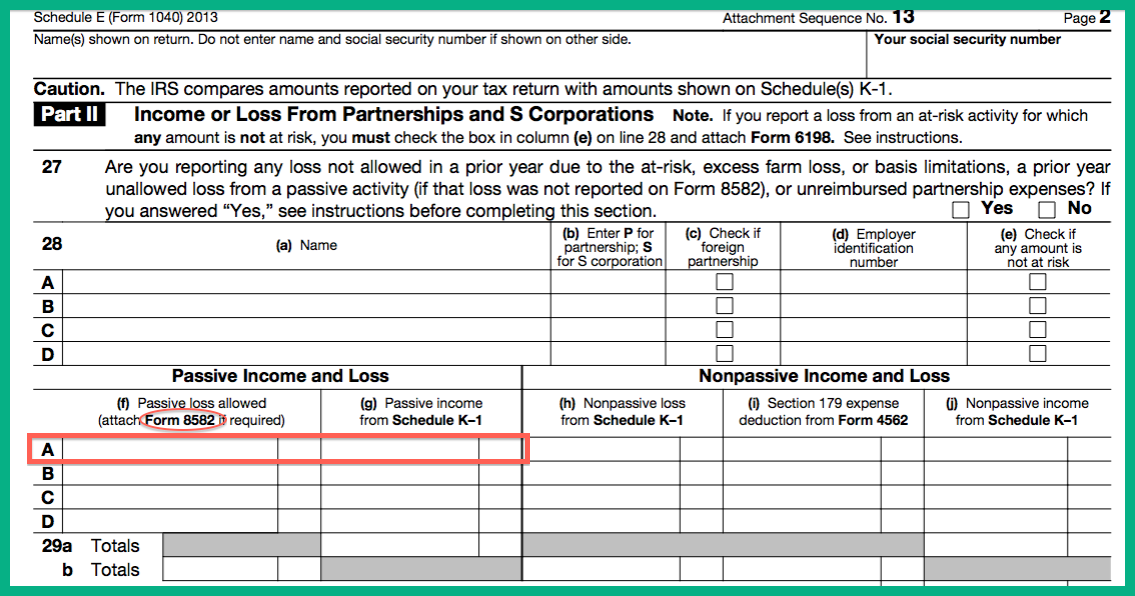

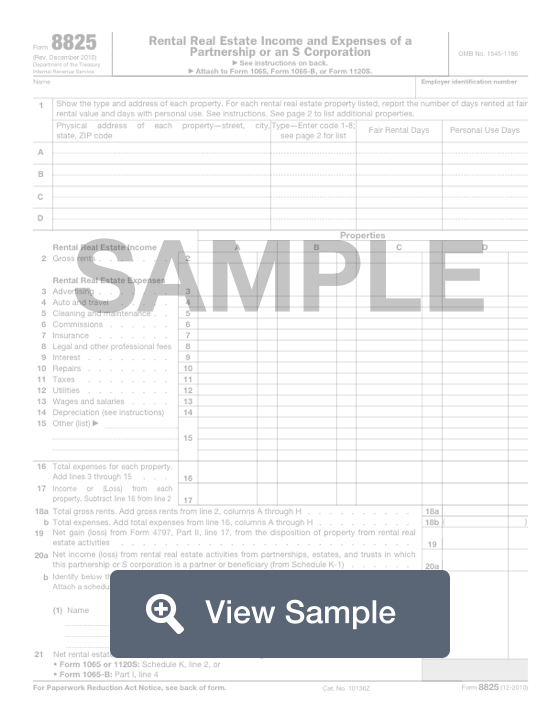

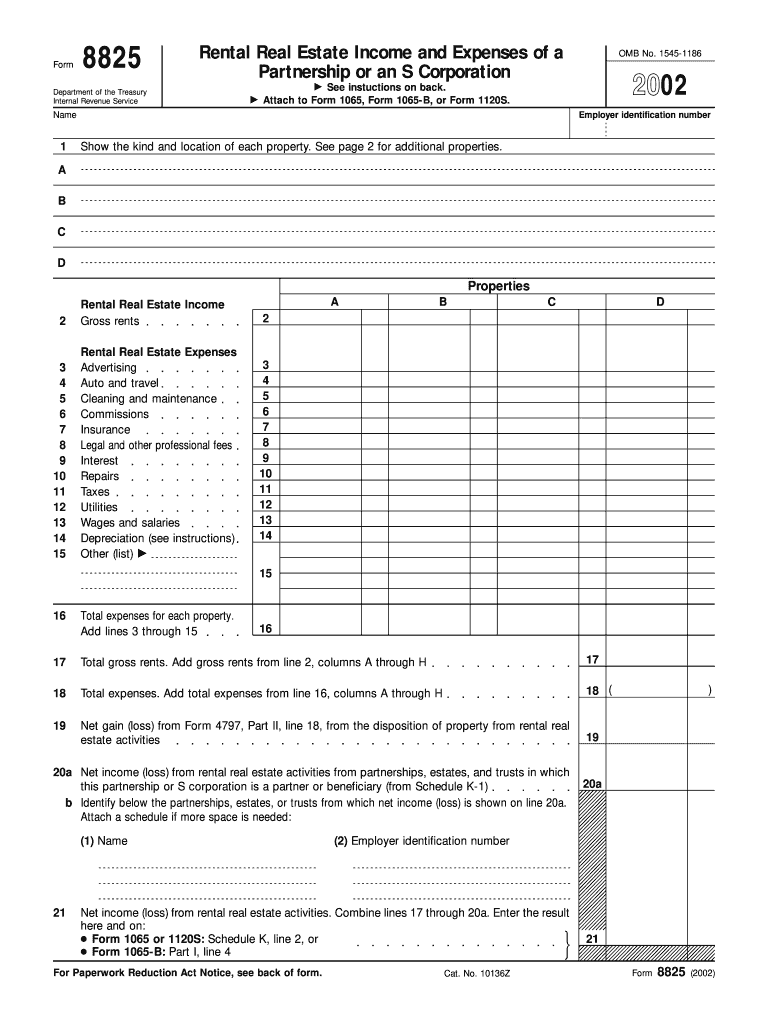

Irs Form 8825 Instructions - 1065 gain or loss from. Web form 8825, rental real estate income and expenses of a partnership or an s corporation. For the latest information about developments related to form 8825 and. Web learn & support. • how to file form 1065 for 2022 for a. Web form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from rental real estate activities that flow through from. Web information about form 8825, rental real estate income and expenses of a partnership or an s corporation, including recent updates, related forms, and instructions on how to file. Ad outgrow.us has been visited by 10k+ users in the past month Web we last updated the rental real estate income and expenses of a partnership or an s corporation in february 2023, so this is the latest version of form 8825, fully updated. Attach to form 1065 or form 1120s. Enter the ale member’s complete address (including. Web up to $40 cash back form 8825 rental real estate income and expenses of a partnership or an s corporation see instructions on back. Web learn & support. Ad thecountyoffice.com has been visited by 100k+ users in the past month Attach to form 1065 or form 1120s. Rental real estate income and expenses of a partnership or an s corporation. Self‐employed health insurance deduction worksheet. Form 8825 is used to report income and deductible expenses from rental. Web to complete the form: Web up to $40 cash back form 8825 rental real estate income and expenses of a partnership or an s corporation see instructions on back. Go to www.irs.gov/form8825 for the latest. Ad outgrow.us has been visited by 10k+ users in the past month Web form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from rental real estate activities that flow through from. For a full form 1065 example with form 8825, please see our video here: Section. Web form 8825, rental real estate income and expenses of a partnership or an s corporation. Form 8825 is used to report income and deductible expenses from rental. Rental real estate income and expenses of a partnership or an s corporation. Form 8825 form and instructions. Solved • by intuit • 20 • updated 1 year ago. Web form 8825, rental real estate income and expenses of a partnership or an s corporation. Section references are to the internal revenue code. Web developments related to form 8825 and its instructions, such as legislation enacted after they were published, go to. Use this november 2018 revision of form 8825 for tax. Section references are to the internal revenue. Form 8825 is used by partnerships and s corps to report income and deductible expenses. Publication 527, residential rental property (including rental of vacation. Web up to $40 cash back form 8825 rental real estate income and expenses of a partnership or an s corporation see instructions on back. Complete lines 1 through 17 for each property. Form 8825 is. Web form 8825, rental real estate income and expenses of a partnership or an s corporation. Ad outgrow.us has been visited by 10k+ users in the past month Then indicate the amount of income and expenses associated with that property. Enter the ale member’s complete address (including. Publication 527, residential rental property (including rental of vacation. Web up to $40 cash back form 8825 rental real estate income and expenses of a partnership or an s corporation see instructions on back. Then indicate the amount of income and expenses associated with that property. Form 8825 is used by partnerships and s corps to report income and deductible expenses. Web form 8825 to report income and deductible. Then indicate the amount of income and expenses associated with that property. Self‐employed health insurance deduction worksheet. For a full form 1065 example with form 8825, please see our video here: Web instructions for form 1065 or form 1120s for additional information that must be provided for each activity. Web to complete the form: Ad outgrow.us has been visited by 10k+ users in the past month Self‐employed health insurance deduction worksheet. Web up to $40 cash back form 8825 rental real estate income and expenses of a partnership or an s corporation see instructions on back. Use form 8885 to elect and figure the amount, if any, of your hctc. Form 8825 form and. Web form 8825, rental real estate income and expenses of a partnership or an s corporation. Enter the ale member’s complete address (including. Go to www.irs.gov/form8825 for the latest. 1065 gain or loss from. Section references are to the internal revenue code. Web form 8825, rental real estate income and expenses of a partnership or an s corporation. For the latest information about developments related to form 8825 and. Solved • by intuit • 20 • updated 1 year ago. Complete lines 1 through 17 for each property. Common questions for form 8825 in proseries. Then indicate the amount of income and expenses associated with that property. Web partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from rental real estate. Web up to $40 cash back form 8825 rental real estate income and expenses of a partnership or an s corporation see instructions on back. Form 8825, rental real estate income and expenses of a partnership or an. You must start by identifying each property. Use form 8885 to elect and figure the amount, if any, of your hctc. Self‐employed health insurance deduction worksheet. Web developments related to form 8825 and its instructions, such as legislation enacted after they were published, go to. Web learn & support. Web we last updated the rental real estate income and expenses of a partnership or an s corporation in february 2023, so this is the latest version of form 8825, fully updated.All about the 8825 Linda Keith CPA

Instructions for Form 990EZ (2023)

Form 8825 Rental Real Estate and Expenses of a Partnership or

Fillable IRS Form 8825 Printable PDF Sample FormSwift

IRS 8825 2002 Fill out Tax Template Online US Legal Forms

Form 8825 Rental Real Estate and Expenses of a Partnership or

3.11.15 Return of Partnership Internal Revenue Service

Form 8825 Rental Real Estate and Expenses of a Partnership or

IRS Form 8825 Fill Out and Sign Printable PDF Template signNow

irs 8825 10 Simple (But Important) Things To Remember About

Related Post: