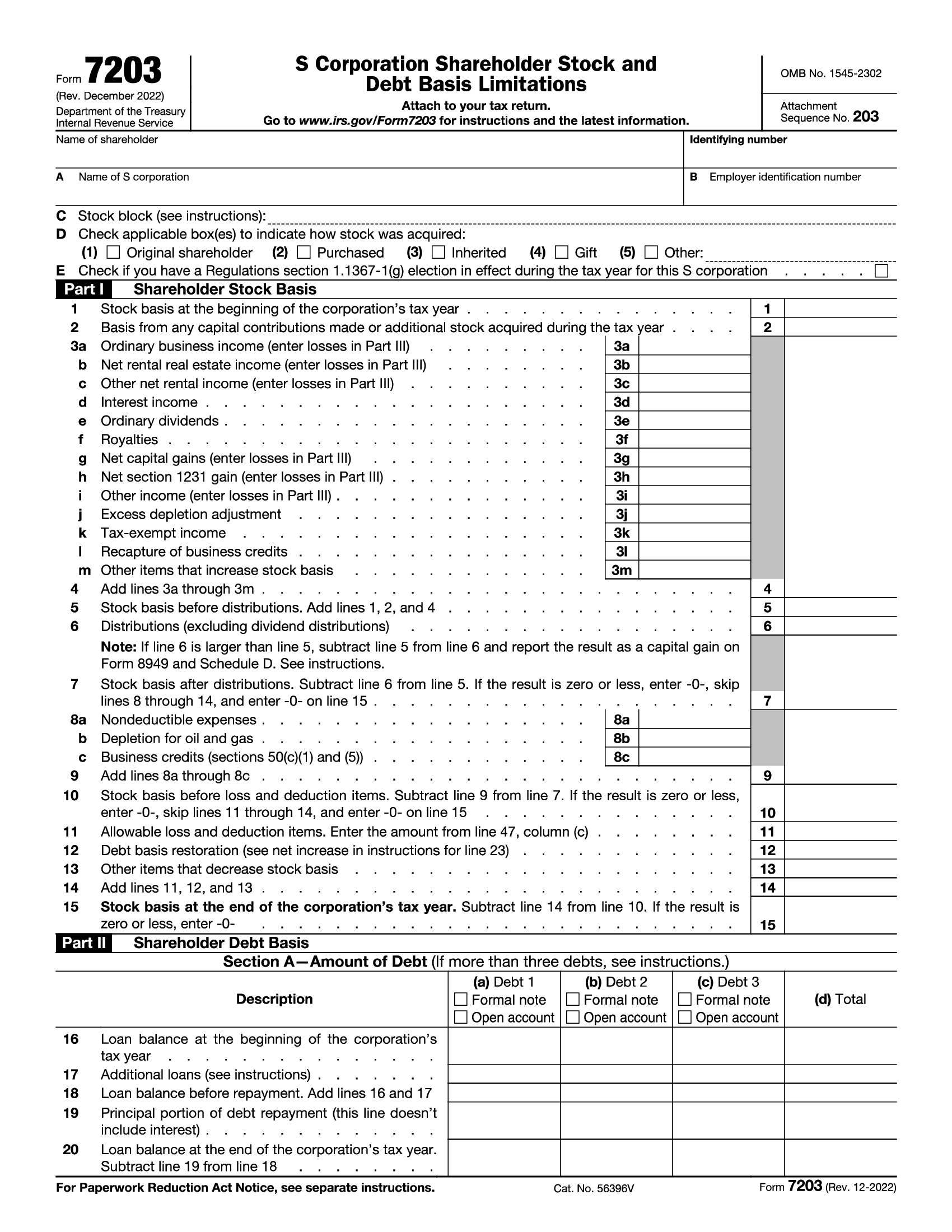

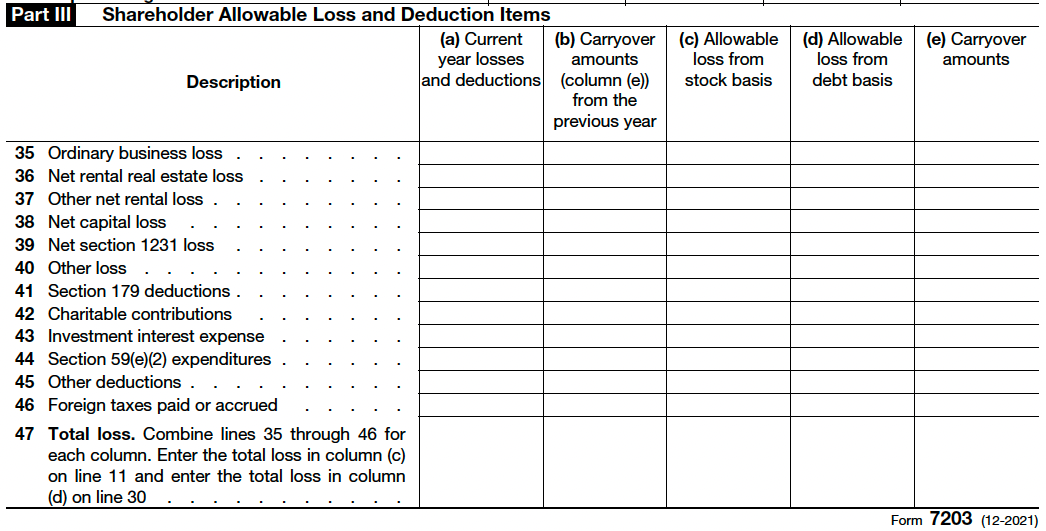

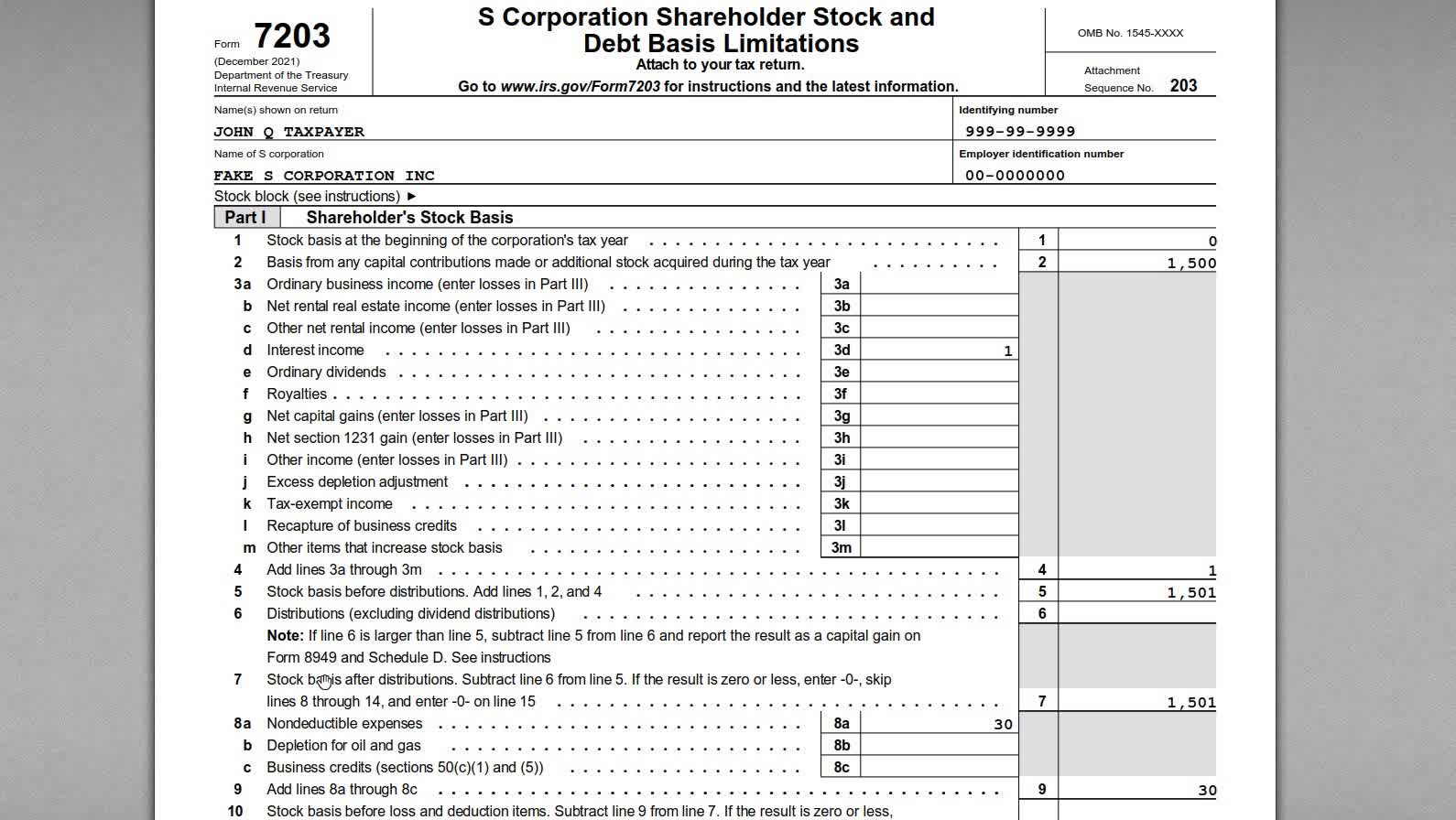

Irs Form 7203 Stock Block

Irs Form 7203 Stock Block - Web effective for 2021, the internal revenue service (“irs”) requires s corporation shareholders to prepare and attach form 7203, s corporation shareholder. Web the 7203 is not required on the 1120s return and needs to be completed on the 1040 return by the shareholders. Discover a wide range of office stationery products at great prices. Ad outgrow.us has been visited by 10k+ users in the past month The irs recently issued a new draft form 7203, s corporation shareholder stock and debt basis limitations, and the corresponding draft. Web you must complete and file form 7203 if you’re an s corporation shareholder and you: Web you will enter 1 for the stock block if you have only purchased 1 block of stocks. Web attach to your tax return. Web january 19, 2021. Go to www.irs.gov/form7203 for instructions and the latest information. For instance, if you purchase 100 shares on day 1 then purchase 100 more on day 200, you have 2. In 2022, john decides to sell 50 shares of company a stock. Web using form 7203, john can track the basis of each stock block separately directly on his income tax return. Ad find essential office supplies for meticulous recordkeeping. In 2022, john decides to sell 50 shares of company a stock. Web you will enter 1 for the stock block if you have only purchased 1 block of stocks. Web january 19, 2021. Form 7203 is filed by shareholders. A stock block refers to the group of stocks you purchase each time. Web you must complete and file form 7203 if you’re an s corporation shareholder and you: Web you will enter 1 for the stock block if you have only purchased 1 block of stocks. Ad outgrow.us has been visited by 10k+ users in the past month You use either number or a description such as 100 shares of abc corp.. Web january 19, 2021. Web the stock block on form 7203 is to identify your shares so you can keep track. Attach to your tax return. Web page last reviewed or updated: Go to www.irs.gov/form7203 for instructions and the latest information. Go to www.irs.gov/form7203 for instructions and the latest information. A stock block refers to the group of stocks you purchase each time. December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax. Web these limitations and the order in which you must apply them are as follows: For instance,. Web these limitations and the order in which you must apply them are as follows: Attach to your tax return. Web page last reviewed or updated: Form 7203 is filed by shareholders. Web january 19, 2021. Ad outgrow.us has been visited by 10k+ users in the past month Web starting with the 2021 tax year, a new form 7203 replaces the supplemental worksheet for figuring a shareholder’s stock and debt basis. Attach to your tax return. Web the 7203 is not required on the 1120s return and needs to be completed on the 1040 return by. The irs recently issued a new draft form 7203, s corporation shareholder stock and debt basis limitations, and the corresponding draft. Go to www.irs.gov/form7203 for instructions and the latest information. You use either number or a description such as 100 shares of abc corp. Form 7203 is filed by shareholders. Ad outgrow.us has been visited by 10k+ users in the. You use either number or a description such as 100 shares of abc corp. Web these limitations and the order in which you must apply them are as follows: Go to www.irs.gov/form7203 for instructions and the latest information. Attach to your tax return. Web january 19, 2021. December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax. Discover a wide range of office stationery products at great prices. The irs recently issued a new draft form 7203, s corporation shareholder stock and debt basis limitations, and the corresponding draft. You use either number or a description. For instance, if you purchase 100 shares on day 1 then purchase 100 more on day 200, you have 2. Discover a wide range of office stationery products at great prices. Go to www.irs.gov/form7203 for instructions and the latest information. In 2022, john decides to sell 50 shares of company a stock. Attach to your tax return. Web the stock block on form 7203 is to identify your shares so you can keep track. Web the 7203 is not required on the 1120s return and needs to be completed on the 1040 return by the shareholders. December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax. Web s corporation shareholder stock and debt basis limitations. Web page last reviewed or updated: Web you must complete and file form 7203 if you’re an s corporation shareholder and you: Web attach to your tax return. The irs recently issued a new draft form 7203, s corporation shareholder stock and debt basis limitations, and the corresponding draft. Ad outgrow.us has been visited by 10k+ users in the past month Web using form 7203, john can track the basis of each stock block separately directly on his income tax return. Web effective for 2021, the internal revenue service (“irs”) requires s corporation shareholders to prepare and attach form 7203, s corporation shareholder. Go to www.irs.gov/form7203 for instructions and the latest information. Web january 19, 2021. A stock block refers to the group of stocks you purchase each time. You use either number or a description such as 100 shares of abc corp.SCorporation Shareholders May Need to File Form 7203

IRS Form 7203. S Corporation Shareholder Stock and Debt Basis

More Basis Disclosures This Year for S corporation Shareholders Need

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

IRS Form 7203 S Corporation Losses Allowed with Stock & Debt Basis

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

IRS Form 7203 Multiple Blocks of S Corporation Stock YouTube

How to Complete IRS Form 7203 S Corporation Shareholder Basis

National Association of Tax Professionals Blog

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

Related Post: