Form 5498 Vanguard

Form 5498 Vanguard - Get ready for tax season deadlines by completing any required tax forms today. Form 5498, which includes information about transactions in traditional iras,. Web form 5498 reports the contribution. Web there are several other forms you might receive from vanguard. Web filing form 5498 with the irs. Ad access irs tax forms. Use information from your own records. File this form for each. Web “each year vanguard sends me form 5498 showing the amount i contributed to my roth. The information on form 5498 is submitted to the irs by the trustee or issuer of your individual retirement arrangement (ira) to report contributions,. Because you can make a 2020 contribution as late. Web there are several other forms you might receive from vanguard. Web form 5498 reports your contributions to a traditional or roth ira, or a sep or simple account, for 2014. Web to ease statement furnishing requirements, copies b, c, d, 1, and 2 have been made fillable online in a. Form 5498 is a simple tax form that’s typically issued after tax day. Find out when tax forms for your iras are available. Web form 5498 reports the contribution. File this form for each. Form 5498 is provided to clients and filed with the irs in may for informational purposes only. Here are the most common. Web to ease statement furnishing requirements, copies b, c, d, 1, and 2 have been made fillable online in a pdf format available at irs.gov/ form1099r and. Web the ira custodian must report each year to the irs on form 5498 any ira contributions for the year. The irs form 5498 exists so that financial. File this form for each. Ira contributions information reports to the irs your ira contributions for the year along with other information about your ira account. Web information about form 5498, ira contribution information (info copy only), including recent updates, related forms and instructions on how to file. Web the ira custodian must report each year to the irs on. There are two form 5498 mailing periods: Because you can make a 2020 contribution as late. Find out when tax forms for your iras are available. Web this applies to both traditional iras and roth iras (you will receive one form 5498 for each ira that you contribute to). Web filing form 5498 with the irs. File this form for each. Web “each year vanguard sends me form 5498 showing the amount i contributed to my roth. Web information about form 5498, ira contribution information (info copy only), including recent updates, related forms and instructions on how to file. Form 5498 is a simple tax form that’s typically issued after tax day. Web to ease statement. Find out when tax forms for your iras are available. Form 5498 is provided to clients and filed with the irs in may for informational purposes only. Web all recharacterizations are reportable, but aren’t taxable, when you file. What is irs form 5498? Form 5498, which includes information about transactions in traditional iras,. File this form for each. It also reports whether you rolled money over from another. Web the ira custodian must report each year to the irs on form 5498 any ira contributions for the year. Web this applies to both traditional iras and roth iras (you will receive one form 5498 for each ira that you contribute to). Ad access. Web you must report your 2020 irs contributions on your 2020 tax return. Free, fast, full version (2023) available! Web to ease statement furnishing requirements, copies b, c, d, 1, and 2 have been made fillable online in a pdf format available at irs.gov/ form1099r and. Ira contributions information reports to the irs your ira contributions for the year along. Web the information on form 5498 is submitted to the internal revenue service by the trustee or issuer of your individual retirement arrangement (ira) to report contributions, including. Learn more about ira recharacterizations. Web the ira custodian must report each year to the irs on form 5498 any ira contributions for the year. Form 5498, which includes information about transactions. The information on form 5498 is submitted to the irs by the trustee or issuer of your individual retirement arrangement (ira) to report contributions,. Web all recharacterizations are reportable, but aren’t taxable, when you file. Web the ira custodian must report each year to the irs on form 5498 any ira contributions for the year. Web form 5498 reports your contributions to a traditional or roth ira, or a sep or simple account, for 2014. Form 5498 is a simple tax form that’s typically issued after tax day. Vanguard will send you and the irs the following two forms: Form 5498 is provided to clients and filed with the irs in may for informational purposes only. It also reports whether you rolled money over from another. Web the information on form 5498 is submitted to the internal revenue service by the trustee or issuer of your individual retirement arrangement (ira) to report contributions, including. What is irs form 5498? Get ready for tax season deadlines by completing any required tax forms today. Learn more about ira recharacterizations. Web form 5498 reports the contribution. The irs form 5498 exists so that financial institutions can report ira information. Ad access irs tax forms. Web “each year vanguard sends me form 5498 showing the amount i contributed to my roth. File this form for each. Web filing form 5498 with the irs. Web you must report your 2020 irs contributions on your 2020 tax return. Use information from your own records.What Is Form 5498 For Taxes

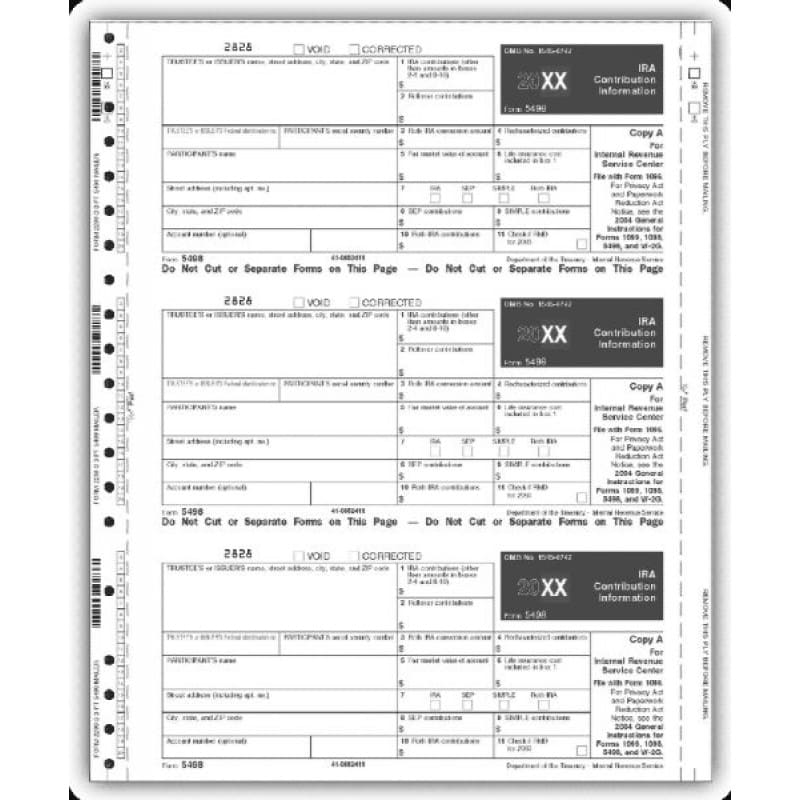

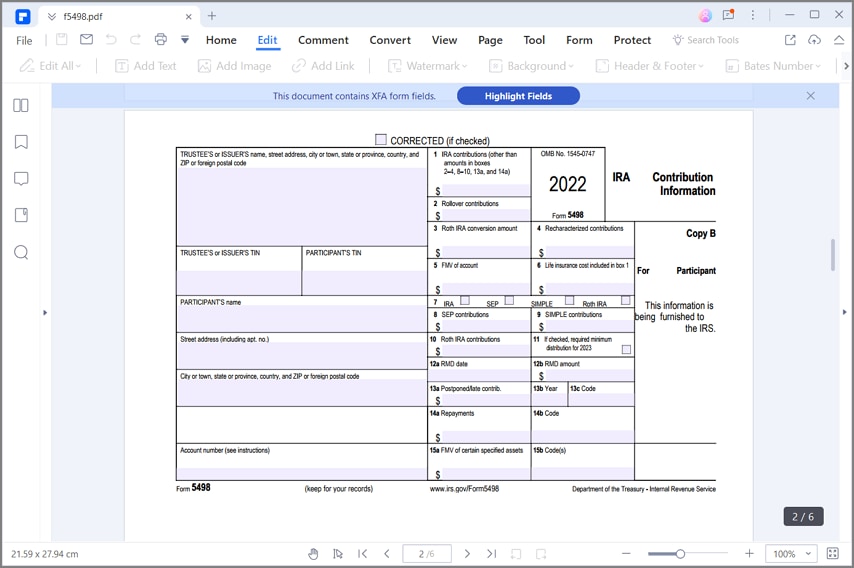

for How to Fill in IRS Form 5498

Form 5498

2019 Form IRS 5498Fill Online, Printable, Fillable, Blank pdfFiller

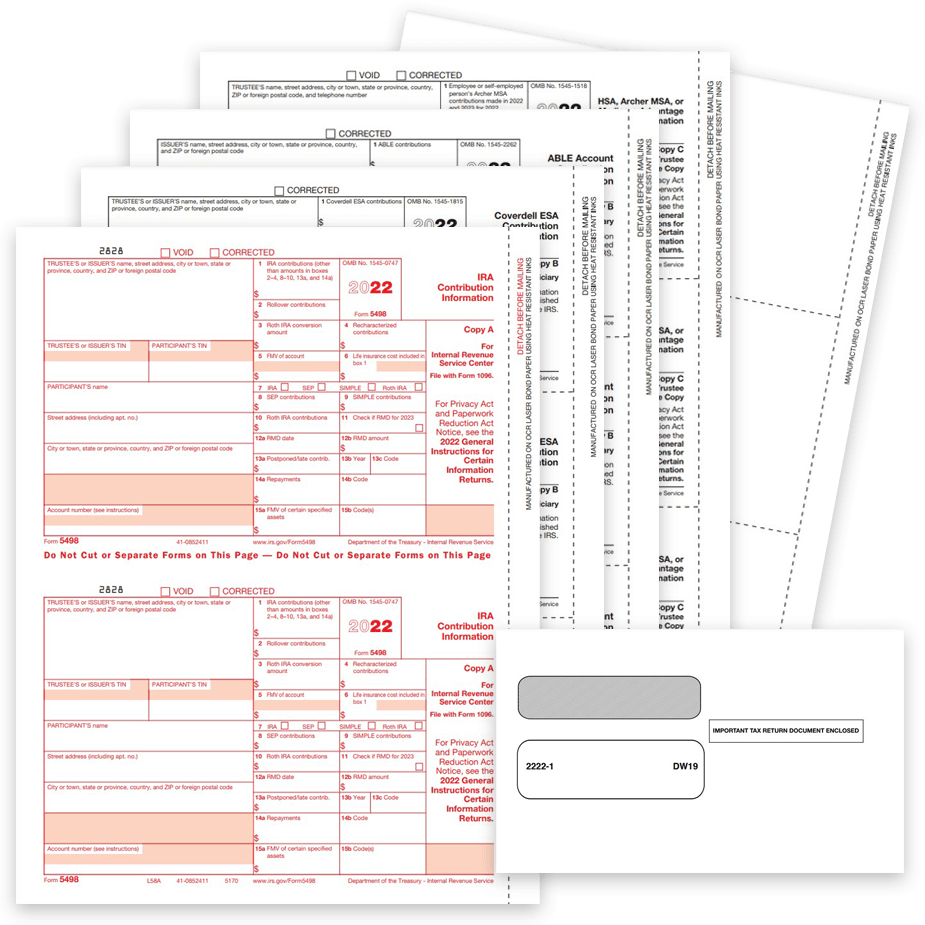

5498 IRA/ESA/SA Contribution Information (1099R)

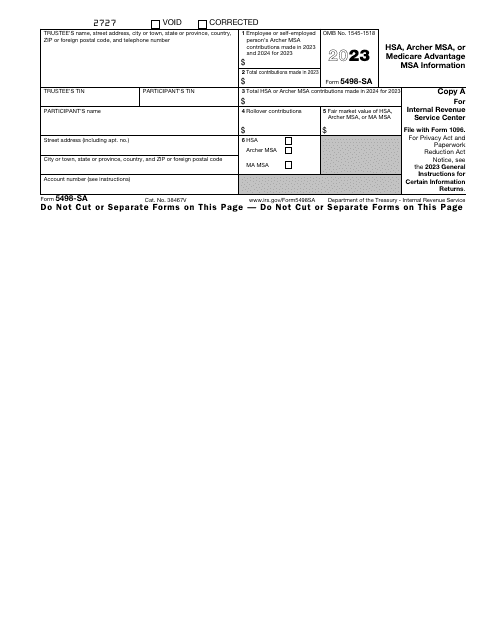

IRS Form 5498SA Download Fillable PDF or Fill Online Hsa, Archer Msa

5498 Tax Forms and Envelopes for 2022

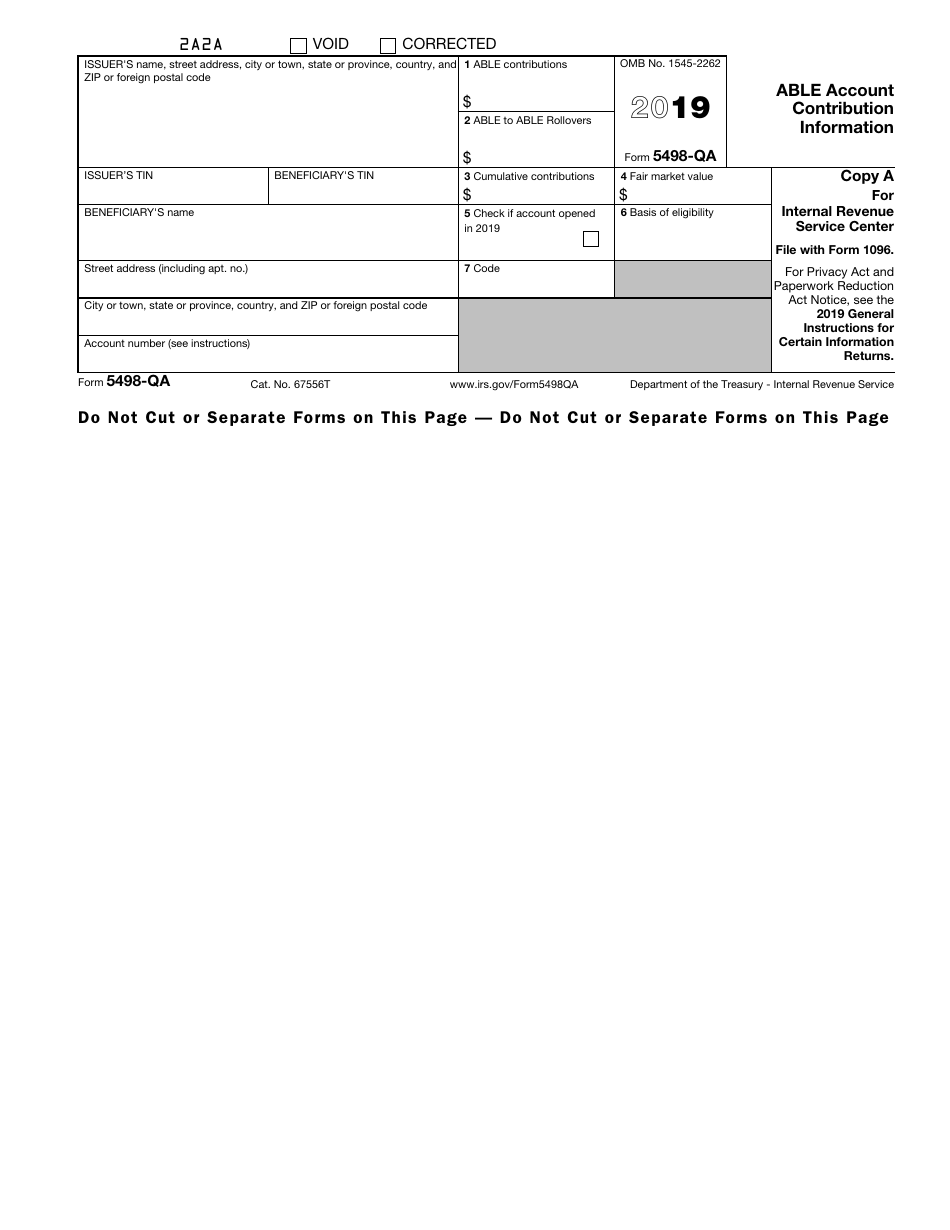

IRS Form 5498QA Download Fillable PDF or Fill Online Able Account

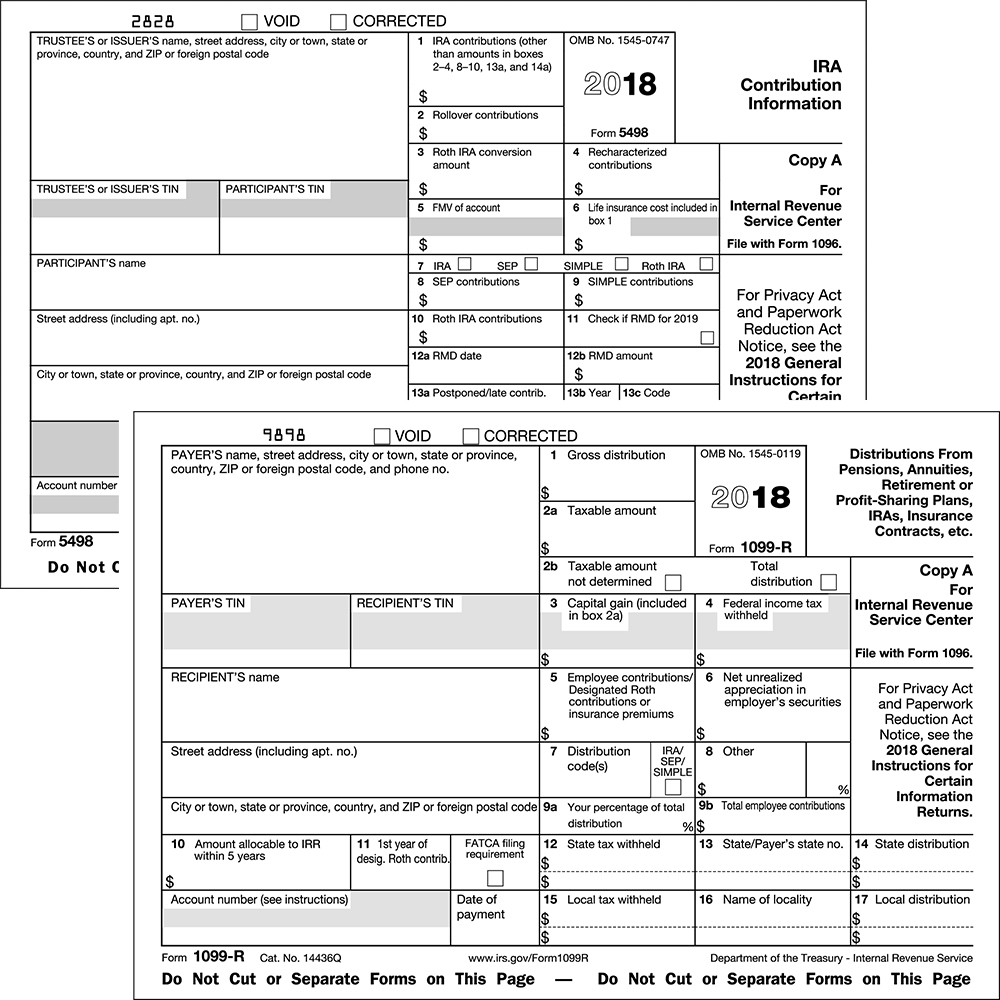

2018 Forms 5498, 1099R Come With a Few New Requirements — Ascensus

401k Rollover Form 5498 Universal Network

Related Post: