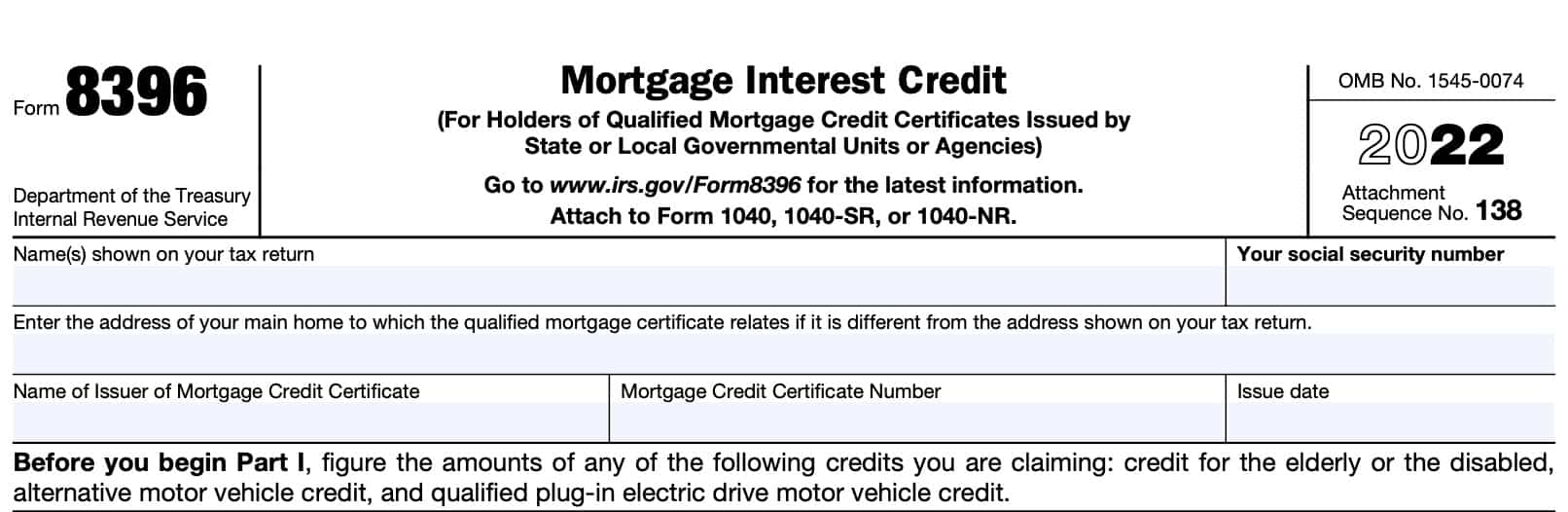

Irs Form 8396

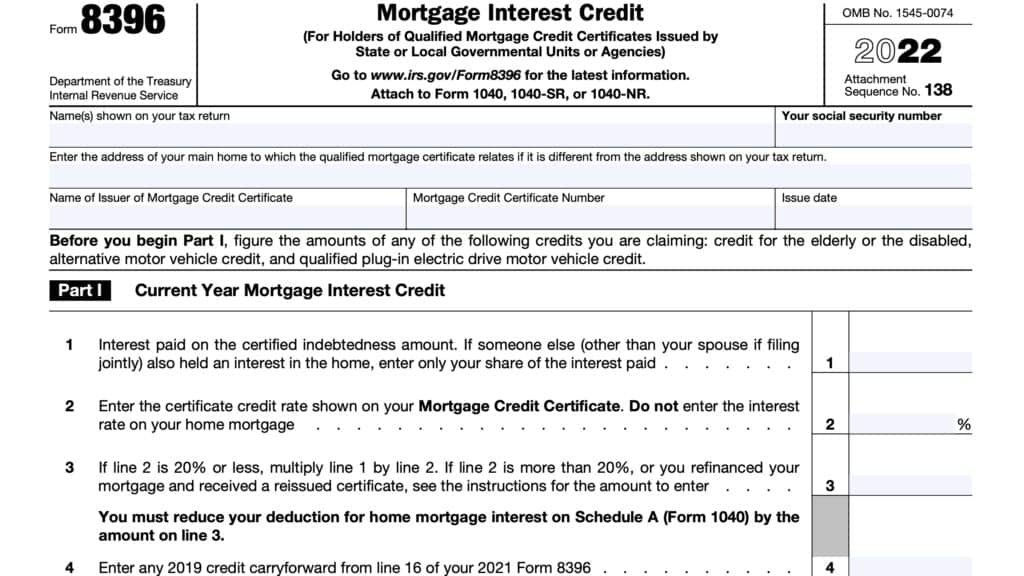

Irs Form 8396 - Web enter interest paid. You can download or print current or past. Web form 8396 2022 mortgage interest credit department of the treasury internal revenue service. Web form 8396 is an irs form used by homeowners to apply for a mortgage. Enter the ale member’s complete address (including. Web form 8396 is for holders of qualified mortgage credit certificates (mcc) issued by state or local governmental units or agencies; Part i of form 8396 is used to calculate the taxpayer’s current year. Attach to form 1040 or 1040nr. (for holders of qualified mortgage credit certificates issued by state or local. Web you simply submit an irs form 8396 each year when you file your taxes. Web form 8396 2022 mortgage interest credit department of the treasury internal revenue service. For paperwork reduction act notice, see your tax return instructions. (for holders of qualified mortgage credit certificates issued by state or local. Web use form 8396 to figure out the mortgage interest credit for the current year and any credit for the upcoming year. Attach to. Web you simply submit an irs form 8396 each year when you file your taxes. Complete all required information as prompted; Web irs form 8396 is used by taxpayers to determine and report their mortgage interest credit. Web form 8396 department of the treasury internal revenue service (99) mortgage interest credit (for holders of qualified mortgage credit certificates issued by. Web form 8396 (for holders of qualified mortgage credit certificates issued by state or local governmental units or agencies) department of the treasury internal revenue service. Web irs form 8396 is used by taxpayers to determine and report their mortgage interest credit. Web www.irs.gov/form8396 for the latest information. The certificate credit rate is shown on the. Part i of form. Web irs form 8396 is used by taxpayers to determine and report their mortgage interest credit. Complete, edit or print tax forms instantly. Part i of form 8396 is used to calculate the taxpayer’s current year. Web to figure your credit, use form 8396: Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Web form 8396 department of the treasury internal revenue service (99) mortgage interest credit (for holders of qualified mortgage credit certificates issued by state or local. Web you simply submit an irs form 8396 each year when you file your taxes. Web information about form 8396, mortgage interest credit, including recent updates, related. Web to figure your credit, use form 8396: Web form 8396, titled “mortgage interest credit” , is a document issued by the internal revenue service (irs) in the united states. Web form 8396 mortgage interest credit is separate from form 1098 mortgage interest statement you receive from your bank or financial institution for mortgage interest paid. You could claim the. Department of the treasury internal revenue service (99) mortgage interest credit. Complete, edit or print tax forms instantly. Web we last updated the mortgage interest credit in february 2023, so this is the latest version of form 8396, fully updated for tax year 2022. Web www.irs.gov/form8396 for the latest information. Web form 8396 2022 mortgage interest credit department of the. Web form 8396 department of the treasury internal revenue service (99) mortgage interest credit (for holders of qualified mortgage credit certificates issued by state or local. Web form 8396 is an irs form used by homeowners to apply for a mortgage. Web www.irs.gov/form8396 for the latest information. Web form 8396 2022 mortgage interest credit department of the treasury internal revenue. Web use form 8396 to figure out the mortgage interest credit for the current year and any credit for the upcoming year. Web form 8396 is an irs form used by homeowners to apply for a mortgage. Web mortgage interest credit form 8396; Web you simply submit an irs form 8396 each year when you file your taxes. Web form. Name(s) shown on your tax return. Its underlying purpose is to allow homeowners to. (for holders of qualified mortgage credit certificates issued by state or local. It’s a fairly simple form to complete. Form 8396 is used to figure your. Web information about form 8396, mortgage interest credit, including recent updates, related forms, and instructions on how to file. (for holders of qualified mortgage credit certificates issued by state or local. Web irs form 8396 is used by taxpayers to determine and report their mortgage interest credit. Select credit certificate or form 1098 depending on which form the taxpayer received; (for holders of qualified mortgage credit certificates issued by state or local. Web we last updated the mortgage interest credit in february 2023, so this is the latest version of form 8396, fully updated for tax year 2022. Web www.irs.gov/form8396 for the latest information. Mortgage interest credit 2022 12/05/2022 « previous | 1 | next » get adobe ® reader. Web form 8396 2022 mortgage interest credit department of the treasury internal revenue service. Web you simply submit an irs form 8396 each year when you file your taxes. It’s a fairly simple form to complete. Complete, edit or print tax forms instantly. If you itemize your deductions on irs schedule a. Web form 8396 mortgage interest credit is separate from form 1098 mortgage interest statement you receive from your bank or financial institution for mortgage interest paid. Web form 8396, titled “mortgage interest credit” , is a document issued by the internal revenue service (irs) in the united states. Department of the treasury internal revenue service (99) mortgage interest credit. Enter the ale member’s complete address (including. Web to figure your credit, use form 8396: Begin by entering the interest you paid during the. Web form 8396 (for holders of qualified mortgage credit certificates issued by state or local governmental units or agencies) department of the treasury internal revenue service.Fill Free fillable IRS PDF forms

Form8396Mortgage Interest Credit

Form 8872 Political Organization Report of Contributions and

IRS Form 8396 Instructions Claiming the Mortgage Interest Credit

Tax Forms In Depth Tutorials, Walkthroughs, and Guides

2021 Internal Revenue Service Form Fill Out and Sign Printable PDF

Form 8396 Mortgage Interest Credit (2014) Free Download

Prior year tax returns irss americanpikol

Printable Irs Form 1040 Printable Form 2023

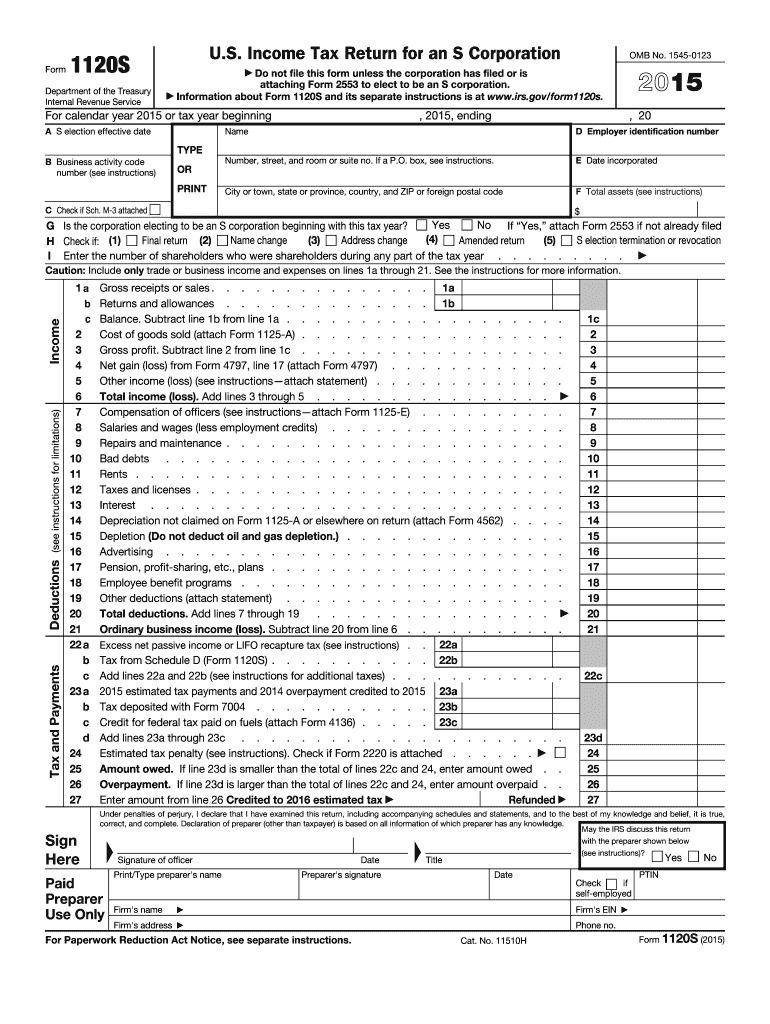

2015 Form IRS 1120SFill Online, Printable, Fillable, Blank pdfFiller

Related Post: