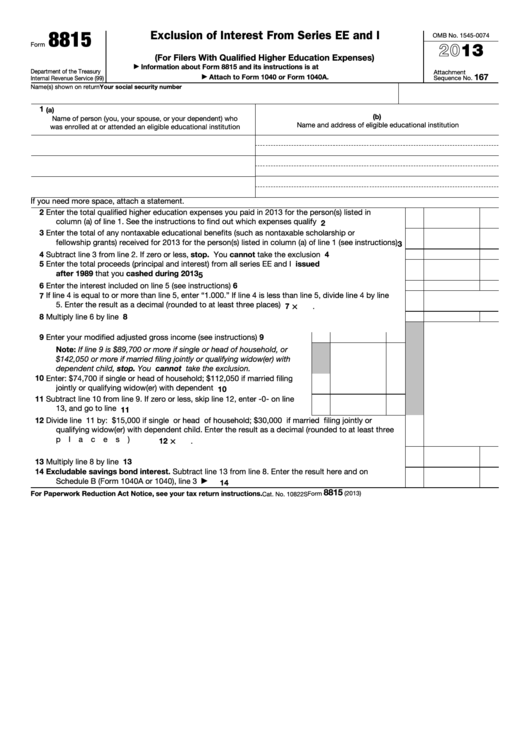

Irs Form 8815

Irs Form 8815 - Web to take the tax exclusion, you must complete irs form 8815. Ad we help get taxpayers relief from owed irs back taxes. Savings bonds issued after 1989 (for filers with qualified higher. Savings bonds to pay for higher education expenses, use form 8815 to exclude the interest from. When individuals aren?t connected to document administration and lawful operations, completing irs docs can be quite stressful. Web 8815 department of the treasury internal revenue service (99) exclusion of interest from series ee and i u.s. Savings bonds sep 13, 2023 — form 8815 — exclusion of interest from series ee and series i u.s. Web a savings bond rollover is reported on irs form 8815 to exclude the savings bond interest from income. Web form 8815 — exclusion of interest from series ee and series i u.s. Ad access irs tax forms. Complete, edit or print tax forms instantly. Savings bonds this year that were issued after 1989, you may be able to exclude from your income part or all of the interest on. The interest income exclusion is phased out at higher income levels. View more information about using irs forms, instructions, publications and other item files. Web this number typically. Savings bonds issued after 1989 (for filers with qualified higher. You were already age 24 or older before your savings bonds were. Web the latest versions of irs forms, instructions, and publications. Web follow the simple instructions below: Estimate how much you could potentially save in just a matter of minutes. If you redeemed series ee or series i u.s. Savings bonds issued after 1989 (for filers with qualified higher. Web follow the simple instructions below: 8 minutes watch video get the form! Savings bonds sep 13, 2023 — form 8815 — exclusion of interest from series ee and series i u.s. Web we last updated the exclusion of interest from series ee and i u.s. Get ready for tax season deadlines by completing any required tax forms today. Web follow the simple instructions below: Web purpose of formif you cashed series ee or i u.s. Complete, edit or print tax forms instantly. You were already age 24 or older before your savings bonds were. The interest income exclusion is phased out at higher income levels. Savings bonds issued after 1989 in december 2022, so this is the latest version of form 8815, fully updated for. Exclusion of interest from series ee and i u.s. Complete, edit or print tax forms instantly. Savings bonds issued after 1989 (for filers with qualified higher. See irs form 8815 for. You cash the qualifying savings bonds in the same tax year for which you are claiming the exclusion. Estimate how much you could potentially save in just a matter of minutes. Web form 8815 department of the treasury internal revenue service (99) exclusion of interest. Savings bonds to pay for higher education expenses, use form 8815 to exclude the interest from. Instructions fillable forms in the united. Web form 8815 — exclusion of interest from series ee and series i u.s. Web this number typically increases each year and irs form 8815 shows each year’s exclusion. Web we last updated the exclusion of interest from. Ad we help get taxpayers relief from owed irs back taxes. Web use form 8815 to figure the interest income you can exclude from income. Web the latest versions of irs forms, instructions, and publications. 8 minutes watch video get the form! Savings bonds this year that were issued after 1989, you may be able to exclude from your income. Get ready for tax season deadlines by completing any required tax forms today. Get likely tax options free. See irs form 8815 for. Savings bonds issued after 1989 (for filers with qualified higher. Web what is form 8815? Web if you cashed series ee or i u.s. Web treasury/irs form 8815 department of the treasury internal revenue service. Web the latest versions of irs forms, instructions, and publications. Get ready for tax season deadlines by completing any required tax forms today. Web schedule b (form 1040), line 3, or schedule 1 (form 1040a), line 3, whichever applies' 14. Web if you cashed series ee or i u.s. Web we last updated the exclusion of interest from series ee and i u.s. Instructions fillable forms in the united. Savings bonds in 2022 that were issuedafter 1989, you may be able to exclude from your income part or all of. To exclude the bond interest from gross. Savings bonds issued after 1989 in december 2022, so this is the latest version of form 8815, fully updated for. Irs form 8815 includes the necessary worksheet and instructions for taxpayers to use in connection with tax returns. You can learn more about what you need to qualify on the treasury department’s website. Complete, edit or print tax forms instantly. If you redeemed series ee or series i u.s. Get ready for tax season deadlines by completing any required tax forms today. Web schedule b (form 1040), line 3, or schedule 1 (form 1040a), line 3, whichever applies' 14 cat. Savings bonds to pay for higher education expenses, use form 8815 to exclude the interest from. This amount typically changes every year. Ad we help get taxpayers relief from owed irs back taxes. Savings bonds sep 13, 2023 — form 8815 — exclusion of interest from series ee and series i u.s. 10822s form 8815(2007) purpose of form 1. Ad affordable and reliable help. Exclusion of interest from series ee and i u.s. You were already age 24 or older before your savings bonds were.Form 8815 Exclusion of Interest From Series EE and I U.S. Savings

Fill Free fillable Form 8815 U.S. Savings Bonds Issued After 1989

Form 8815 Exclusion of Interest From Series EE and I U.S. Savings

IRS Form 8815 Instructions TaxFree Savings Bonds for College

IRS Form 8815 Instructions TaxFree Savings Bonds for College

Fillable Form 8815 Exclusion Of Interest From Series Ee And I U.s

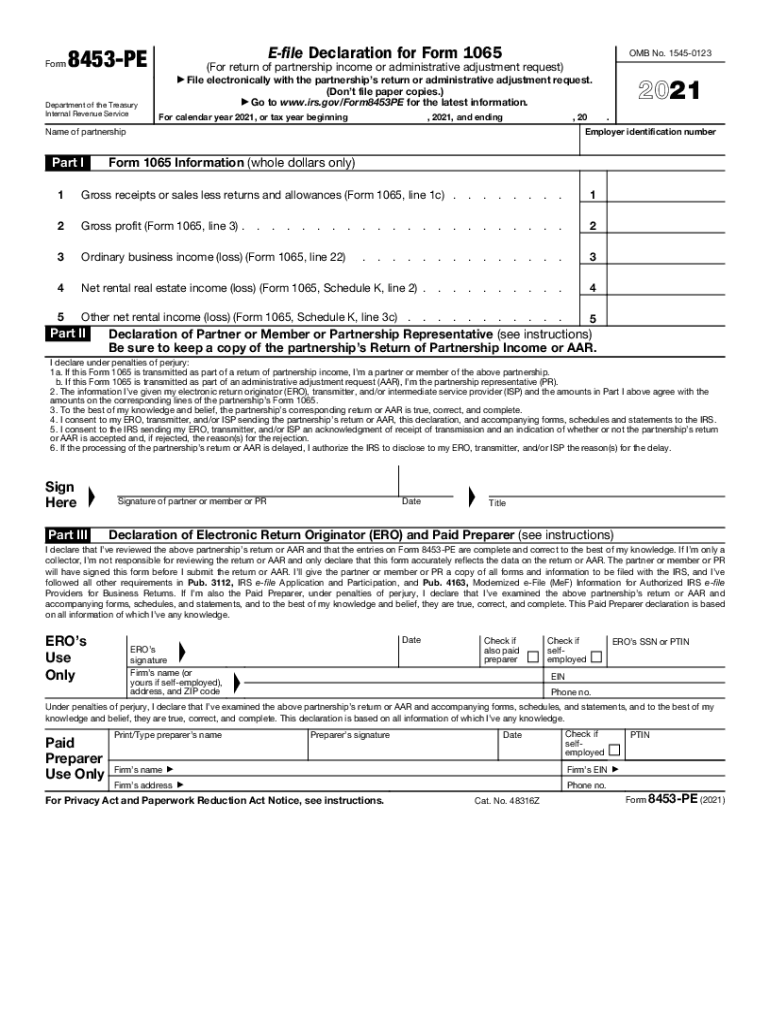

2021 Internal Revenue Service Form Fill Out and Sign Printable PDF

Online IRS Form 8815 2019 Fillable and Editable PDF Template

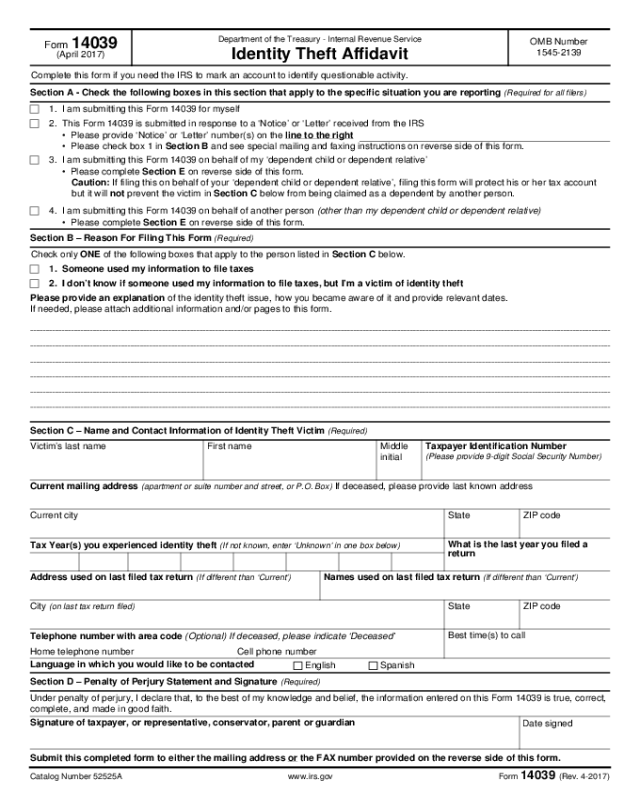

2019 IRS Gov Forms Fillable, Printable PDF & Forms Handypdf

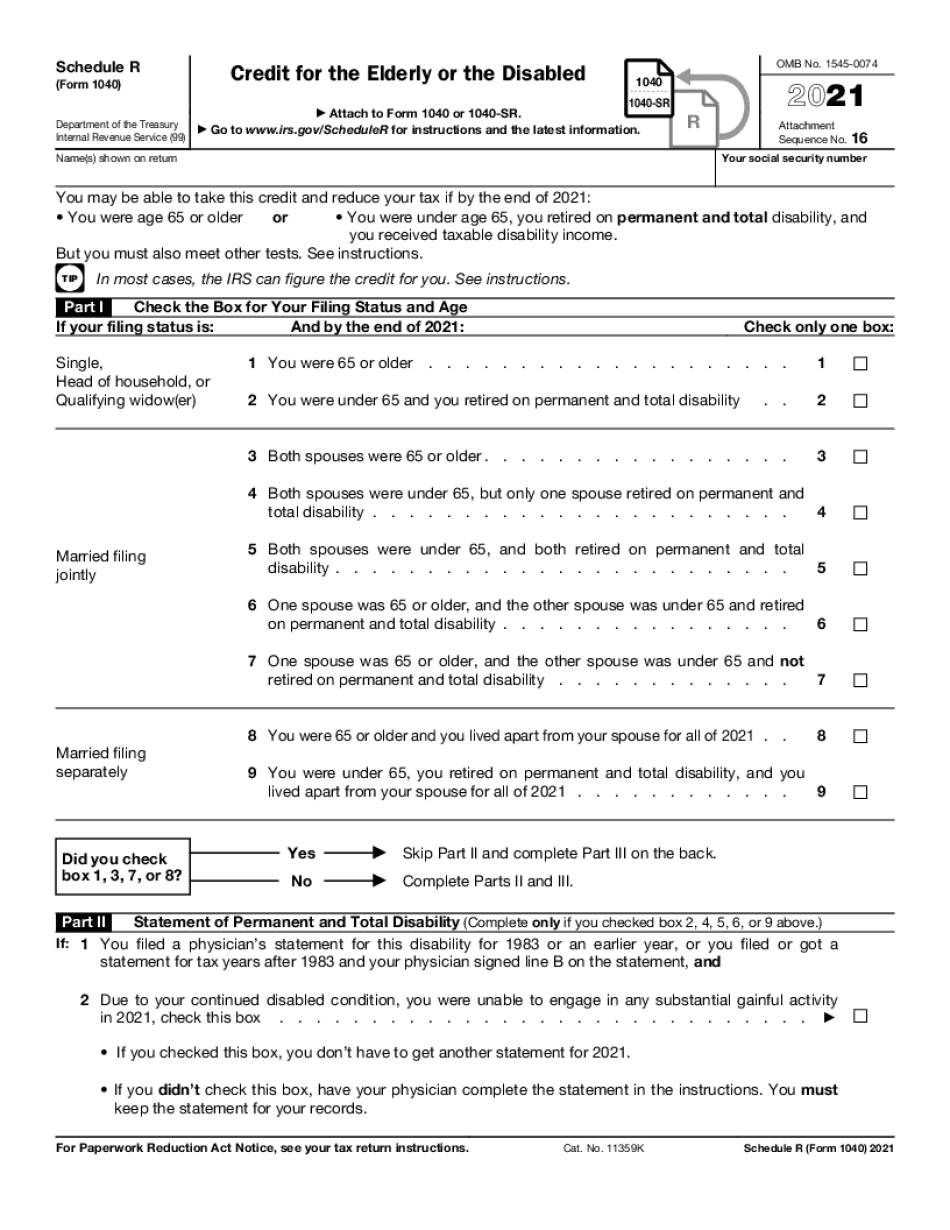

2022 Schedule R (Form 1040) Internal Revenue Service Fill Online

Related Post: