Itr 2 Filled Form Example

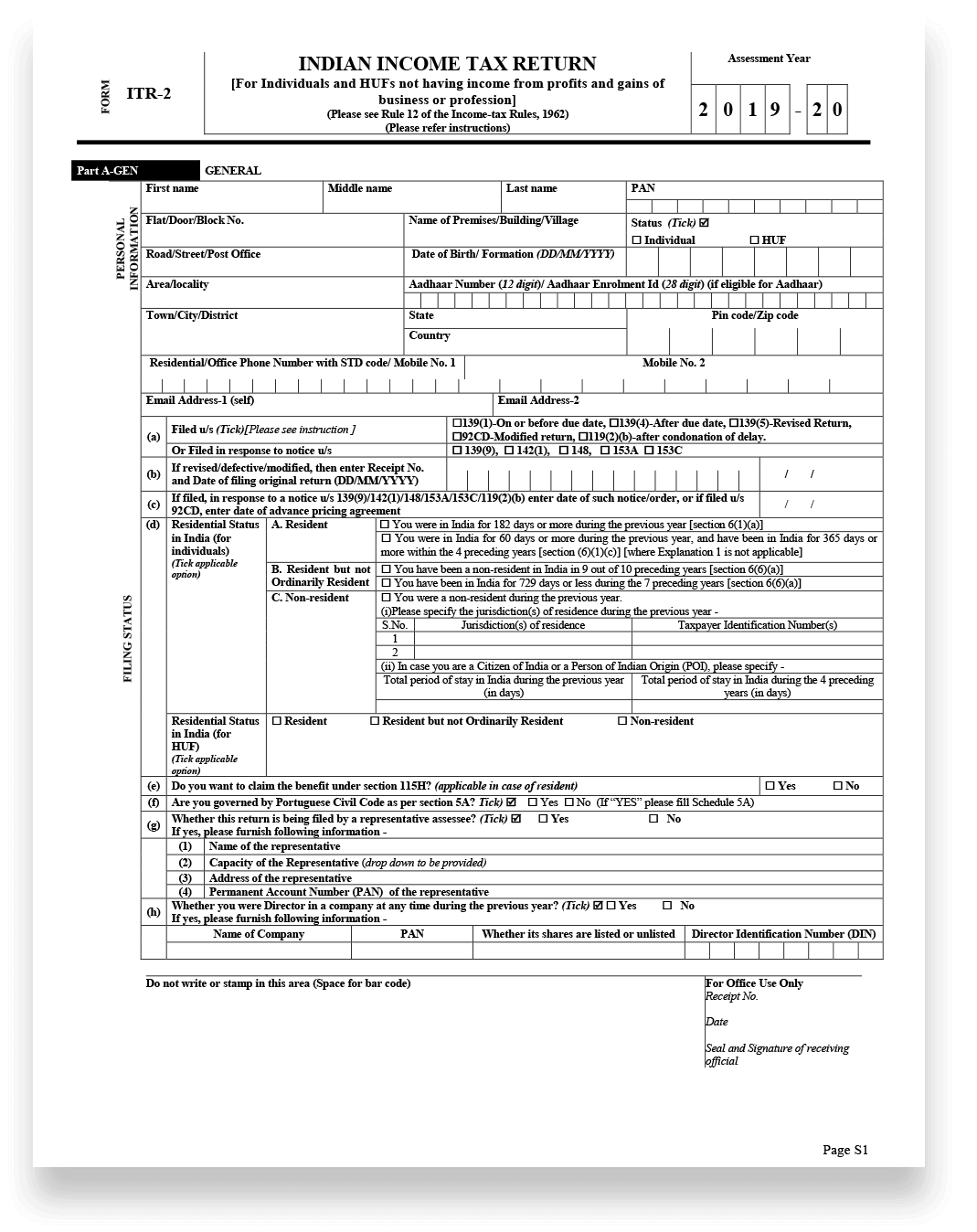

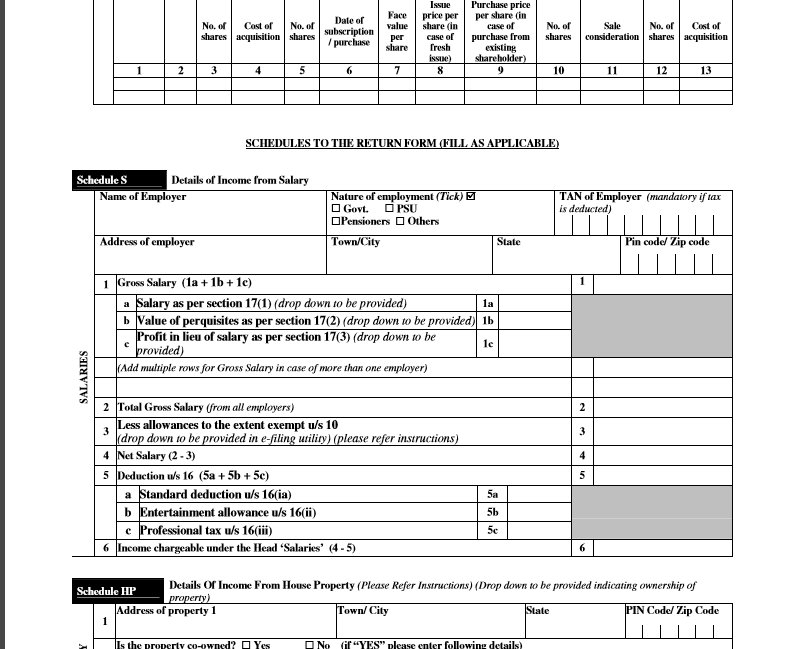

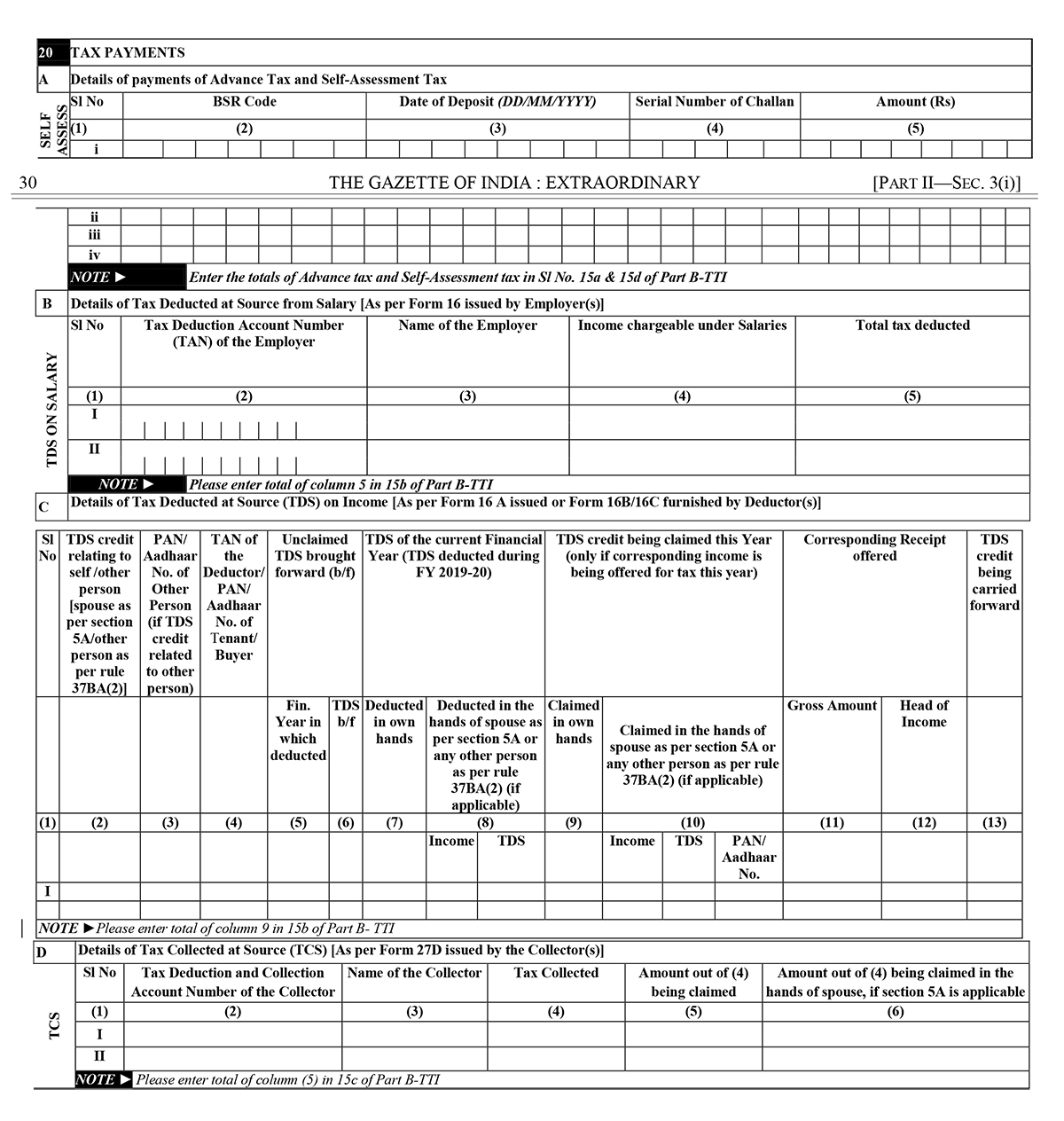

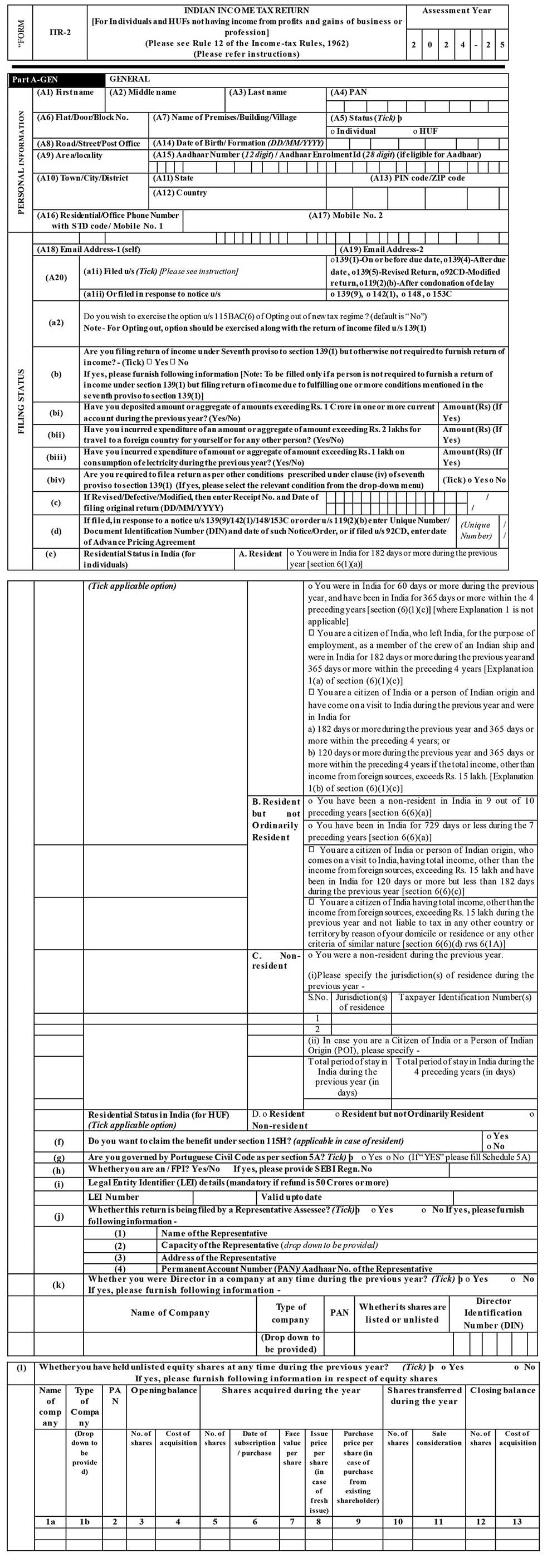

Itr 2 Filled Form Example - Web we would like to show you a description here but the site won’t allow us. Individual income tax return i 2 30, 31 09,10 1040c u.s. The following information needs to be. Get complete guide on itr 2 form. Title file source tax class mft code doc. File itr 2 via gen it. Assessment year for which this return form is applicable. Departing alien income tax return i 2. Salaried taxpayers who hold the post of director with a listed or unlisted. Click here & know everything about itr 2 form in india, including the instructions to fill the form, how to download the. Only if your age is over 80 you can file the itr 2 offline. If you are over 80. Title file source tax class mft code doc. These documents provide information about your salary and tax deducted at source (tds). What is itr 2 form; These documents provide information about your salary and tax deducted at source (tds). Web up to $40 cash back the itr 2 form is used for reporting income from various sources including salary, house property, capital gains, etc. Title file source tax class mft code doc. Departing alien income tax return i 2. Web we would like to show you. Title file source tax class mft code doc. Individual income tax return i 2 30, 31 09,10 1040c u.s. Only if your age is over 80 you can file the itr 2 offline. Departing alien income tax return i 2. What is itr 2 form; Only if your age is over 80 you can file the itr 2 offline. What is itr 2 form; Individual income tax return i 2 30, 31 09,10 1040c u.s. File itr 2 via gen it. These documents provide information about your salary and tax deducted at source (tds). The following information needs to be. Only if your age is over 80 you can file the itr 2 offline. Salaried taxpayers who hold the post of director with a listed or unlisted. Web we would like to show you a description here but the site won’t allow us. Web up to $40 cash back the itr 2 form is. Salaried taxpayers who hold the post of director with a listed or unlisted. Web up to $40 cash back the itr 2 form is used for reporting income from various sources including salary, house property, capital gains, etc. Individual income tax return i 2 30, 31 09,10 1040c u.s. The following information needs to be. Title file source tax class. File itr 2 via gen it. If you are over 80. Web up to $40 cash back the itr 2 form is used for reporting income from various sources including salary, house property, capital gains, etc. Web we would like to show you a description here but the site won’t allow us. Only if your age is over 80 you. Web up to $40 cash back the itr 2 form is used for reporting income from various sources including salary, house property, capital gains, etc. If you are over 80. Assessment year for which this return form is applicable. These documents provide information about your salary and tax deducted at source (tds). File itr 2 via gen it. If you are over 80. Web we would like to show you a description here but the site won’t allow us. The following information needs to be. What is itr 2 form; Only if your age is over 80 you can file the itr 2 offline. Assessment year for which this return form is applicable. File itr 2 via gen it. What is itr 2 form; Departing alien income tax return i 2. If you are over 80. Get complete guide on itr 2 form. If you are over 80. Title file source tax class mft code doc. Web up to $40 cash back the itr 2 form is used for reporting income from various sources including salary, house property, capital gains, etc. Web certain individuals may need to complete only a few lines on form 982. Salaried taxpayers who hold the post of director with a listed or unlisted. File itr 2 via gen it. Assessment year for which this return form is applicable. The following information needs to be. This statement contains details of. For example, if you are completing this form because of a discharge of indebtedness on a personal loan. What is itr 2 form; Departing alien income tax return i 2. Individual income tax return i 2 30, 31 09,10 1040c u.s. Click here & know everything about itr 2 form in india, including the instructions to fill the form, how to download the. Web we would like to show you a description here but the site won’t allow us. These documents provide information about your salary and tax deducted at source (tds). Only if your age is over 80 you can file the itr 2 offline.What is ITR2 Form? How to fill ITR 2 Form? How to file ITR 2 Form?

ITR2 Form Filing Tax Return IndiaFilings

ITR 2 Form for from Capital Gains Learn by Quicko

Tax Return (ITR) 2 Filing Form How do I file my ITR2 Form?

What is ITR2 Form? How to fill ITR 2 Form? How to file ITR 2 Form?

What is ITR2 Form? How to fill ITR 2 Form? How to file ITR 2 Form?

Step by Step Guide to File ITR 2 Online AY 201920 (Full Procedure) Blog

What is ITR 2 Form? How to fill ITR 2 Form? Tax2win

Step by Step Guide to File ITR 2 Online AY 202021 (Full Procedure)

How to fill ITR2 Schedule112A of Excel Utility Manmohan

Related Post: