Irs Form 500

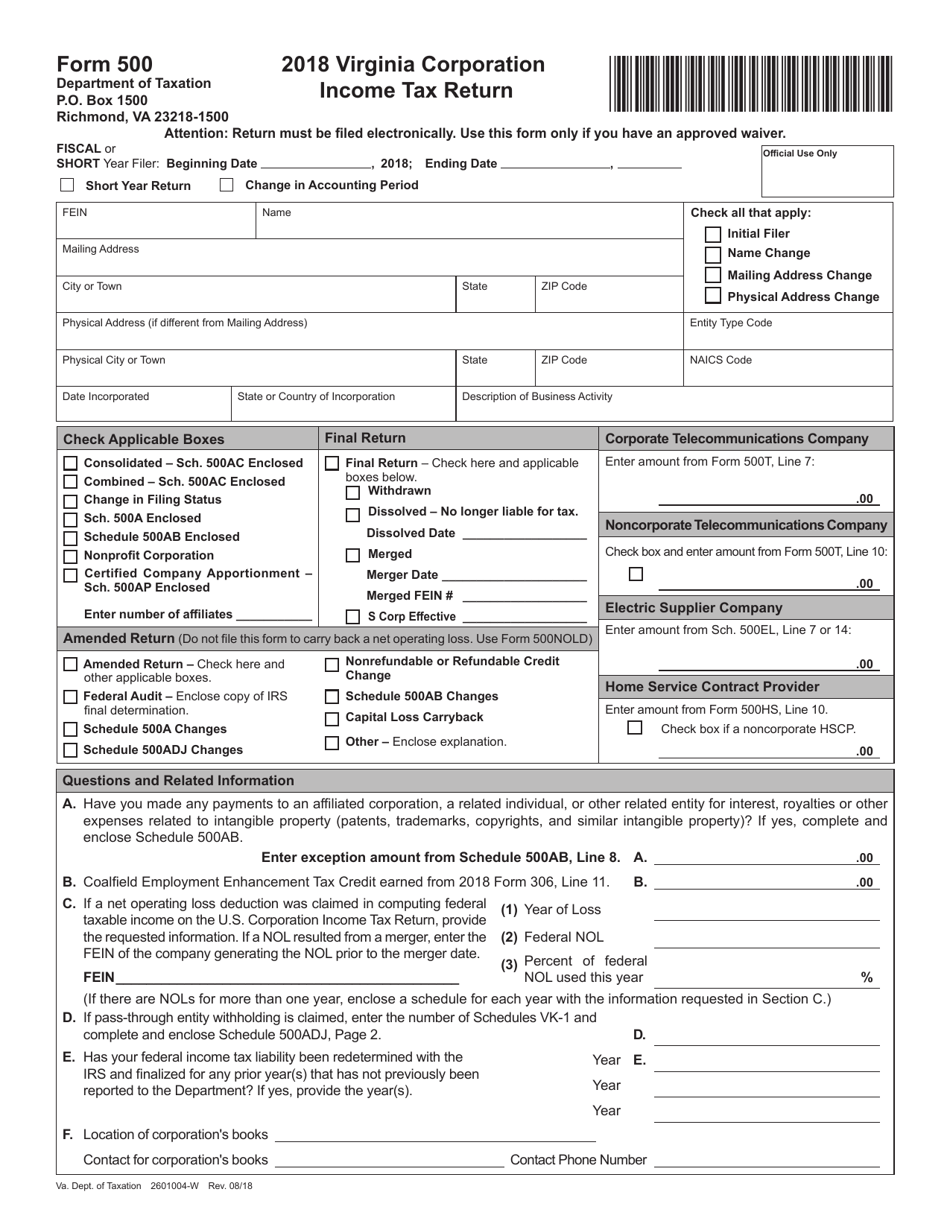

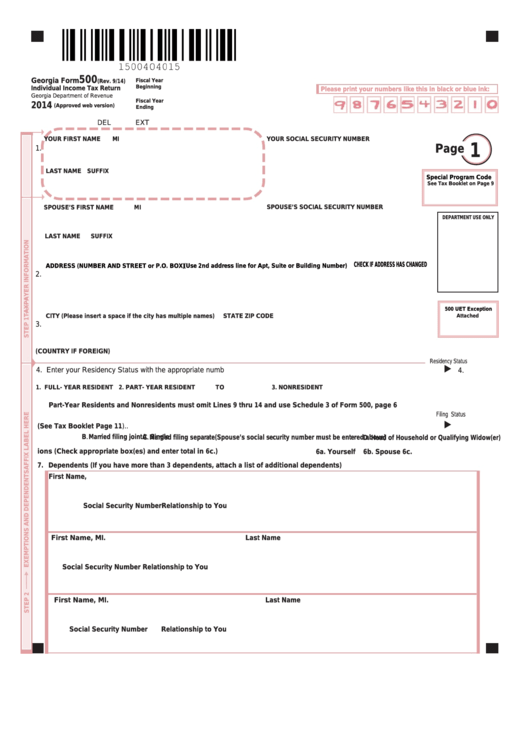

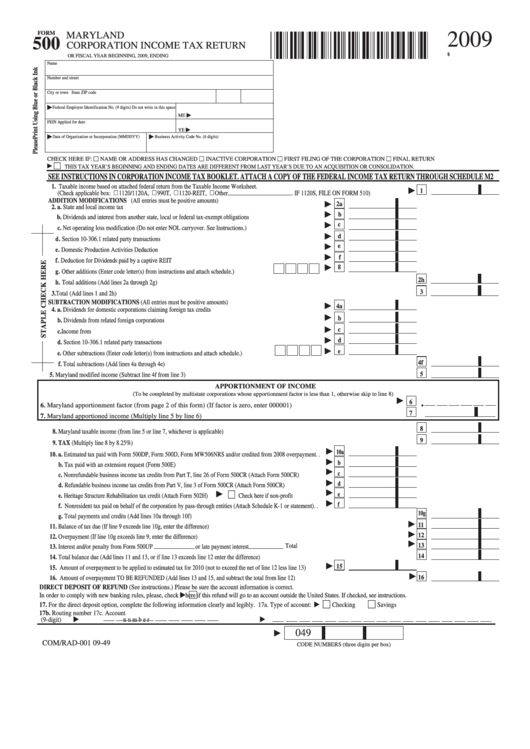

Irs Form 500 - Try it for free now! Enter the number from line 6c. Or form 500ez, line 5a. Web corporation income tax is federal taxable income (form 500, line 1), net operating loss deductions are generally taken into account on the virginia return to the extent that such. Web official use only 4 if the name and/or ein of the plan sponsor has changed since the last return/report filed for this plan, enter the name, ein and the plan number from the last. Web search irs and state income tax forms to efile or complete, download online and back taxes. Search by form number, name or organization. Contains 500 and 500ez forms and general instructions. Ad download or email pbgc 500 & more fillable forms, register and subscribe now! (a) income not effectively connected with the conduct of a trade or business in the united. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Complete and download the form to your computer to print and sign before mailing. Add lines 2 and 3; Web reporting & filing assistance. Web official use only 4 if the name and/or ein of the plan sponsor has changed since the last. Or form 500ez, line 5a. Web enter 1 if you or your spouse is 65 or older; Department of labor, internal revenue service, and the pension benefit guaranty corporation jointly. Enter 2 if you and your spouse are 65 or older. Attach one or more forms 8283 to your tax return if. Enter 2 if you and your spouse are 65 or older. Add lines 2 and 3; Web enter 1 if you or your spouse is 65 or older; (a) income not effectively connected with the conduct of a trade or business in the united. Contains 500 and 500ez forms and general instructions. Web ga tax withheld georgia form500 individual income tax return georgia department of revenue 2020 14a. Web reporting & filing assistance. Enter on form 500, schedule 2, line 11a; Web search irs and state income tax forms to efile or complete, download online and back taxes. Complete and download the form to your computer to print and sign before mailing. Ad register and subscribe now to work on your wheda self employed income statement form. To successfully complete the form, you must. Go paperless, fill & sign documents electronically. For box a and box b, the authorization to disclose or the designation of representative can be limited to a certain tax type (e.g., individual income. Your social security number gross. Complete and download the form to your computer to print and sign before mailing. Department of labor, internal revenue service, and the pension benefit guaranty corporation jointly. Web reporting & filing assistance. • this form relates to: Ad download or email pbgc 500 & more fillable forms, register and subscribe now! Complete and download the form to your computer to print and sign before mailing. Add lines 2 and 3; Search by form number, name or organization. To successfully complete the form, you must. Upload, modify or create forms. Web reporting & filing assistance. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Posting on the web does not constitute acceptance of the filing by the. (a) income not effectively connected with the conduct of a trade or business in the united. Web search irs and state income tax forms to. Search by form number, name or organization. November 2022) department of the treasury internal revenue service. Complete and download the form to your computer to print and sign before mailing. Web the person named on line 1 of this form is not a u.s. To successfully complete the form, you must. Contains 500 and 500ez forms and general instructions. Web ga tax withheld georgia form500 individual income tax return georgia department of revenue 2020 14a. To successfully complete the form, you must. Enter the number from line 6c. For box a and box b, the authorization to disclose or the designation of representative can be limited to a certain tax type. Web official use only 4 if the name and/or ein of the plan sponsor has changed since the last return/report filed for this plan, enter the name, ein and the plan number from the last. Your social security number gross income is less than your you must include. Web search irs and state income tax forms to efile or complete, download online and back taxes. To successfully complete the form, you must. Web ga tax withheld georgia form500 individual income tax return georgia department of revenue 2020 14a. (a) income not effectively connected with the conduct of a trade or business in the united. Try it for free now! Posting on the web does not constitute acceptance of the filing by the. Or, use the official printed paper. For box a and box b, the authorization to disclose or the designation of representative can be limited to a certain tax type (e.g., individual income. Complete and download the form to your computer to print and sign before mailing. Go paperless, fill & sign documents electronically. Web get federal tax return forms and file by mail. Web corporation income tax is federal taxable income (form 500, line 1), net operating loss deductions are generally taken into account on the virginia return to the extent that such. Ad download or email pbgc 500 & more fillable forms, register and subscribe now! Upload, modify or create forms. Web the person named on line 1 of this form is not a u.s. November 2022) department of the treasury internal revenue service. Attach one or more forms 8283 to your tax return if. Web enter 1 if you or your spouse is 65 or older;Form 500 Download Fillable PDF or Fill Online Virginia Corporation

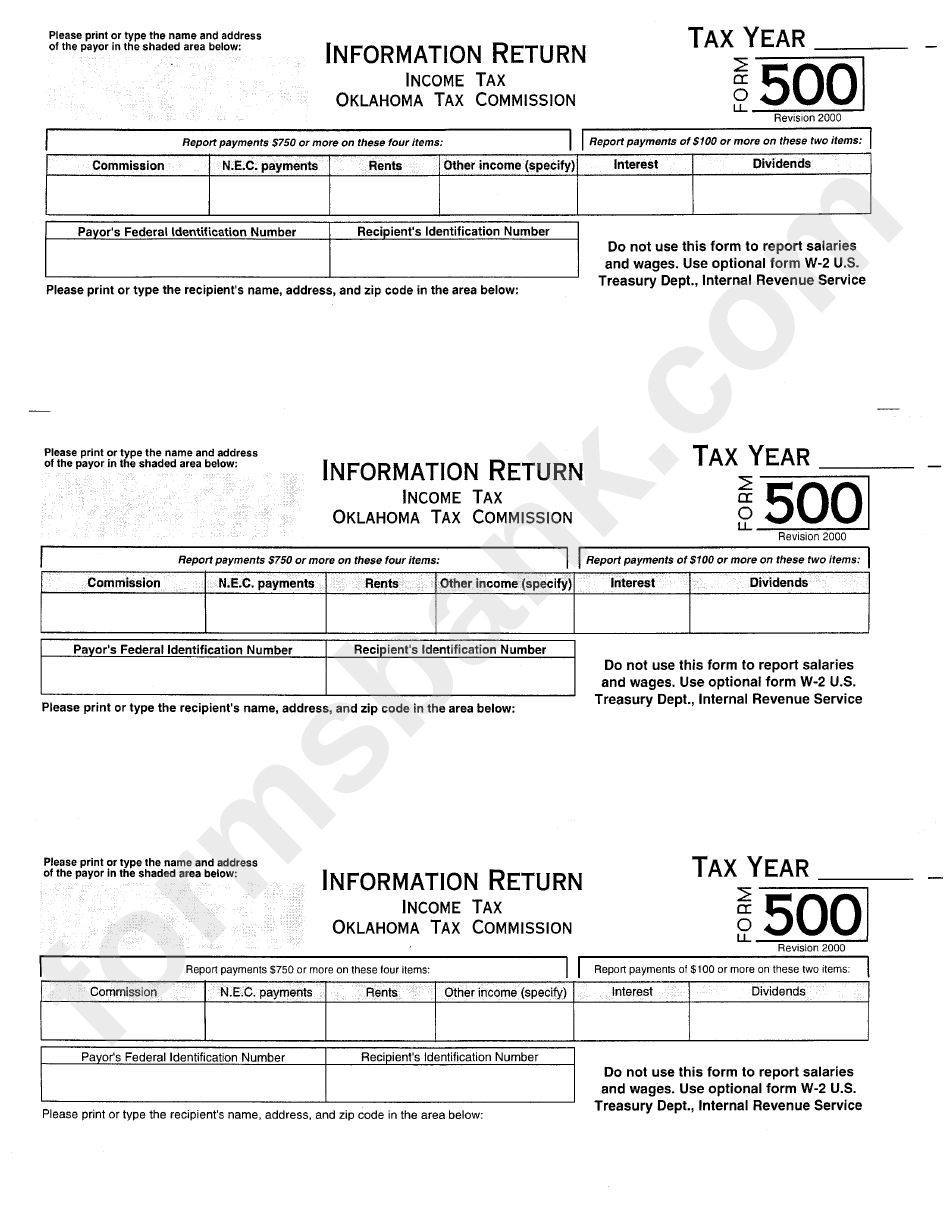

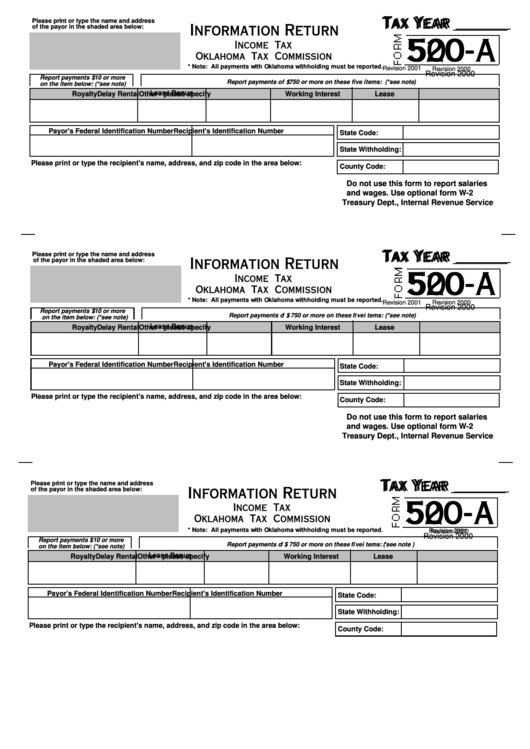

Form 500 Information Return Tax Oklahoma Tax Commission

Form 500 Fill out & sign online DocHub

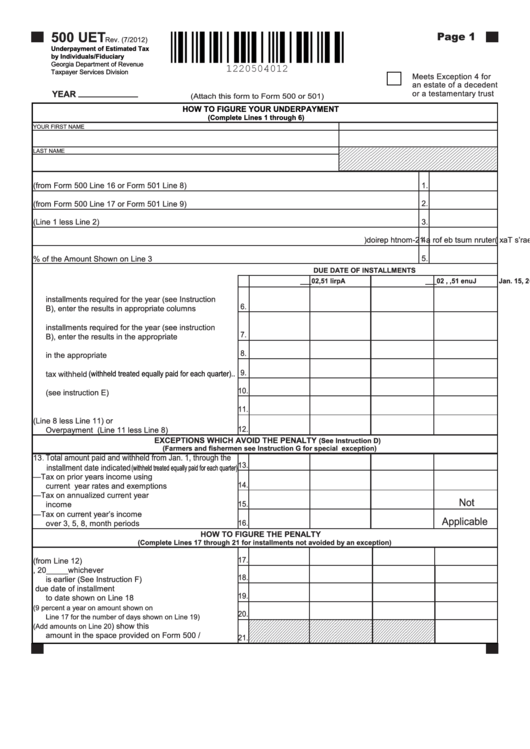

Fillable Form 500 Uet Underpayment Of Estimated Tax By Individuals

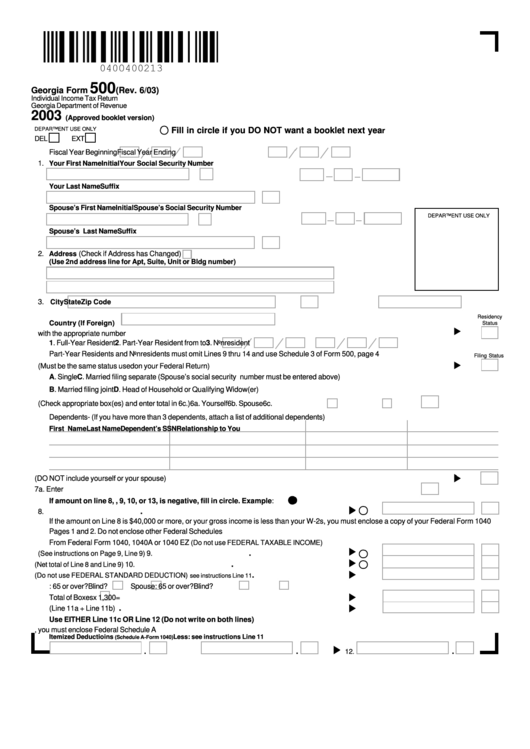

Form 500 Individual Tax Return 2003 printable pdf

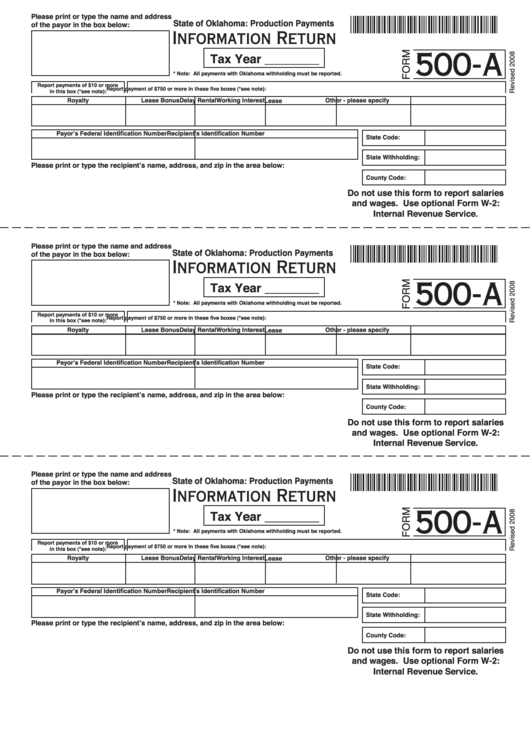

Fillable Form 500A Information Return 2008 printable pdf download

Free Printable Tax Form 500 Printable Forms Free Online

Fillable Form 500 Maryland Corporation Tax Return 2009

Form 500A Tax Information Return printable pdf download

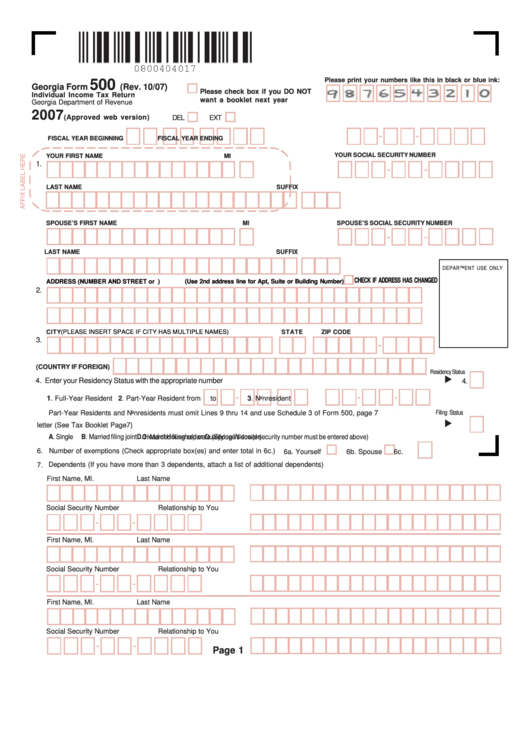

Fillable Form 500 Individual Tax Return (2007)

Related Post: