California Witholding Form

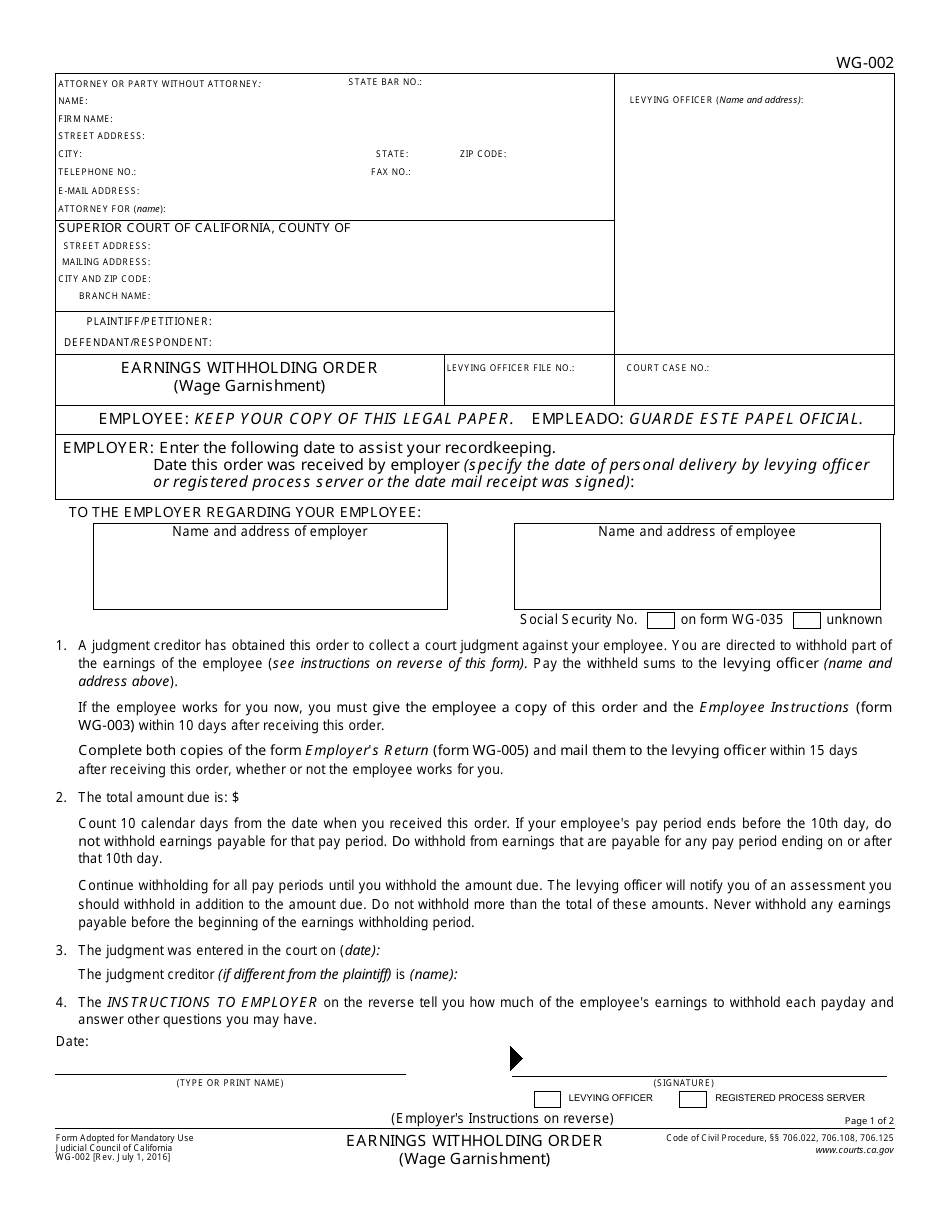

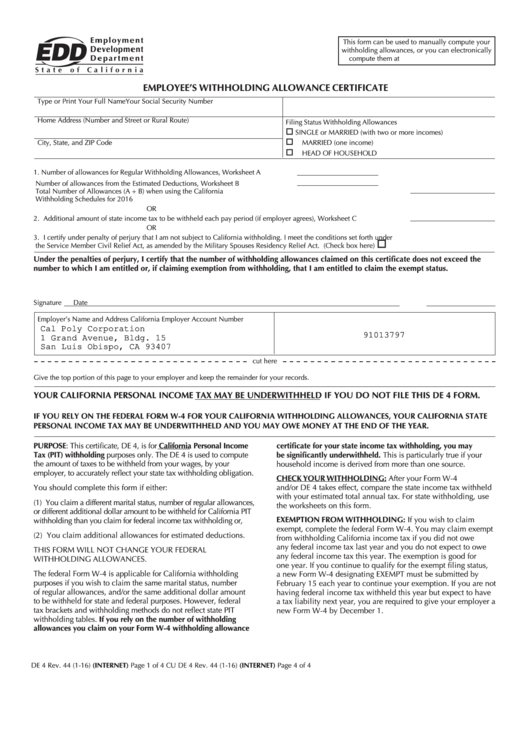

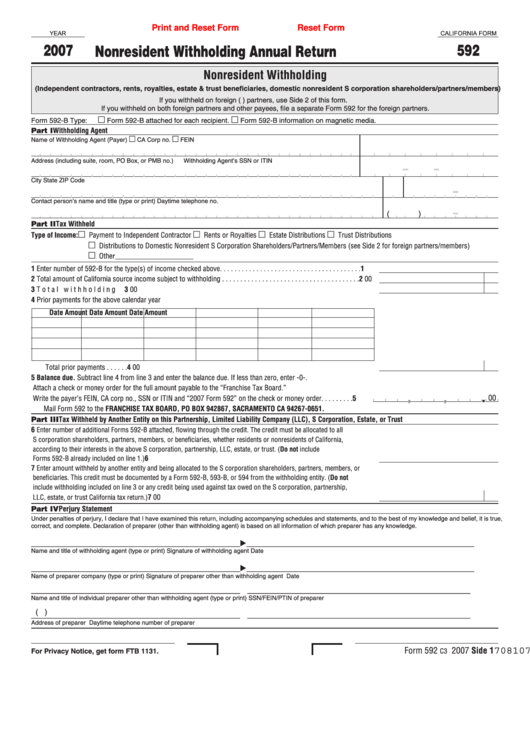

California Witholding Form - If you do not provide your. Ad pdffiller.com has been visited by 1m+ users in the past month The withholding agent keeps this form. Employee's withholding certificate form 941; Web california deposit requirements for pit and sdi deposit due dates are based on federal deposit schedule, payday, and state pit withholding. (1) claim a different number of allowances. The payee completes this form and submits it to the withholding agent. Web of california withholding allowances used in 2020 and prior, then a new de 4 is not needed. Web this article will assist you with entering the california real estate withholding reported on form 593 to print on the individual return form 540, line 73. Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in california. The payee completes this form and submits it to the withholding agent. Web of california withholding allowances used in 2020 and prior, then a new de 4 is not needed. Employee's withholding certificate form 941; Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in california. Use. Employee’s withholding allowance certificate (de 4) to determine the appropriate california personal income tax (pit) withholding. The de 4p allows you to: The de 4 is used to compute the amount of taxes to be. Web need to withhold less money from your paycheck for taxes, increase the number of allowances you claim. This certificate, de 4, is for california. Web to increase your withholding, complete employment development department (edd) form de 4, employee’s withholding allowance certificate, and give it to your. The withholding agent keeps this form with. Web california withholding schedules for 2023 california provides two methods for determining the amount of wages and salaries to be withheld for state personal. Filling out the california withholding form de. Web for state withholding, use the worksheets on this form, and for federal withholding use the internal revenue service (irs) publication 919 or federal withholding calculations. Web california deposit requirements for pit and sdi deposit due dates are based on federal deposit schedule, payday, and state pit withholding. Filling out the california withholding form de 4 is an important step. Web need to withhold less money from your paycheck for taxes, increase the number of allowances you claim. Web california withholding schedules for 2023 california provides two methods for determining the amount of wages and salaries to be withheld for state personal. Web for state withholding, use the worksheets on this form, and for federal withholding use the internal revenue. Web this article will assist you with entering the california real estate withholding reported on form 593 to print on the individual return form 540, line 73. Ad pdffiller.com has been visited by 1m+ users in the past month Web california withholding schedules for 2023 california provides two methods for determining the amount of wages and salaries to be withheld. Web california deposit requirements for pit and sdi deposit due dates are based on federal deposit schedule, payday, and state pit withholding. Use the calculator or worksheet to determine the number of. Employee’s withholding allowance certificate (de 4) to determine the appropriate california personal income tax (pit) withholding. (1) claim a different number of allowances. California, massachusetts and new york. Web use form 587, nonresident withholding allocation worksheet, to determine if withholding is required and the amount of california source income subject to. The withholding agent keeps this form with. The withholding agent keeps this form. Web this article will assist you with entering the california real estate withholding reported on form 593 to print on the individual return form. Web of california withholding allowances used in 2020 and prior, then a new de 4 is not needed. Web need to withhold less money from your paycheck for taxes, increase the number of allowances you claim. Use the calculator or worksheet to determine the number of. The de 4 is used to compute the amount of taxes to be. Estimate. (1) claim a different number of allowances. Web use form 593, real estate withholding statement to: Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in california. The de 4p allows you to: Web california deposit requirements for pit and sdi deposit due dates are based on. This certificate, de 4, is for california personal income tax (pit) withholdingpurposes only. California, massachusetts and new york will be able to. The withholding agent keeps this form. Web for state withholding, use the worksheets on this form, and for federal withholding use the internal revenue service (irs) publication 919 or federal withholding calculations. Employee's withholding certificate form 941; The payee completes this form and submits it to the withholding agent. Web california withholding schedules for 2023 california provides two methods for determining the amount of wages and salaries to be withheld for state personal. Employee’s withholding allowance certificate (de 4) to determine the appropriate california personal income tax (pit) withholding. The withholding agent keeps this form with. The de 4p allows you to: Estimate the amount of the. Web use form 592 to report the total withholding under california revenue and taxation code (r&tc) sections 18662 and 18664. The de 4 is used to compute the amount of taxes to be. Web use form 593, real estate withholding statement to: Web california provides two methods for determining the withholding amount from wages and salaries for state personal income tax. You must make monthly sdi and. Web california deposit requirements for pit and sdi deposit due dates are based on federal deposit schedule, payday, and state pit withholding. Ad pdffiller.com has been visited by 1m+ users in the past month Web to increase your withholding, complete employment development department (edd) form de 4, employee’s withholding allowance certificate, and give it to your. Certify the seller/transferor qualifies for a full, partial, or no withholding exemption.Form WG002 Download Fillable PDF or Fill Online Earnings Withholding

california withholding Doc Template pdfFiller

Filing California State Withholding Form

Fillable Employee Development Department State Of California Employee

California Withholding Tax Form 592

California Worksheet A Regular Withholding Allowances Tripmart

Form De4 California Employee Withholding

1+ California State Tax Withholding Forms Free Download

California withholding form Fill out & sign online DocHub

Ca De 4 Printable Form California Employee's Withholding Allowance

Related Post: