Irs Form 4562 Instructions

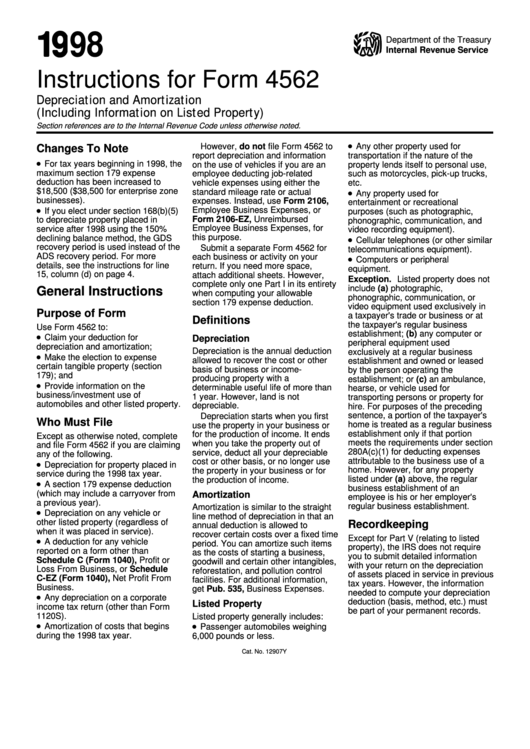

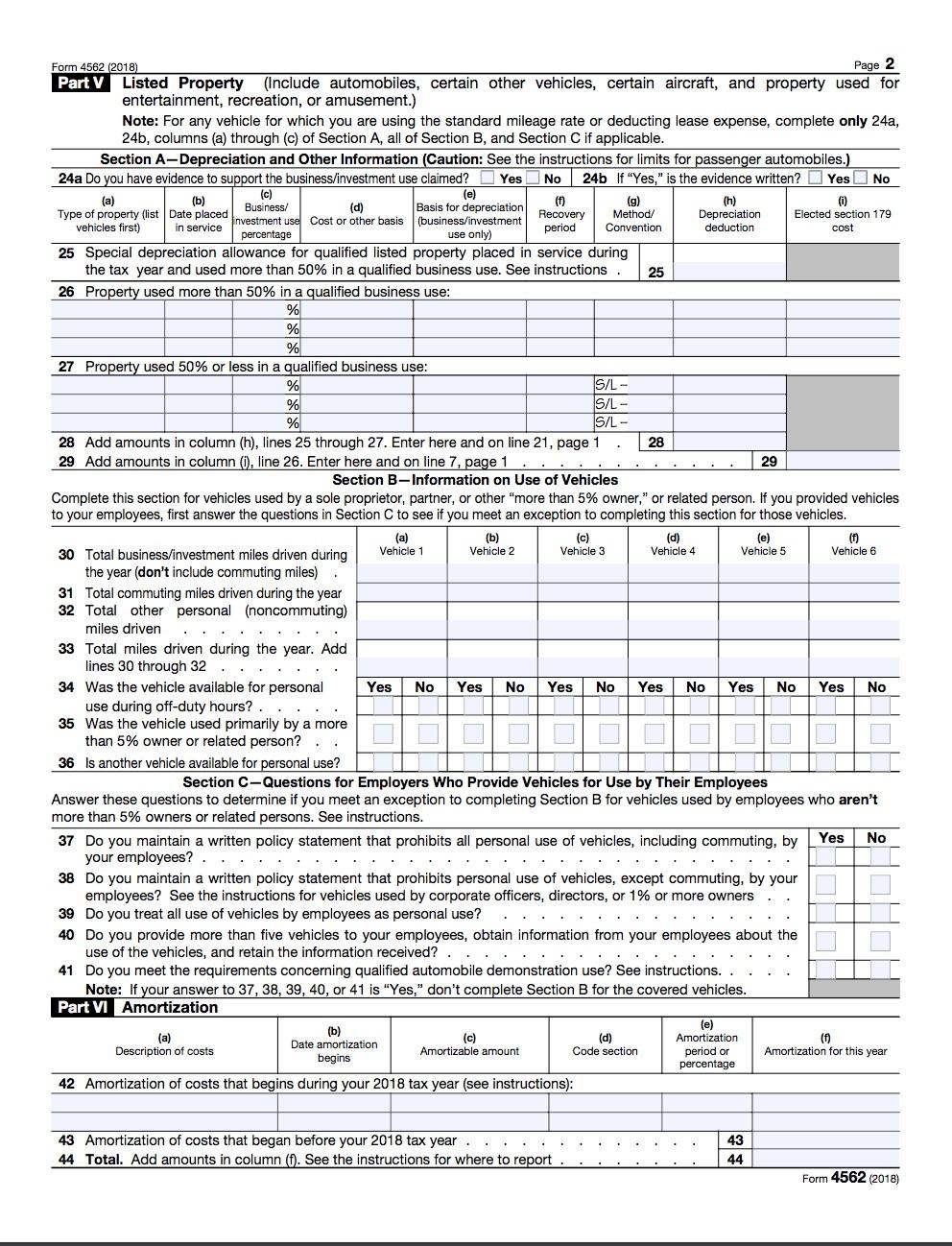

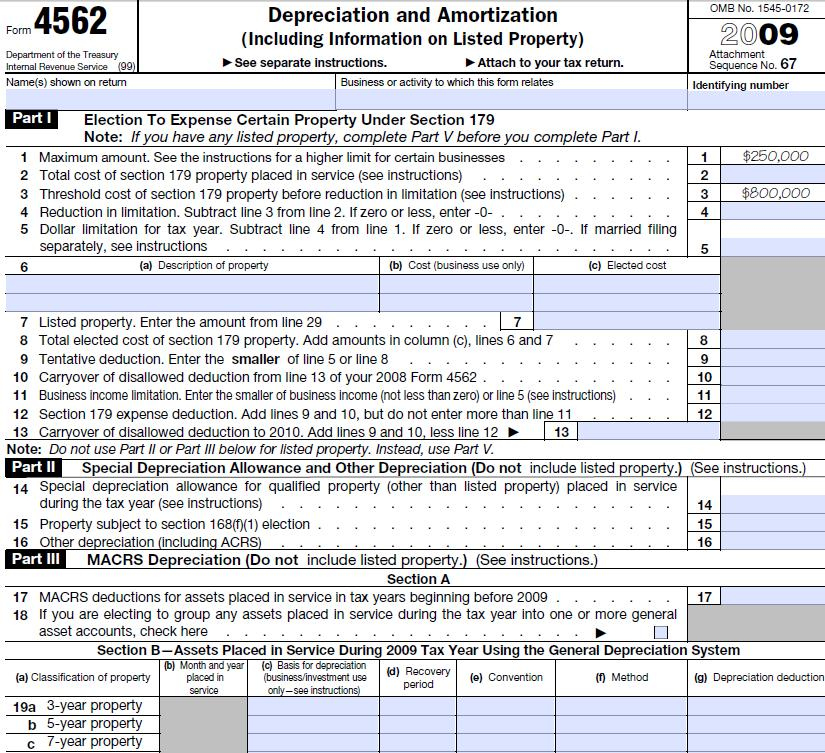

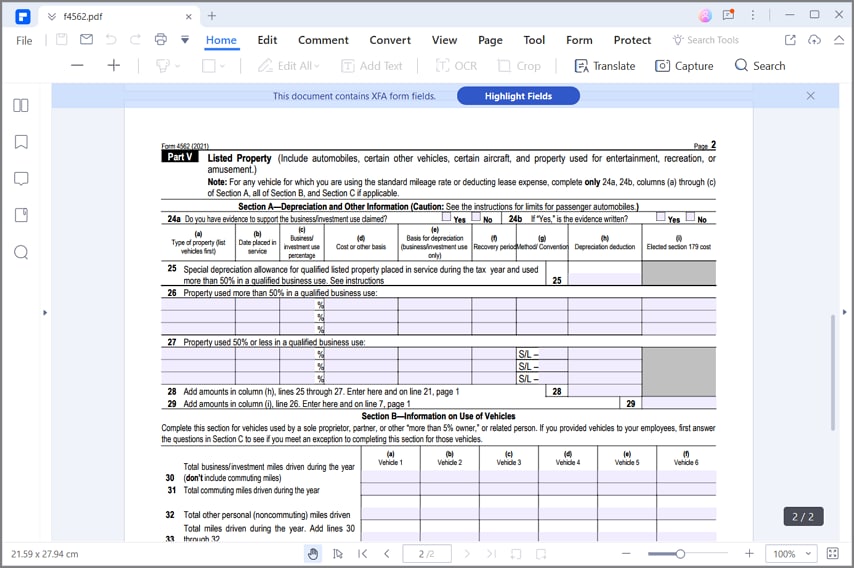

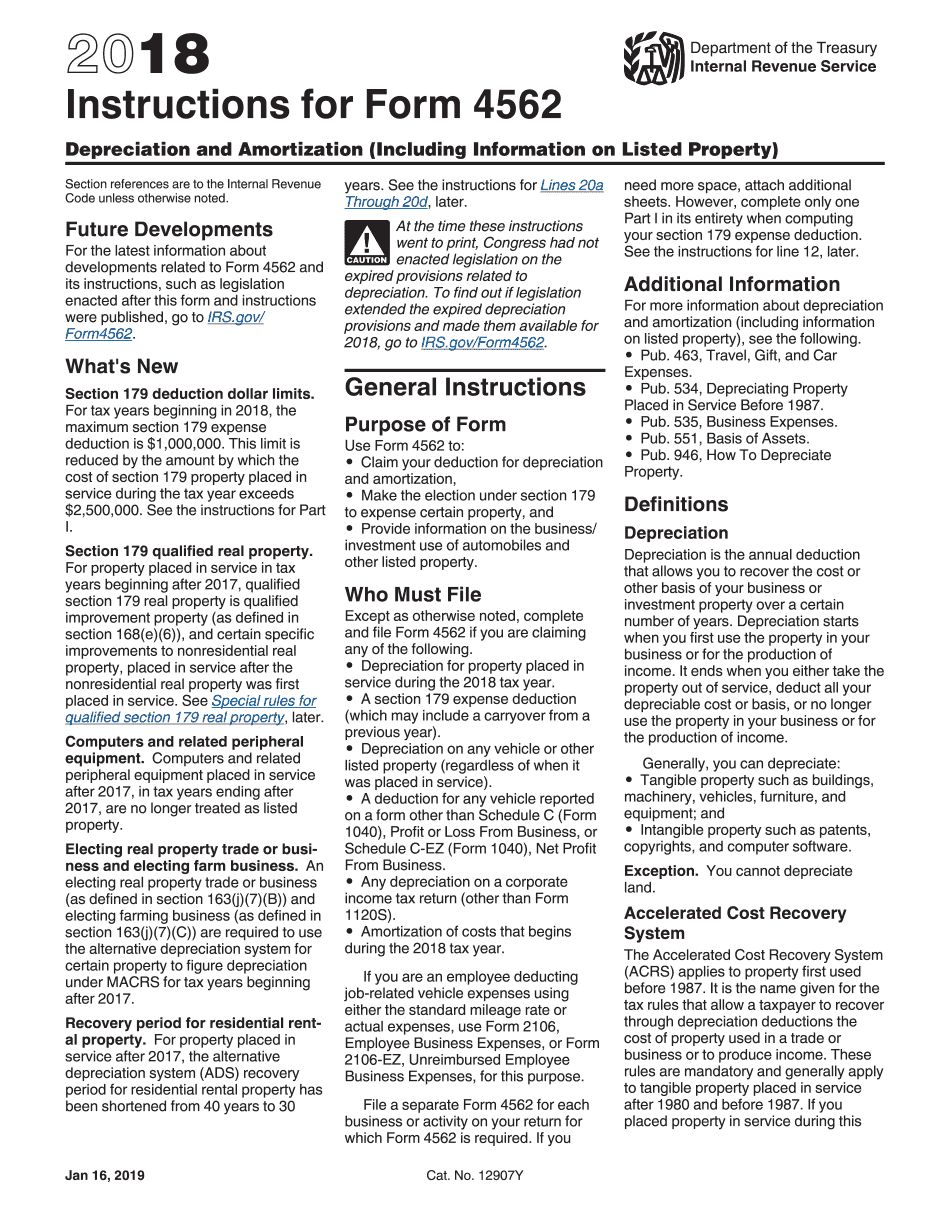

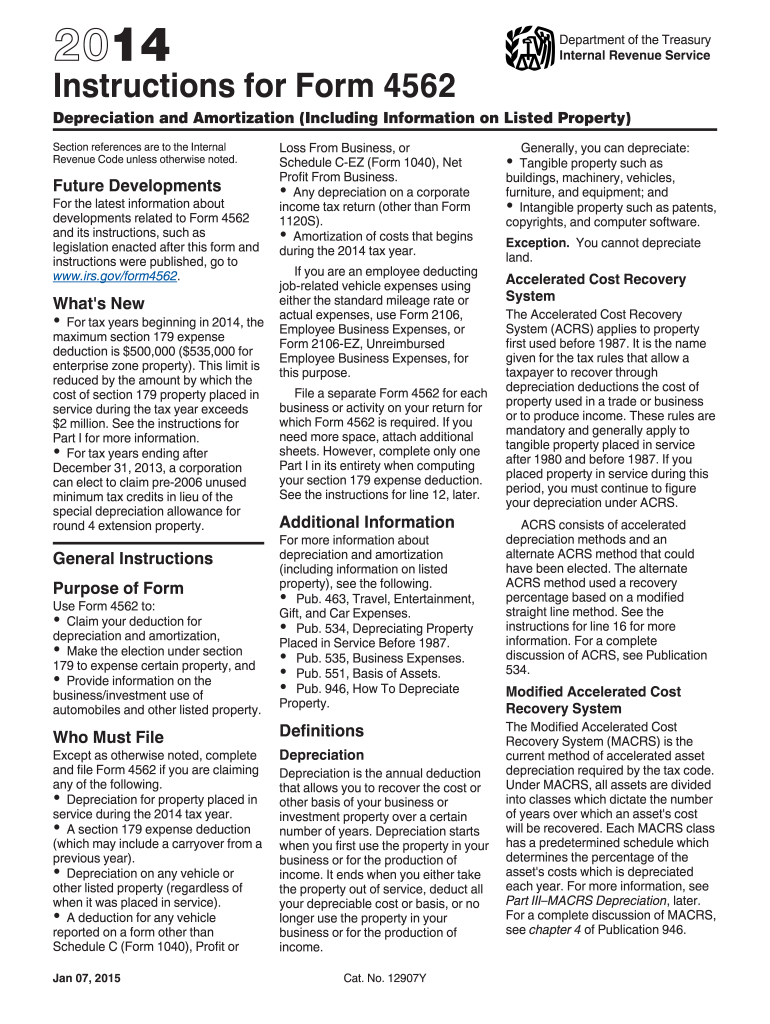

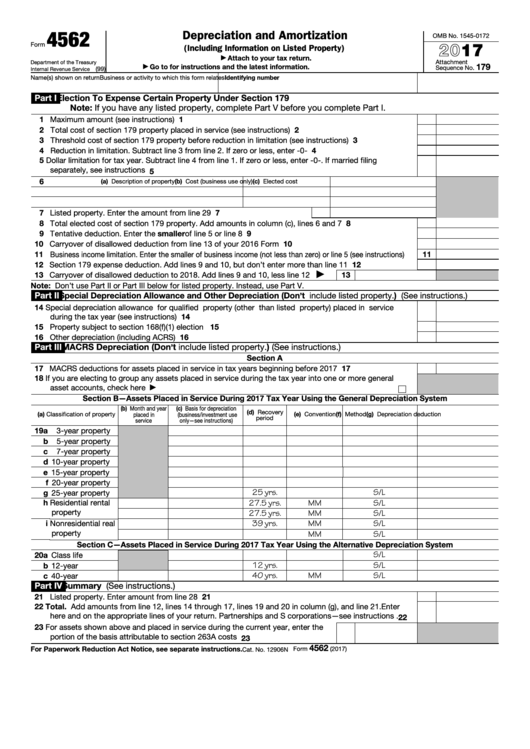

Irs Form 4562 Instructions - Web form 4562 is the irs form used to report these deductions accurately and consistently. The percentage of bonus depreciation phases down in 2023 to 80%, 2024 to 60%,. Read and follow the directions for every section, by recording the value as directed on the form 4562. Web who must file form 4562? If you are claiming any of the following,. Web developments related to form 4562 and its instructions, such as legislation enacted after this form and instructions were published, go to irs.gov/ form4562. Web irs form 4562 is used to claim deductions for depreciation and amortization for business assets. Ad get ready for tax season deadlines by completing any required tax forms today. You must make section 179 election on irs form. Web the new rules allow for 100% bonus expensing of assets that are new or used. The percentage of bonus depreciation phases down in 2023 to 80%, 2024 to 60%,. Remember, the irs instructions for form 4562 are also an excellent. Web use form 4562 to: Ad complete irs tax forms online or print government tax documents. Depreciation and amortization (including information on listed property) department of the treasury. Claim your deduction for depreciation and amortization. Upload, modify or create forms. The percentage of bonus depreciation phases down in 2023 to 80%, 2024 to 60%,. Web file a separate form 4562 for each business or activity on your return for which form 4562 is required. Learn how to fill out form 4562 step by step and depreciate/amortize asset. Web developments related to form 4562 and its instructions, such as legislation enacted after this form and instructions were published, go to irs.gov/ form4562. You must make section 179 election on irs form. Web form 4562 is the irs form used to report these deductions accurately and consistently. Web who must file form 4562? Web irs form 4562 is used. Learn how to fill out form 4562 step by step and depreciate/amortize asset. If you need more space, attach additional sheets. View more information about using irs forms, instructions, publications. Web use form 4562 to: Web irs form 4562 is used to claim deductions for depreciation and amortization for business assets. Web who must file form 4562? If you need more space, attach additional sheets. Irs suggests submitting one form 4562 per business or activity included on your tax return. Make the election under section 179 to expense certain property. Remember, the irs instructions for form 4562 are also an excellent. Web form 4562 is the irs form used to report these deductions accurately and consistently. Web the new rules allow for 100% bonus expensing of assets that are new or used. Claim your deduction for depreciation and amortization. Web find irs forms, instructions, publications, and notices for prior years back to 1864. Get ready for tax season deadlines by completing. If you are claiming any of the following,. Ad complete irs tax forms online or print government tax documents. Web who must file form 4562? Make the election under section 179 to expense certain property. Web irs updates instructions for form 4562 (2022) depreciation and amortization including immediate expense limit — orbitax tax news & alerts. The percentage of bonus depreciation phases down in 2023 to 80%, 2024 to 60%,. You must make section 179 election on irs form. Depreciation and amortization (including information on listed property) department of the treasury. Make the election under section 179 to expense certain property. Web irs updates instructions for form 4562 (2022) depreciation and amortization including immediate expense limit. The percentage of bonus depreciation phases down in 2023 to 80%, 2024 to 60%,. Upload, modify or create forms. Depreciation and amortization (including information on listed property) department of the treasury. Claim your deduction for depreciation and amortization. Web form 4562 is the irs form used to report these deductions accurately and consistently. Web the internal revenue service allows people to claim deductions on irs form 4562, depreciation and amortization. Keep copies of all paperwork to support the claim. The percentage of bonus depreciation phases down in 2023 to 80%, 2024 to 60%,. Web file a separate form 4562 for each business or activity on your return for which form 4562 is required.. The percentage of bonus depreciation phases down in 2023 to 80%, 2024 to 60%,. View more information about using irs forms, instructions, publications. Remember, the irs instructions for form 4562 are also an excellent. Web we last updated the depreciation and amortization (including information on listed property) in december 2022, so this is the latest version of form 4562, fully updated for. Get ready for tax season deadlines by completing any required tax forms today. Upload, modify or create forms. Web form 4562 is the irs form used to report these deductions accurately and consistently. Try it for free now! Web form 4562 department of the treasury internal revenue service depreciation and amortization (including information on listed property) attach to your tax return. View more information about using irs forms, instructions, publications and other item files. Web developments related to form 4562 and its instructions, such as legislation enacted after this form and instructions were published, go to irs.gov/ form4562. Web the internal revenue service allows people to claim deductions on irs form 4562, depreciation and amortization. Web irs updates instructions for form 4562 (2022) depreciation and amortization including immediate expense limit — orbitax tax news & alerts. If you are claiming any of the following,. Depreciation and amortization (including information on listed property) department of the treasury. Web find irs forms, instructions, publications, and notices for prior years back to 1864. Irs suggests submitting one form 4562 per business or activity included on your tax return. Web the new rules allow for 100% bonus expensing of assets that are new or used. Keep copies of all paperwork to support the claim. Web who must file form 4562?Form 4562 Depreciation And Amortization Worksheet

IRS 4562 Instructions 2011 Fill out Tax Template Online US Legal Forms

Form 4562 A Simple Guide to the IRS Depreciation Form Bench Accounting

2020 Form IRS 4562 Instructions Fill Online, Printable, Fillable, Blank

Form 4562 A Simple Guide to the IRS Depreciation Form Bench Accounting

IRS Form 4562 Information And Instructions 2021 Tax Forms 1040 Printable

Cómo completar el formulario 4562 del IRS

Editable IRS Instructions 4562 2018 2019 Create A Digital Sample in PDF

IRS 4562 Instructions 2014 Fill out Tax Template Online US Legal Forms

Fillable IRS Form 4562 Depreciation and Amortization Printable

Related Post: