Where To Enter Form 3922 On Turbotax

Where To Enter Form 3922 On Turbotax - The irs 3922 form titled, “transfer of stock acquired through an employee stock purchase plan under section 423(c).” this form captures all of the espp. Web 1 best answer. Review and transmit it to the irs. Your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), if you purchased espp stock during the tax year. Click on take me to my return. Web irs form 3922 is for informational purposes only and isn't entered into your return. Simply keep it with your tax or investment paperwork. Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423(c) is for informational purposes only and isn't entered into your. Generally, enter the name shown on your tax return. Sign in or open turbotax. File form 3922 online with taxbandits to receive. To get or to order these instructions, go to www.irs.gov/form3922. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your return. Generally, form 3922 is issued for informational. Web generally, form 3922 is issued for. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your return. If you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. If you purchased espp shares, your employer will send you. File form 3922 online with taxbandits to receive. Web the form is required to be furnished to a taxpayer by january 31 of the year following the year of first transfer of the stock acquired through the espp. If you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan.. Information about form 3922, transfer of stock acquired through an employee stock purchase plan under section. Review and transmit it to the irs. Web for the latest information about developments related to forms 3921 and 3922 and their instructions, such as legislation enacted after they were published, go to. If you purchased espp shares, your employer will send you form. Web the form is required to be furnished to a taxpayer by january 31 of the year following the year of first transfer of the stock acquired through the espp. Web form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c) solved • by intuit • 433 • updated 1 year ago. To get. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your return. Web generally, form 3922 is issued for informational purposes only unless stock acquired through an employee stock purchase plan under section 423 (c) is sold or. Web to add form 3922 (transfer. Currently, the irs allows taxpayers with adjusted gross incomes up to $73,000 to file their federal tax returns. If you have changed your last name without informing the social security administration. Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423(c) is for informational purposes only and isn't entered into your. File form. Information about form 3922, transfer of stock acquired through an employee stock purchase plan under section. Web enter the name, address, and tin of the corporation whose stock is being transferred pursuant to the exercise of the option. Review and transmit it to the irs. Web to add form 3922 (transfer of stock acquired through employee stock purchase plan.): Web. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your return. Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423(c) is for informational purposes only and isn't entered into your. File form 3922 online with. Keep the form for your records because you’ll need the information when you sell, assign, or. Web 1 best answer. If you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. Generally, form 3922 is issued for informational. Web irs form 3922 transfer of stock acquired through an employee. If you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. Web solved•by turbotax•16130•updated march 13, 2023. Web the form is required to be furnished to a taxpayer by january 31 of the year following the year of first transfer of the stock acquired through the espp. Web you should have received form 3922 when you exercised your stock options. If you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee. The irs 3922 form titled, “transfer of stock acquired through an employee stock purchase plan under section 423(c).” this form captures all of the espp. Currently, the irs allows taxpayers with adjusted gross incomes up to $73,000 to file their federal tax returns. Web 1 best answer. Information about form 3922, transfer of stock acquired through an employee stock purchase plan under section. To get or to order these instructions, go to www.irs.gov/form3922. Web if you didn't sell any espp stock, you do not need to enter anything from your form 3922. Generally, enter the name shown on your tax return. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your return. If you have changed your last name without informing the social security administration. Web 2 days agowhy the irs is testing a free direct file program. Enter this information only if the corporation is not. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your return. If you did sell any shares, you will. Web • the current instructions for forms 3921 and 3922. Generally, form 3922 is issued for informational.3922 2020 Public Documents 1099 Pro Wiki

Where do i enter form 3921 information? (Turbotax 2019)

ez1099 Software How to Print or eFile Form 3922, Transfer of Stock

State and Federal Taxes Paidwhere to enter in TurboTax

File IRS Form 3922 Online EFile Form 3922 for 2022

3922 Forms, Employee Stock Purchase, Employee Copy B DiscountTaxForms

IRS Form 3922 Instructions 2022 How to Fill out Form 3922

IRS Form 3922 Software 289 eFile 3922 Software

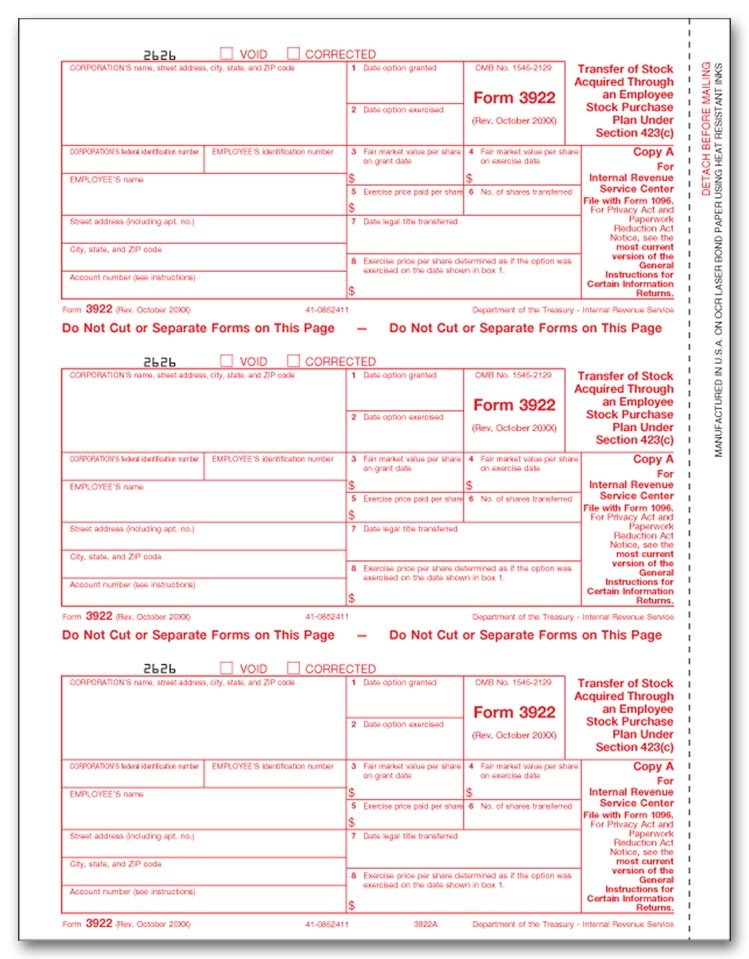

3922 Laser Tax Forms, Copy A

IRS Form 3922

Related Post: