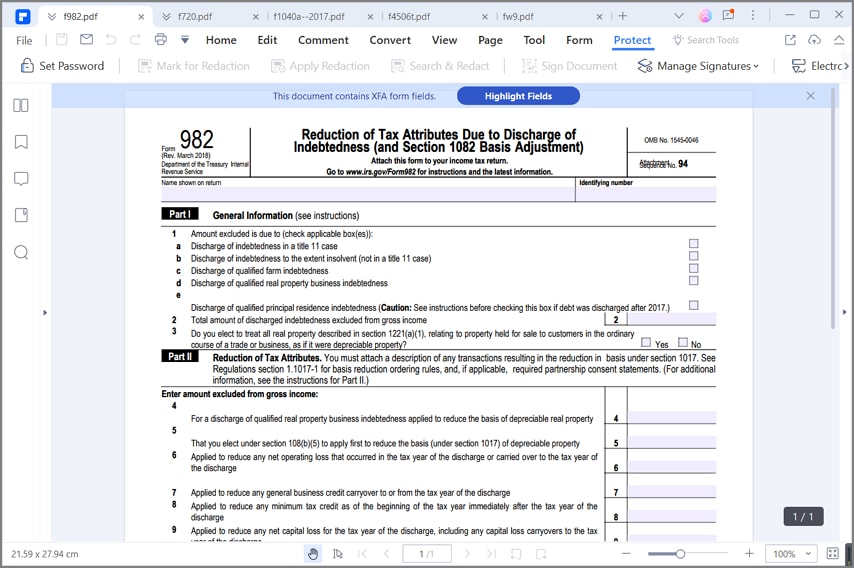

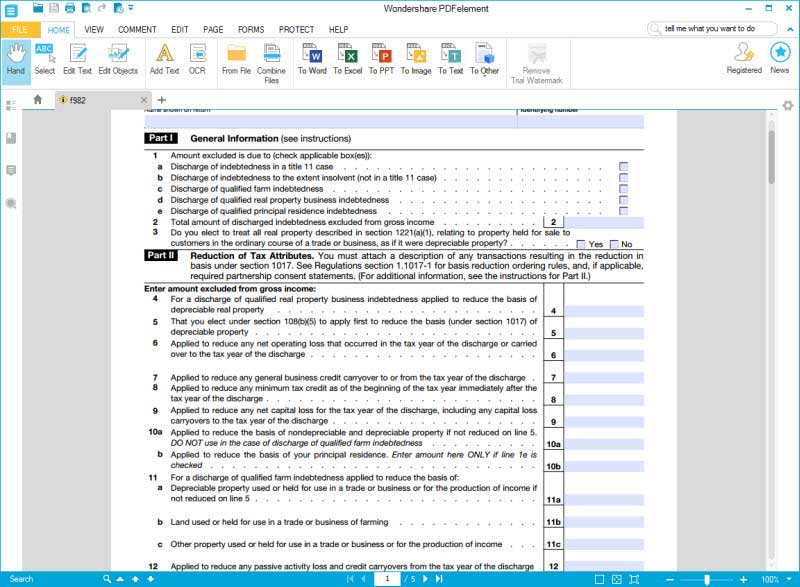

Irs Form 982 Instructions

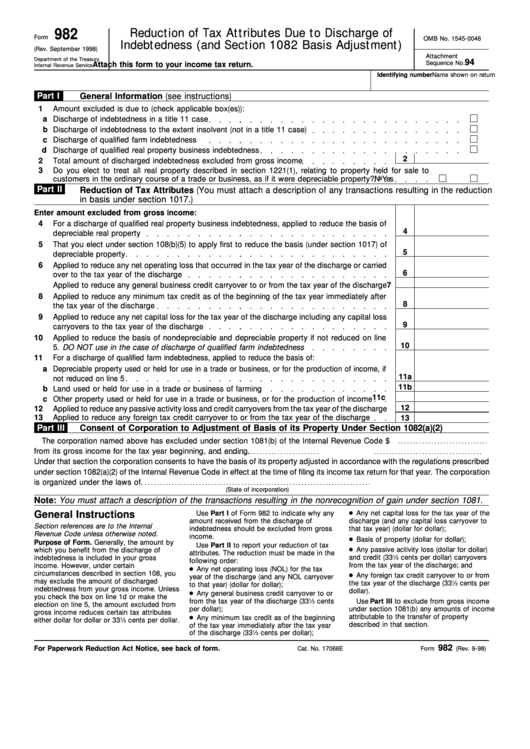

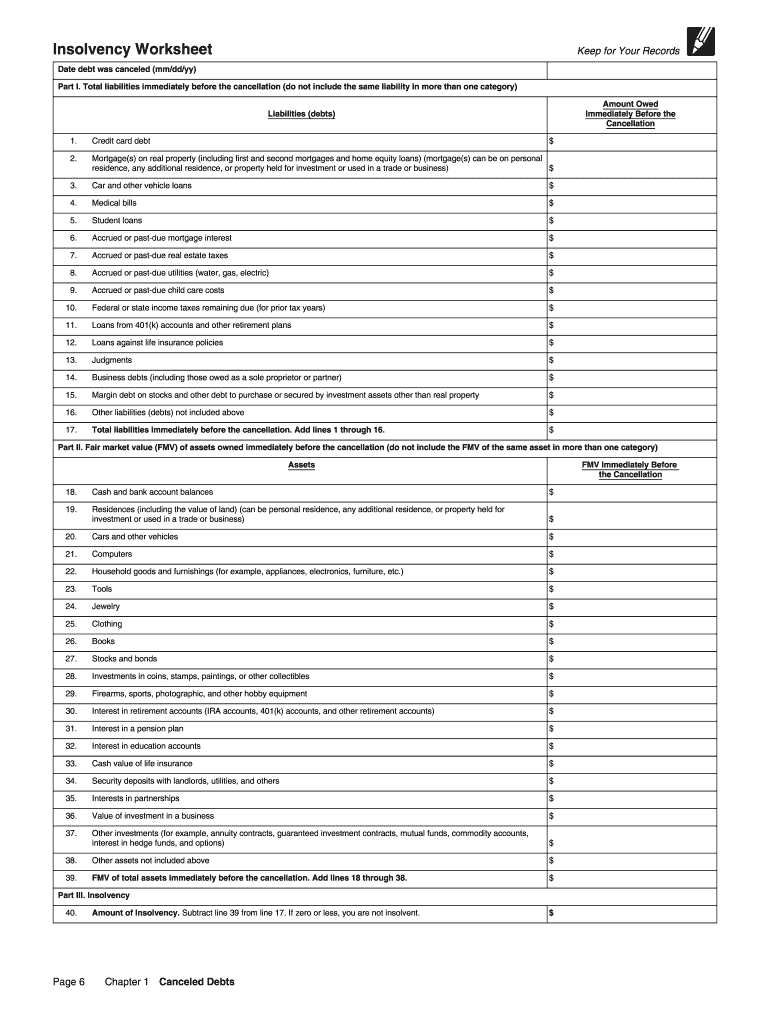

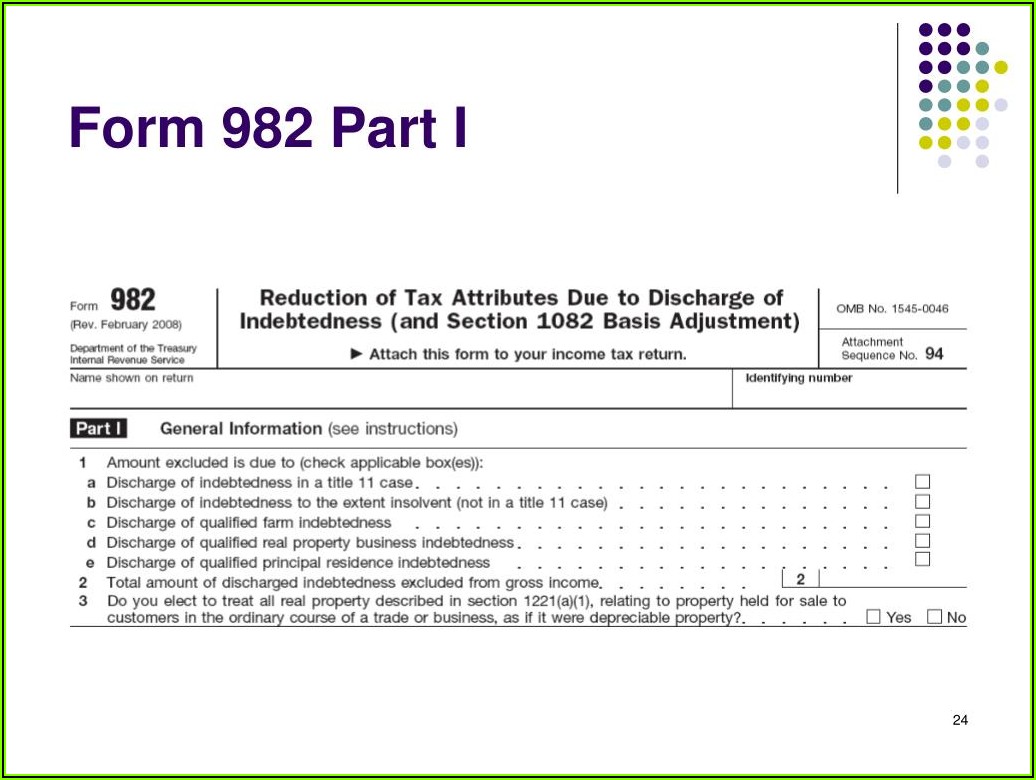

Irs Form 982 Instructions - Web in order to claim this, taxpayers must file irs form 982, reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment). Reduction of tax attributes due to discharge of indebtedness (and section 1082 basis. Ad grab great deals and offers on forms & recordkeeping items at amazon. Web for the latest information about developments related to form 982 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form982. Web access irs forms, instructions and publications in electronic and print media. Estimate how much you could potentially save in just a matter of minutes. Web (for use with form 982 (rev. The order is dependent upon why the canceled debt is being excluded from income. Qualified principal residence indebtedness can be excluded from income for discharges. Web check box 1e on form 982. Web access irs forms, instructions and publications in electronic and print media. March 2018) department of the treasury internal revenue service. Web the internal revenue service (irs) considers debt cancellation to be a form of income and so if you have had cancelled debt, you can probably expect to see a. Web learn five ways to reduce or eliminate your. However, when using an exception and it relates to property that. Web in order to claim this, taxpayers must file irs form 982, reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment). Web the election must be made on a timely filed federal income tax return (including extensions) for 2022 and can be revoked only. Web reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment) form 982 (rev. Estimate how much you could potentially save in just a matter of minutes. Ad we help get taxpayers relief from owed irs back taxes. Reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment) (for use with form. Web information about form 982, reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment), including recent updates, related. March 2018)) section references are to the internal revenue code unless otherwise noted. Web (for use with form 982 (rev. Web the election must be made on a timely filed federal income tax return (including extensions) for. Use screen 982 or 982s (as applicable),. Ad we help get taxpayers relief from owed irs back taxes. March 2018)) department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. Web information about form 982, reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment), including recent updates,. March 2018) form 982 (rev. Use screen 982 or 982s (as applicable),. Web the election must be made on a timely filed federal income tax return (including extensions) for 2022 and can be revoked only with irs consent. Web tax attributes must be reduced in a particular order. See publication 4012, income tab, capital loss on foreclosure, on how to. March 2018) department of the treasury internal revenue service. Web access irs forms, instructions and publications in electronic and print media. Web reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment) form 982 (rev. Web solved•by intuit•68•updated 1 year ago. Web (for use with form 982 (rev. Web if you qualify for an exception or exclusion, you don’t report your canceled debt on your tax return. However, when using an exception and it relates to property that. The order is dependent upon why the canceled debt is being excluded from income. Estimate how much you could potentially save in just a matter of minutes. Web the election. Estimate how much you could potentially save in just a matter of minutes. Web reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment) form 982 (rev. Web in order to claim this, taxpayers must file irs form 982, reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment). Web 908 bankruptcy. Get deals and low prices on irs form 1099 nec at amazon Web information about form 982, reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment), including recent updates, related. March 2018)) department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. Ad grab great deals and. Use screen 982 or 982s (as applicable),. Form 982 is a direct input and output form and will only generate based on the entries on the discharge of. March 2018) form 982 (rev. See publication 4012, income tab, capital loss on foreclosure, on how to complete form 982. March 2018)) section references are to the internal revenue code unless otherwise noted. Taxpayers who are not personally liable for. Web (for use with form 982 (rev. Get deals and low prices on irs form 1099 nec at amazon Web tax attributes must be reduced in a particular order. Web the internal revenue service (irs) considers debt cancellation to be a form of income and so if you have had cancelled debt, you can probably expect to see a. Estimate how much you could potentially save in just a matter of minutes. Web if you qualify for an exception or exclusion, you don’t report your canceled debt on your tax return. March 2018) department of the treasury internal revenue service. However, when using an exception and it relates to property that. Web 908 bankruptcy tax guide. Web information about form 982, reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment), including recent updates, related. Ad we help get taxpayers relief from owed irs back taxes. Web check box 1e on form 982. Web the election must be made on a timely filed federal income tax return (including extensions) for 2022 and can be revoked only with irs consent. Web for the latest information about developments related to form 982 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form982.Remplir Formulaire 982 de l'IRS correctement

Form 982 Worksheet

Form 982 Fill Out and Sign Printable PDF Template signNow

Debt Irs Form 982 Form Resume Examples 0g27K7n2Pr

Download Instructions for IRS Form 982 Reduction of Tax Attributes Due

Ordinary Power Of Attorney Pdf

IRS Form 982 How to Fill it Right

Form 982 Reduction of Tax Attributes Due to Discharge of Indebtedness

Of Debt Form 982 Universal Network

IRS Form 982 Instructions Discharge of Indebtedness

Related Post: