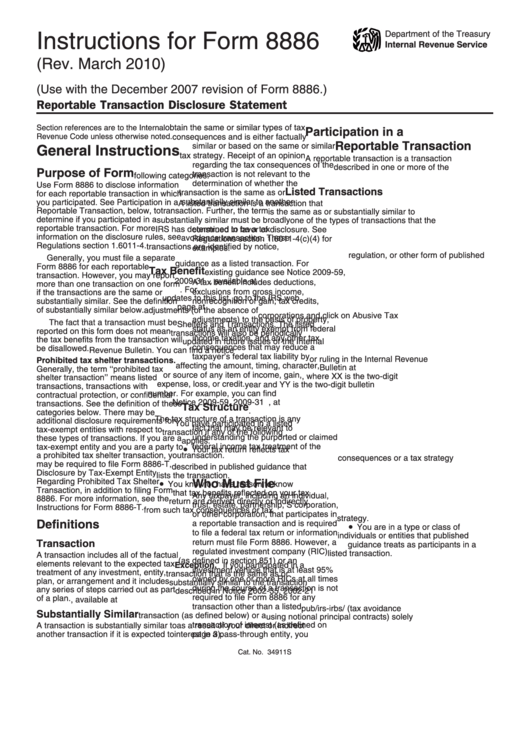

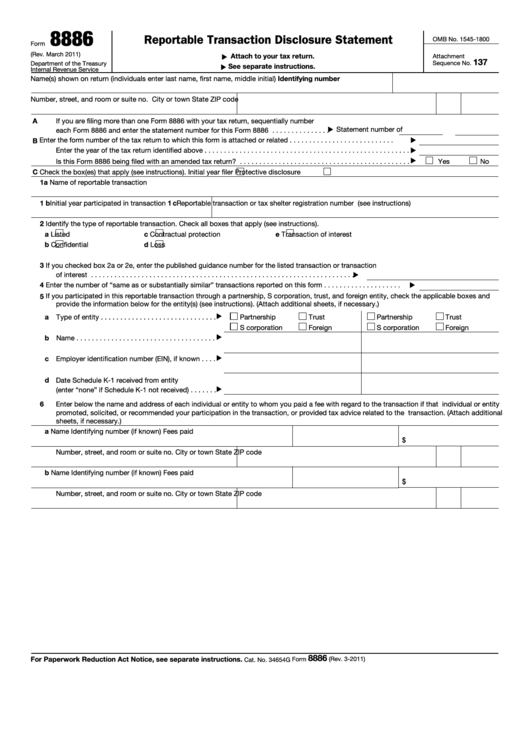

Federal Form 8886

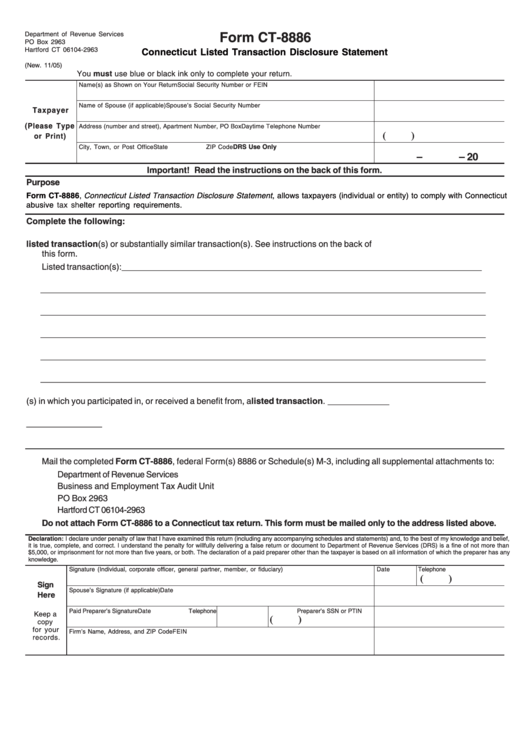

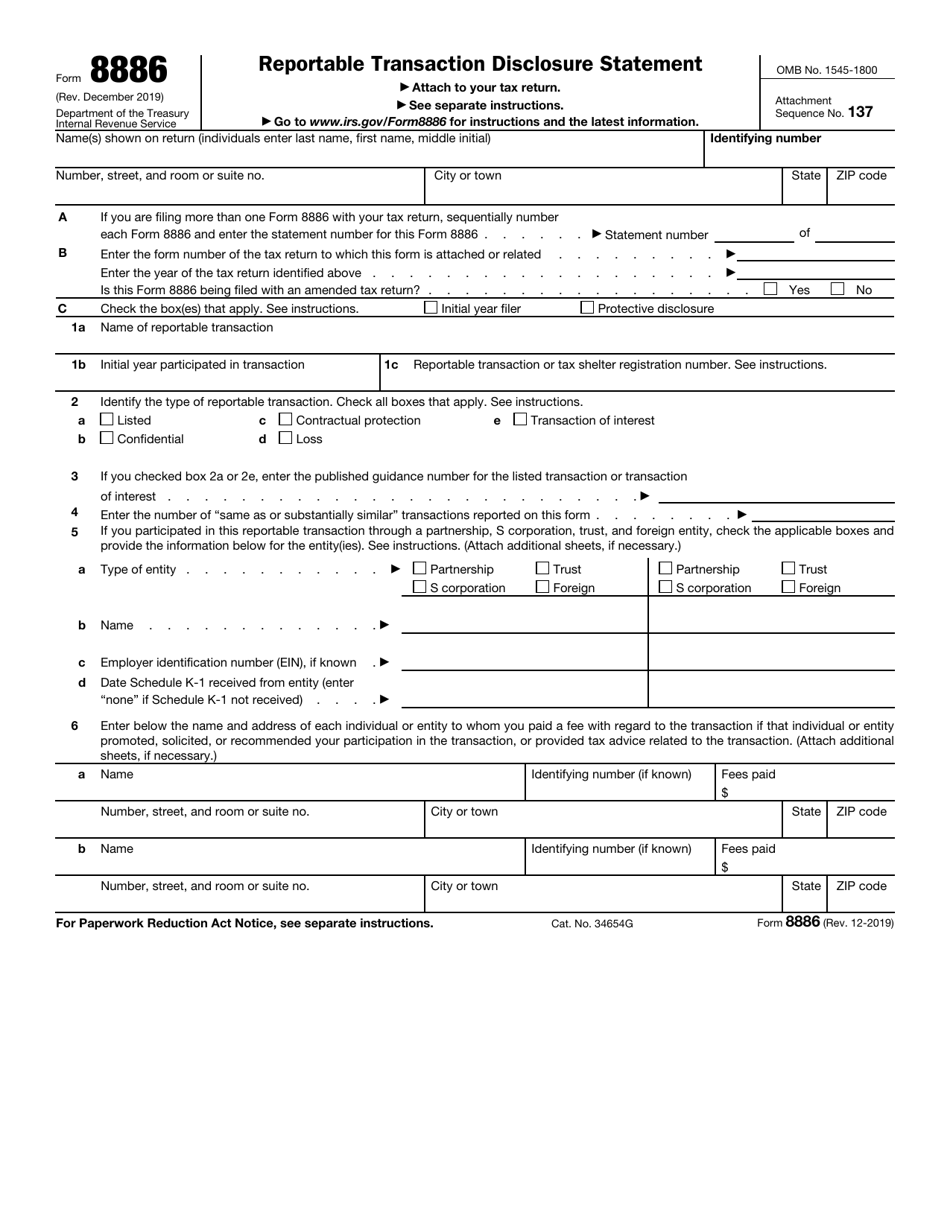

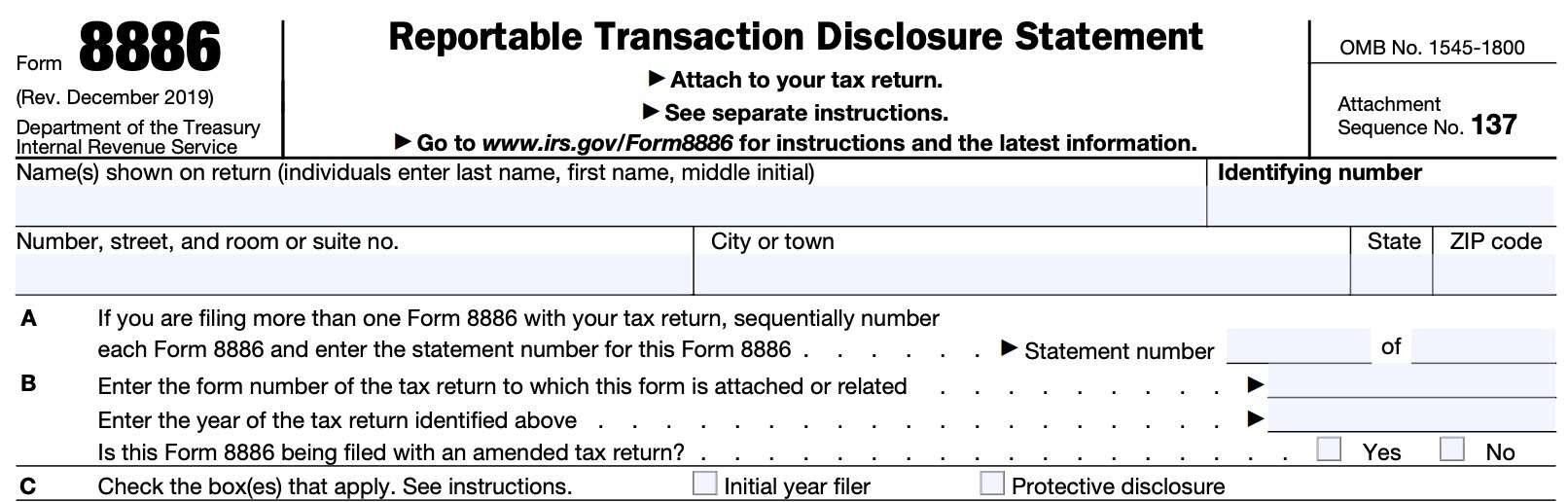

Federal Form 8886 - Who must file any taxpayer, including an individual, trust, estate, partnership, s corporation, or other corporation, that participates. Any taxpayer, including an individual, trust, estate, partnership, s corporation, or other corporation, that participates in a reportable transaction and is. Web if you claim a deduction, credit, or other tax benefit related to a reportable transaction and are required to submit federal form 8886, reportable transaction disclosure statement. Web if you are filing more than one form 8886 with your tax return, sequentially number each form 8886 and enter the statement number for this form 8886. Web the instructions to form 8886, reportable transaction disclosure statement. Web information about form 8886, reportable transaction disclosure statement, including recent updates, related forms and instructions on how to file. Web federal form 8886, reportable transaction disclosure statement, must be attached to any return on which the partnership has claimed or reported income from, or a deduction,. Web federal form 8886 is required to be attached to any return on which a deduction, loss, credit, or any other tax benefit is claimed or is reported, or any income the s corporation. State tax refund included on federal return; Generally, form 8886 must be attached to the tax return for each tax year. Name, address, ssn, and residency; Web information about form 8886, reportable transaction disclosure statement, including recent updates, related forms and instructions on how to file. The ftb may impose penalties if. Web we last updated the reportable transaction disclosure statement in february 2023, so this is the latest version of form 8886, fully updated for tax year 2022. Web federal. See participation in a reportable transaction, below, to. When a taxpayer participates in certain transactions in which the irs has deemed the type of transaction prone to illegal tax avoidance — it is is referred to as a. Web federal form 8886 is required to be attached to any return on which a deduction, loss, credit, or any other tax. Who must file any taxpayer, including an individual, trust, estate, partnership, s corporation, or other corporation, that participates. Web we last updated the reportable transaction disclosure statement in february 2023, so this is the latest version of form 8886, fully updated for tax year 2022. Web if this is the first time the reportable transaction is disclosed on the return,. Web information about form 8886, reportable transaction disclosure statement, including recent updates, related forms and instructions on how to file. Use form 8886 to disclose information for each reportable transaction in which you participated. December 2019) department of the treasury internal revenue service. Web federal form 8886 is required to be attached to any return on which a deduction, loss,. The ftb may impose penalties if. Generally, form 8886 must be attached to the tax return for each tax year. However, a regulated investment company (ric) (as defined in section 851) or an investment vehicle that is at. Web if you are filing more than one form 8886 with your tax return, sequentially number each form 8886 and enter the. The ftb may impose penalties if. The instructions to form 8886 (available at irs.gov) provide a specific explanation of what. See participation in a reportable transaction, below, to. Generally, form 8886 must be attached to the tax return for each tax year. Any taxpayer, including an individual, trust, estate, partnership, s corporation, or other corporation, that participates in a reportable. Web if you are filing more than one form 8886 with your tax return, sequentially number each form 8886 and enter the statement number for this form 8886. However, a regulated investment company (ric) (as defined in section 851) or an investment vehicle that is at. Web the instructions to form 8886, reportable transaction disclosure statement. Web as announced in. State tax refund included on federal return; Web information about form 8886, reportable transaction disclosure statement, including recent updates, related forms and instructions on how to file. Web if you are filing more than one form 8886 with your tax return, sequentially number each form 8886 and enter the statement number for this form 8886. Any taxpayer, including an individual,. When a taxpayer participates in certain transactions in which the irs has deemed the type of transaction prone to illegal tax avoidance — it is is referred to as a. Web if you claim a deduction, credit, or other tax benefit related to a reportable transaction and are required to submit federal form 8886, reportable transaction disclosure statement. However, a. December 2019) department of the treasury internal revenue service. Web if you are filing more than one form 8886 with your tax return, sequentially number each form 8886 and enter the statement number for this form 8886. Web federal form 8886, reportable transaction disclosure statement, must be attached to any return on which the partnership has claimed or reported income. When a taxpayer participates in certain transactions in which the irs has deemed the type of transaction prone to illegal tax avoidance — it is is referred to as a. Web if you are filing more than one form 8886 with your tax return, sequentially number each form 8886 and enter the statement number for this form 8886. Name, address, ssn, and residency; Web the irs has identified the following losses as potentially subject to abuse and requires anyone who claims a loss of at least one of the following amounts on a tax return to. Web federal form 8886 is required to be attached to any return on which a deduction, loss, credit, or any other tax benefit is claimed or is reported, or any income the s corporation. Web federal form 8886, reportable transaction disclosure statement, must be attached to any return on which the partnership has claimed or reported income from, or a deduction,. Web we last updated the reportable transaction disclosure statement in february 2023, so this is the latest version of form 8886, fully updated for tax year 2022. The ftb may impose penalties if. However, a regulated investment company (ric) (as defined in section 851) or an investment vehicle that is at. December 2019) department of the treasury internal revenue service. Web federal income tax treatment of the transaction. See participation in a reportable transaction, below, to. Web as announced in today’s faqs, the irs (until further notice) is implementing a temporary procedure to allow for fax transmission of the separate office of tax shelter analysis. Web the instructions to form 8886, reportable transaction disclosure statement. Generally, form 8886 must be attached to the tax return for each tax year. Web use form 8886 to disclose information for each reportable transaction in which participation has occurred. Web if this is the first time the reportable transaction is disclosed on the return, send a duplicate copy of the federal form 8886 to the address below. The instructions to form 8886 (available at irs.gov) provide a specific explanation of what. Web to file a federal tax return or information return must file form 8886. Web federal form 8886 is required to be attached to any return on which a deduction, loss, credit, or any other tax benefit is claimed or is reported, or any income the corporation.Form Ct8886 Listed Transaction Disclosure Statement printable pdf

IRS Form 8886 Download Fillable PDF or Fill Online Reportable

Form 8886 Reportable Transaction Disclosure Statement (2011) Free

IRS Form 8886 Instructions Reportable Transaction Disclosure

IRS Form 8886 Instructions Reportable Transaction Disclosure

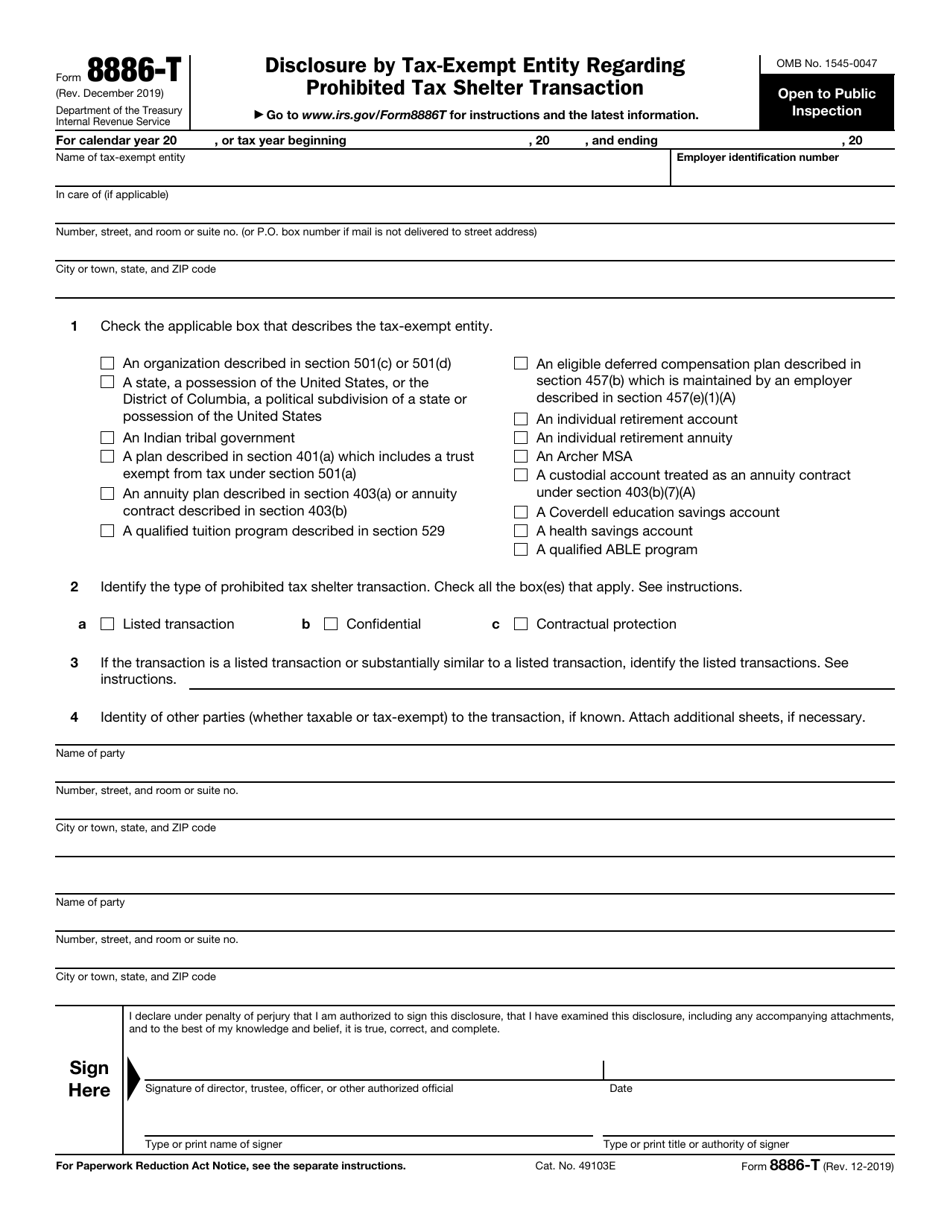

IRS Form 8886T Download Fillable PDF or Fill Online Disclosure by Tax

Instructions For Form 8886 Reportable Transaction Disclosure

Form 8886 Edit, Fill, Sign Online Handypdf

Fillable Form 8886 Reportable Transaction Disclosure Statement

IRS Form 8886 Instructions Reportable Transaction Disclosure

Related Post: