8615 Form Instructions

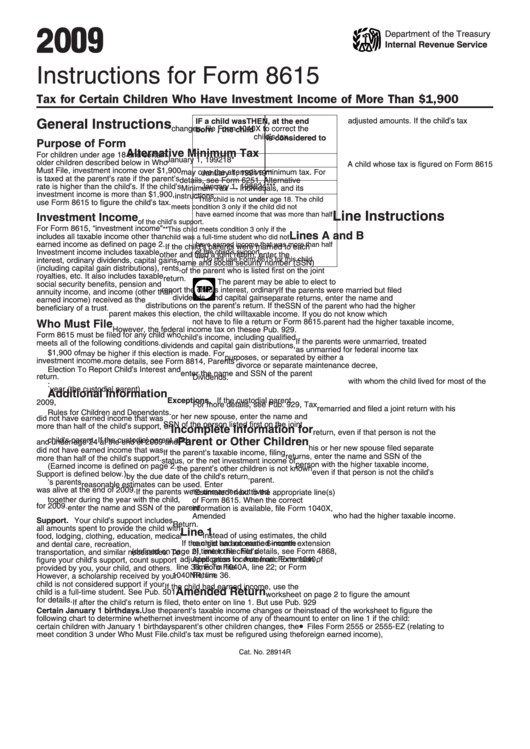

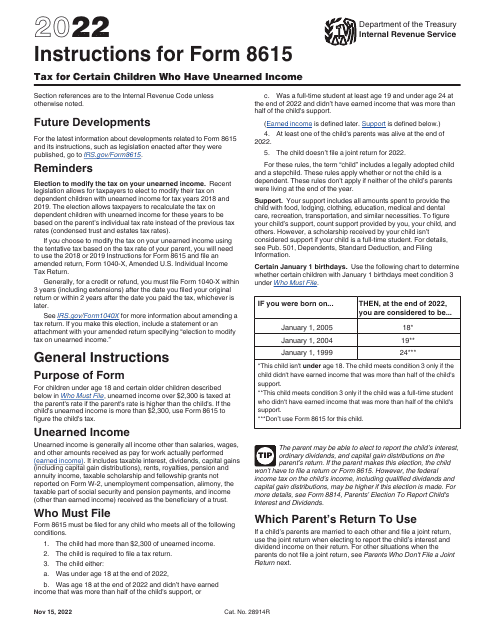

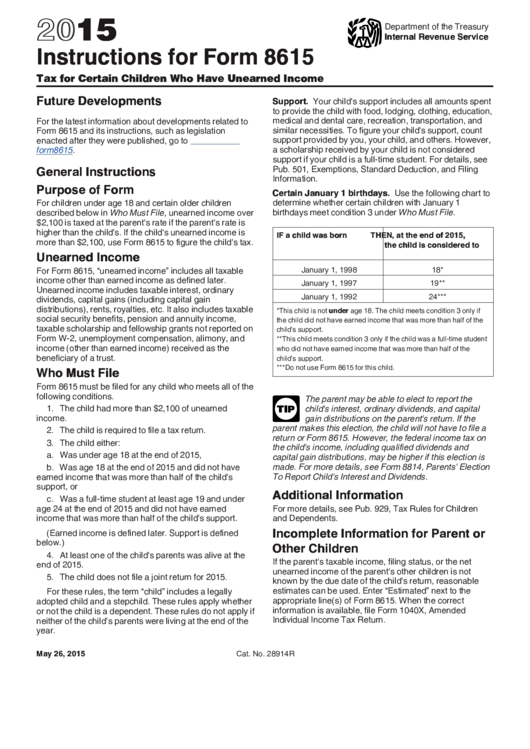

8615 Form Instructions - Web common questions about form 8615 and unearned income. Ad register and subscribe now to work on your irs form 8615 & more fillable forms. A child whose tax is figured on form 8615 may owe the alternative minimum tax. Web per irs instructions for form 8615 on page 1: Below, you'll find answers to frequently asked. Web who's required to file form 8615? Web using form 8814 or form 8615 to report a child's income this article will help determine if your client is eligible to use form 8814 or form 8615 to report a child's. The child had more than $2,300 of unearned income. Web single married filing jointlymarried filing separately head of householdqualifying widow(er) part i child’s net unearned income 1 enter the child’s unearned income. Web refer to the instructions for form 8615 for more information about what qualifies as earned income. Form 8814, parent's election to report child's interest and. Web for children under age 18 and certain older children described below in who must file, unearned income over $2,000 is taxed at the parent's rate if the parent's rate is higher. Web form 8615 must be filed with the child’s tax return if all of the following apply: Web taxslayer. The child had more than $2,300 of unearned income. Ad register and subscribe now to work on your irs form 8615 & more fillable forms. Web single married filing jointlymarried filing separately head of householdqualifying widow(er) part i child’s net unearned income 1 enter the child’s unearned income. Web who's required to file form 8615? For children under age 18. Web taxslayer support refunds children who have unearned income that’s subject to the kiddie tax must file a form 8615 with their 1040 tax return. Web who must file form 8615 must be filed for any child who meets all of the following conditions. Solved•by intuit•2•updated february 08, 2023. A child whose tax is figured on form 8615 may owe. Web this article will help resolve the following diagnostic for form 8615, tax for certain children who have unearned income: Form 8615 may be used for multiple billable service events. Web single married filing jointlymarried filing separately head of householdqualifying widow(er) part i child’s net unearned income 1 enter the child’s unearned income. Get ready for tax season deadlines by. Web who's required to file form 8615? Form 8615 may be used for multiple billable service events. Web 2020 department of the treasury internal revenue service instructions for form 8615 tax for certain children who have unearned income section references are to the internal. Get ready for tax season deadlines by completing any required tax forms today. Form 8814, parent's. For 2023, form 8615 needs to be filed if all of the following conditions apply: Web instructions for form 8615 tax for certain children who have unearned income section references are to the internal revenue code unless otherwise noted. Web per irs instructions for form 8615 on page 1: Form 8814, parent's election to report child's interest and. Web using. Web form 8615 must be filed with the child’s tax return if all of the following apply: Get ready for tax season deadlines by completing any required tax forms today. Web refer to the instructions for form 8615 for more information about what qualifies as earned income. Web single married filing jointlymarried filing separately head of householdqualifying widow(er) part i. Web this article will assist you with figuring out whether to use 8615 or form 8814 to report a child's income in the individual module of lacerte.form 8615, tax fo you. Web single married filing jointlymarried filing separately head of householdqualifying widow(er) part i child’s net unearned income 1 enter the child’s unearned income. For children under age 18 and. For children under age 18 and certain older children described below in who must file , unearned income over $2,300 is taxed at the parent's rate if the parent's. Form 8814, parent's election to report child's interest and. Form 8615, tax for certain children. Purpose of form use form 8615 to figure your tax on unearned income over $2,200 if. Web taxslayer support refunds children who have unearned income that’s subject to the kiddie tax must file a form 8615 with their 1040 tax return. Solved•by intuit•2•updated february 08, 2023. Web who's required to file form 8615? Web common questions about form 8615 and unearned income. Form 8615 must be used for only one individual. Ad register and subscribe now to work on your irs form 8615 & more fillable forms. Web general instructions purpose of form use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations if you are older. Get ready for tax season deadlines by completing any required tax forms today. Form 8615 must be used for only one individual. Web who must file form 8615 must be filed for any child who meets all of the following conditions. Web using form 8814 or form 8615 to report a child's income this article will help determine if your client is eligible to use form 8814 or form 8615 to report a child's. If applicable, include this amount on your form 1040, line. Web single married filing jointlymarried filing separately head of householdqualifying widow(er) part i child’s net unearned income 1 enter the child’s unearned income. The child are required to file a tax return. Web refer to the instructions for form 8615 for more information about what qualifies as earned income. Web per irs instructions for form 8615 on page 1: Web instructions for form 8615 tax for certain children who have unearned income section references are to the internal revenue code unless otherwise noted. The child has more than $2,500 in unearned income;. Web for children under age 18 and certain older children described below in who must file, unearned income over $2,000 is taxed at the parent's rate if the parent's rate is higher. Form 8615 may be used for multiple billable service events. Each billable service event must have a begin. The child had more than $2,300 of unearned income. Solved•by intuit•2•updated february 08, 2023. For children under age 18 and certain older children described below in who must file , unearned income over $2,300 is taxed at the parent's rate if the parent's. Web form 8615 must be filed with the child’s tax return if all of the following apply:Instructions for Form 8615 2022 Internal Revenue Service SPYKE® 中国区官方网站

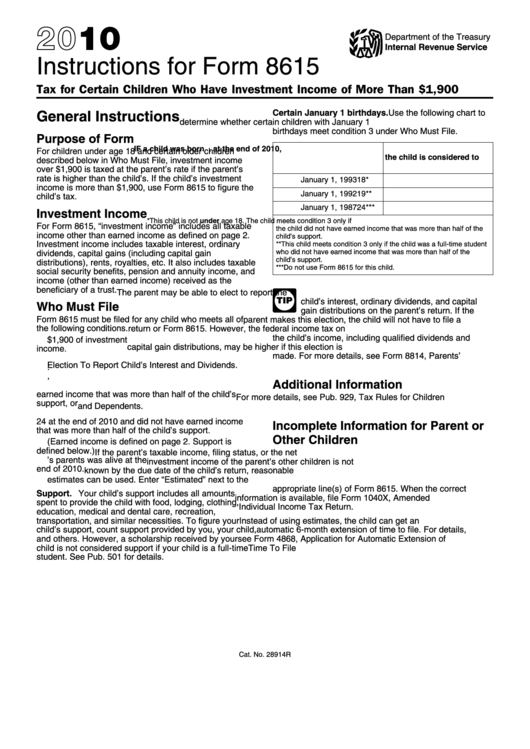

Instructions For Form 8615 Tax For Certain Children Who Have

PPT Don’t Miss Out On These Facts About the Form 8615 TurboTax

Form 8615 Tax for Certain Children Who Have Unearned (2015

Download Instructions for IRS Form 8615 Tax for Certain Children Who

Form 8615 Instructions (2015) printable pdf download

Instructions For Form 8615 Tax For Certain Children Who Have

Las instrucciones para el formulario 8615 del IRS Los Basicos 2023

Form 8615 Tax Pro Community

Download Instructions for IRS Form 8615 Tax for Certain Children Who

Related Post: