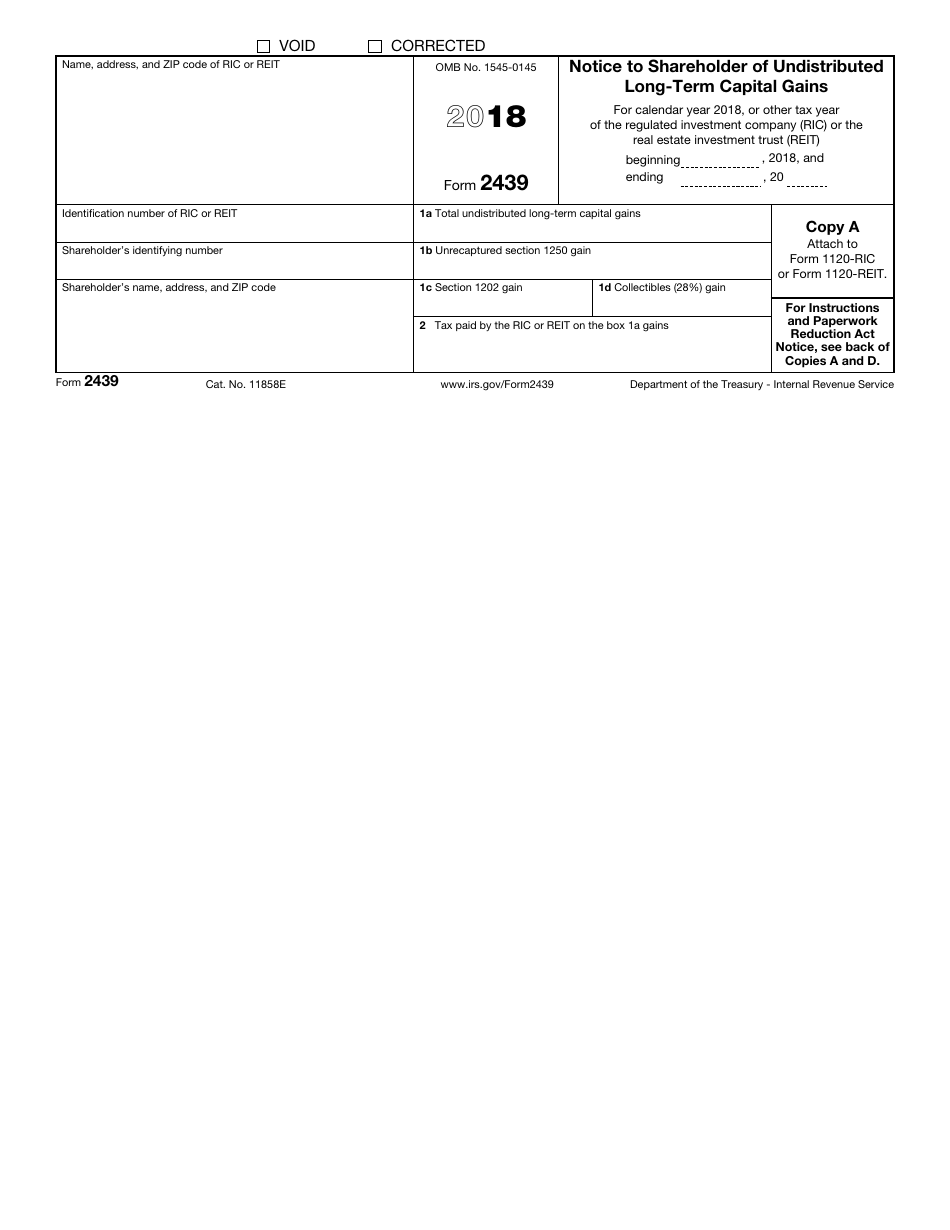

Irs Form 2439

Irs Form 2439 - Web form 2439 is a tax form that reports the undistributed capital gains of a mutual fund or a real estate investment trust (reit) to its shareholders. Click investment income in the federal quick q&a topics menu to expand, then click undistributed long. Knott 15.5k subscribers 1.1k views 1 year ago irs forms & schedules the irs form 2439 is. Ad we help get taxpayers relief from owed irs back taxes. Get ready for tax season deadlines by completing any required tax forms today. Access irs forms, instructions and publications in electronic and print media. Web form 2439 is an irs tax form required to be issued by rics, mutual funds, etfs, & reits. Regulated investment companies must report any gains they do not. The mutual fund company reports these gains on. Complete, edit or print tax forms instantly. Click investment income in the federal quick q&a topics menu to expand, then click undistributed long. Web cpas should read the detailed instructions in this announcement for changes in the following forms: Ad access irs tax forms. Ad we help get taxpayers relief from owed irs back taxes. Enter the ale member’s complete address (including. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Estimate how much you could potentially save in just a matter of minutes. Click investment income in the federal quick q&a topics menu to expand, then click undistributed long. Complete, edit or print tax forms instantly. Ad access irs tax forms. Web form 2439 is an irs tax form required to be issued by rics, mutual funds, etfs, & reits. Web cpas should read the detailed instructions in this announcement for changes in the following forms: Complete, edit or print tax forms instantly. The mutual fund company reports these gains on. Access irs forms, instructions and publications in electronic and print media. The amounts entered in boxes 1b, 1c, and 1d and. Web form 2439 is an irs tax form required to be issued by rics, mutual funds, etfs, & reits. Web cpas should read the detailed instructions in this announcement for changes in the following forms: Estimate how much you. Ad access irs tax forms. Web to enter form 2439 go to investment income and select undistributed capital gains or you can search for form 2439 in the top right corner of your screen. Web your basis is essentially your investment in an asset—the amount you will use to determine your profit or loss when you sell it. The higher. Estimate how much you could potentially save in just a matter of minutes. Form 2439 will be sent. Regulated investment companies must report any gains they do not. Web your basis is essentially your investment in an asset—the amount you will use to determine your profit or loss when you sell it. The amounts entered in boxes 1b, 1c, and. Get ready for tax season deadlines by completing any required tax forms today. The higher your basis, the less gain. Form 2439 will be sent. Ad we help get taxpayers relief from owed irs back taxes. Web to enter form 2439 go to investment income and select undistributed capital gains or you can search for form 2439 in the top. Web to enter form 2439 capital gains, complete the following: Complete, edit or print tax forms instantly. Ad access irs tax forms. Complete, edit or print tax forms instantly. Web instructions for regulated investment company (section references are to the internal revenue code.) paperwork reduction act notice.—we ask for the information on this. Web information about form 2438, undistributed capital gains tax return, including recent updates, related forms and instructions on how to file. Estimate how much you could potentially save in just a matter of minutes. Click investment income in the federal quick q&a topics menu to expand, then click undistributed long. Ad access irs tax forms. Complete, edit or print tax. The higher your basis, the less gain. Web form 2439 is an irs tax form required to be issued by rics, mutual funds, etfs, & reits. Ad access irs tax forms. Web to enter form 2439 capital gains, complete the following: The amounts entered in boxes 1b, 1c, and 1d and. Web information about form 2438, undistributed capital gains tax return, including recent updates, related forms and instructions on how to file. Ad we help get taxpayers relief from owed irs back taxes. Web to enter form 2439 capital gains, complete the following: Click investment income in the federal quick q&a topics menu to expand, then click undistributed long. Complete, edit or print tax forms instantly. The amounts entered in boxes 1b, 1c, and 1d and. The higher your basis, the less gain. Web complete copies a, b, c, and d of form 2439 for each owner. A mutual fund usually distributes all its capital gains to its shareholders. Ad access irs tax forms. Get ready for tax season deadlines by completing any required tax forms today. Estimate how much you could potentially save in just a matter of minutes. Knott 15.5k subscribers 1.1k views 1 year ago irs forms & schedules the irs form 2439 is. Get ready for tax season deadlines by completing any required tax forms today. Web cpas should read the detailed instructions in this announcement for changes in the following forms: Form 2439 is a form used by the irs to request an extension of time to file a return. Ad access irs tax forms. Complete, edit or print tax forms instantly. Web form 2439 is an irs tax form required to be issued by rics, mutual funds, etfs, & reits. Regulated investment companies must report any gains they do not.3.11.3 Individual Tax Returns Internal Revenue Service

Ssurvivor Form 2439 Statements

IRS Form 2439 Instructions Undistributed LongTerm Capital Gains

Form 2439 Notice to Shareholder of Undistributed LongTerm Capital

Ssurvivor Form 2439 Statements

IRS Form 2439 Instructions Undistributed LongTerm Capital Gains

IRS Form 2439 2018 Fill Out, Sign Online and Download Fillable PDF

Albamv Tax Form 2439

Schedule d Fill out & sign online DocHub

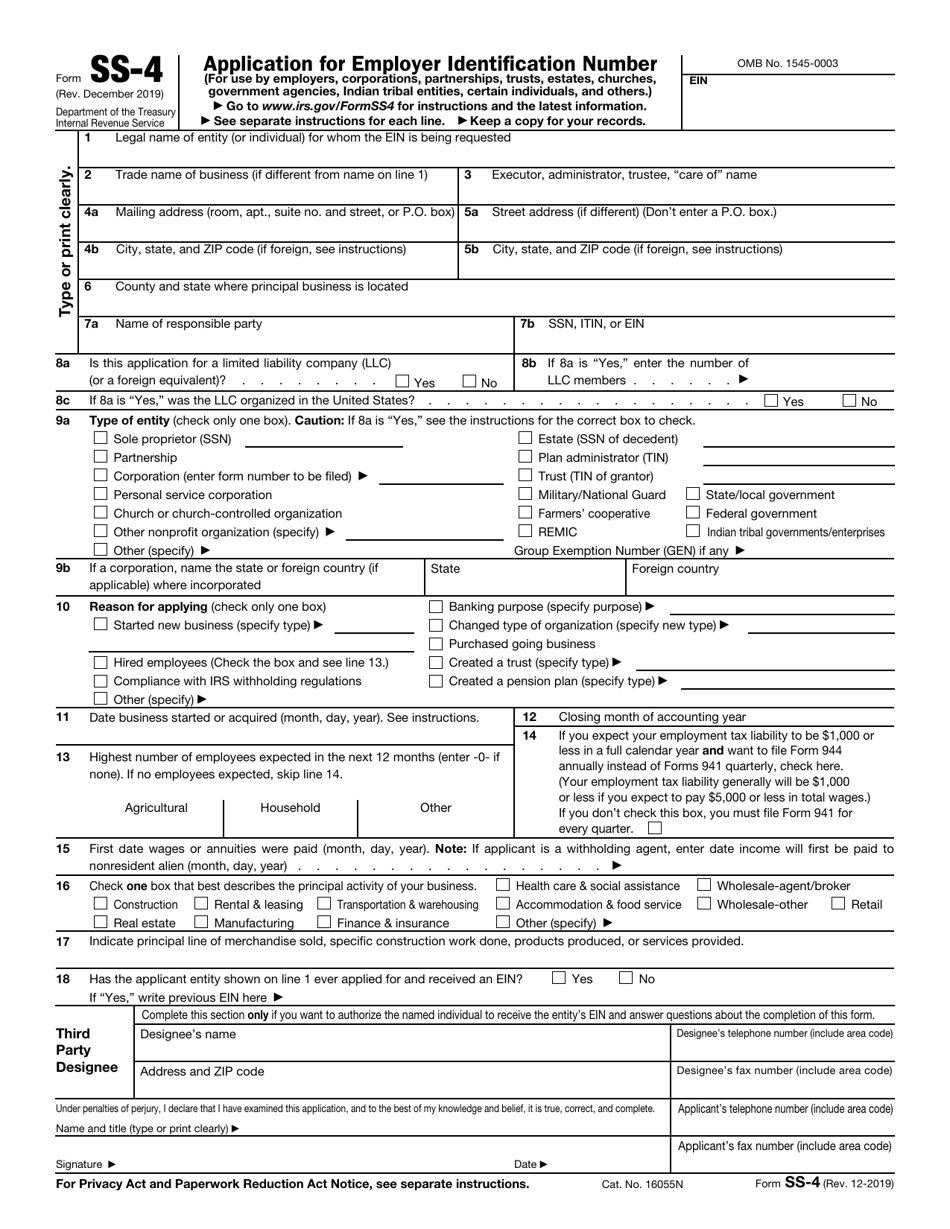

IRS Form SS4 Download Fillable PDF or Fill Online Application for

Related Post: