Form 5564 Irs

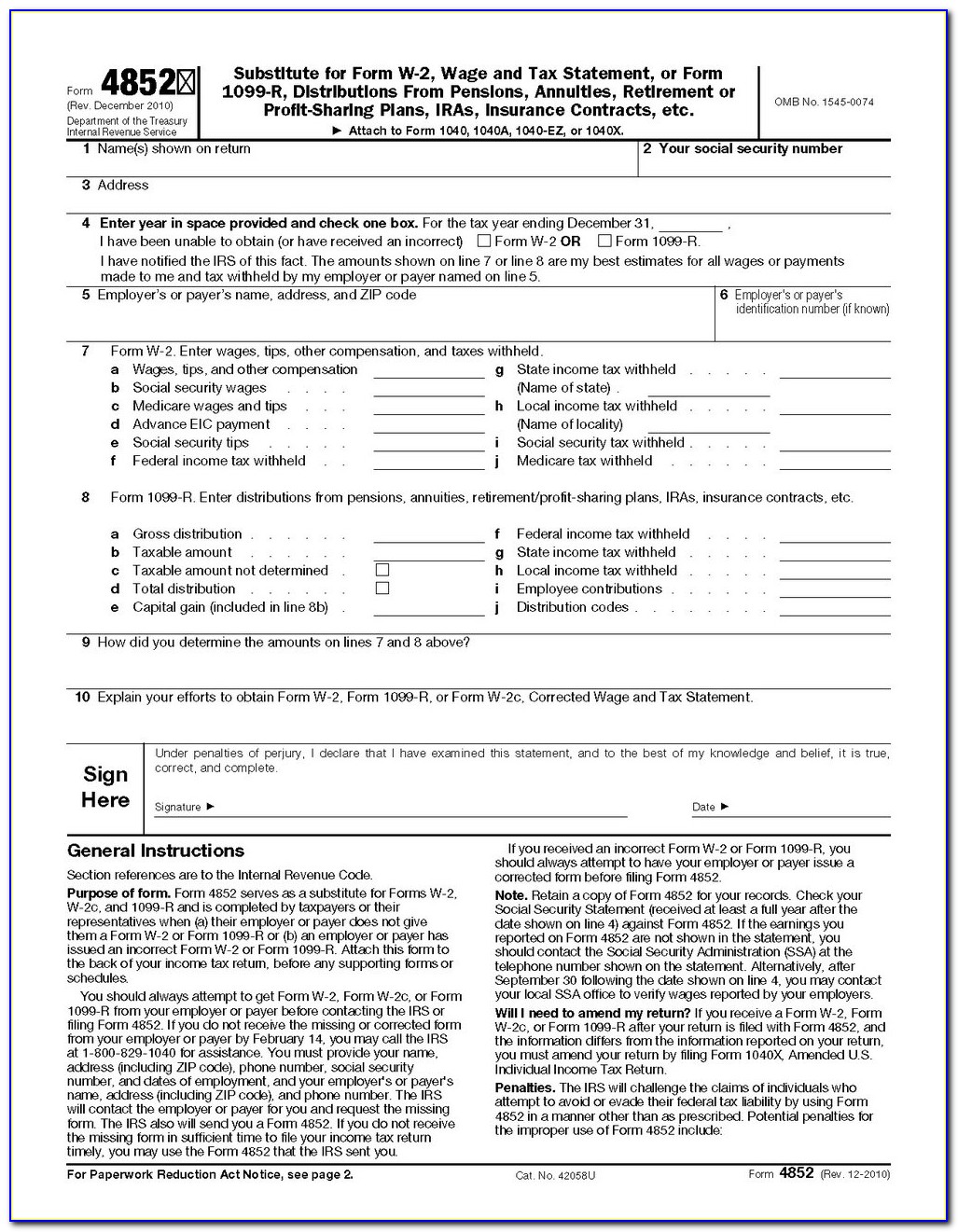

Form 5564 Irs - Web if you agree with the notice of deficiencies proposed increase in tax, consider filling the irs notice of deficiency waiver form 5564. Web if you are making a payment, include it with the form 5564. Web this letter explains the changes… and your right to challenge the increase in tax court. Irs form 5564 is included when the federal tax agency sends the irs notice cp3219a. Web it also notifies our member of his or her right to challenge. 5564 notice of deficiency waiver free ebay auction templatesvictoria secret coupons 2012 ×10. Web • if you are not paying your tax liability now, sign the enclosed form 5564, notice of deficiency waiver and mail it to the irs at the following address: Web what to do if you agree with the notice. This form notifies the irs that you agree with the proposed additional tax due. Web irs notice of deficiency: Web form 5564 notice of deficiency waiver. This form notifies the irs that you agree with the proposed additional tax due. Web • if you are not paying your tax liability now, sign the enclosed form 5564, notice of deficiency waiver and mail it to the irs at the following address: Web forms that must be ordered from the irs. Web it also notifies our member of his or her right to challenge. If the irs believes that you owe more tax than what was reported on your tax return, the irs will send a notice of. Web if you agree with the notice of deficiency and don’t wish to challenge it, then simply sign form 5564, the notice of. Page last reviewed or updated: Web it also notifies our member of his or her right to challenge. Web if you agree with the notice of deficiencies proposed increase in tax, consider filling the irs notice of deficiency waiver form 5564. How to complete the ir's form 5564 notice of. This form might arrive because the income you. This form lets the internal revenue. If the irs believes that you owe more tax than what was reported on your tax return, the irs will send a notice of. This form might arrive because the income you. Web form 5564 notice of deficiency waiver. If you receive cp2000 or cp3219a and realize, yes, you made a mistake, and you. Form 5564 & notice 3219a. Web form 5564 notice of deficiency waiver. Web it also notifies our member of his or her right to challenge. What does form 5564 mean? When the automated systems at the irs detect a problem with your tax payment you will receive a form 5564. 5564 notice of deficiency waiver free ebay auction templatesvictoria secret coupons 2012 ×10. Web form 5564 notice of deficiency waiver. Web forms that must be ordered from the irs are labeled for information only and can be ordered online. What does form 5564 mean? Web this letter explains the changes… and your right to challenge the increase in tax court. Irs form 5564 is included when the federal tax agency sends the irs notice cp3219a. Web this letter explains the changes… and your right to challenge the increase in tax court. This form might arrive because the income you. Web irs notice of deficiency: Web what is irs form 5564? If you’ve received notice cp3219 from the irs, you may be wondering what it means and what you need. Web form 5564 notice of deficiency waiver. How to complete the ir's form 5564 notice of. Web forms that must be ordered from the irs are labeled for information only and can be ordered online. Web if you are making a. Web form 5564 notice of deficiency waiver. What happens if you don't respond to notice of deficiency? Web if you agree with the notice of deficiencies proposed increase in tax, consider filling the irs notice of deficiency waiver form 5564. What does form 5564 mean? If you pay the amount due now, you will reduce the amount of interest and. Web irs notice of deficiency: Web form 5564 notice of deficiency waiver. Ad freetaxusa.com has been visited by 10k+ users in the past month When the automated systems at the irs detect a problem with your tax payment you will receive a form 5564. Irs form 5564 is included when the federal tax agency sends the irs notice cp3219a. If you’ve received notice cp3219 from the irs, you may be wondering what it means and what you need. If you receive cp2000 or cp3219a and realize, yes, you made a mistake, and you agree with the irs that you owe more in taxes, and. Web forms that must be ordered from the irs are labeled for information only and can be ordered online. Web this letter explains the changes… and your right to challenge the increase in tax court. This form might arrive because the income you. Ad freetaxusa.com has been visited by 10k+ users in the past month If the irs believes that you owe more tax than what was reported on your tax return, the irs will send a notice of. If you pay the amount due now, you will reduce the amount of interest and penalties. Our team of expert audit representatives,. Web if you agree with the notice of deficiencies proposed increase in tax, consider filling the irs notice of deficiency waiver form 5564. Form 5564 & notice 3219a. Web if you are making a payment, include it with the form 5564. Web what to do if you agree with the notice. Web • if you are not paying your tax liability now, sign the enclosed form 5564, notice of deficiency waiver and mail it to the irs at the following address: Review the changes and compare them to your tax return. It explains the proposed increase or decrease in your tax. Web form 5564 notice of deficiency waiver. When the automated systems at the irs detect a problem with your tax payment you will receive a form 5564. Page last reviewed or updated: 5564 notice of deficiency waiver free ebay auction templatesvictoria secret coupons 2012 ×10.Delinquency Notice Template Master Template

Irs Form 941 Schedule B 2014 Form Resume Examples 7mk9YKrkGY

Irs Form W4V Printable IRS 656B 2020 Fill and Sign Printable

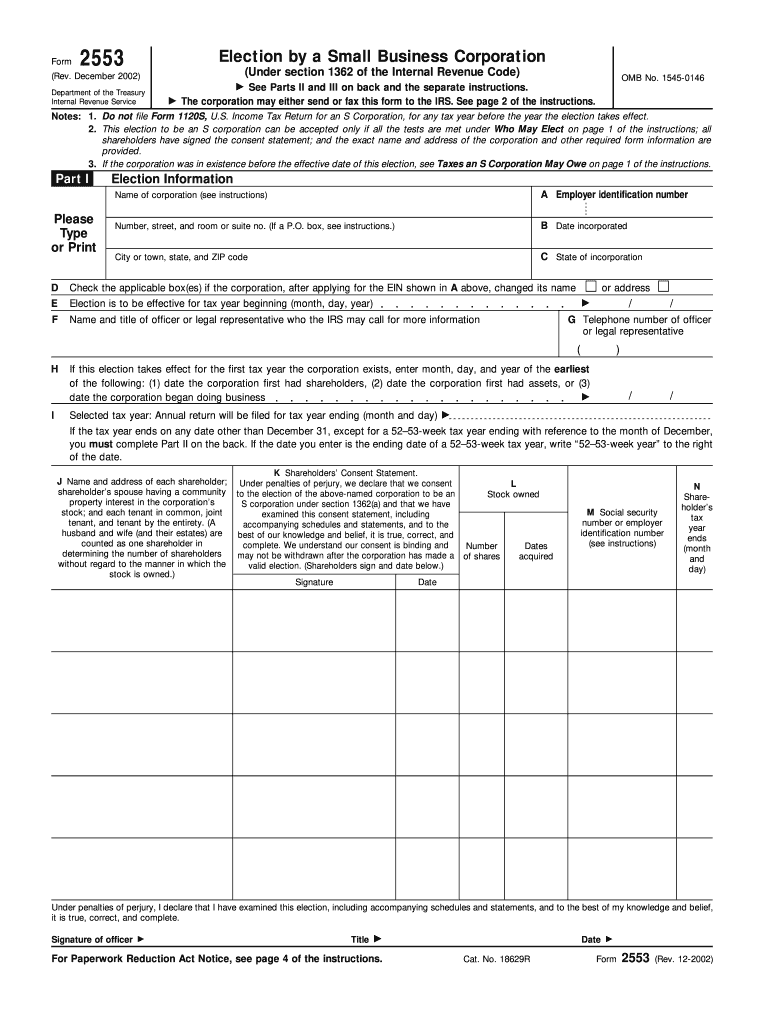

Ir's Form 2553 Fill in Fill Out and Sign Printable PDF Template signNow

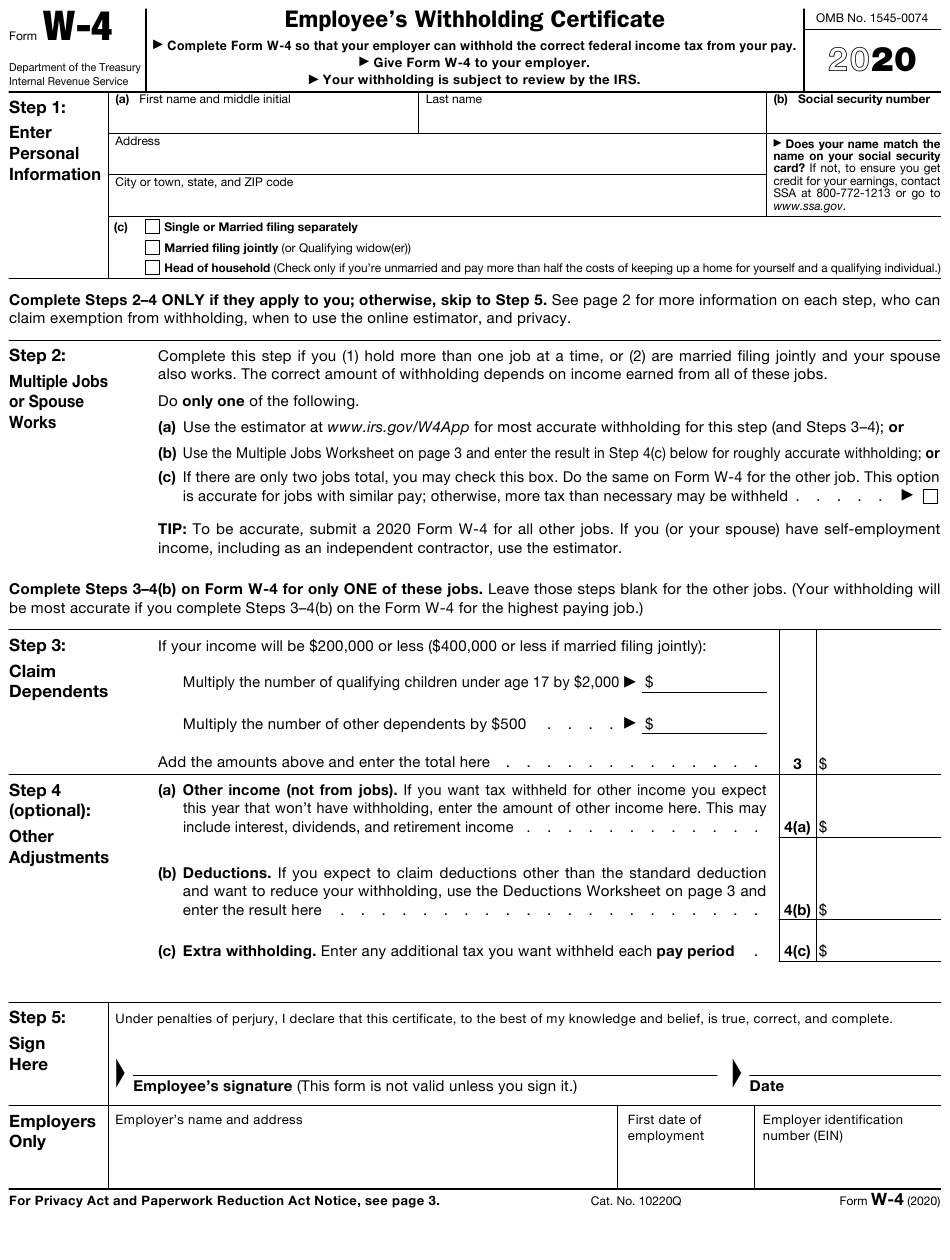

IRS Form W4 Printable 2022 W4 Form

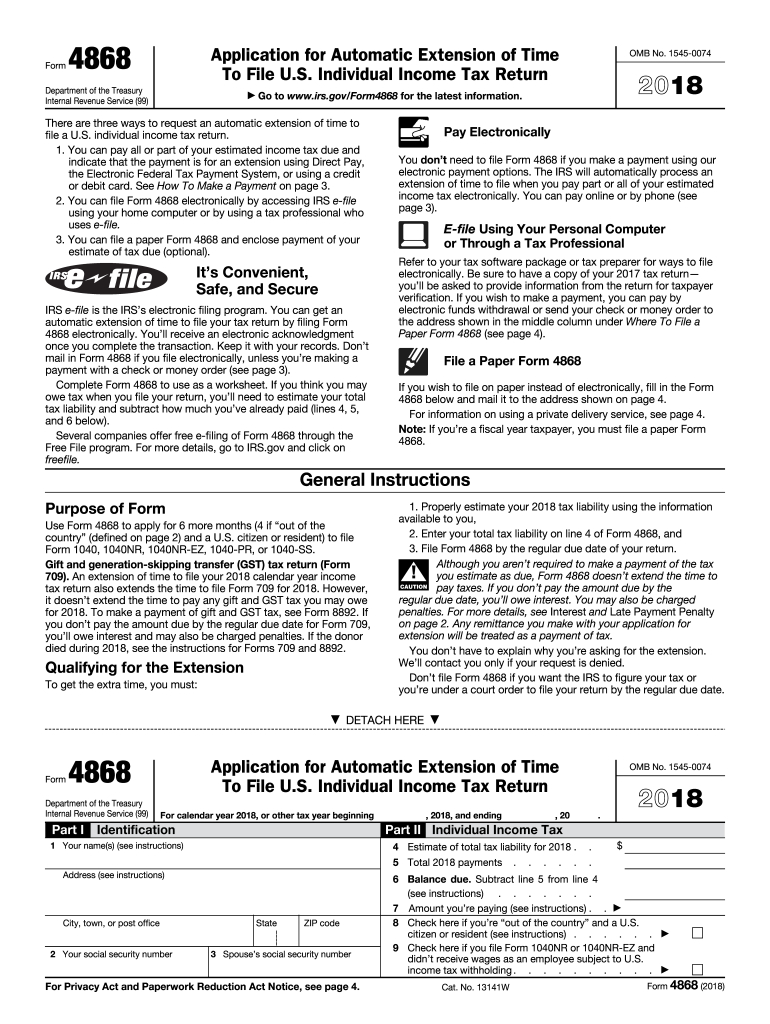

Print Irs Extension Form 4868 2021 Calendar Printables Free Blank

Irs Forms 1040 Es Form Resume Examples

Irs Form W4V Printable where do i mail my w 4v form for social

Irs Form 5564 Pdf Fill Online, Printable, Fillable, Blank pdfFiller

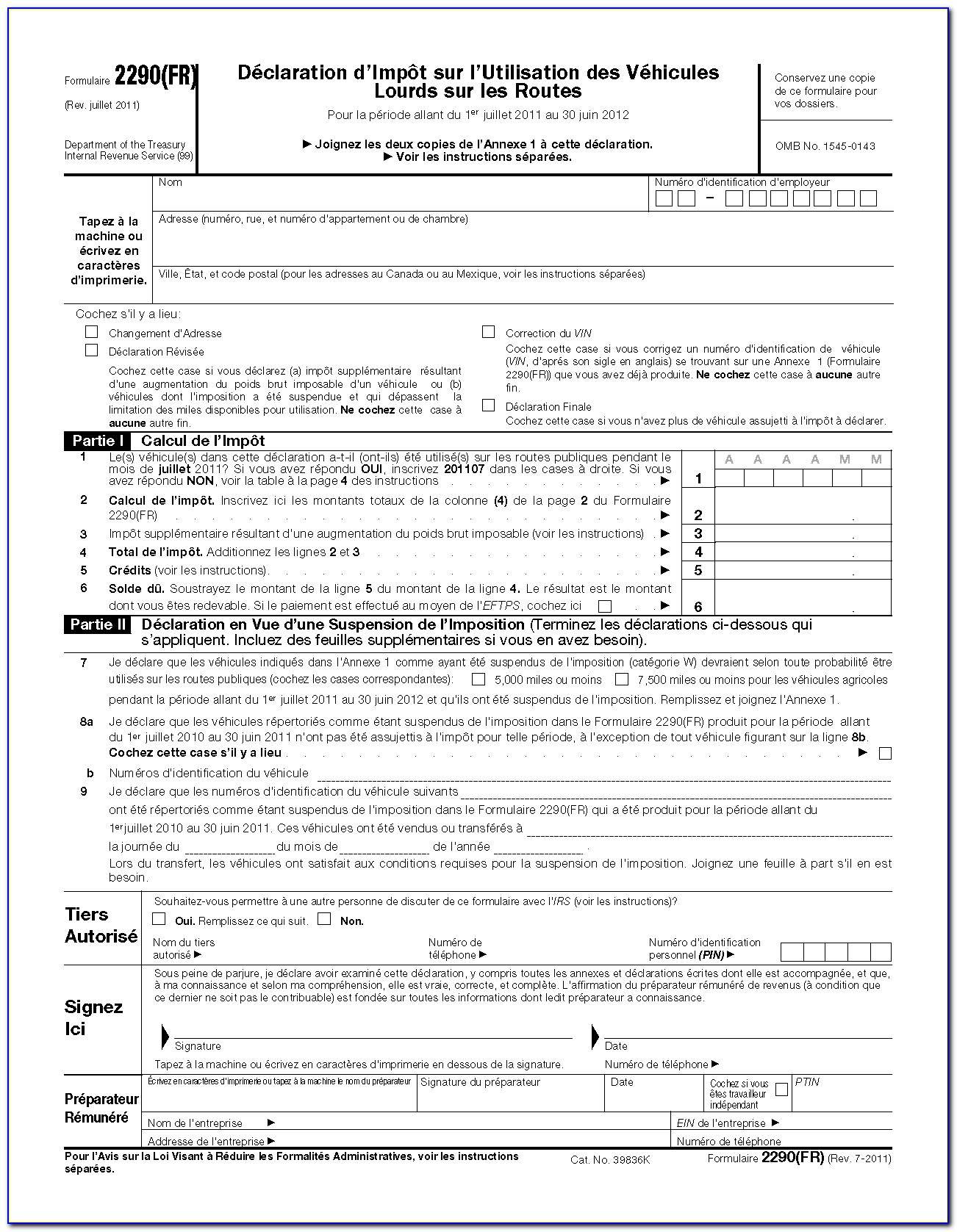

2290 Form Inspirational Irs Form 2290 Instructions Choice Image Form

Related Post: