Irs Form 9297

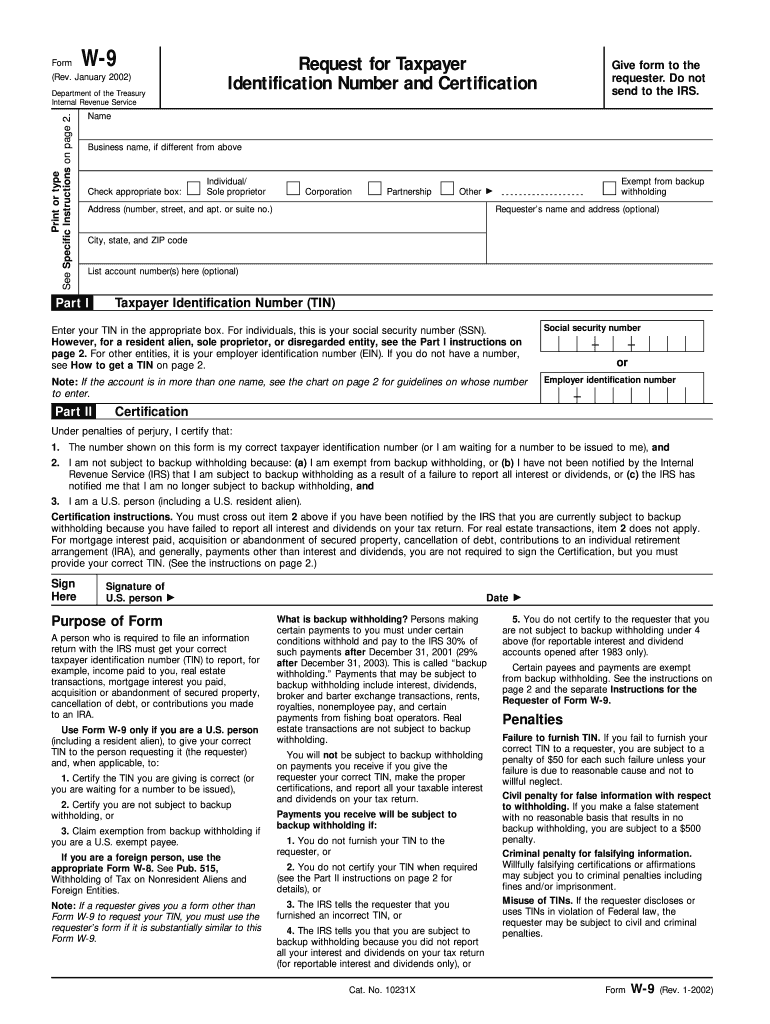

Irs Form 9297 - Create this form in 5 minutes! Web a completed form 9297, summary of taxpayer contact, should also be included, letting the taxpayer or representative know which items will be needed at the. You or your representative has contacted the irs revenue officer. Rated 4.5 out of 5 stars by our customers. Inform the recipient of the total due and the amount of payment that can be arranged. Web irs form 9297 is used to: Complete, edit or print tax forms instantly. Individual tax return form 1040 instructions; Web may require the irs to take certain actions, such as issuing a summons, issuing a notice of levy, or other actions as specified below. Ad we help get taxpayers relief from owed irs back taxes. You or your representative has contacted the irs revenue officer. Web irs form 9297 is used to: Did you like how we did? Complete, edit or print tax forms instantly. Web irs form 9297 pdf. Web based on 1533 reviews. Rated 4.5 out of 5 stars by our customers. Enter the ale member’s complete address (including. Online technologies allow you to arrange your document administration and strengthen the productiveness of your workflow. Complete, edit or print tax forms instantly. Estimate how much you could potentially save in just a matter of minutes. Get ready for tax season deadlines by completing any required tax forms today. Individual tax return form 1040 instructions; Ad download or email irs 940 & more fillable forms, register and subscribe now! Web may require the irs to take certain actions, such as issuing a summons,. Did you like how we did? Estimate how much you could potentially save in just a matter of minutes. Get ready for tax season deadlines by completing any required tax forms today. You or your representative has contacted the irs revenue officer. Web irs form 9297, also known as the “summary of taxpayer contact”, is the form that an irs. Web based on 1533 reviews. Ad access irs tax forms. Web you received irs letter 9297 because there is an irs revenue officer assigned to your case. Web a completed form 9297, summary of taxpayer contact, should also be included, letting the taxpayer or representative know which items will be needed at the. Enter the ale member’s complete address (including. Request for taxpayer identification number (tin) and. Online technologies allow you to arrange your document administration and strengthen the productiveness of your workflow. If you have unfiled returns, the revenue officer will need those to be prepared. Did you like how we did? You or your representative has contacted the irs revenue officer. Did you like how we did? Web the revenue officer’s demands in form 9297 can be broken down into four areas: The duty of an irs revenue officer is collect unpaid taxes by any means necessary. Web may require the irs to take certain actions, such as issuing a summons, issuing a notice of levy, or other actions as specified. Ad we help get taxpayers relief from owed irs back taxes. Individual tax return form 1040 instructions; Ad access irs tax forms. Web form 9297 is used to guide irs case management, and while these deadlines are important, they can usually be negotiated. Web irs form 9297 is used to: Ad download or email irs 940 & more fillable forms, register and subscribe now! Ad we help get taxpayers relief from owed irs back taxes. Complete, edit or print tax forms instantly. Estimate how much you could potentially save in just a matter of minutes. Web irs form 9297 pdf. Inform the recipient of the total due and the amount of payment that can be arranged. You or your representative has contacted the irs revenue officer. Web irs form 9297 is used to: Prepare the detailed payment of federal tax. Web the revenue officer’s demands in form 9297 can be broken down into four areas: Web irs form 9297, also known as the “summary of taxpayer contact”, is the form that an irs revenue officer sends to a taxpayer to inform them of: Ad we help get taxpayers relief from owed irs back taxes. Web irs form 9297 pdf. Complete, edit or print tax forms instantly. Web the revenue officer’s demands in form 9297 can be broken down into four areas: You or your representative has contacted the irs revenue officer. Web a completed form 9297, summary of taxpayer contact, should also be included, letting the taxpayer or representative know which items will be needed at the. The duty of an irs revenue officer is collect unpaid taxes by any means necessary. Request for taxpayer identification number (tin) and. Web form 9297 is used to guide irs case management, and while these deadlines are important, they can usually be negotiated. Prepare the detailed payment of federal tax. Ad download or email irs 940 & more fillable forms, register and subscribe now! Web based on 1533 reviews. Estimate how much you could potentially save in just a matter of minutes. Inform the recipient of the total due and the amount of payment that can be arranged. Get ready for tax season deadlines by completing any required tax forms today. Web irs form 9297 is used to: Web what is form 9297? Did you like how we did? Web may require the irs to take certain actions, such as issuing a summons, issuing a notice of levy, or other actions as specified below.Irs.gov Form 941 X Instructions Form Resume Examples 86O7Vo75BR

Irs.gov Forms 941 Instructions Form Resume Examples Bw9jr5n97X

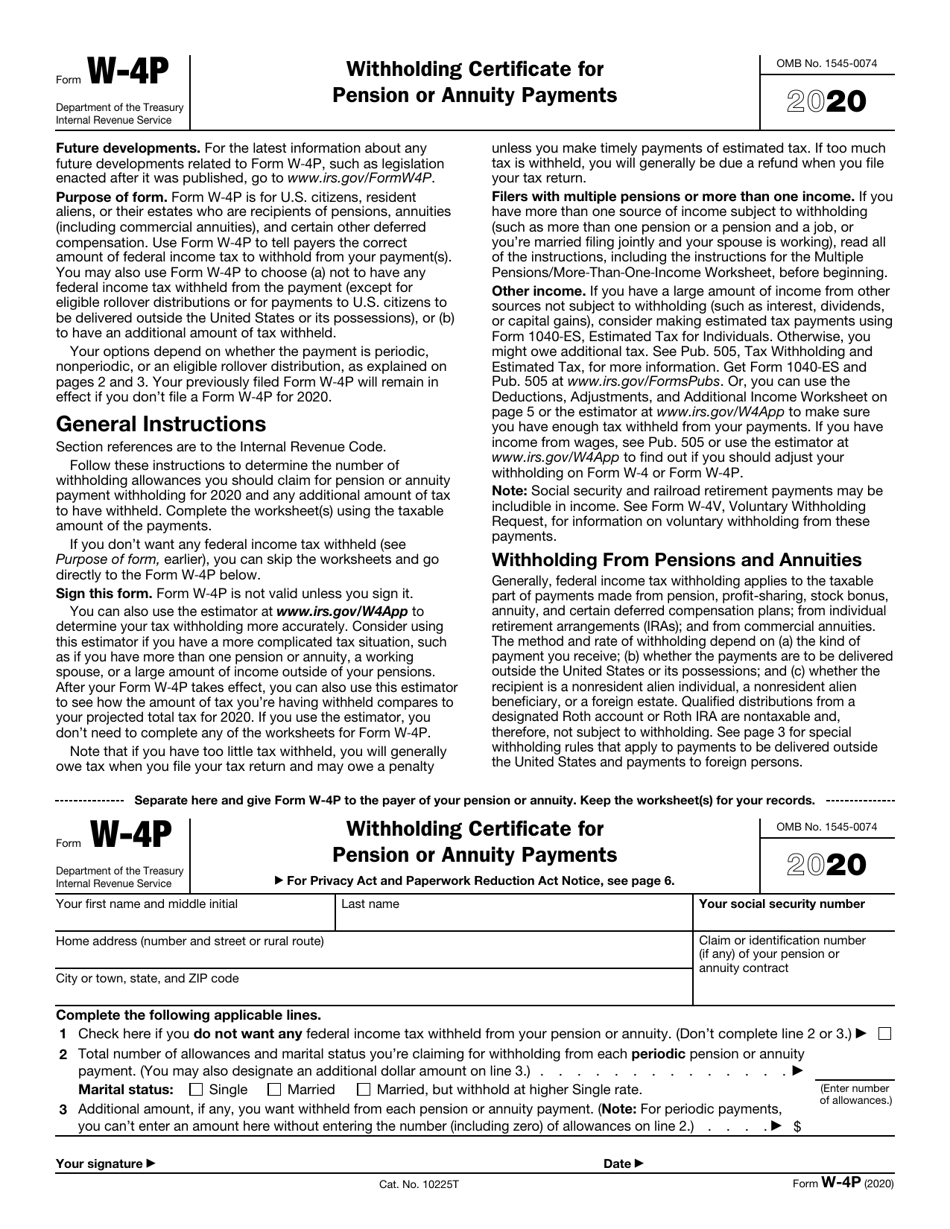

Irs Form W4V Printable Irs W 4p Pdffiller

What Is IRS Form 9297 How to Respond Tax Attorney Newport Beach CA

Irs Form 9297 What Is It And Why Use It TaxReliefMe Tax Attorneys

2002 Form IRS W9Fill Online, Printable, Fillable, Blank pdfFiller

IRS FORM 9297 SUMMARY OF CONTACT Get Tax Help

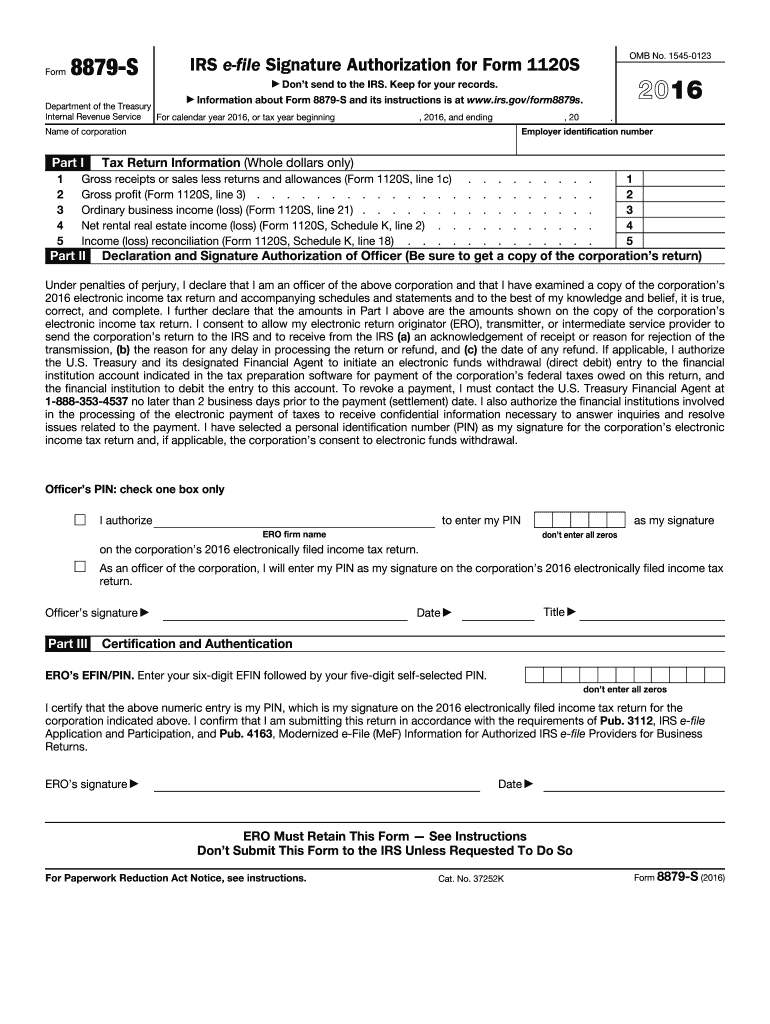

2016 Form IRS 8879S Fill Online, Printable, Fillable, Blank pdfFiller

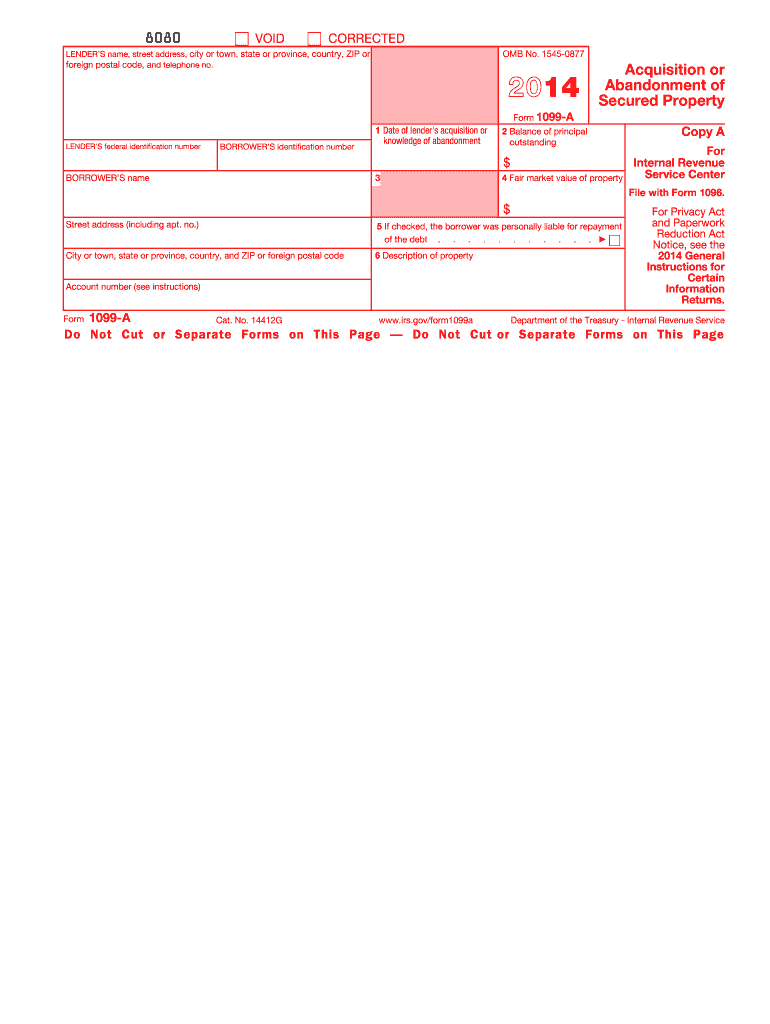

2014 Form IRS 1099AFill Online, Printable, Fillable, Blank pdfFiller

IRS Form 9297 What To Do If You Received This From a Revenue Officer

Related Post: