Illinois 1041 Form

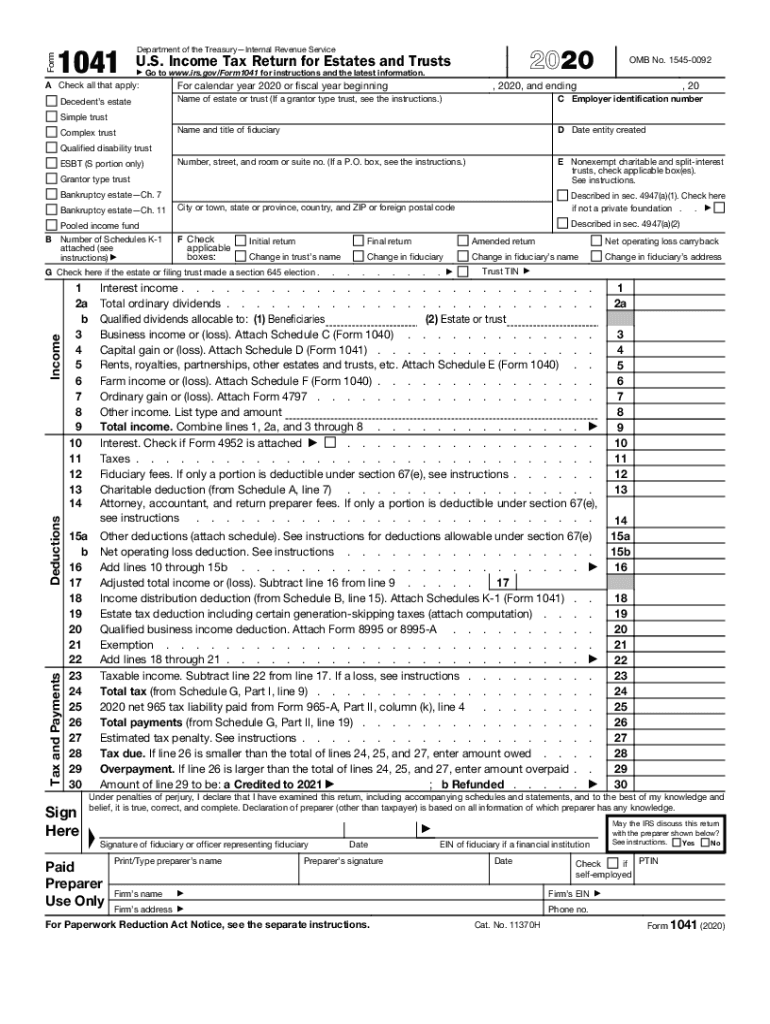

Illinois 1041 Form - Enter the amount you are paying. Then, complete the remainder of this schedule. You will likely need to make. Complete, edit or print tax forms instantly. Don’t complete for a simple trust or a pooled income fund. Beneficiary's share of current year income, deductions, credits, and other items. Month day year month day. Web schedule nr, nonresident computation of fiduciary income allows a trust or estate that is a nonresident of illinois to determine the income that is taxable to illinois. Get ready for tax season deadlines by completing any required tax forms today. Find irs mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in. Web illinois department of revenue. Instructions for form 1041 ( print version pdf) recent developments. Enter the amount you are paying. Web schedule nr, nonresident computation of fiduciary income allows a trust or estate that is a nonresident of illinois to determine the income that is taxable to illinois. You will likely need to make. Enter the amount you are paying. Instructions for form 1041 ( print version pdf) recent developments. Fiduciary income and replacement tax return. Beneficiary's share of current year income, deductions, credits, and other items. Web schedule nr, nonresident computation of fiduciary income allows a trust or estate that is a nonresident of illinois to determine the income that is taxable to. Web page last reviewed or updated: Department of the treasury—internal revenue service. Web find irs mailing addresses by state to file form 1041. Month day year month day. Use for tax year ending on or after december 31, 2022, and before december 31, 2023. Web illinois department of revenue. Use for tax year ending on or after december 31, 2022, and before december 31, 2023. Web electronic filing forms and payment options: Web why choose 1041 income tax. Fiduciary income and replacement tax return. Printed all of your illinois income tax forms? Don’t complete for a simple trust or a pooled income fund. Then, complete the remainder of this schedule. Get ready for tax season deadlines by completing any required tax forms today. Ad download or email irs 1041 & more fillable forms, register and subscribe now! 2 schedule a charitable deduction. Fiduciary income and replacement tax return. Web find irs mailing addresses by state to file form 1041. Income tax return for estates and trusts. Use for tax year ending on or after december 31, 2022, and before december 31, 2023. Department of the treasury—internal revenue service. Get ready for tax season deadlines by completing any required tax forms today. Web if this return is not for calendar year 2021, enter your fiscal tax year here. This form is for income earned in tax year 2022, with tax returns due in april. Ad download or email irs 1041 & more fillable. This form is for income earned in tax year 2022, with tax returns due in april. Tax year beginning 20 , ending. Fiduciary income and replacement tax return. Thomson reuters onesource 1041 software automates the entire income tax reporting process for estates and trusts, from loss limitations to dni. Web if this return is not for calendar year 2021, enter. Income tax return for estates and trusts. 2 schedule a charitable deduction. Web why choose 1041 income tax. 1041 (2021) form 1041 (2021) page. Find irs mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in. Web illinois department of revenue. Month day year month day. Get ready for tax season deadlines by completing any required tax forms today. 1041 (2021) form 1041 (2021) page. Use for tax year ending on or after december 31, 2022, and before december 31, 2023. Web showing 1 to 25 of 62 entries. Web page last reviewed or updated: Department of the treasury—internal revenue service. Web if this return is not for calendar year 2021, enter your fiscal tax year here. Printed all of your illinois income tax forms? Thomson reuters onesource 1041 software automates the entire income tax reporting process for estates and trusts, from loss limitations to dni. Use for tax year ending on or after december 31, 2022, and before december 31, 2023. Head over to the federal income tax forms page to get any forms you need for. Tax year beginning 20 , ending. Ad download or email irs 1041 & more fillable forms, register and subscribe now! Enter the amount you are paying. Web find irs mailing addresses by state to file form 1041. Web why choose 1041 income tax. Web schedule nr, nonresident computation of fiduciary income allows a trust or estate that is a nonresident of illinois to determine the income that is taxable to illinois. Beneficiary's share of current year income, deductions, credits, and other items. You will likely need to make. Web illinois department of revenue. Web the earned income credit,. Complete, edit or print tax forms instantly. Instructions for form 1041 ( print version pdf) recent developments.2020 Form IRS 1041 Fill Online, Printable, Fillable, Blank pdfFiller

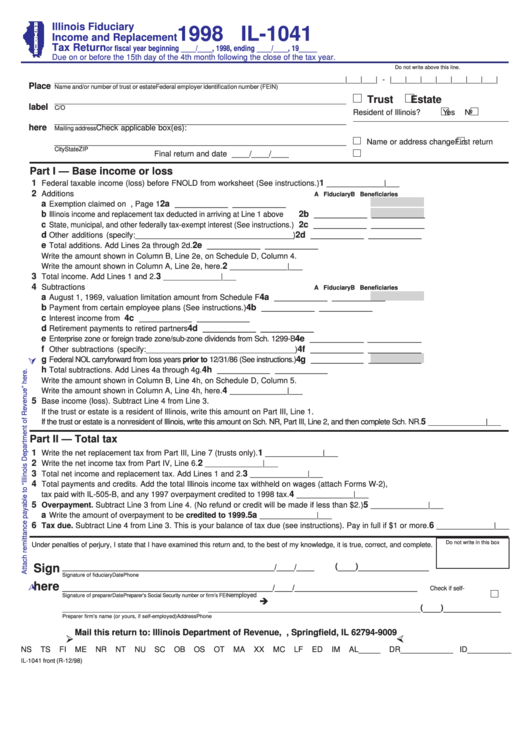

Fillable Form Il1041 Illinois Fiduciary And Replacement Tax

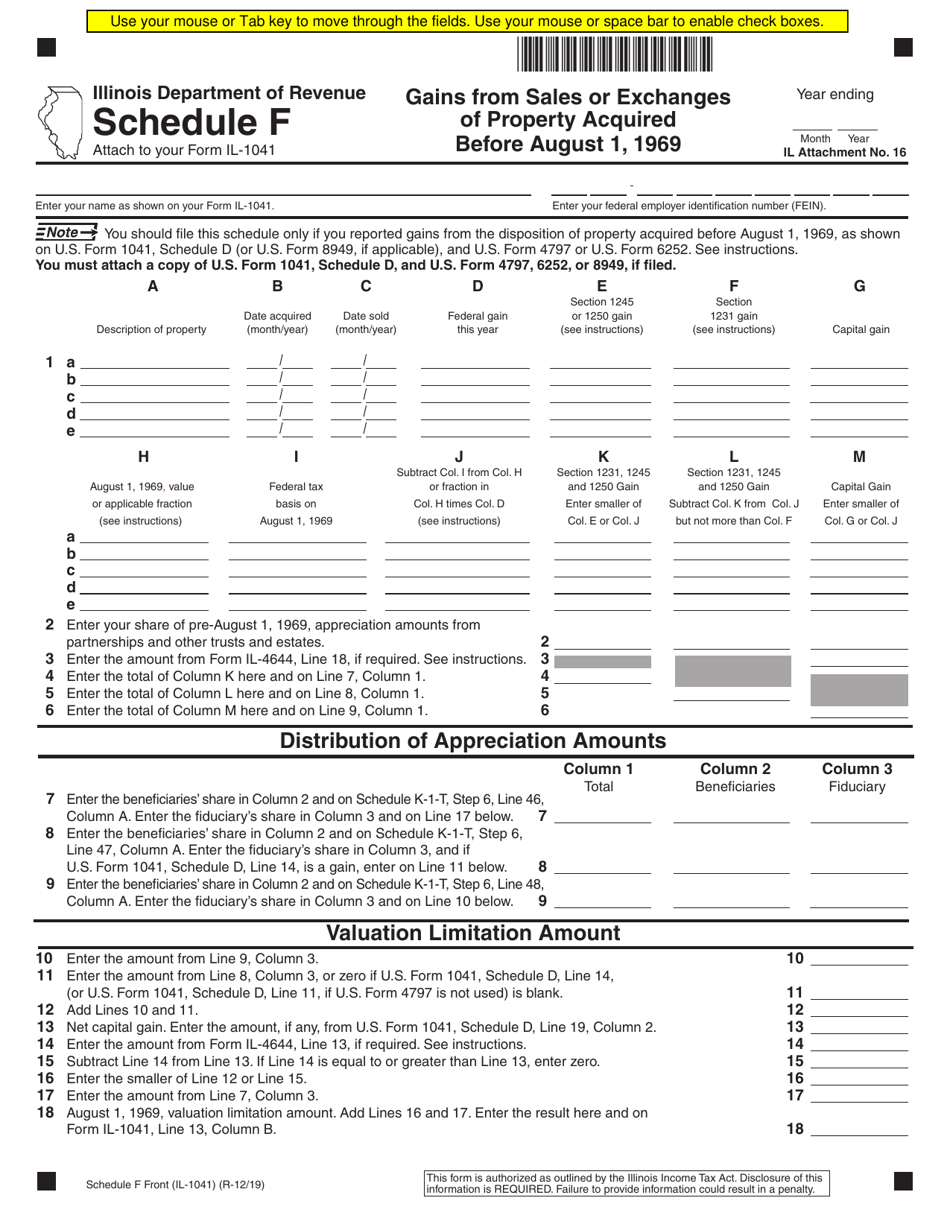

Form IL1041 Schedule F Download Fillable PDF or Fill Online Gains From

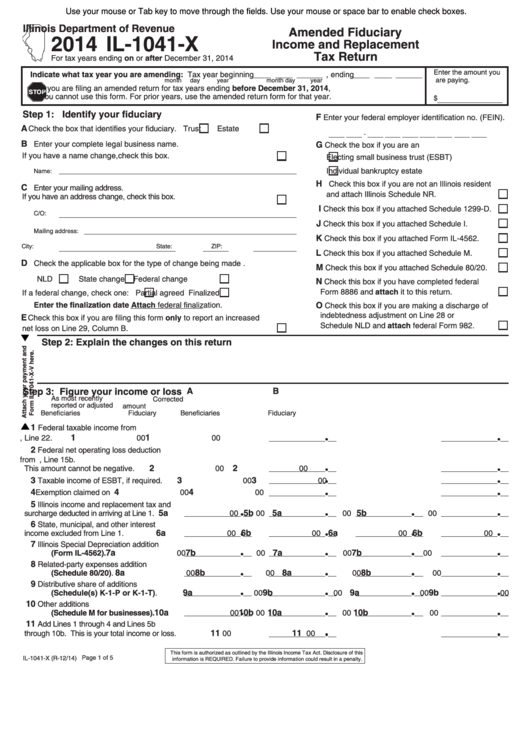

Fillable Form Il1041X Amended Fiduciary And Replacement Tax

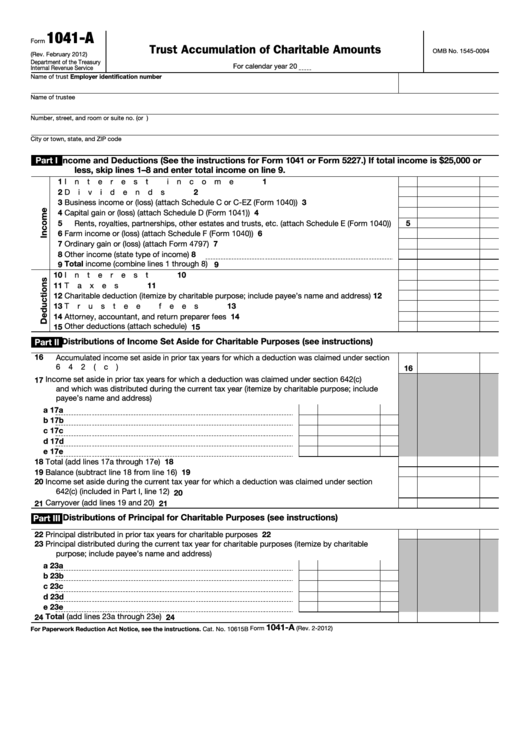

Fillable Form 1041A U.s. Information Return Trust Accumulation Of

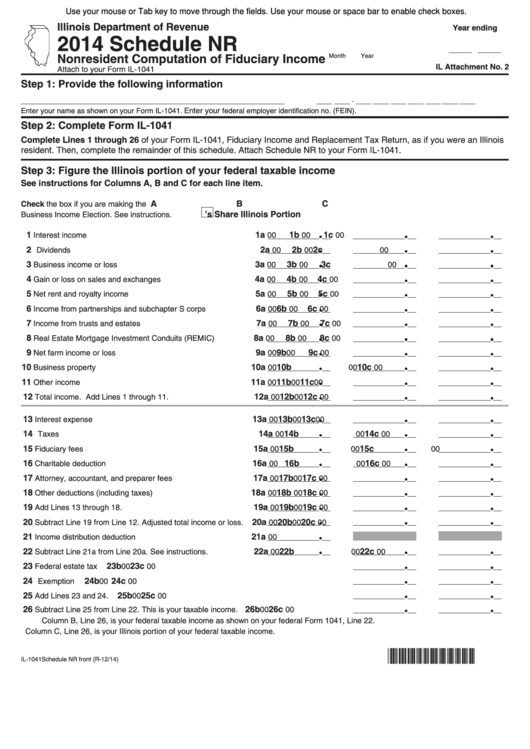

Fillable Form Il1041 Schedule Nr Nonresident Computation Of

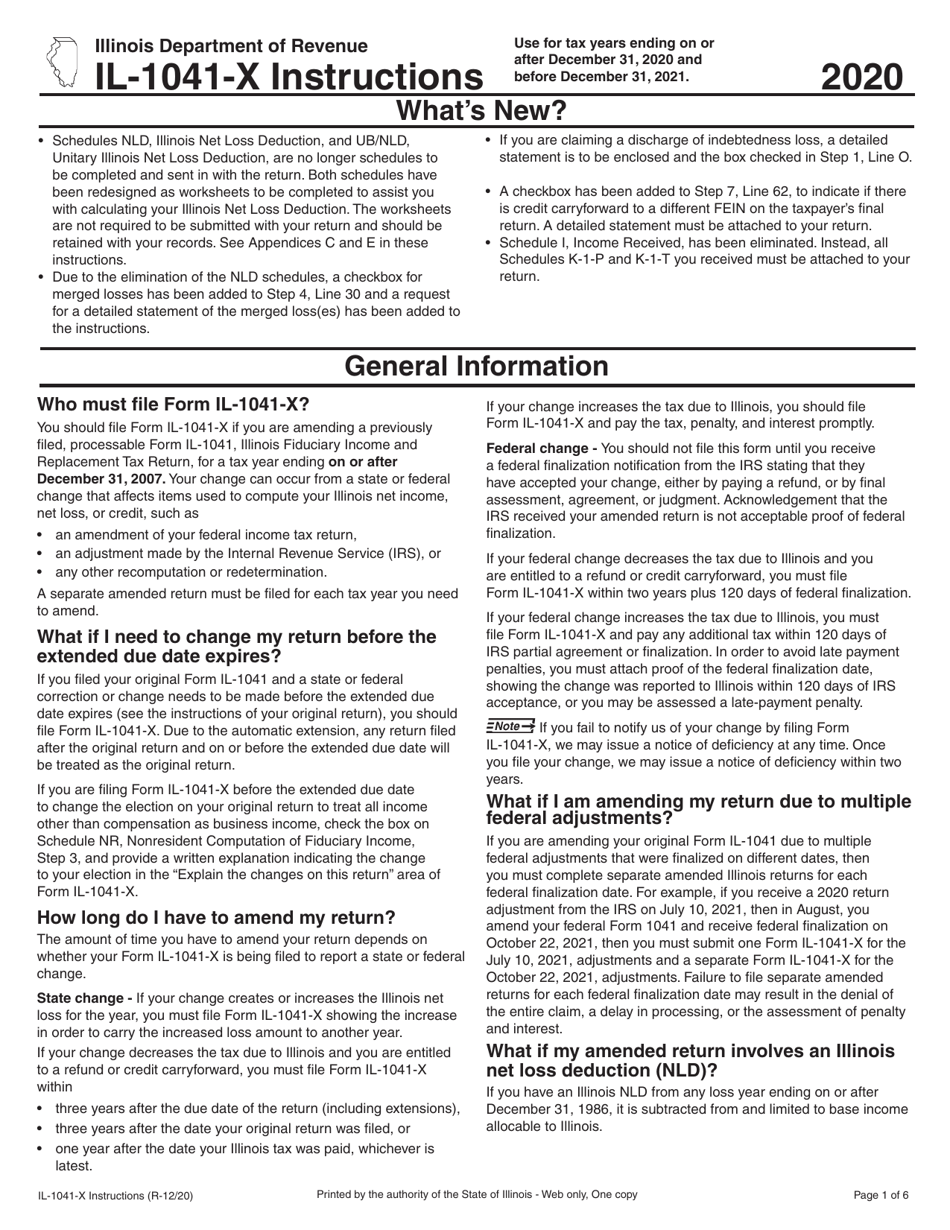

Download Instructions for Form IL1041X Amended Fiduciary and

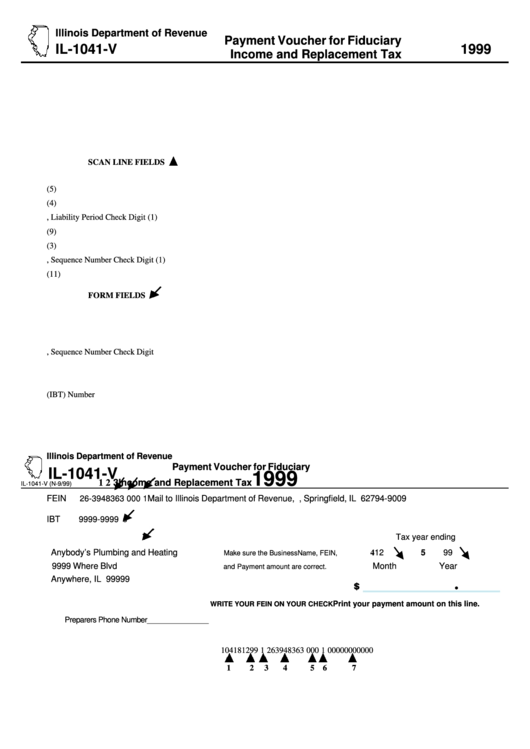

Form Il1041V Payment Voucher For Fiduciary And Replacement

Form 1041 Fillable Printable Forms Free Online

Form Il1041 Illinois Department Of Revenue Edit, Fill, Sign Online

Related Post: