Irs Form 7004 Mailing Address

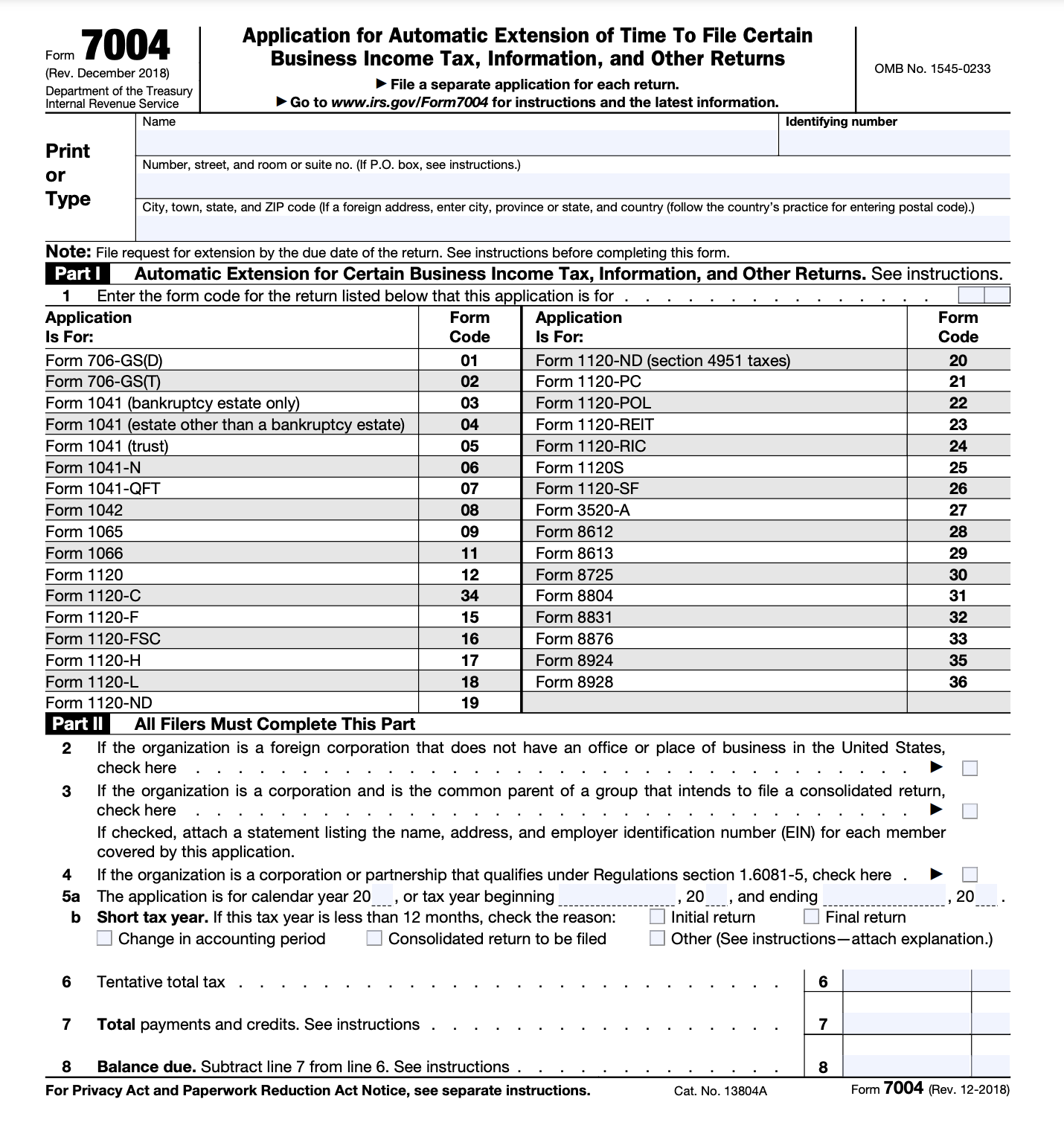

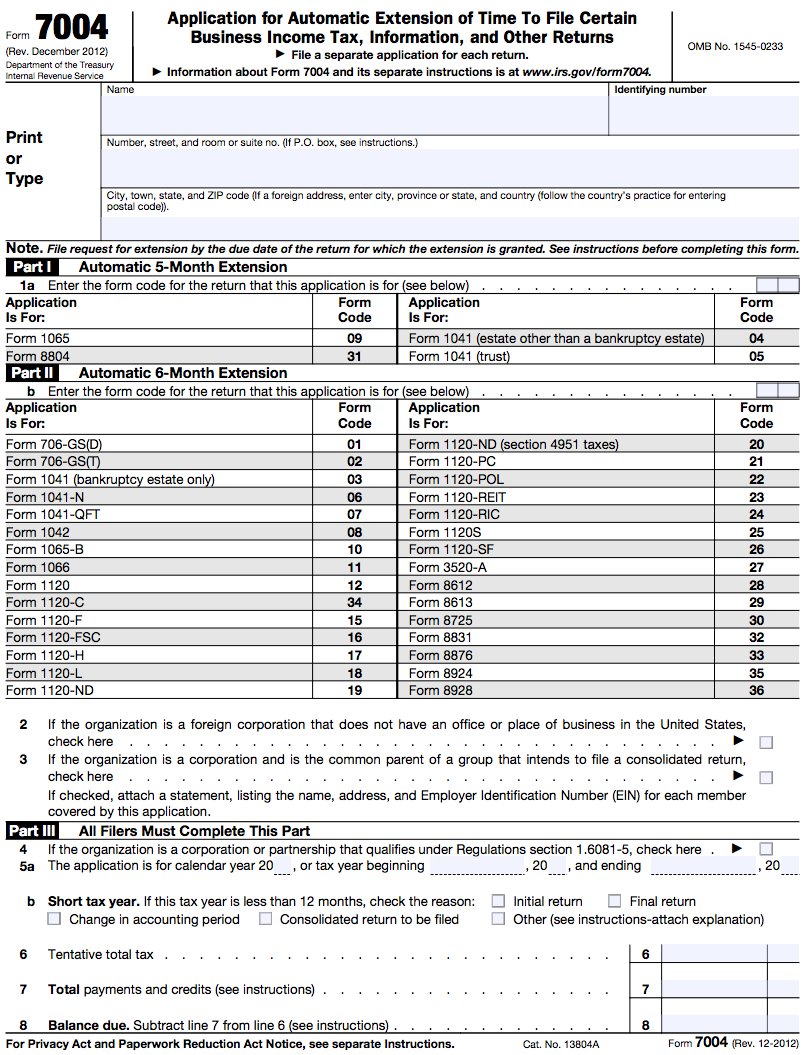

Irs Form 7004 Mailing Address - Ad access irs tax forms. Depending on which form the company is requesting the. Complete, edit or print tax forms instantly. What form 7004 is who’s eligible for a form 7004 extension how and when to file form 7004 and make tax payments what is form. Web in this guide, we cover it all, including: Department of the treasury internal revenue service austin, tx. See where to file, later. Web the address for filing form 7004 has changed for some entities. It only requires that you enter the name, address, and tax id number for your business. Here are the business types that can use form 7004: Any location department of the treasury. Where to file the form and do i mail it? It only requires that you enter the name, address, and tax id number for your business. Web the mailing address where you’ll send form 7004 depends on the tax form that it was filed for. Ad get information on tax collection, income tax forms,. Complete, edit or print tax forms instantly. Web in this guide, we cover it all, including: Ad get information on tax collection, income tax forms, and tax assistance near you. This article will help you determine which mailing address to use when sending a form 7004 application for. Web if you choose to file a paper copy of form 7004,. Web the mailing address where you’ll send form 7004 depends on the tax form that it was filed for. Where to file the form and do i mail it? Web the address for filing form 7004 has changed for some entities. The address used to file a form 7004 should be the one that the business, office or agency that. Web taxes most business entities—with the exception of sole proprietors—can file form 7004. Web which mailing address should i use to file form 7004? Use form 7004 to request an automatic 6. General instructions purpose of form use form 7004 to request an automatic. If your company mailing address has changed since you filed your last. Learn about the locations, phone numbers of nearby irs offices. See where to file, later. The address used to file a form 7004 should be the one that the business, office or agency that the person. Web this form contains instructions and filing addresses for [[form 7004]], application for automatic extension of time to file certain business income tax, information,. Irs form 7004 tax extension: If your company mailing address has changed since you filed your last. Web form 7004 is a relatively short form by irs standards. Web find irs mailing addresses to file forms beginning with the number 7. Department of the treasury internal revenue service austin, tx. Web which mailing address should i use to file form 7004? Web the address for filing form 7004 has changed for some entities. Web enter your applicable employer identification number (ein) or social security number (ssn) and address. A foreign country or u.s. Web all types of businesses are required to file income tax returns with the irs annually to. Use form 7004 to request an automatic 6. Any location department of the treasury. Web find irs mailing addresses to file forms beginning with the number 7. Get ready for tax season deadlines by completing any required tax forms today. This article will help you determine which mailing address to use when sending a form 7004 application for. What form 7004 is who’s eligible for a form 7004 extension how and when to file form 7004 and make tax payments what is form. Depending on which form the company is requesting the. Where to file the form and do i mail it? Web which mailing address should i use to file form 7004? Department of the treasury internal. General instructions purpose of form use form 7004 to request an automatic. Web what are the new dates? The address used to file a form 7004 should be the one that the business, office or agency that the person. Get ready for tax season deadlines by completing any required tax forms today. Use form 7004 to request an automatic 6. Web enter your applicable employer identification number (ein) or social security number (ssn) and address. Learn about the locations, phone numbers of nearby irs offices. Web the address for filing form 7004 has changed for some entities. The address used to file a form 7004 should be the one that the business, office or agency that the person. Web form 7004 is a relatively short form by irs standards. Web in this guide, we cover it all, including: General instructions purpose of form use form 7004 to request an automatic. Use form 7004 to request an automatic 6. Web taxes most business entities—with the exception of sole proprietors—can file form 7004. Depending on which form the company is requesting the. Web what are the new dates? Here are the business types that can use form 7004: Web which mailing address should i use to file form 7004? Any location department of the treasury. Web about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns. Ad get information on tax collection, income tax forms, and tax assistance near you. Get ready for tax season deadlines by completing any required tax forms today. See where to file, later. Irs form 7004 tax extension: Ad access irs tax forms.7004 Form 2023 IRS Forms Zrivo

What is Form 7004 and How to Fill it Out Bench Accounting

File IRS Tax Extension Form 7004 Online TaxBandits Fill Online

Form 7004 Extension of time to file Business Tax Returns

Irs Form 7004 amulette

File IRS Tax Extension Form 7004 Online TaxBandits Fill Online

How to Fill Out IRS Form 7004

Irs Form 7004 amulette

Get an Extension on Your Business Taxes with Form 7004 Excel Capital

2008 Form IRS 7004 Fill Online, Printable, Fillable, Blank pdfFiller

Related Post: